RPAR is a single fund solution for an all-weather portfolio strategy based on risk parity – one ETF to be fully diversified across multiple assets. I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

RPAR ETF Review Video

Prefer video? Watch it here:

What Is the RPAR Risk Parity ETF?

To discuss the RPAR ETF, we first have to talk about the concept of an “all-weather portfolio.” As the name suggests, this phrase describes a portfolio designed to perform well during any market environment. We know that diversification lowers portfolio volatility and risk by using assets that move at different times relative to one another. An all-weather approach sort of takes this to the extreme across different asset classes to smooth out the ride as much as possible.

As such, it often sacrifices some return in doing so, but this is usually acceptable for the risk-averse investor or retiree who wants an all-weather portfolio. In fairness, too, historically this idea has not had to sacrifice much performance to drastically lower the portfolio's risk. The most famous example of this concept is Ray Dalio's famous All Weather Portfolio, which uses a mix of stocks, treasury bonds, commodities, and gold. To do so, it uses at least 5 different funds.

Enter RPAR, a relatively new fund-of-funds from Evoke-ARIS. Alex Shahidi is a co-founder; he wrote about the strategy's underpinnings in a book here. Basically, this ETF is a single investable fund that holds multiple funds across different asset classes to arrive at an all-weather strategy. In their words, the fund “seeks to generate positive returns during periods of economic growth, preserve capital during periods of economic contraction, and preserve real rates of return during periods of heightened inflation.” To do that, RPAR holds global stocks, U.S. treasury bonds, commodities, and TIPS in risk parity allocations, and rebalances quarterly. Their reasoning for each asset class is as follows:

- Global equities – strong economy; falling inflation

- Commodities – rising inflation

- Commodity producers – strong economy

- Physical gold – weak economy

- TIPS – weak economy; rising inflation

- Treasuries – weak economy; falling inflation/deflation

Again, RPAR is purposefully agnostic toward the prevailing economic environment, and diversifies accordingly across a risk-parity-weighted collection of different asset classes. The fund uses broad indexes for those asset classes and diversifies globally within stocks, which I'm a fan of. The fund even aims to maximize tax-efficiency by minimizing income and distributions, so this fund wouldn't be terrible for a taxable environment as well.

Similar to SWAN, RPAR aims to protect investors during severe market downturns but still allow for participation in up markets. Here's what RPAR looks like:

35% Long Treasury Bonds

35% Long TIPS

25% Global Stocks

15% Commodity Producers

10% Gold

-20% Cash (Leverage)

RPAR seeks to track the Advanced Research Risk Parity Index, a proprietary index created by ARIS and EQM Indexes. This ETF launched in late 2019 and has a gross expense ratio of 0.54%. Assets may stray fairly quickly from their intended allocations, so the fund is rebalanced quarterly.

UPAR ETF

RPAR utilizes a “modest leverage” of 120% via treasury futures, similar to how NTSX uses them, to provide slightly enhanced exposure in a way that's still tax-efficient. The true All Weather Fund at Bridgewater does something similar. In October, 2021, Toroso filed for a new, riskier ETF, UPAR, which launched in January, 2022. It seeks to track the proprietary Advanced Research Ultra Risk Parity Index (the “UPAR Index”). UPAR is essentially the same thing as RPAR but cranks the leverage up to about 168%. Its target allocations are as follows:

49% Long Treasury Bonds

49% Long TIPS

35% Global Stocks

21% Commodity Producers

14% Gold

UPAR has an expense ratio of 0.65%.

Risk Parity Explained

Apropos of its ticker name, RPAR uses risk parity as the weighting scheme for its components. This just means each asset is weighted in such a way that they all contribute the same amount of “risk” (for which volatility is the proxy used) to the portfolio.

For a simplistic example, the historical volatility of long U.S. stocks is about 15%. For U.S. treasury bonds, it's about 10%. Thus, risk parity is achieved at a 40/60 allocation of stocks to long treasuries, where each asset is contributing the same 6% volatility. One doesn't need to know anything about risk parity to know that a 40/60 portfolio is considered to be pretty conservative.

