Financially reviewed by Patrick Flood, CFA.

Two of the most popular dividend-oriented ETF's are the Vanguard Dividend Appreciation ETF (VIG) and the Vanguard High Dividend Yield ETF (VYM). Let's compare them.

To be clear, I don't obsess over dividends. But it's impossible to avoid seeing and hearing about dividend investors' preferences of dividend-focused ETF's. Dividend investors seem to use these two funds interchangeably, perhaps not realizing they are two fundamentally different things. Here we'll review these ETFs and explore the nuances between them.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here are the highlights:

- VIG and VYM are two popular dividend-oriented ETF's from Vanguard.

- VIG is comprised of dividend growth stocks – companies with a historically increasing dividend of at least 10 consecutive years, excluding REITs.

- VYM is comprised of higher-than-average-dividend-yield stocks, excluding REITs.

- Since their inception in 2006, VIG has handily beaten VYM on every notable metric.

- VYM has underperformed the S&P 500 index historically.

- Vanguard themselves concluded that the performance of the stocks within VIG and VYM was fully explained by their exposure to the known equity factors of Value, Quality, and Low Volatility.

Contents

Video

Prefer video? Watch it here:

VIG vs. VYM – Methodology

As the name implies, the Vanguard Dividend Appreciation ETF (VIG) is comprised of dividend growth stocks – companies with a history of an increasing dividend over time. Specifically, VIG tracks the NASDAQ US Dividend Achievers Select Index, formerly known as the Dividend Achievers Select Index. This index was created in 2006, and is comprised of companies with at least 10 consecutive years of an increasing dividend payment. VIG has a mutual fund equivalent VDADX.

The Vanguard High Dividend Yield ETF (VYM) seeks to track the FTSE® High Dividend Yield Index. Constituent stocks are selected from the FTSE® All-World Index, excluding REITs, and ranked by forecasted dividend yield. VYM has a mutual fund equivalent VHYAX.

VIG vs. DGRO

While we're at it, we can compare Vanguard's VIG to the iShares Core Dividend Growth ETF (DGRO). They are very similar. The primary difference is that VIG has a dividend growth requirement of 10 consecutive years, while DGRO requires only 5 consecutive years. I compared VIG and DGRO in more detail in a separate post here.

SCHD vs. VYM

Another popular comparison is SCHD and VYM. SCHD is the Schwab U.S. Dividend Equity ETF. It tracks the Dow Jones U.S. Dividend 100™ Index. I delved into more details of this specific comparison in a separate post here.

Basically, as we might expect, compared to both VYM and VIG, SCHD has more loading on the Profitability factor but less loading on the Size and Value factors:

VIG vs. VYM – Composition

| VIG | VYM | |

| Basic Materials | 3.40% | 3.30% |

| Consumer Goods | 11.50% | 15.00% |

| Consumer Services | 20.00% | 9.10% |

| Financials | 10.80% | 15.80% |

| Healthcare | 12.60% | 16.20% |

| Industrials | 25.00% | 8.40% |

| Oil & Gas | 0.00% | 5.50% |

| Technology | 10.10% | 11.20% |

| Telecommmunications | 0.00% | 5.50% |

| Utilities | 6.60% | 10.00% |

Notice VYM's larger weighting to Consumer Goods, Financials, Telecom, and Utilities. These are sectors notorious for relatively high dividend yields, but not necessarily a growing dividend over long time periods.

VIG vs. VYM – Performance Backtest

Typical of Vanguard funds, both VIG and VYM have sufficient AUM and trading volume and low expense ratios; I'm ignoring those quick facts on these since they're largely similar. Yield chasers will of course note that VYM – being focused on high yield per se – has a considerably higher dividend yield than VIG. I would encourage you to ignore that fact and instead focus on the fundamental mechanics and historical performance:

