Financially reviewed by Patrick Flood, CFA.

The Golden Butterfly Portfolio is a medium-risk portfolio similar to Ray Dalio's All Weather Portfolio. Here we'll look at its components and the best ETF's to use in its construction.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Golden Butterfly Portfolio Review Video

Prefer video? Watch it here.

What Is the Golden Butterfly Portfolio?

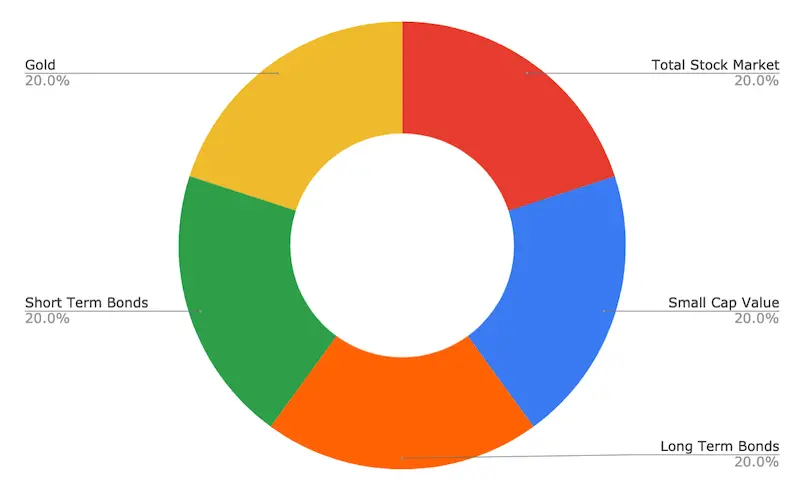

The Golden Butterfly Portfolio is essentially a modified version of the Permanent Portfolio. It was designed by Tyler of PortfolioCharts.com. Its asset allocation looks like this:

- 20% Total US Stock Market

- 20% US Small Cap Value

- 20% Long-Term Treasury Bonds

- 20% Short-Term Treasury Bonds

- 20% Gold

Tyler maintains that the Golden Butterfly Portfolio “goes against conventional investing wisdom.” I wouldn't really go that far. We know that Small Cap Value has historically paid a risk premium and gets us exposure to the Size and Value factors, small- and mid-caps have beaten large-caps historically, short-term treasury bonds are a cash equivalent, and long-term treasury bonds tend to be the best diversifier to hold alongside stocks (and thus are usually a very good hedge/insurance for a stock crash).

The only real point of contention in my opinion is the pretty heavy allocation to gold. I'm personally not a big fan of gold. It has a nonnegative correlation to stocks, albeit low/small, is much more volatile than bonds, is not a value-producing asset (it has a real expected return of zero), and has not been a reliable inflation hedge historically. That said, gold is typically uncorrelated to both stocks and bonds, offering a diversification benefit to lower the portfolio's volatility and risk. Basically, we'd expect to sacrifice some return for a lower risk profile. This may be a perfectly sensible and desirable tradeoff for the risk-averse investor.

Your excitement – or lack thereof – over gold also depends on your view of monetary policy. I'm personally of the mind that monetary policy in the United States is fundamentally different post-Volcker (1982), in that we now know which levers to pull and which levers not to pull in order to avoid a runaway inflationary environment like we saw in the late 1970's, when bonds suffered and gold did well.

I would argue that for a young investor with a long time horizon and a high tolerance for risk, holding gold only creates the opportunity cost of holding something else in its place with greater expected returns, like more stocks. That said, again, I'll concede that it may offer a short-term diversification benefit and the metal does seem to reliably hedge against currency devaluation, making for safer withdrawal rates in retirement, so adopting the Golden Butterfly Portfolio may very well be a prudent move at or near retirement, or for a risk-averse investor who wants to cover all bases for all environments to minimize volatility and risk.

