One of the core tenets of the Boglehead philosophy is to minimize fees whenever possible. That sounds reasonable enough on the surface, but here I'll explain why it's not so simple and why fees aren't as big of a deal as they're made out to be.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Fees Are Relative

If you've read any of my stuff on factor investing or specific small cap value funds, for example, you may remember that I always try to stress the fact that fund fees should be considered and spoken about not in absolute terms but rather in a relative sense for whatever exposure you're paying for.

I'll explain what that means.

Suppose I tell you nothing about two investments except that Investment A has a fee of 1% and Investment B has a fee of 2%. Is one better than the other? Many would reflexively say Investment A with the lower fee is better, but in reality we don't have enough information to draw that conclusion. Investment A may have a return of 5% while Investment B has a return of 7%, in which case we're still coming out ahead after fees with Investment B despite it having the greater expense ratio.

Of course, we can't know realized returns ahead of time, but we develop our investing strategy using expected returns and target exposure that align with our personal goal(s), time horizon, and risk tolerance.

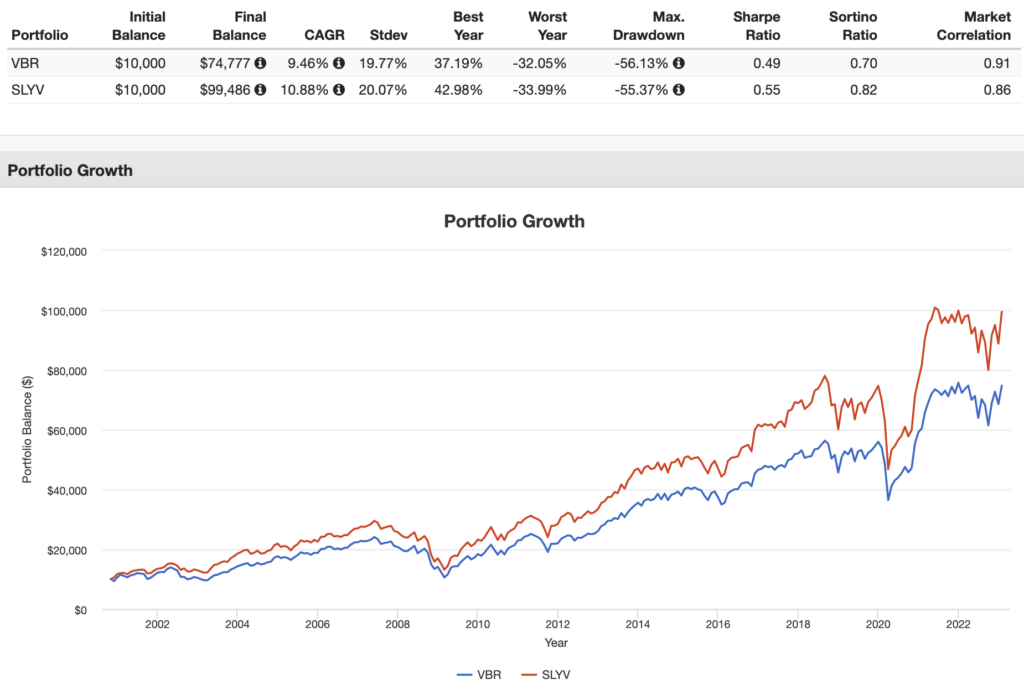

Here's a more concrete example. VBR is an index fund from Vanguard for U.S. small cap value stocks that has a fee of 0.07%. SLYV is another U.S. small cap value fund from SPDR with a fee of 0.15% that uses a different index. Should we prefer the cheaper VBR? In this case I'd say no, because the selection methodology of the index that VBR tracks results in stocks that are neither very small nor very value-y.

That is, we would say SLYV provides superior exposure to the small cap value segment that should more than compensate the investor for its slightly greater fee, which has indeed been true empirically going back to SLYV's inception in late 2000:

We can say the same thing about a fund like NTSX, which provides a modestly leveraged effective exposure of 90% stocks and 60% treasury bonds using bond futures. Some reflexively shy away from its fee of 0.20%, but I'd gladly pay that to avoid rolling futures contracts myself. Again, in this example, the fund's expense ratio is worth its exposure in my opinion. You may feel differently.

The simple point is that it makes little sense to speak about fees in absolute terms and compare funds on that dimension alone, which unfortunately is usually the case with devout Bogleheads. Instead, aim to assess whether or not the exposure you're paying for is worth that fee.

Investors may forget about the broader forest – their strategy, goals, asset allocation, target exposure, etc. – while focusing too much on the trees (fees).

While it may be an unpopular opinion, we can extend this concept to paying for an advisor as well, which in many cases can help check or eliminate your own biases, prevent tinkering and market timing, and provide peace of mind, all of which can outweigh the advisor's fee.

Next we'll discuss why small differences in fees aren't that big of a deal.

Small Differences in Fees Don't Have a Huge Impact

Obligatory clarification here that I'm not at all saying fees don't matter. I'm the first to point out that fees are one aspect of investing that investors can and should control. But make no mistake; tiny differences in fees will not determine the success or failure of your investing strategy and financial plan.

Consider VTI, an ETF from Vanguard to capture the total U.S. stock market. It has an expense ratio of 0.03%. Its mutual fund equivalent VTSAX has a fee 1 basis point higher at 0.04%. For $100k invested, that would be respective annual fees of $30 and $40, so assuming identical pre-tax returns, you'd save a whopping $10 per year going with VTI.

Now of course it may require no extra time and effort to invest in VTI instead of VTSAX, but in a hypothetical scenario that requires extra research, logistical effort, mental energy, and/or time in an attempt to shave off fractions of a percent in fees, sit back and realize that tiny fee savings may not be worth it. This was my exact argument regarding Fidelity ZERO funds.

The point is investors should not waste time obsessing over small differences in fees and should instead focus on much more impactful things like asset allocation, cutting expenses, increasing income, and ensuring their strategy aligns with their goals and risk profile.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply