PIMCO have been quietly beating the market and doing a version of the famous Hedgefundie Adventure for years with their mutual fund PSLDX. But is it a good investment? I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Contents

PSLDX Review Video

Prefer video? Watch it here:

What Is PSLDX?

To talk about PSLDX, let's first talk briefly about the famous Hedgefundie Adventure. Ironically, you're probably more likely to have heard about the latter than the former. If you're not familiar with the strategy, go check it out here. Basically, it takes a traditionally pretty conservative asset allocation of 55/45 stocks to long treasury bonds and levers it up 3x via the funds UPRO and TMF. A guy with the username Hedgefundie proposed the strategy on the Bogleheads forum and it took the internet by storm, which has been cool to see.

But the idea is not really new. PIMCO was already beating the market by doing something similar for over a decade before Hedgefundie came along and made his now-famous post on the Bogleheads forum in early 2019. Their mutual fund PSLDX is roughly 50/50 stocks/bonds levered up 2x for effective 100/100 exposure, and as is the PIMCO way, they're active on the bonds side, with the stocks side linked to the S&P 500 via derivatives. PIMCO call it the StocksPLUS® Long Duration Fund.

It hasn't gotten much attention from retail investors because it is an institutional fund. The fund has nearly $1 billion in assets. Hedgefundie himself described PSLDX as “a strategy that delivers 2x the performance of the S&P in good times but matches the S&P in bad times.”

PSLDX launched in late 2007. I'm glad it didn't end up getting shut down after having to weather the Global Financial Crisis of 2008 soon thereafter. PIMCO maintain that “the fund offers the combined benefit of PIMCO's 40 years of active bond management and two decades of passive, index-linked investment expertise” and that “the fund can serve as a strong core equity choice in an overall portfolio, complementing both fixed income holdings and traditional equity investments.”

PSLDX vs. NTSX vs. HFEA

So basically we've got a real-world proof of concept of the Hedgefundie strategy that's been going on since 2007. Whereas HFEA (Hedgefundie's Excellent Adventure) is 165/135 and NTSX is 90/60, PSLDX sits somewhere in the middle around 100/100. Also note that NTSX uses intermediate bonds, while HFEA and PSLDX use long bonds. HFEA and NTSX only use treasury bonds, but PSLDX's managers are buying a cauldron of U.S. and foreign government and corporate debt securities. So while these 3 strategies are similar, they're also different.

PSLDX has an adjusted expense ratio of 1.01% 0.59%, compared to 0.99% for HFEA and 0.20% for NTSX at the time of writing. Note that PSLDX would be terribly tax-inefficient and should only be held in tax-advantaged space. It pays sizable quarterly dividends and annual capital gains distributions. Its turnover is nearly 200%! Seriously, don't even try.

Update – August 18, 2021 – PSLDX has drastically cut its fee, from 1.01% to 0.59%, making it considerably more attractive now in my opinion.

Risks of PSLDX

Let's talk about some risks and downsides for PSLDX.

First, just like with HFEA (or any stocks/bonds portfolio, really), stocks and bonds crashing in tandem wouldn't be good for the fund. But I'd argue that's unlikely to happen; the Fed has indicated they intend to keep rates low for a while, and interest rates don't have to revert to their mean. I would also submit that just because bonds now have lower expected returns doesn't mean they won't still do their job of mitigating stock market drawdowns. You can find my lengthier rant on bonds and interest rates here.

Secondly, I'd rather see straightforward treasury bonds, as with HFEA and NTSX, due to their reliably lower correlation to stocks and their nature of being the flight-to-safety asset. Credit risk is highly correlated with market risk. I'm not entirely sure why PIMCO seem to love corporate bonds. That said, if you have an active bond portfolio, PIMCO is who you'd want managing it, but there's also the general risk of that active management itself. And of course, they want to earn their fee. I'll talk about a way to DIY a rough replication of PSLDX using just treasury bonds later.

Thirdly, the knee-jerk reaction to the fund's fee is obviously to think it's high at >1%. But remember that fees are relative. Is the exposure and expected return you're getting worth the fee? In this case, I'd say yes. In other words, the fund's performance should make up for its higher fee; it has and more historically. We'll look at historical performance in a second.

Update – August 18, 2021 – PSLDX has drastically cut its fee, from 1.01% to 0.59%, making it considerably more attractive now in my opinion.

Lastly, just to reiterate, this thing is horribly tax-inefficient in all sorts of ways. Don't hold it in taxable. Just don't.