Golden Butterfly Portfolio vs. Permanent Portfolio

The premise of the Permanent Portfolio is to utilize assets that perform well in four economic conditions: expansion (stocks), recession (cash or short-term bonds), inflation (gold; debatable), and deflation (long-term treasury bonds). The Golden Butterfly Portfolio simply takes those same assets and specifically adds Small Cap Value, a move that I'm a fan of. This invariably makes it comparatively more “aggressive” than the Permanent Portfolio, but we're still talking about a relatively low-volatility, all-seasons portfolio. Adding small-cap value conveniently means greater expected returns and a diversification benefit from the Size and Value factors being lowly correlated to market risk (beta).

In taking up a larger stocks position, we're also tilting toward an expansionary economic environment. I'm definitely okay with this; the economy grows more than it declines. Your adoption thereof may depend on your economic outlook.

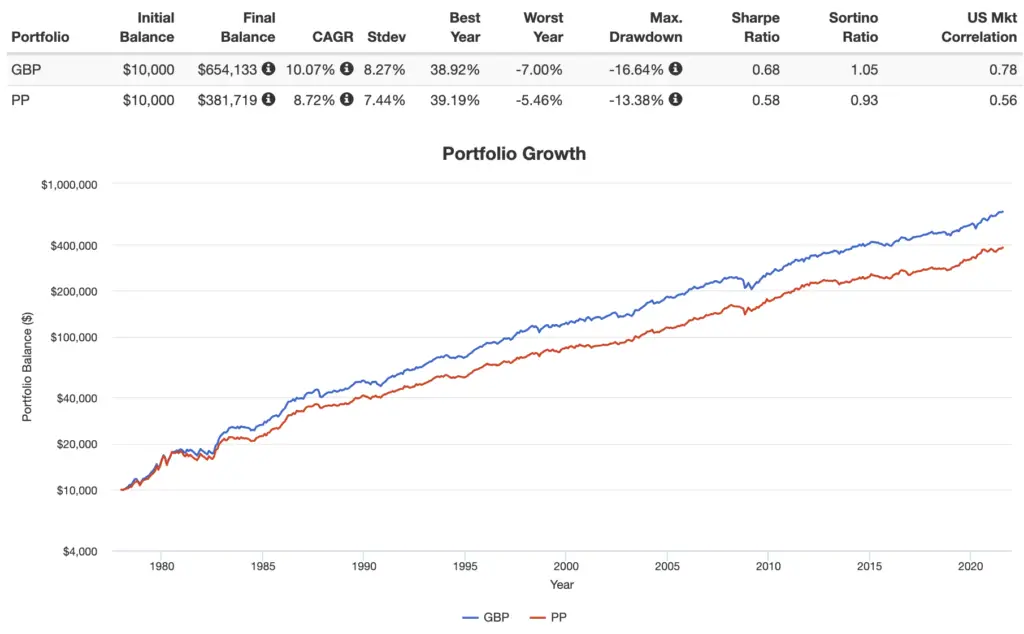

Here's a backtest from 1978 through July, 2021 comparing the Golden Butterfly Portfolio and the Permanent Portfolio:

As we'd expect, going back to 1978, we see a greater CAGR and Sharpe (risk-adjusted return) for the Golden Butterfly, with slightly more volatility and a larger drawdown. This is due again to its inclusion of small cap value stocks. Looking at the Sharpe ratios, a measure of risk-adjusted return, we can see that we were better compensated per unit of risk by going with the Golden Butterfly Portfolio.

I'd definitely take the Golden Butterfly over the Permanent Portfolio. Again, I like small cap value stocks, and I don't want the Permanent Portfolio's extra 5% in gold.

Golden Butterfly Portfolio vs. All Weather Portfolio

Compared to Ray Dalio's All Weather Portfolio, we're talking about more gold, more stocks, and less treasuries. Like the All Weather, the Golden Butterfly Portfolio is designed to “weather” any storm by utilizing diversification.

As mentioned, the Golden Butterfly Portfolio tilts toward economic expansion. Dalio chooses to be a little more market-agnostic with the All Weather Portfolio, admitting that we don't know what the future will hold. Unfortunately, while this provides a lower risk profile similar to the Permanent Portfolio, it has tended to drag down the portfolio's returns a bit over the long term, particularly due to its inclusion of broad commodities.