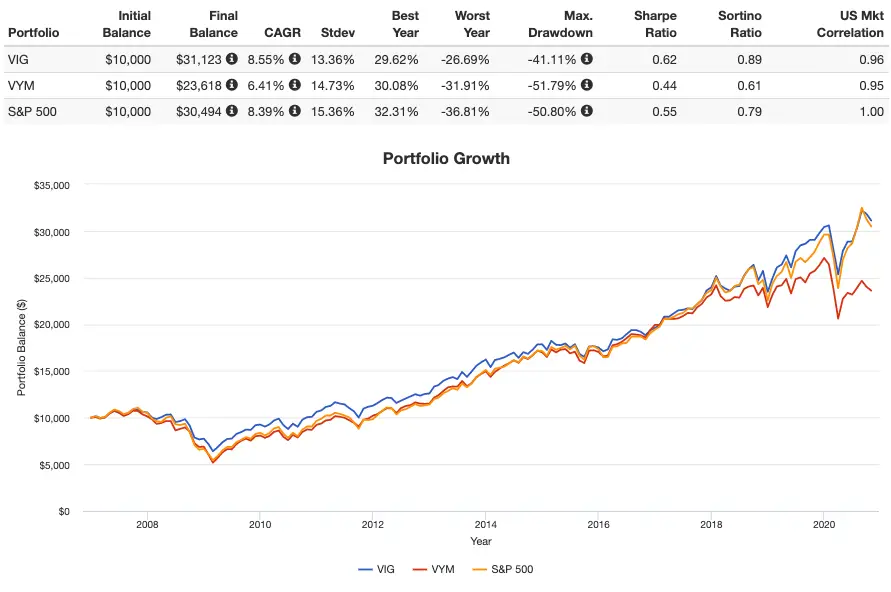

In short, VIG has handily beaten VYM on every metric since inception – higher return, lower volatility, smaller drawdowns, and considerably higher risk-adjusted return (Sharpe). Over that same time period, VYM also underperformed an S&P 500 index.

Of course, when you stop and think about the underlying fundamentals, we should probably expect VIG to beat VYM – dividend growth companies tend to be more stable and less volatile, and have strong profitability. Specifically, VIG has more loading on the Quality/Profitability factor than VYM. Simultaneously, we know that in some cases, a high dividend yield can actually be a signal of an unstable company.

In fairness, VYM also has comparatively more loading on Value than VIG, and the Value factor has suffered over the backtested time period. In short, if one wants to utilize these funds, it's likely wise to just utilize both VIG and VYM (and VIGI and VYMI for international), as they are two different funds. I created a dividend-focused portfolio that incorporates both of these funds that can be found here.

So are VIG and VYM good investments? Maybe. But here's the kicker. Vanguard themselves investigated the strategies contained in VYM and VIG and concluded that their constituent stocks’ performance was fully explained by their exposure to the known equity risk factors of Value, Quality, and Low Volatility, so you may be better off simply investing in products that specifically target those factors.

Conveniently, all these funds should be available at any broker, including M1 Finance, which is the one I'm usually suggesting around here.

Do you hold any of these ETFs in your portfolio? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

After finding your extremely informative site, I began down a rabbit hole of evaluation of factors. My feeling on it varies daily still, so was drawn to what my gut says: buy high quality companies (VIG) and those that pay me to own them (VYM), as well as small companies that potentially have more room to run and may be under valued (VIOV). So came up with the following:

20% each of VIG VYM VIGI VYMI and VIOV.

Coincidentally, the portfolio provides statistically significant loading across profitability, value, and size, along with a tidy 60/40 US/global split, while keeping costs low, portfolio relatively simple, and aligning with my general beliefs of how to invest (which I acknowledge are likely flawed, but nonetheless exist).

I appreciate the article above and the link to the Vanguard article discussing this same conclusion, and thought I’d share. Best option? Probably not. But could probably do worse… thanks again.

Hi

Thanks for the comparison. I want to point out something and get your opinion because I am not sure my assumption is incorrect or not.

So, while VIG has outperformed VYM consistently, VYM’s yield is also about 1.25% higher than VIG. Then on an annual basis VYM is returning 1.25% more in dividend than VIG. If you add that to year over year return then it is not that bad (especially if you are reinvesting the dividend back) – now, I dont know if annual return takes into account dividend yield or not –

Thanks

Returns here include dividends reinvested. Share price compensates for the dividend anyway.

I hold both VIG and VYM, roughly 70/30% split. I am looking for ways to reduce my exposure to FAANG going into 2021.

Tilting toward Value would definitely reduce that exposure. I use a dash of Utilities to specifically diversify away from tech, since I work in tech and the market is already over 1/4 tech.

This was very useful. Love your site and work!

I am currently constructing an in-retirement (i.e. decumulation stage) portfolio and VIG will be a big component. VIG is recommended in all of Morningstar’s Model ETF portfolios.

The big appeal to me is that VIG has the lowest volatility of all the large blend domestic equity ETFs. I am now debating shifting some of my VIG allocation to VYM (I was hesitant before I read this article).

The trend toward value and cyclicals seems to be picking up speed as we as we head into 2021 with an economic rebound expected (VYM is beating VIG on trailing 1-mo, 3-mo and YTD).

I am also looking at VTIP, another Morningstar recommended holding, for a chunk of my bond holdings. VTIP is already making moves and is one of the few bond ETFs with a YTD gain so far. With the 10-year yield rising, the long duration bond ETFs are suffering, but eventually I am going to allocate a big portion to AGG.

My overall portfolio will be 50/50 stocks/bonds split across taxable and trad-IRA accounts. It gets complicated when constructing a multi-account portfolio that you know will be drawn down and down the road you will have glidepath considerations, and taxable income sources like social security and IRA RMDs kicking in.

Thanks Tom!

Excellent Article John. I own both VIG and VYM. Your article makes it Ver easy for anyone to understand the fundamental difference between the two ETFs.

Thanks for the kind words, Sanjay! Glad you found it helpful!

Great work and very helpful as I try to generate income while navigating a very uncertain future

Thanks Bert! Glad you found it helpful!