Small-cap stocks have delivered greater returns than large-cap stocks historically. Below we'll review some of the best small cap ETFs to capture that risk premium in 2024.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here's the list:

- VB – Vanguard Small-Cap ETF

- ISCB – iShares Morningstar Small-Cap ETF

- IJR – iShares Core S&P Small-Cap ETF

- VIOO – Vanguard S&P Small-Cap 600 ETF

- SPSM – SPDR Portfolio S&P 600 Small Cap ETF

- SCHA – Schwab U.S. Small-Cap ETF

- VSS – Vanguard FTSE All-World ex-US Small-Cap ETF

Contents

Video

Prefer video? Watch it below. If not, keep scrolling to keep reading.

Introduction – Why Small Cap Stocks?

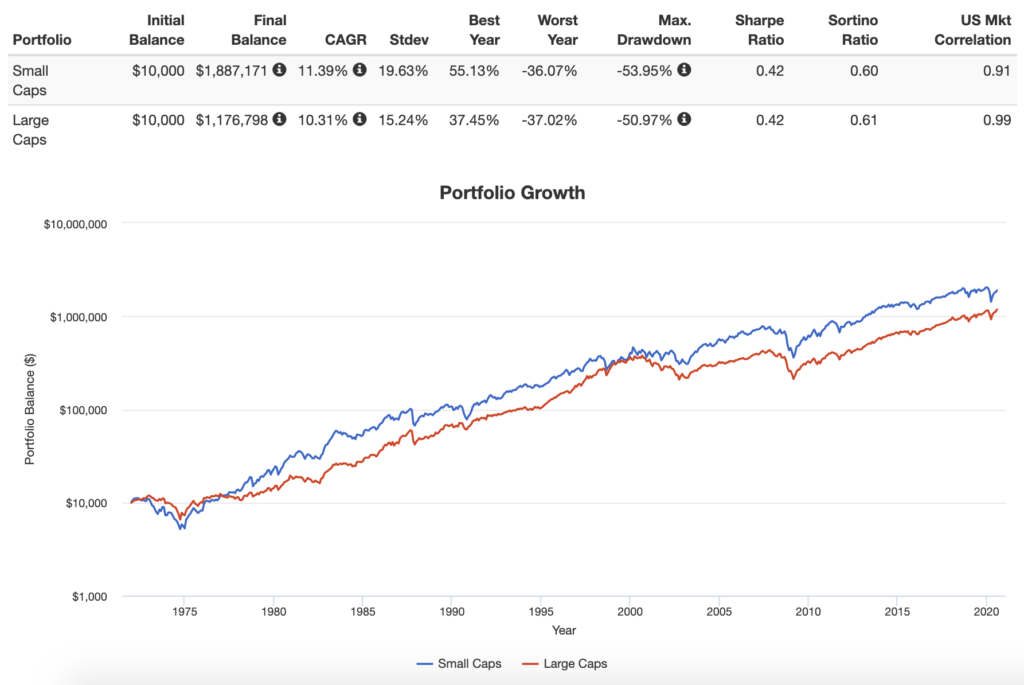

Small-cap stocks account for roughly 6% of a total market index fund by weight. Many investors like to overweight or tilt small-cap stocks due to their historical outperformance:

Small-cap stocks tend to have more room to move than large-caps, so they exhibit greater volatility. More importantly, small-caps are more risky than more stable, large-cap stocks. Because of this, investors demand higher returns for this greater risk, so small-cap stocks have historically paid a risk premium, referred to as the Size factor premium. As an added bonus, small caps aren't perfectly correlated with large caps, potentially offering a small diversification benefit.

Including small caps also took the famous 4% Rule (a safe withdrawal rate estimate for retirement) up to 4.5% historically.

For those wanting to specifically focus in narrower on small cap value or small cap growth, I made lists for them here and here respectively.

So now that we know why small-caps may deliver market outperformance, let's explore the best small cap ETFs.

The 7 Best Small Cap ETFs

Below are the 7 best small cap ETFs in no particular order:

VB – Vanguard Small-Cap ETF

The Vanguard Small-Cap ETF (VB) seeks to track the CRSP US Small Cap Index. With over $90 billion in assets, it is the one of the most popular ETFs to capture the small cap market segment. The fund has over 1,300 holdings and an expense ratio of 0.05%.