PSLDX Historical Performance vs. the S&P 500, HFEA, and NTSX

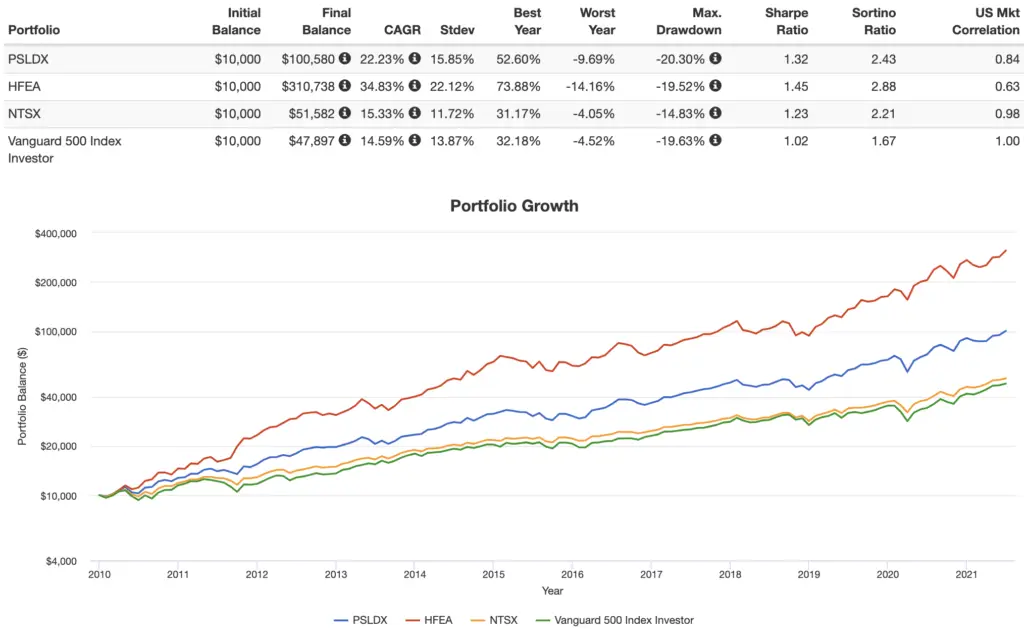

Using the live fund data, we can compare the historical performance of PSLDX, HFEA, NTSX, and the S&P 500 going back to 2009 through 2021:

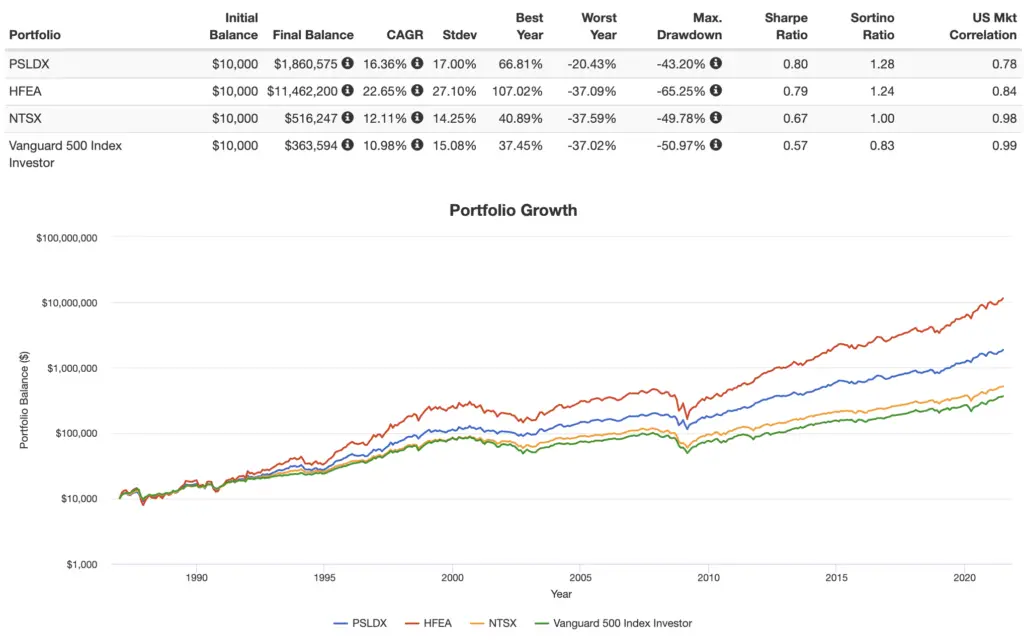

But of course we've basically been in a bull market that entire time (recency bias), and it's only a decade, so it doesn't tell us too much. So we can get a rough idea of the performance of these strategies by using mutual funds and somewhat crudely replicating PSLDX going back to 1986:

So as we'd expect, HFEA won out on total return. But note how Sharpe ratios (risk-adjusted return) are nearly identical for HFEA and PSLDX. This makes sense. Both are using basically the same assets; one is just levering up more. Because of this, HFEA exhibited much greater volatility and a larger max drawdown during the time period. As usual, diversification is our friend when we layer on leverage.