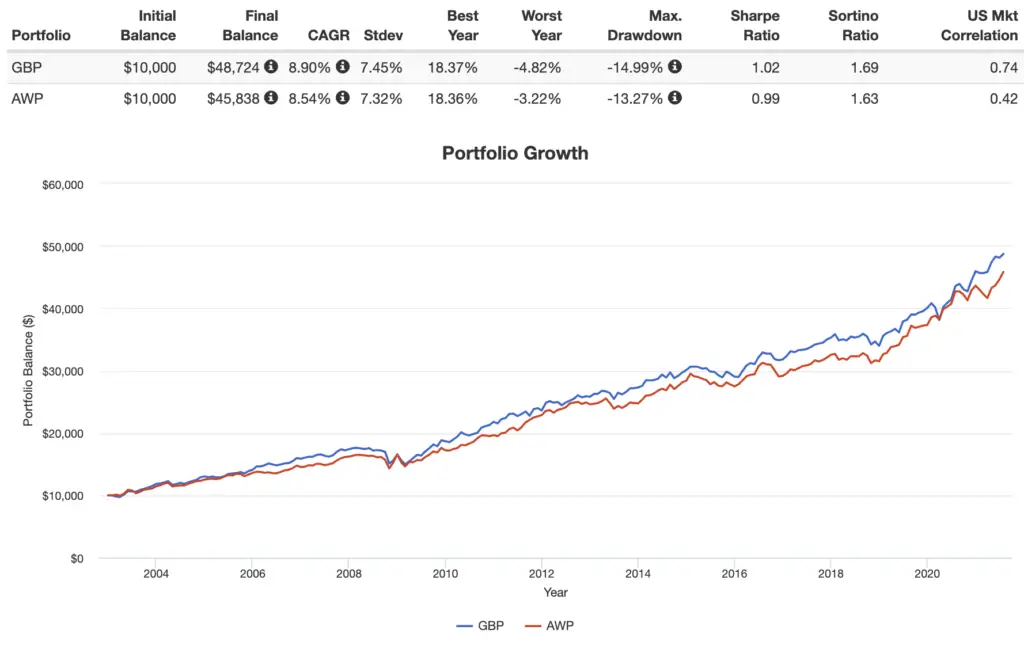

With data for Commodities funds only going back to 2002, here's what the comparison looks like from then through July, 2021:

Results have been very close for that time period. Just like we saw with the Permanent Portfolio, with the Golden Butterfly we have a very slightly higher risk profile, but we're compensated for that greater risk in the form of higher general and risk-adjusted returns.

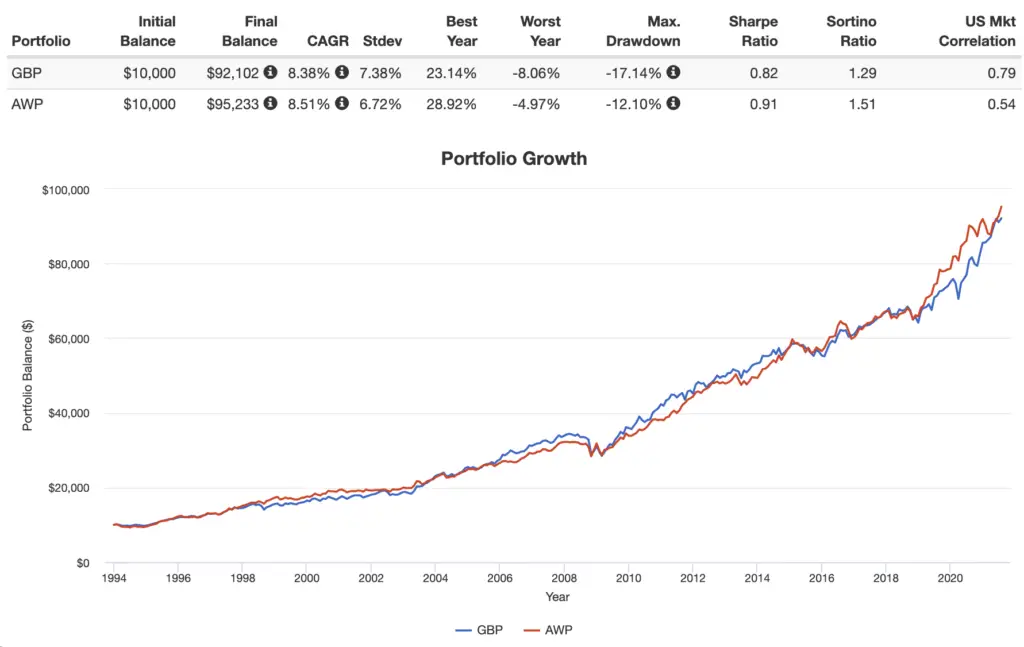

Let's explore an alternative. If you're like me, you might replace Commodities (they're pretty awful) in the All Weather Portfolio with Utilities (I delved into this here). Making that substitution, we can get data going back to 1993, and the results are pretty different:

Results have been neck and neck for that time period in terms of return. The All Weather came out with a significantly smaller max drawdown and slightly lower volatility to deliver a higher risk-adjusted return. But in fairness, the Size and Value factors have also suffered greatly over the decade 2010-2019, which didn't bode well for the Golden Butterfly for that time period, and the past 40 years have also been very kind to the All Weather's greater allocation to and longer duration of bonds.

Golden Butterfly Portfolio ETFs for M1 Finance

M1 Finance is a great choice of broker for U.S. investors to implement the Golden Butterfly Portfolio because it makes regular rebalancing seamless and easy, and it has zero transaction fees. I wrote a comprehensive review of M1 Finance here.

Utilizing mostly low-cost Vanguard funds, we can construct the Golden Butterfly Portfolio pie with the following ETF's:

- VTI – 20%

- VIOV – 20%

- VGLT – 20%

- VGSH – 20%

- SGOL – 20%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Add to Portfolio.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Taking the Golden Butterfly Portfolio International

You may have noticed a glaring problem with the Golden Butterfly Portfolio: it only uses U.S. assets and has no international exposure. That's almost certainly suboptimal, especially considering its whole purpose is to reduce volatility and risk. Taking the stocks global, the portfolio and subsequent pie then look like this:

- VT (world stock market) – 20%

- VIOV (US small cap value) – 10%

- AVDV (int'l small cap value) – 10%

- VGLT – 20%

- VGSH – 20%

- SGOL – 20%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Add to Portfolio.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Modified Golden Butterfly Portfolio

A “Modified Golden Butterfly Portfolio” emerged on the Bogleheads forum in mid-2017. Of course, anyone can create their own “modified” version of any portfolio. The one proposed combines my above suggestion of diversifying internationally with equities and avoiding gold, choosing instead to use TIPS and REITs as direct inflation hedges:

- 20% Total World Stock Market

- 20% Total World Small Cap Value

- 20% Long-Term Bonds

- 20% Short-Term Bonds

- 10% TIPS

- 10% REITs

Using mostly low-cost Vanguard funds, we can construct this Modified Golden Butterfly Portfolio as follows. At the time of writing, since there's no ETF available for global small cap value, I'm using half U.S. small cap value and half international small-cap value.

- VT – 20%

- VIOV – 10%

- AVDV – 10%

- VGLT – 20%

- VGSH – 20%

- SCHP – 10%

- VNQ – 10%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Add to Portfolio.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Leveraged Golden Butterfly Portfolio

We can't construct a leveraged Golden Butterfly Portfolio that matches the base portfolio perfectly because there are no leveraged ETFs available for short-term bonds or small-cap value stocks. However, holding 20% long-term bonds and 20% short-term bonds is roughly the same thing as holding 40% intermediate-term bonds. We can also combine the 2 20% stocks positions to a single 40% position to track the S&P 500.

The next issue is that there are now no 3x gold ETFs available. Using 3x leverage on intermediate-term treasury bonds and 3x leverage on the S&P 500 for stocks, we can roughly match the intended exposure ratio with the following allocations:

36% 3x stocks

36% 3x interm. treasury bonds

28% 2x gold

This leveraged Golden Butterfly Portfolio essentially becomes a variant of Hedgefundie's Excellent Adventure with a heavy allocation to gold.