The theory is that the diversification benefit of holding multiple uncorrelated assets (think higher risk-adjusted return as measured by Sharpe) is probably maximized somewhere around risk parity weights. This is the case because we can only offset the movement of a high-volatility asset with a low-volatility asset if we have a higher allocation to the low-volatility asset. Hopefully that makes sense intuitively once you think about it. I'll provide a couple more examples to drive the point home in a second.

Interestingly, this idea of maximizing risk-adjusted return (Sharpe) around risk parity weights actually is the case historically for stocks and intermediate treasury bonds. The greatest risk-adjusted return is achieved historically by a 30/70 allocation, which is roughly risk parity for those two assets. That happens to be the asset allocation for the Larry Swedroe Portfolio.

For those interested in Bitcoin, you might enjoy this example. Bitcoin is so volatile (i.e. it moves up and down so wildly) that its risk parity weighting in a portfolio alongside stocks and long treasury bonds is only 3%! The long bonds get 54% and the stocks get 43%.

Another key underlying assumption is that asset class returns depend largely on the macroeconomic environment, which is usually unpredictable. In this sense, an all-weather strategy helps mitigate the impact of black swan events like the 2008 crash and 2020 pandemic as well.

However, note that one can still utilize an “all-weather” strategy without using risk parity, and vice versa. While we don't want to overfit and try to predict the future, I would argue the risk parity calculation at least offers a place to start the conversation of how one might allocate different assets, depending on the goal.

RPAR Risk Parity ETF – Historical Performance

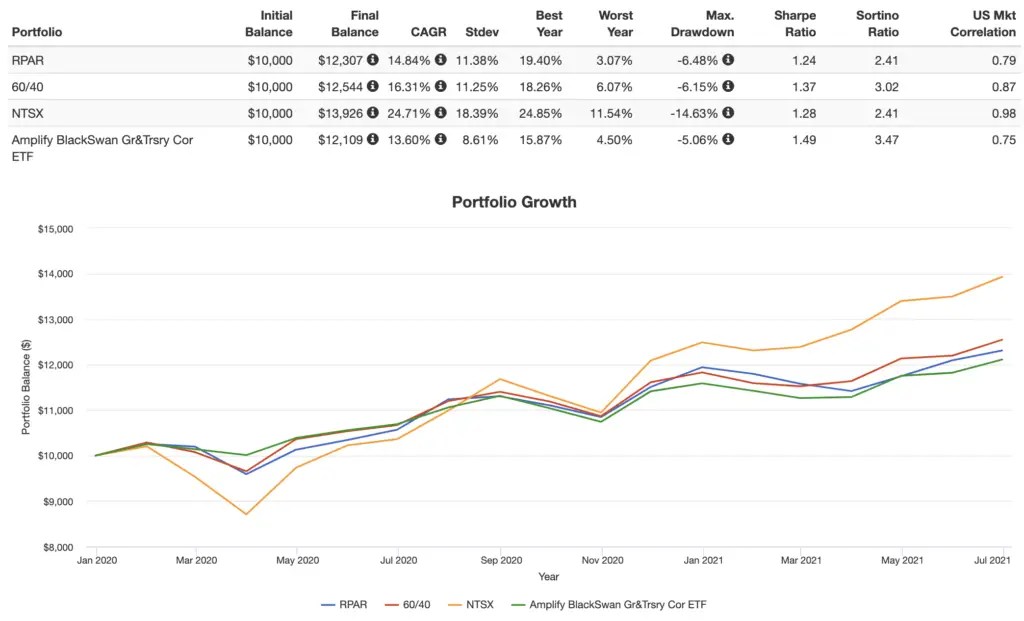

Again, RPAR is very new. A very short backtest using the live fund from January, 2020 through June, 2021 is below, with 60/40 global stocks and long treasuries as a benchmark, and SWAN and NTSX also thrown in for a fun comparison:

