Emerging Markets refer to nations that are growing and becoming more engaged in the global economy. They are a crucial piece in any globally diversified portfolio. Here we'll look at the best Emerging Markets ETFs to get in on this corner of the market in 2024.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – Why Emerging Markets?

Emerging Markets are growing countries that are becoming more active in the global economy. As such, they have a lower income per capita than developed markets. The growth of these economies typically coincides with industrialization and an increased standard of living. Notable emerging market economies include Russia, Mexico, China, Egypt, Taiwan, India, and Brazil.

Emerging markets comprise about 10% of the global stock market and about 25% of the international (ex-US) stock market. They have outpaced both the U.S. stock market and Developed Markets historically. Arguably more importantly, emerging markets tend to have a lower correlation to the U.S. stock market than international developed markets, offering a superior diversification benefit. Ray Dalio himself, for example, is very bullish on China as a hedge against U.S. market downturns.

For example, consider the decade 2000-2009. While this famous “lost decade” delivered a negative 10% (-10%) return for the S&P 500, Emerging Markets stocks returned a positive 155%. This sort of massive performance difference between Emerging Markets and the U.S. has been fairly consistent throughout history. When Emerging Markets outperform the U.S., they tend to outperform by a wide margin. And when they underperform the U.S., they tend to underperform by a wide margin. This is actually a good thing for diversification.

Emerging Markets are not without extra risk. Specifically, obvious risks include political instability, currency devaluation, infrastructure issues, lack of liquidity, market inefficiency, and absence of free market forces. This is precisely why they are less correlated with Developed Markets, as developed countries do not possess these risks. In fairness, transparency and accounting concerns in Emerging Markets have largely dissipated in the past decade or so with the adoption of accounting and reporting practices. Moreover, investors tend to be compensated for these risks, and they diminish or disappear as emerging market economies grow. Countries can be upgraded or downgraded from classification as an emerging market at any time, based on factors like income levels, financial systems, and growth.

Emerging Markets vs. Developed Markets

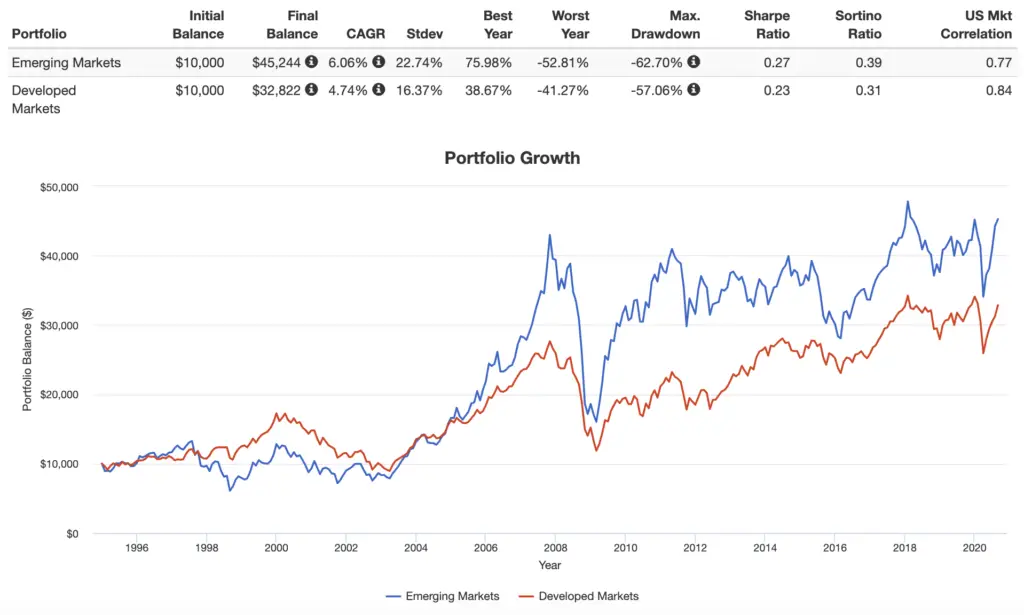

Think of emerging markets as having more room to grow versus developed markets, similar to small cap stocks relative to large cap stocks. Emerging markets have historically outperformed international developed markets, albeit with much greater volatility and risk. Thankfully, more volatile assets make better diversifiers, and returns from emerging markets stocks have compensated investors for this increased level of risk, with emerging markets still delivering higher risk-adjusted returns than ex-US developed markets historically:

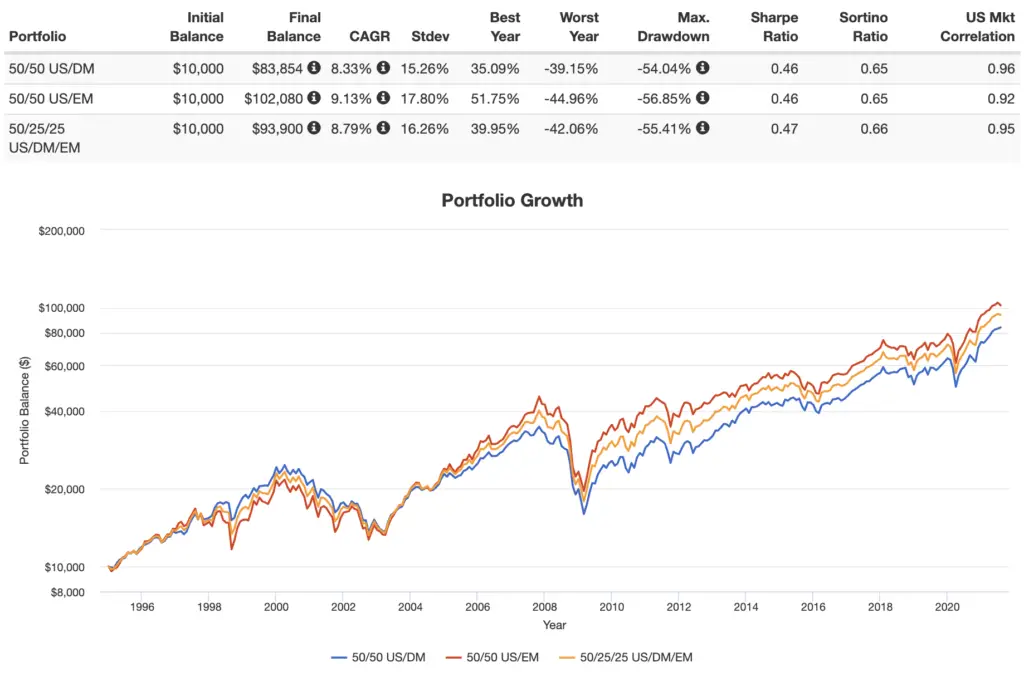

We can demonstrate the aforementioned diversification benefits in a total portfolio as well. The following backtest shows portfolios of 50/50 US to Developed Markets stocks, 50/50 US to Emerging Markets, and 50/25/25 US/DM/EM, from 1995 through July, 2021:

The 5 Best Emerging Markets ETFs

More tools have emerged in recent years to efficiently access emerging markets as an investment. ETFs are the most popular way.