Also notice how PSLDX, NTSX, and the S&P 500 all had pretty similar risk metrics, but the 2 funds beat the index on CAGR. Remember we've also been in a bond bull market during this time since about 1982. With bond yields where they are at the time of writing, the future may look different.

Replicating PSLDX with Leveraged ETFs

We can roughly replicate PSLDX's strategy while conveniently utilizing only treasuries on the bond side with leveraged ETFs via UPRO (3x S&P 500) at 33% and EDV (Vanguard Extended Duration Treasury ETF) at 67%. You'd probably want to rebalance it quarterly.

I've created that pie here for those using M1 Finance.

But also note this is very nearly just a 2x version of the Hedgefundie strategy.

Of course, one of the primary attractions of PSLDX is the ability to set it and forget it, as PIMCO are handling all the logistics for you. So a DIY replication may not be worthwhile for the investor who wants to be completely hands-off.

Is PSLDX a Good Investment?

So is PSLDX a good investment? Maybe.

I think PSLDX is a good solution for someone who wants to implement a milder version of the HFEA while being completely hands-off. Truly set and forget. You would quite literally be letting the pros handle it. You're just paying that relatively high fee for that convenience. But the fee is about the same as the leveraged funds it would require to get the same exposure. That fee has also decreased as of August, 2021, from 1.01% to 0.59%.

Where To Buy PSLDX

Now we come to the topic of where to buy PSLDX. This is probably the section people are most interested in, because this thing has historically been somewhat hard to buy if you're a DIY retail investor. After all, it's supposed to be for institutional investors. That said, the various brokers' requirements seem to have decreased in recent years.

I've personally got PSLDX in an IRA at Ally. If I remember correctly, there was a transaction fee of $10 and a minimum investment of $100. This may have changed since I first bought it.

The following are pieces of info I've gathered from around the web or from calling the broker directly:

- At Vanguard, you're looking at a transaction fee of $20, a minimum initial buy of $25,000, and minimum additional purchases of $1,000.

- TD Ameritrade has no minimum but imposes a $50 transaction fee.

- Firstrade has a $500 minimum and no fee.

- Schwab has a $1,000 minimum and a $50 fee.

- Etrade offers it for a $20 fee and no minimum.

- Interactive Brokers has it for a $25,000 minimum and a $15 fee.

- Fidelity told me that individuals can't buy this fund. Period. But apparently you can transfer the fund into Fidelity if you already own it elsewhere, after which it's $50 for each transaction, so sort of a backdoor way to get it in there. YMMV.

- Check your 401(k) menu for this fund, but odds are it's not there.

What do you think of PSLDX? Let me know in the comments.

Disclosure: I own PSLDX, UPRO, TMF, VOO, and NTSX in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. All examples above are hypothetical, do not reflect any specific investments, are for informational purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Don't want to do all this investing stuff yourself or feel overwhelmed? Check out my flat-fee-only fiduciary friends over at Advisor.com.

I can confirm that e*Trade now has PSLDX for zero commission / transaction fees. ($0).

Great write up! I’ve been a huge fan of this fund for a long time. It’s a very sensible way to use leverage in my opinion.

A couple things that may be helpful to others looking to access it:

1. Federal employees have access to it through their TSP (i.e., 401k) via the mutual fund window. There’s currently a $150 annual fee to hold funds through the mutual fund window, which isn’t ideal, but historically it would have more than made up for that fee vs. a vanilla S&P 500 fund.

2. You can access it via Ally Invest with no fee or minimum purchase.

PIMCO is doing a 1 for 3 reverse split on PSLDX on March 24.

Hello,

Thank you for all you do for this.

I just wanted to drop a line that this is now free at e-trade with any dollar amount.

Thanks again!

Was wondering about your thoughts concerning PSLDX after the 40+ percent decline so far in 2022. Seems like the perfect storm is occuring right now. Both stocks and lond term bonds are getting hammered.

Indeed, this environment was always the achilles heel for strategies like this. I’d like to think it would still only be a blip over a 30+ year horizon, though.