The SARK ETF allows investors to directly bet against Cathie Wood by aiming to deliver the inverse return of her ARKK ETF. It has returned a whopping 95% in a little over a year. Let's check it out.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Prefer video? Watch it here:

Cathie Wood is at the helm of ARK Invest, whose flagship fund ARKK – the ARK Innovation ETF – saw record inflows after it returned 153% in 2020. Savvy investors knew it was probably due for a turnaround, and in late 2021 Tuttle Capital Management brought that sentiment to market with the SARK ETF, which trades on the Nasdaq exchange and seeks to provide the daily inverse return of ARKK by using swap agreements on ARKK itself.

The SARK ETF was created by Matthew Tuttle of Tuttle Capital Management in late 2021, but AXS Investments acquired their ETF lineup in mid-2022, so the Tuttle Capital Short Innovation ETF is now called the AXS Short Innovation Daily ETF. Matthew Tuttle said the sale is more like a merger and that he would join AXS as a managing director.

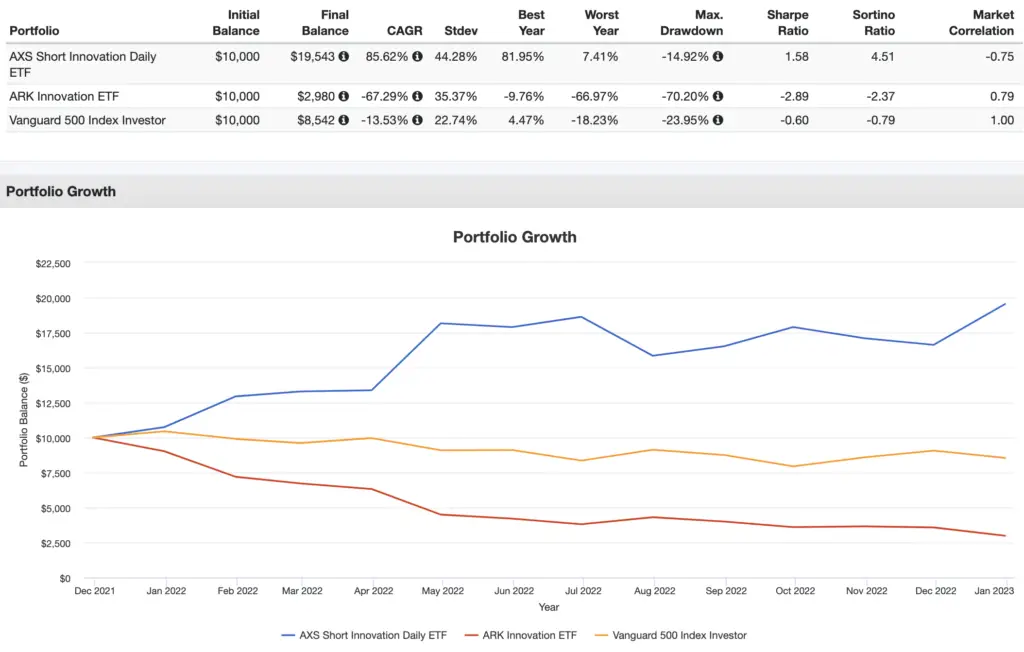

Since ARKK took a nosedive in 2022, SARK has returned a massive 95% since its inception in November, 2021. ARKK and the S&P 500 are down 70% and 15% respectively over the same period.

And just as ARKK itself saw huge capital inflows when it was soaring, SARK has attracted over $300 million in assets in its short lifespan thus far, which would be impressive even for a long-only fund.

A bearish position on what is effectively a tech-heavy mid-cap growth fund may not be as crazy as it sounds on the surface, as rising rates hurt high-growth stocks the most, the valuation spread between Value and Growth has still been as large as it's ever been for over a year now, and technological revolutions haven't been the greatest investments historically. Investors who tilt Value like myself have been thankful the past couple years while it has clobbered Growth. Value may finally be making its comeback.

Specifically, Tuttle's thesis is that the bullish stance on the “transformational industries” that ARKK targets is “stretched.” At the very least, Cathie Wood has her work cut out for her, and she may be fighting an uphill battle over both the short term and the long term. After all, stock picking tends to underperform the market over the long term, and all else equal, Value has greater expected returns than Growth, especially at current valuations.

But just as I'd never suggest owning a poorly diversified, tech-heavy growth fund full of unprofitable companies like ARKK, I also wouldn't suggest that buy-and-hold investors own an inverse fund over the long term. At best, SARK is a short-term tool to bet against Cathie Wood's selection of “innovative” stocks. At worst, it's simply a meme to provide some laughs and entertainment while overpriced Growth stocks tank.

We also can't deny that SARK's impressive performance thus far is largely due to near-perfect timing. To add insult to injury, just like ARKK, SARK carries a relatively hefty fee of 0.75%.

In any case, I have to give props to Matthew Tuttle for creatively and boldly making some money from being in the halo of Cathie Wood and her flagship fund in recent years. He aims to do the same thing with an inverse Jim Cramer ETF soon.

What do you think of the SARK ETF? Let me know in the comments.

Disclosure: None.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. All examples above are hypothetical, do not reflect any specific investments, are for informational purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Don't want to do all this investing stuff yourself or feel overwhelmed? Check out my flat-fee-only fiduciary friends over at Advisor.com.

Leave a Reply