Remember that using leverage – especially in the form of leveraged ETFs – increases portfolio risk and the potential for greater returns, but also the potential for greater losses. Do your own due diligence before blindly buying leveraged funds, and read the fine print on these products. They can potentially be extremely dangerous. I talked a bit more about leveraged ETFs and how they work here.

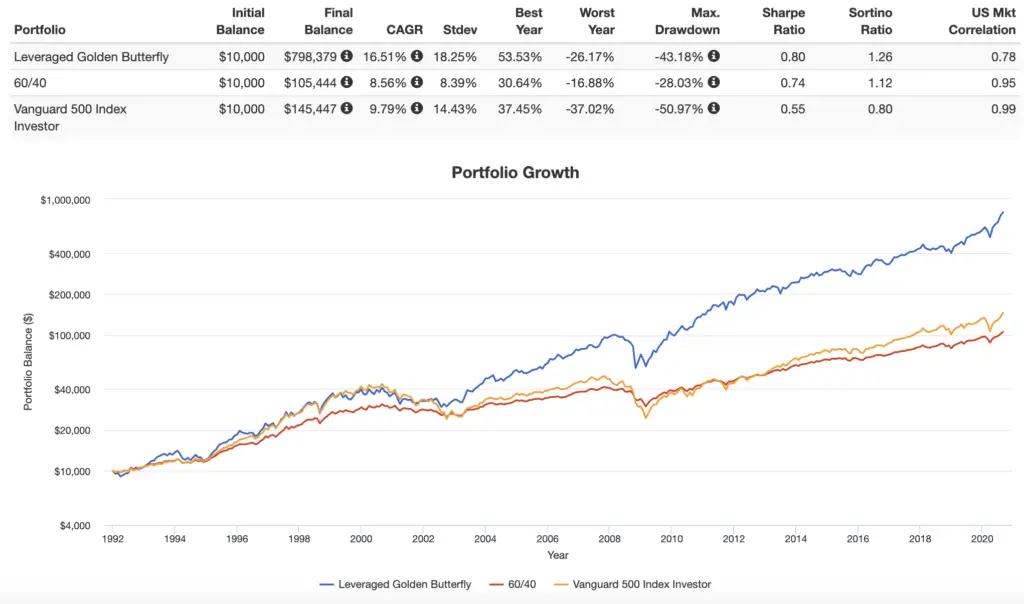

Below is a backtest showing how this portfolio would have performed vs. the S&P 500 and a 60/40 portfolio historically:

Notice this portfolio would have achieved much higher returns historically with volatility not too much greater than an S&P 500 index fund, and with smaller drawdowns. This portfolio even achieved a greater risk-adjusted return than a classic 60/40 portfolio.

Using popular leveraged ETFs from ProShares and Direxion, we can construct this leveraged Golden Butterfly Portfolio as follows:

UPRO – 36%

TYD – 36%

UGL – 28%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Add to Portfolio.”

Right now M1 is offering a transfer promotion of a 0.50% payout on settled transfers over $10,000 into Invest accounts before January 31 with a max payout of $25,000. Terms for this promotion are here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosures: I am long VTI and UPRO in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

It seems like LTPZ serves as an interesting option that offers lower standard deviation and CAN outperform the UGL portfolio over some time horizons while underperforming over others where gold spiked. At the same time, LTPZ seems like a more ‘natural’ hedge for such a levered portfolio. Thinking that more ‘natural’ hedge that uses the duration risk rather than direct leverage exposure in an already levered portfolio is more conservative on the downside while allowing much of the same upside. Thoughts?

I’ve been messing with Backtest Portfolio and the leveraged utilities / financial All Weather numbers. This was pretty darn good.

UPRO 30

UBT 40

TYD 15

UTSL 7.5

FAS 7.5

But then I was comparing Golden Butterfly and ended up at a “reversed” AW (or modified Perm?). Only -0.4% CAGR but better volatility, Drawdown, and Sharpe. Would that still be the case further back in time, say through 2008 or DotCom?