ISCB – iShares Morningstar Small-Cap ETF

iShares recently slashed fees on some of their funds. ISCB is one. It now only costs 0.04%, 1 basis point less than Vanguard's VB above. ISCB also conveniently captures smaller stocks, whereas VB above has some mid-caps. The fund seeks to track the Morningstar US Small-Cap Extended Index and has about $230 million in assets.

IJR – iShares Core S&P Small-Cap ETF

The iShares Core S&P Small-Cap ETF (IJR), as the name suggests, seeks to track the S&P Small Cap 600 Index. The fund has over $75 billion in assets, 600 holdings, and an expense ratio of 0.06%.

This fund has the highest loading on the Size factor of all the funds on this list, meaning it captures the returns of the smallest stocks. It also provides some convenient exposure to Profitability through the S&P earnings screen.

VIOO – Vanguard S&P Small-Cap 600 ETF

VIOO from Vanguard tracks the same index as IJR above (the S&P Small Cap 600 Index), so it provides excellent exposure to small stocks, albeit at a slightly higher price of 0.10%. That said, if for some reason you prefer Vanguard funds, this would be my choice. This fund has nearly $3 billion in assets.

SPSM – SPDR Portfolio S&P 600 Small Cap ETF

SPSM from SPDR rounds out the trio tracking the same S&P Small Cap 600 Index, conveniently at the lowest fee of 0.03%, which is what makes it my “best in class” ETF of choice for the US small cap blend segment.

SCHA – Schwab U.S. Small-Cap ETF

The Schwab U.S. Small-Cap ETF (SCHA) seeks to track the Dow Jones U.S. Small-Cap Total Stock Market Total Return Index. This fund is another great, low-fee option for investing broadly in small-cap stocks.

Those seeking broader diversification in the small cap space compared to the previous few funds will enjoy the fact that SCHA has over 1,700 holdings.

This ETF has over $15 billion in assets and is very affordable with an expense ratio of 0.04%.

VSS – Vanguard FTSE All-World ex-US Small-Cap ETF

Ready to target international (ex-US) small-cap stocks?

The Vanguard FTSE All-World ex-US Small-Cap ETF (VSS) tracks the MSCI ACWI ex USA Small Cap Index at a low fee of only 0.07%, providing exposure to small caps in both developed and emerging markets outside the U.S. in the form of over 4,000 holdings.

Where to Buy These Small Cap ETFs

All these small cap ETFs should be available at any major broker. My choice is M1 Finance. M1 has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Disclosures: None.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

I just heard of an interesting one today. XSVM. I came back here because I thought you might like it.

It screens the s&p600 for the top 240 based on p/e, p/s and p/b.

Then out of the 240 best “value” names, it somehow calculates the top half of those based on momentum. So you sorta get 2 factors in this. Size and momentum.

Reasonable expense ratio and a backtest shows it, so far, has done well against AVUV

Sorry I just realized this wasn’t a small cap value article. But I’m out for time and the info is hopefully still useful.

I just heard of an interesting one today. XSVM. I came back here because I thought you might like it.

It screens the s&p600 for the top 240 based on p/e, p/s and p/b.

Then out of the 240 best “value” names, it somehow calculates the top half of those based on momentum. So you sorta get 2 factors in this. Size and momentum.

Reasonable expense ratio and a backtest shows it, so far, has done well against AVUV

Sorry I just realized this wasn’t a small cap value article. But I’m out for time and the info is hopefully still useful.

Jim, XSVM is definitely not a bad choice, but its factor loading looks pretty different than AVUV. Its index has also changed several times. Why did you submit the same comment 3 different times?

Can you go into more detail on why you prefer VIOO over VB/VSMAX? Especially since Vanguard recommends the opposite? Any good advice or articles on holding small cap in a taxable brokerage account?

Just superior exposure to the Size and Profitability factors. I detailed some of this in relation to Value here. Vanguard doesn’t really “recommend” one, they just assume most people are naively looking for the lowest fee for a stated market segment, which is true. Not much to know about small caps in taxable. All things being equal, they’ll be less tax-efficient than a large cap fund due to higher turnover, especially when talking about small cap value.