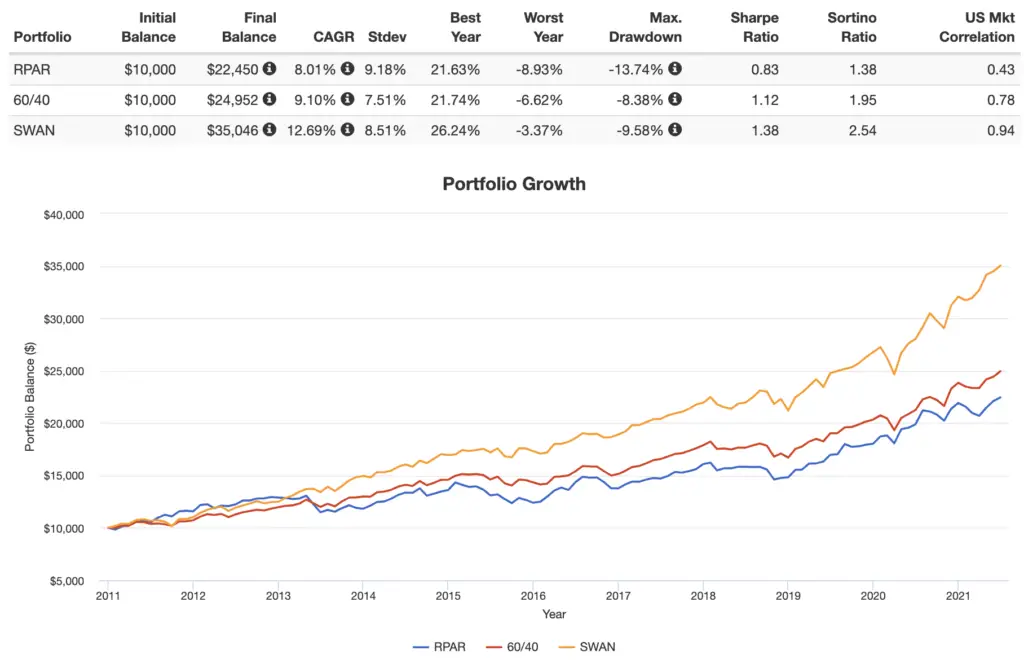

While we get to see the behavior during the March 2020 crash, 1 year is just noise. 10 years is probably still noise, but that's how far I was able to go back using the constituent funds that comprise RPAR, along with simulated proxies for NTSX and SWAN:

Notice how RPAR hasn't really delivered on its promise during the time periods above. 60/40 and SWAN both still had lower volatility and smaller drawdowns. RPAR had the lowest risk-adjusted return (Sharpe) of all the portfolios. I'll talk about why in the next section.

My Review of RPAR

Again, RPAR is agnostic toward economic environment and market behavior and uses a risk parity scheme to diversify across various asset classes. And there's the rub. In my opinion, it leans too far into fear-based allocations for market environments that are almost certainly less likely than others. Granted, it uses a modest amount of leverage to counteract that, but I think it still sacrifices too much space – born of the formulaic risk parity weighting – to assets with low or zero expected returns for the sake of protecting the downside. That is, it inherently focuses too much on the downside and not enough on the upside, and we're investing in the market precisely because we expect it to go up more than it goes down.

This is like buying an umbrella every day during the summer just in case it rains that day. A better analogy about strategies like this is from the famous Hedgefundie, who said “it’s not so smart to stock up on winter coats when you live in Miami.” Put another way, the premium you're paying for that insurance policy is likely just dragging down your long-term total return. A major crash happens about every 7 years on average. While it certainly feels better psychologically to weather the storm when it hits for the investor checking their portfolio often, we don't want to stifle the growth happening in the 6 years leading up to that storm.

Now don't get me wrong. All this market-agnostic risk parity stuff is fine for the risk-averse investor or retiree aiming to minimize volatility and the potential for material loss. It's also fine if the assets you're using with it have similar, positive expected returns. But it is almost certainly a bad idea for the young investor in an accumulation phase with a medium to high risk tolerance.

And in fairness, it looks like RPAR wasn't really built for the latter audience. This is how hedge funds invest. But most people do not need to and should not want to invest like a hedge fund. Moreover, I still think there are better, cheaper ways to go about achieving its intended goal. More on that in a sec. First let's talk about specific assets.

Global stocks across all geographies and cap sizes sound great to me. Unfortunately they only get about 25% of the fund.

I like the choice of long treasuries, and I'm even okay with their allocation of about 35%. In short, we know that duration should be matched to time horizon, treasuries are a superior diversifier versus corporate bonds, and long bonds are better able to counteract the movement of stocks. But we also have to grapple with the fact that we're now in an unprecedented time of historically low bond yields, which means we probably don't want 70% in long bonds.