UPRO 30

*UBT 15*

*TYD 40*

UTSL 7.5

FAS 7.5

How can I check this stuff further back in time? It tells me UTSL is the limiting factor, UPW (2x) got me back to 2010, TMF back to July 09, SPXL to May 09…

And thank you for your quick response to my other post.

UBT is 2x while the others are 3x. I think you meant to use TMF.

Yea, 10 years doesn’t tell us too much, especially since we’ve been in a bull market basically the whole time.

You can create your own simulation data from the underlying index and upload to PV (this might only be on the paid version now) or for a quick and dirty method, use the ‘normal’ 1x funds and a negative cash position to simulate borrowing.

I came across the Golden Butterfly portfolio a few years ago while doing research for a portfolio that would provide a high Safe Withdrawal Rate during retirement – at the time, the SWR for the GB portfolio was around 6.5% over 30 years. Although you touched upon it’s value of providing a portfolio to minimize volatility and risk in retirement, I’m surprised that you started swapping some of the core assets out to maximize performance (to the point of using leveraged funds, which is counter to why people use this fund in the first place).

People are free to use whatever version of whatever portfolio they want based on their own goals, time horizon, risk tolerance, and beliefs about certain assets. “Swapping” some assets wasn’t an attempt at chasing performance; those versions would likely have lower volatility and risk than the original. Global stocks is a no-brainer.

Here’s a question that’s I’m having a hard time finding an answer to. Dues having short term bonds in the golden actually make any sense? Replacing shot term Treasurys with more long term increase returns and barely effect draw downs on PV (about 1% different in 08.) Is the short term T for times like the 70s with high inflation as the short term rates will quickly rise or are they just pointless?

For the GBP’s intended purpose of doing well in any environment for basically any horizon, yes, in that short bonds are a decent inflation hedge. But for a long term investor, not really, in my opinion. The portfolio takes a bond barbell approach – half long, half short, which basically equals an intermediate duration position. Keep in mind what happened in the past may not happen in the future.

I’d be interested to hear your thoughts on using VBR for small cap value, given your recent small value showdown https://www.optimizedportfolio.com/small-value-showdown/. .i.e. why VBR here vs VIOV or AVUV?

Just haven’t swapped it out for this portfolio yet. Will hopefully get to it soon.

Hi John,

Thank you for this excellent post.

I have a practical question. I would like to back test your leveraged golden butterfly portfolio, but in PortfolioVisualizer UPRO, TYD (and possibly UGL) go back only about 10 years. For UPRO I found a simulation file in the HedgeFundy discussion. Do you have a similar solution for the others as well?

Kind regards,

Wouter

You could create simulated returns for those, or for a quick and dirty way, just use mutual fund equivalents of the underlying and set them at 200% or 300% with a negative CASHX position in PV to simulate borrowing.

Curious as to your choice of TIP for your modified GB portfolio, versus VTIP, SCHP, or LTPZ? Does TIP have a longer average maturity then others, providing better protection (within this overall allocation setup)?

Great question. VTIP is short. LTPZ is long. TIP and SCHP are intermediate, so SCHP would be a suitable replacement. I’ll probably make that swap when I have time. LTPZ would likely be a fine choice too if one has a long investing horizon. I may look into which one backtests better and will come back and update you.

Did some backtesting. As we’d probably expect, the one with LTPZ has delivered slightly greater returns, with slightly more volatility. Identical risk-adjusted returns as measured by Sharpe.

Have you ever thought about a leveraged version of the Golden Butterfly portfolio ?

I did some backtest on PV and it looks amazing,both x2 and x3 versions.

Hi Jeremy. I explored a leveraged option above here.

Yeah,my bad I didn’ see that for error

Which one has the best chance to perform with higher sharpe ratio,cagr and lower drawdown and standard deviation,if you had to bet on it:

Hedgefundie or Leveraged Golden Butterfly ?

Tough to say. I’d bet the leveraged Golden Butterfly would have lower volatility and smaller drawdowns but it would probably sacrifice some return with the gold. Hedgefundie would likely have a higher CAGR with more volatility, but long term bonds are also starting to look potentially questionable. I’d imagine the risk-adjusted returns as Sharpe would be extremely close.