What if I told you there’s a way to get the risk-free return of T-bills but in a way that’s more tax-efficient than buying T-bills directly or buying a T-bills fund? Here I review the BOXX ETF and why you might want to consider it over your favorite T-bills ETF or money market fund for your cash management needs. Video Prefer video? Watch it below. If not, keep … [Read more...] about BOXX ETF Review – Alpha Architect 1-3 Month Box ETF

Recent Posts

Avantis Launches 3 New ETFs – AVMC, AVMV, AVEE

Avantis launched new ETFs on November 9, 2023 - AVMC, AVMV, and AVEE. I briefly summarize them here. Avantis launched 3 new ETFs to provide narrow exposure to corners of the market that they previously didn't have dedicated funds for. AVMC - Avantis U.S. Mid Cap Equity ETF AVMC, the Avantis U.S. Mid Cap Equity ETF, provides exposure to the arguably … [Read more...] about Avantis Launches 3 New ETFs – AVMC, AVMV, AVEE

BlackRock iShares Launches First Target Date ETFs

Previously you could only get a target date fund in the form of a mutual fund. Now they're available as ETFs. Prefer video? Watch it below. If not, keep scrolling to keep reading. The enormous asset manager BlackRock has launched the industry's first lineup of target date ETFs. I've noted elsewhere why ETFs are usually preferable to mutual funds for a number … [Read more...] about BlackRock iShares Launches First Target Date ETFs

Buy Borrow Die Strategy Explained – How the Rich Avoid Taxes

The Buy Borrow Die strategy is a tax minimization technique that has made headlines in recent years because it's what rich people like Jeff Bezos, Elon Musk, and Warren Buffett do to avoid taxes. Here we'll look at how exactly the strategy works and how you can use some of the same tactics as the wealthy to minimize your tax burden. Video Prefer video? Watch it … [Read more...] about Buy Borrow Die Strategy Explained – How the Rich Avoid Taxes

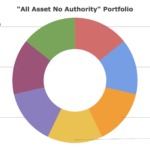

All Asset No Authority Portfolio Review (AANA) & ETFs (2024)

The All Asset No Authority Portfolio is a medium-risk portfolio of 7 equally-weighted assets. Here we'll look at its components, performance, and the best ETFs to use in its construction. Video Prefer video? Watch it here: What Is the All Asset No Authority Portfolio? The All Asset No Authority Portfolio - or AANA for short - comes from Doug Ramsey, … [Read more...] about All Asset No Authority Portfolio Review (AANA) & ETFs (2024)

Whole vs. Term Life Insurance – Which Is Best for You?

Whole life insurance and term life insurance are pretty different. Here we'll go over their similarities and differences and pros and cons to decide why you might want one over the other, or neither. Term Life Insurance Term life insurance, as the name suggests, has a specified term length for coverage during which it will pay out if you die. That term could be … [Read more...] about Whole vs. Term Life Insurance – Which Is Best for You?

529 Education Savings Plan Explained – Invest for College + More

A 529 account or "529 plan" is a tax-advantaged investment account to save for future education expenses. Here we'll look at what it is and where, why, and how to open one. What Is a 529 Account? A 529 account, legally known as a “qualified tuition plan,” is named after section 529 of the IRS tax code. It is an investment account that allows for tax-advantaged … [Read more...] about 529 Education Savings Plan Explained – Invest for College + More

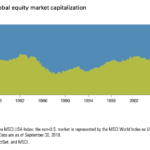

“Should I Invest in International Stocks?” Yes. Here’s Why.

The U.S. stock market isn't always king, and it doesn't really matter if it has been historically. Here I'll explain why that's the case and why it's probably a prudent idea for U.S. investors to also invest in international stocks. Video Prefer video? Watch it here: Introduction Make no mistake that the U.S. stock market usually dominates the global … [Read more...] about “Should I Invest in International Stocks?” Yes. Here’s Why.

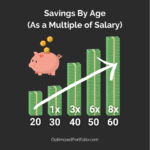

How Much You Should Save by Age 20, 30, 40, 50, and 60

While there's no one-size-fits-all approach for how much one should save by age, here's a general framework to aim for as you progress on your financial journey to retirement. Video Prefer video? Watch it here: Introduction - Savings Benchmarks by Age Obviously the specific amount of money you need as you get older will depend on your personal … [Read more...] about How Much You Should Save by Age 20, 30, 40, 50, and 60

No, There’s Not an “Index Fund Bubble.” Here’s Why.

The term index fund bubble has been thrown around frighteningly often in recent years. In this post I'll explain why there's not one and why the primary fundamental argument itself doesn't make much logical sense. Prefer video? Watch it below. If not, continue scrolling to keep reading. If you've arrived on this page, hopefully you already know that index funds are … [Read more...] about No, There’s Not an “Index Fund Bubble.” Here’s Why.