Where it starts getting weird for me is the fact that they're also allocating another 35% to TIPS. I even like that they're long TIPS, but 35% seems heavy, especially given that we know stocks are probably still the best inflation “hedge” over the long term. Again, this weighting is simply a product of the risk parity scheme. TIPS are great for a retiree, but then a retiree probably shouldn't have 70% in long-term bonds.

Next we have gold at about 10%. I've said it plenty of times elsewhere: I'm not a huge fan of gold; it has a long-term expected return of zero, it doesn't seem to be a reliable inflation hedge, and it's taxed as a collectible. That said, gold does reduce volatility due to its usual uncorrelation to both stocks and bonds, and it does seem to hedge against uncertainty. Also, at least we're not talking about a huge 25% allocation like with the Permanent Portfolio. Again, the inclusion of gold is more appropriate for a retiree or someone with a short time horizon; we wouldn't expect any outsized returns from it.

Then we have commodities. Well, not exactly. RPAR uses commodity producers (think energy companies, metal miners, etc.; allocation is about 15%) via the S&P Global Natural Resources Index, but I'm not even sure why. These are businesses involved in commodity production. As such, commodity producers are more correlated with the stock market than with commodities themselves, which sort of defeats the intended purpose of their inclusion. In holding them, the investor would also be taking on the business risks of these companies that may be unrelated to commodities. Lastly, commodity producers tend to sell commodity futures to hedge their price risk, which basically cancels out the precise hedge we're looking for.

The choice of commodity producers could just be for the lower fee or for the greater expected returns compared to commodities per se. In either case, we wouldn't expect anything special out of them. In a nutshell, commodities have had negative real returns over the past century. Remember we still always want our diversifiers to have positive future expected returns. And commodity producers don't even give us much of a diversification benefit with their positive correlation to equities, and don't provide the economic protection we're looking for. So it's wasted space in my opinion. As with the case of the 7Twelve Portfolio that also used commodity producers, it appears to be a case of diversification for the sake of diversification. To be completely fair, once again, this is much less egregious if we're talking about a retiree's portfolio where we're looking to diversify to minimize volatility and risk, but it's still probably not the best way to go about achieving that goal.

To put it succinctly, I guess my main point is this: If you're going to use commodities and TIPS, don't use risk parity weighting, and if you're going to use risk parity weighting, don't use commodities and TIPS. Sadly and ironically, I'd rather see RPAR ditch its risk parity roots in favor of a more realistic, evidence-based view of asset performance and market behavior – and the likelihood thereof – to weight different assets more strategically, though then it would have to change its ticker symbol. Even taking Dalio's retail All Weather Portfolio from the Tony Robbins interview and packaging that as a single product would likely yield superior results over the long term, though admittedly that depends on the investor's goals.

Moreover, RPAR only employs asset class diversification. It does nothing for risk factor diversification, a newer paradigm from financial academia, which researchers have concluded is just as impactful as traditional asset class diversification. We could easily overlay some factor tilts on top of different asset classes, such as with the Golden Butterfly Portfolio and Factor Tank Portfolio.

And while RPAR presents an affordable one-fund solution for a diversified portfolio, I still don't know if that convenience is worth its 0.54% fee. Remember, the fund is not doing anything particularly special other than the treasury futures for some leverage. Aside from that, it's holding a handful of very straightforward, low-cost index funds that any retail investor can buy (e.g. Vanguard's VTI, VWO, and VEA) and rebalance themselves for far cheaper. I'll explore this alternative a bit later on.

Granted, it's obvious that many feel differently, as the fund has amassed an impressive $1.4 billion in assets in a pretty short amount of time. If I had to guess, this is due to a combination of the pre-existing name recognition of terms like “all weather” and “risk parity” and perhaps an efficient solution for both novice investors who don't want to learn to do it themselves and for advisors who don't want to have to take the time to construct and rebalance portfolios for clients.

In complete fairness to Evoke-ARIS, I love the idea of this type of solution, and I even think the fee is reasonable for it; I just wish the execution were a little different. The creators explicitly state that they expect RPAR's long term return to be about the same as that of stocks; I just don't see how that could possibly happen, but all crystal balls are cloudy.