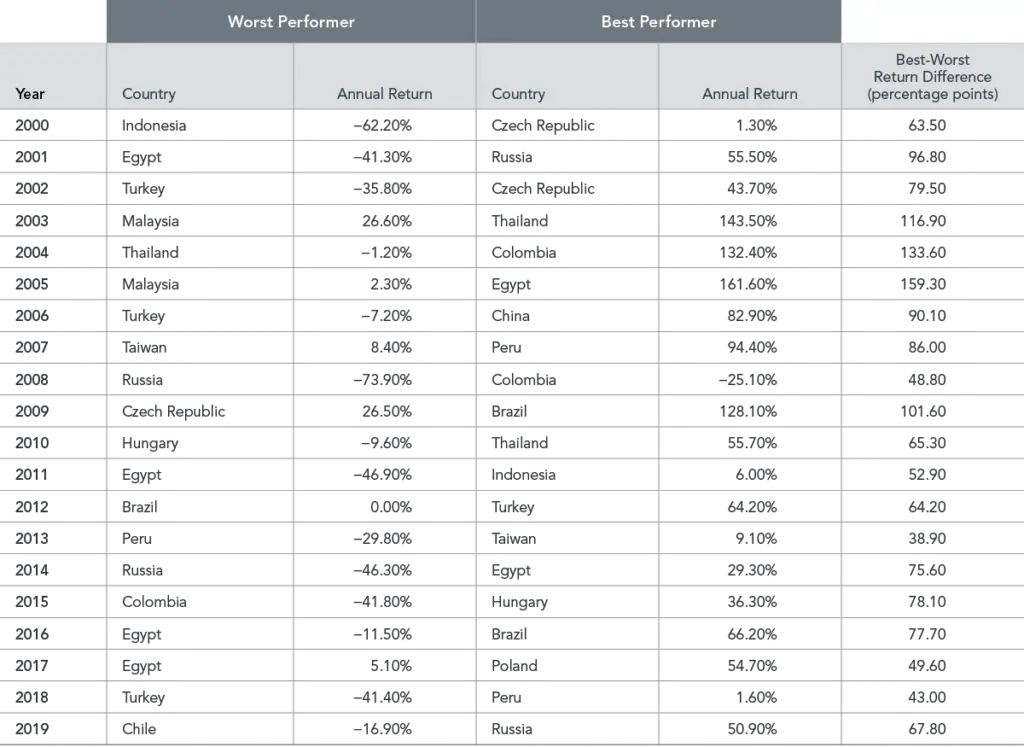

We already know we shouldn't bet on individual countries. This is particularly true in Emerging Markets. For the period 2000-2019, no single country performed the worst for more than two consecutive years, and no single country performed the worst for more than two consecutive years. Similarly, poor-performing countries in certain years tended to be great performers in the years that follow, and vice versa:

Below we'll look at the best emerging markets ETFs to broadly diversify within this market segment. These funds vary somewhat in scope and geographical exposure.

VWO – Vanguard FTSE Emerging Markets ETF

The Vanguard FTSE Emerging Markets ETF (VWO) is the most popular ETF for this space, with over $87 billion in assets. It also happens to be the most affordable, with an expense ratio of 0.10%. The fund seeks to track the FTSE Emerging Markets All Cap China A Inclusion Index. It has over 4,000 holdings.

VWO is popular because of its low fee, but some investors avoid this fund because it is very heavily concentrated in Hong Kong and China at 32% and 18%, respectively.

IEMG – iShares Core MSCI Emerging Markets ETF

The iShares Core MSCI Emerging Markets ETF (IEMG) seeks to track the MSCI Emerging Markets Investable Market Index. It has over $54 billion in assets and an expense ratio of 0.13%. Note that the MSCI index here includes South Korea, while FTSE indexes (e.g. VWO above) do not.

IEMG makes room for South Korea by lowering its exposure to China, but the fund is still highly concentrated in a handful of countries: Hong Kong (28%), Taiwan (15%), South Korea (14%), India (11%), and China (6%).

SCHE – Schwab Emerging Markets Equity ETF

The Schwab Emerging Markets Equity ETF (SCHE) is another affordable Emerging Markets ETF, with an expense ratio of 0.11%. This fund should be considered comparable to VWO from Vanguard. SCHE seeks to track the FTSE Emerging Index. It has over $7 billion in assets.

EMXC – iShares MSCI Emerging Markets ex China ETF

Several of the funds above naturally overweight China. Whether for personal values or due to expectations of lackluster returns, some investors prefer to avoid China altogether. There's an ETF for that.

EMXC from iShares has amassed nearly $1 billion in assets since it launched in 2017. The fund seeks to track the MSCI Emerging Markets ex China Index. In excluding China, this fund covers roughly 85% of the Emerging Markets segment. This narrower targeting comes at a slightly higher cost of 0.25%.

However, EMXC's exclusion of China does not mean it's not still heavily concentrated in a few countries. Top exposure includes Taiwan (22%), South Korea (21%), and India (16%).

XSOE – WisdomTree Emerging Markets ex-State-Owned Enterprises Fund

XSOE is based on the idea that privately run companies are more efficient than companies with mostly government ownership, known as state-owned enterprises. I delved into the details of this idea and this fund in a separate post here.

Basically, this fund excludes any firm with at least 20% state ownership. This strategy has been paying off. XSOE has far outpaced the broader VWO from Vanguard since its inception in late 2014.

The fund seeks to track the WisdomTree Emerging Markets ex-State-Owned Enterprises Index. It has nearly $5 billion in assets and a fee of 0.32%.

Where to Buy These Emerging Markets ETFs

All these emerging markets ETFs should be available at any major broker. My choice is M1 Finance. The broker has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Disclosures: I am long VWO and XSOE in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Curious, you say you are long XSOE in several posts. Are these old disclaimers? As far as your readers know, your portfolios are HFEA, NTSX, and Ginger Ale. Where is XSOE? Would you recommend replacing VWO with XSOE? Thank you.

I’ve got a small amount of fun money in it to see if it outperforms plain VWO just because I find the XSOE concept intriguing. I’m also not obligated to publish my exact portfolio specs.

John what’s your take on Avantis AVEM & AVES emerging markets ETF’S? AVEM has mild tilt & AVES has all cap value tilt.

Wisdom tree also has DGS small cap emerging markets dividend ETF.

AVEM doesn’t seem worth the extra cost. Tiny tilt. It doesn’t look materially different from plain ol’ VWO. AVES is very new; I’m keeping an eye on it. I’ve suggested DGS elsewhere like here, here, and here.

AVEM has some small cap mixed in. Paul Merriman recommends it too. Might be a good option.

Really love your website!