3 Best Floating Rate Bond ETFs – USFR vs. TFLO vs. FLOT

Floating rate bonds adjust quickly to interest rate changes. Here we'll compare the best floating rate ETFs - USFR, TFLO, and FLOT. Video Prefer video? Watch it here: What Are Floating Rate Bonds? Floating rate bonds are debt instruments with variable interest rates, as opposed to a typical bond with a fixed rate. That interest rate is based on some … [Read more...] about 3 Best Floating Rate Bond ETFs – USFR vs. TFLO vs. FLOT

“Passive” Investing Is a Myth. Here’s Why.

Make no mistake that I'm a proponent of index investing, buying broadly diversified funds that hold a basket of investments, preferably at a low cost. I've even probably used the term "passive" cavalierly in other posts on this website. But in this one I'll explain why the idea of "passive" investing is a myth. Prefer video? Watch it below. If not, keep scrolling to … [Read more...] about “Passive” Investing Is a Myth. Here’s Why.

Rental Properties vs. Investing in the Stock Market – An Op-Ed

My LinkedIn feed and YouTube suggestions are full of rental property stuff, presumably because the robots know I browse Zillow sometimes when I’m bored. Seems like a lot of people view and pitch owning rental properties as a passive cash flow machine. When I hear "rental property," I think illiquidity, leverage, concentration, idiosyncratic risk, fees, stress, time, … [Read more...] about Rental Properties vs. Investing in the Stock Market – An Op-Ed

Avantis Files for 6 New ETFs – AVGV, AVDS, AVMG, AVTD, AVTV, AVLC

Avantis filed for 6 new ETFs on March 21, 2023 - AVGV, AVDS, AVMG, AVTD, AVTV, and AVLC. I briefly summarize them here. Avantis clearly provides great factor funds. They're expanding their offering with 6 new ETFs. Most are "fund of funds" products. AVGV - Avantis All Equity Markets Value ETF AVGV, the Avantis All Equity Markets Value ETF, will be a fund of … [Read more...] about Avantis Files for 6 New ETFs – AVGV, AVDS, AVMG, AVTD, AVTV, AVLC

AVGV ETF Review – Avantis All Equity Markets Value ETF

AVGV is a new ETF from Avantis that is a single fund solution for the global stock market investor who wants to go all in on Value stocks. I review it here. Prefer video? Watch it here. If not, continue scrolling to read below. If you've arrived here, I'd guess you already know Avantis is one of the best names in the biz for factor funds, that Value has the most … [Read more...] about AVGV ETF Review – Avantis All Equity Markets Value ETF

Return Stacking Explained – Greater Returns With Lower Risk?

Return stacking refers to applying a modest amount of leverage to a diversified investment portfolio of different asset classes in an attempt to ratchet up expected returns while simultaneously potentially lowering or at least maintaining risk. Here we'll look at what return stacking is and when, why, and how to do it. What Is Return Stacking? Return stacking is … [Read more...] about Return Stacking Explained – Greater Returns With Lower Risk?

SGOV vs. BIL – Which ETF for U.S. T-Bills in 2024?

SGOV and BIL are two popular ETFs for U.S. Treasury Bills. Is there a clear choice for ? Let's compare them. Treasury bills, or T-bills for short, are just ultra-short-term bonds from the U.S. government. These short bonds with maturities of less than a year are called bills. T-bills are referenced as the "risk-free asset" because they are backed by the full faith and … [Read more...] about SGOV vs. BIL – Which ETF for U.S. T-Bills in 2024?

RSSB ETF Review – Return Stacked® Global Stocks & Bonds ETF

RSSB aims to provide a "return stacked" solution for global stocks and bonds in a single fund. It's called the Return Stacked® Global Stocks & Bonds ETF. Let's review it. First, it's important to note that as of March 29, 2023, RSSB is not trading yet. The SEC filing happened on February 6, 2023. Update on December 5, 2023: RSSB has launched! "Return stacking" - … [Read more...] about RSSB ETF Review – Return Stacked® Global Stocks & Bonds ETF

AVES ETF Review – Avantis Emerging Markets Value ETF

AVES is a relatively new ETF from Avantis for targeted factor exposure in Emerging Markets. I review it here and compare it to its counterparts that are usually included in the same conversation, AVEM and DGS. Prefer video? Watch it here: If you've arrived on this page, you probably already know that overweighting or tilting with certain risk factors may offer … [Read more...] about AVES ETF Review – Avantis Emerging Markets Value ETF

Fees, Trees, & Forests – Stop Obsessing Over Expense Ratios

One of the core tenets of the Boglehead philosophy is to minimize fees whenever possible. That sounds reasonable enough on the surface, but here I'll explain why it's not so simple and why fees aren't as big of a deal as they're made out to be. Fees Are Relative If you've read any of my stuff on factor investing or specific small cap value funds, for example, … [Read more...] about Fees, Trees, & Forests – Stop Obsessing Over Expense Ratios