Replicating RPAR with ETFs

RPAR should be available at any major broker if you want to buy it. But if you want to pay less than 1/3 of RPAR's fee and do it yourself, we can roughly replicate RPAR like this:

25% EDV

25% LTPZ

25% VT

15% GNR

10% SGOL

I've created that pie here for those using M1 Finance.

Ideally one would hold this in a tax-advantaged account like an IRA and rebalance regularly.

Conclusion

RPAR sounded cool at first until I actually looked under the hood. I disagree somewhat with some of the asset choices, but I disagree much more with their allocations. In fairness, no one picked those percentages; they're just a product of the unfortunate risk parity approach in this context. I think risk parity can be a useful framework, but not when we're dealing with assets like commodities and TIPS.

I also don't think RPAR is worth its fee, as retail investors can pretty easily replicate it using most of the same exact low-cost index funds that RPAR itself uses. If I were interested in a strategy like this, I'd probably be more likely to use an alternative like SWAN plus gold, classic 60/40, or the Golden Butterfly Portfolio.

What do you think of RPAR? Let me know in the comments.

Disclosure: I own NTSX in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Looking at the past year, RPAR has been diverging from SPY starting in February of 2021 and now, in March of 2023, it is still struggling.

Looking at the backtest from 2020-2023 https://www.portfoliovisualizer.com/backtest-portfolio?s=y&timePeriod=2&startYear=2020&firstMonth=1&endYear=2023&lastMonth=12&calendarAligned=true&includeYTD=false&initialAmount=10000&annualOperation=0&annualAdjustment=0&inflationAdjusted=true&annualPercentage=0.0&frequency=4&rebalanceType=1&absoluteDeviation=5.0&relativeDeviation=25.0&leverageType=0&leverageRatio=0.0&debtAmount=0&debtInterest=0.0&maintenanceMargin=25.0&leveragedBenchmark=false&reinvestDividends=true&showYield=false&showFactors=false&factorModel=3&portfolioNames=false&portfolioName1=Portfolio+1&portfolioName2=Portfolio+2&portfolioName3=Portfolio+3&symbol1=RPAR&allocation1_1=100&symbol2=SPY&allocation2_2=100 it has a larger drawdown than SPY as well. This seems contrary to the funds’ goal of having lower risk. Can you help figure out why this fund is performing so adversely vs the S&P 500 since February of 2021? The fed raised rates in March of 2022 so that can’t be it.

Because basically all the assets in RPAR have been positively correlated recently and have dropped simultaneously. Like I noted in the post, a couple years is just noise anyway though.

Do you have the source on the statement that factor diversification is just as impactful as asset class diversification? In the ’08 crash and the ’20 crash, value and size etfs crashed with the rest of the market.

If you look at the stock portion as a whole, the rpar etf has a 37.5% value tilt (15 / 40 = 37.5) since the commodity producers segment is full of value companies. They aren’t explicitly targeting value, but they have plenty of exposure to it.

The Death of Diversification Has Been Greatly Exaggerated from Kizer and Ilmanen.

Thanks, I hadn’t realized that you were talking about leveraged long short portfolios. I guess, in theory, you could use something like RALS to balance out a portfolio with UPRO and/or NTSX to get a good sharpe ratio. Some people classify long-short portfolios as “alternatives,” but I guess it’s all stocks under the hood.

If you look at GNR on morningstar, it has a P/E of 10 and P/B of 1.62. If you look at its factor regression on portfoliovisualizer, it has a value loading of 0.39. I’m skimming through the holdings of the RPAR etf holdings, and they look pretty similar to GNR.

The Fama-French factors are for equities, not gold and bonds. You can look at the equity components separately to get a sense for what’s going on.

RPAR’s Value loading is nearly zero.

What is your favorite portfolio for a risk adverse retiree?

Thanks!

Hard to say. Probably the All Weather from Dalio.

Hi, what do you think of the UPAR ETF? It uses 1.68 leverage and is benchmarked to stocks. I think the portfolio contains;

49% long treasuries,

49% TIPS,

14% Gold,

21% Commodity Producers,

17.5% US Stocks

7% International Stocks

10.5% Emerging Market Stocks

Thanks for the optimized portfolio website! I appreciate your articles, portfolios, and backtesting.

Thanks, Ty. I mentioned UPAR briefly in the post above. I like it for someone wanting a bit more leverage than RPAR offers.