Robo-advisors like Acorns have grown in popularity recently with low fees, simplicity, convenience, and modern apps and interfaces, especially among young, new investors. Stash isn't a true robo-advisor, but does have some robo-advisor-like qualities such as fractional shares and diversified ETF portfolio options. Here we'll compare Stash and Acorns.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Stash vs. Acorns – Summary Comparison

Contents

Stash vs. Acorns – Commissions and Fees

Neither Stash nor Acorns has commissions on investments. With both platforms, you will still have to pay the unavoidable expense ratios on the ETF's (exchange traded funds) in which you're invested.

Acorns has 3 tiered account levels with different fees and different features:

- All 3 account levels have an individual taxable investment account called Acorns Invest.

- Their Basic plan at $1/mo. is just a taxable investment account.

- The Plus plan at $2/mo. includes access to retirement accounts – called Acorns Later – in the form of a Traditional IRA, Roth IRA, or SEP IRA.

- The Acorns Premium plan is $3/mo. and adds access to an FDIC-insured checking account called Acorns Spend.

Stash also has 3 tiered account levels with different fees and different features:

- All 3 account levels have a taxable investment account and a bank account.

- Their Beginner plan at $1/mo. is just a taxable investment account.

- The Growth plan at $3/mo. includes access to retirement accounts in the form of a Traditional or Roth IRA.

- The Stash+ plan is $9/mo. and adds access to custodial accounts to invest for 2 kids, a metal card for the bank account, and a monthly market insights report.

So Acorns wins out slightly on fees on average.

Stash vs. Acorns – Account Types

Acorns offers these account types:

- Individual (Taxable)

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

Stash offers most of those plus Custodial and minus SEP IRA:

- Individual (Taxable)

- Traditional IRA

- Roth IRA

- Rollover IRA

- Custodial

Stash's Custodial account is only available on their premium Stash+ plan at $9/mo.

Neither platform offers:

- Joint

- SIMPLE IRA

- Solo 401(k)

- 529

- HSA

- Non-Profit

Stash vs. Acorns – Investment Products

As a robo-advisor, Acorns simply has 5 pre-built expert portfolios – comprised of low-cost ETF's – based on one's risk tolerance, allowing you to be completely hands-off in your investing. You can choose among Conservative, Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive. They note that their portfolios were built with the help of Harry Markowitz, the father of modern portfolio theory. Acorns does not offer individual stocks.

Stash is not a true robo-advisor. Stash allows you to invest in individual stocks and a small handful of ETF's of your choosing. They do also have 4 ETF's from iShares that they call “Diversified Mixes” which are not unlike the pre-built portfolios from Acorns, but these are in ETF form directly from iShares and will likely have a higher average expense ratio than that of your Acorns portfolio. These 4 are called Aggressive Mix, Conservative Mix, Long-Term Mix, and Moderate Mix. The respective tickers are AOR, AOK, AOA, and AOM. You can read about these funds on the iShares website if you're curious. In this sense, either platform allows you to be hands-off if you want. You can view the full list of ETF's from Stash here.

Stash vs. Acorns – Mobile App

Acorns has a sleek, modern, intuitive, robust mobile app for both Apple iOS and Android. Stash has a great app too, but Android users specifically seem to complain of problems with the app.

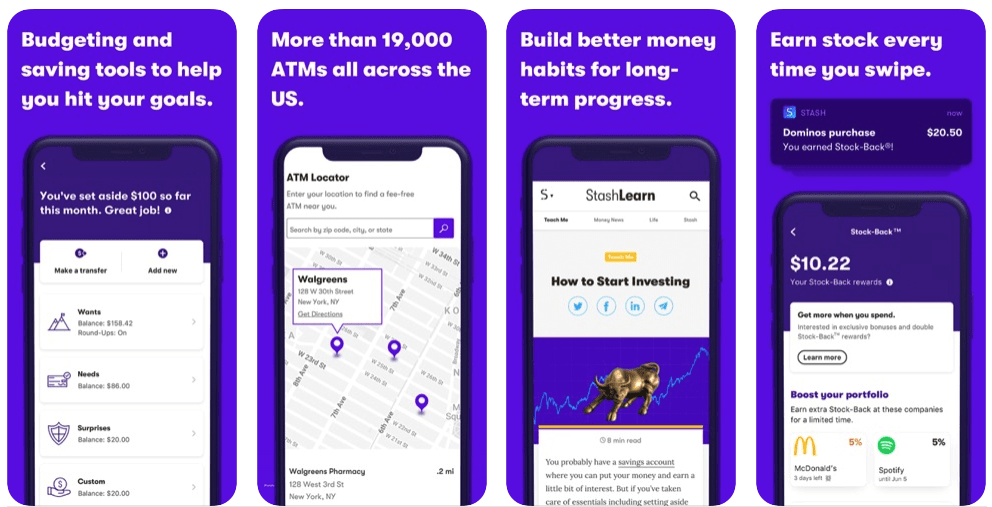

Here are some screenshots of the Stash app:

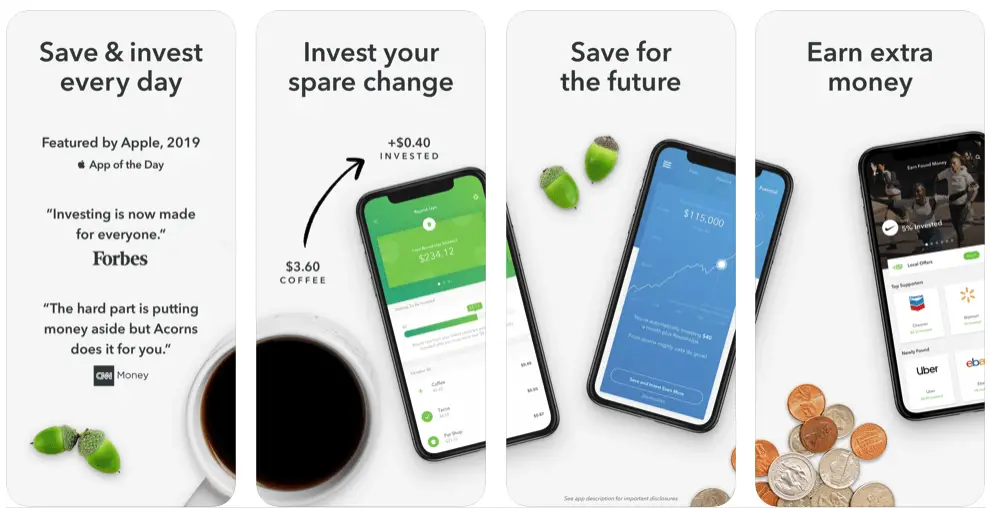

Here are some screenshots of the Acorns app:

Stash vs. Acorns – Extra Features

- Acorns is unique in that it allows you to invest “spare change” automatically, letting you “round up” your purchases and invest the difference. This is great for people who have trouble saving. You can choose to apply a multiplier on these round-ups of up to 10x to consciously save and invest more. Acorns also lets you fund a retirement account like a Traditional or Roth IRA like you normally would.

- Both Stash and Acorns come with an FDIC-insured checking account with debit card, making them both suites of financial tools instead of just investing platforms. Acorns offers a form of cash back as what they call Found Money®, through which they’ve partnered with select stores where when you shop there, cash back goes into your Acorns account to be invested. Stash’s bank account earns you additional shares of stock as part of their Stock-Back® program.

- Both Stash and Acorns have educational resources via their blogs. Stash's premium Stash+ plan at $9/mo. also gets you a monthly market insights report.

- Stash lets you access your direct deposits up to 2 days early, stating that you can “get paid up to 2 days early.”

- Acorns also features automatic rebalancing that keeps your portfolio's target allocations on track. Stash does not offer automatic rebalancing.

- Both Acorns and Stash offer fractional shares, a feature that allows every penny to go to work for you faster. This means you can buy a fraction of a share of your investments. For example, if one single share costs $100 and you only have $10 to invest, you can buy 1/10 of a share with your $10 instead of having to wait to buy a whole share for $100. This is especially important for young investors with a small amount of capital.

- Both platforms offer dividend reinvestment. A dividend is just a return of value to shareholders as a periodic cash payment by a company. Dividend reinvestment means that when your investments pay a dividend, that payment can be automatically reinvested instead of sitting idly as a cash balance.

Stash vs. Acorns – Summary and Conclusion

- Stash and Acorns are both built for passive, long-term, buy-and-hold investing.

- Both Stash and Acorns have a handful of expert-built portfolios in which you can invest. These portfolios from Acorns are built with low-cost ETF's. With Stash, they are simply ETF's directly from iShares. Stash also has some other broad ETF's and individual stocks, whereas Acorns does not.

- Neither Stash nor Acorns offers margin loans. If you want access to margin, consider M1 Finance.

- Acorns has slightly lower average monthly fees than Stash.

- Account type offerings are almost identical between the two platforms. Acorns offers a SEP IRA that Stash doesn't have, and Stash offers a Custodial account that Acorns doesn't have.

- Acorns and Stash both have sleek, modern, intuitive, robust mobile apps and desktop web interfaces. Android users seem to have some complaints about the Stash app.

- Both Stash and Acorns come with an FDIC-insured checking account, with unique cash-back programs.

- Acorns offers automatic rebalancing. Stash does not.

- Both Acorns and Stash support fractional shares and dividend reinvestment.

- Acorns allows you to “round up” your purchases to invest your spare change automatically.

I think the choice between these 2 investing platforms comes down to having more control over your investments with Stash versus lower fees and extra features like automatic rebalancing and Round-Ups with Acorns. Obviously if you need a Custodial account, you'd have to go with Stash, and if you want a SEP IRA account, you'd have to go with Acorns.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. All examples above are hypothetical, do not reflect any specific investments, are for informational purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Don't want to do all this investing stuff yourself or feel overwhelmed? Check out my flat-fee-only fiduciary friends over at Advisor.com.

Leave a Reply