Recent technological advances in the investing world have resulted in new mobile apps that make it easier than ever before to get in the market and start saving for retirement. In this post we'll look at the best investing apps for beginners for 2024.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here's the list:

Contents

Introduction – Features of the Best Investing Apps

Not long ago, investors had to call in on a phone or use a clunky desktop application – or worse, pay hefty fees to an advisor – to buy or sell securities. Fast forward to today, and modern, user-friendly mobile apps have now made it seamless and easy for anyone with a smartphone to start investing in minutes. Even big traditional brokers are overhauling their mobile apps and mobile websites to keep up with trends and to capture younger, more tech-savvy investors.

In selecting and comparing the best investing apps for beginners, here are some of the primary features and criteria we're concerned with:

- Commissions – Trade commissions are fees paid to the broker when an order is placed to buy or sell a security. A security can be a stock, bond, options contract, etc. Commissions are also called trading fees, since they're incurred every time you make a trade. The amount of the commission can vary pretty wildly among brokers.

- Fees – Outside of trade commissions, you might also be looking at account fees and management/advisor fees depending on which investing platform you choose and how you plan to invest. Thankfully, we've seen a recent race to zero for commissions and fees, with quite a few brokers now offering commission-free and fee-free investing, making saving for retirement cheaper and more accessible than ever before. Zero-fee investing is especially important for beginners with a small amount of capital so that you can hold on to every dollar possible.

- Account types – Most beginner investors only need a simple taxable brokerage account and/or a tax-advantaged retirement account like a Roth IRA or a Traditional IRA. More account types include Joint, Custodial, Solo 401(k), Trust, and more. Make sure the investing app you choose offers the account type(s) you need.

- Investment products – Some brokers allow you to invest in more products than others. These products include stocks, ETFs, mutual funds, options contracts, futures, forex, OTC stocks (aka “penny stocks”), and cryptocurrency. Make sure the investing app you choose offers the investment products you want. Beginners will likely only need stocks and/or ETFs. Options and futures are called derivatives that are only appropriate for experienced investors.

- Margin rates – Margin refers to borrowing against your own investments to enhance your exposure with the hopes of enhancing returns. While investing on margin is likely not suitable for beginners right off the bat, it can be a useful tool once the investor fully understands the risks and potential rewards involved. Brokers set an interest rate for the margin loan, usually around 6-7% on average for a margin loan of $100,000.

- Usability – Usability refers to the ease of use or intuitiveness of a particular interface, in this case mobile apps. Older, complex, clunky interfaces are harder to navigate, requiring more time and effort.

- Fractional shares – At the time of writing, a single share of Amazon stock costs north of $3,000. With many brokers, you'd need to save up $3,000 before being able to buy any stock in Amazon! With fractional shares offered by some brokers, you're able to buy a fraction of a single share of a stock or ETF, e.g. buying roughly 1/30th of a single share of Amazon with only $100. This feature is especially important for beginners because it allows every penny to go to work for you as soon as possible, allowing your portfolio to grow faster.

- Automatic rebalancing – Diversified portfolios of multiple asset types (e.g. stocks and bonds) require regular rebalancing to keep your target asset allocation on track. Some brokers can do this for you automatically, saving you time and effort.

The Best Investing Apps for Beginners – The List

1. M1 Finance

Most lists save the best for last. Not here – the best is going first. M1 Finance is the best investing app for beginners right now in my opinion.

M1 Finance

Summary

M1 Finance is the best investing app for beginners at the moment in my opinion, offering zero-fee investing and key features like auto rebalancing, fractional shares, sleek interface, and low margin rates.

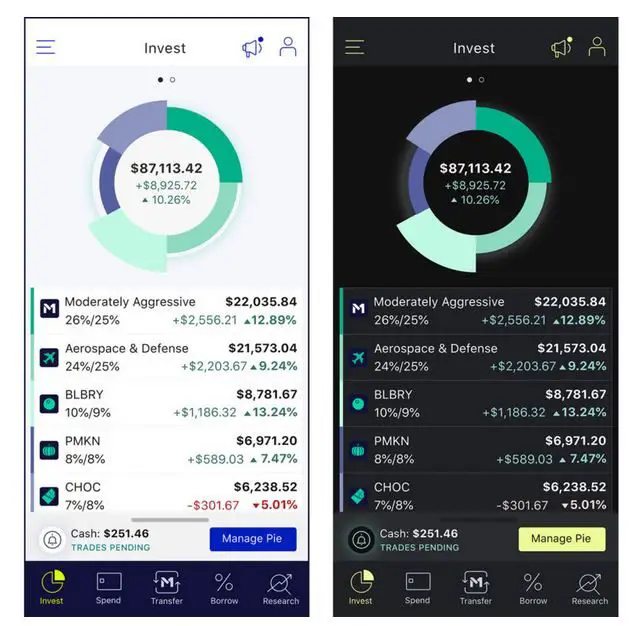

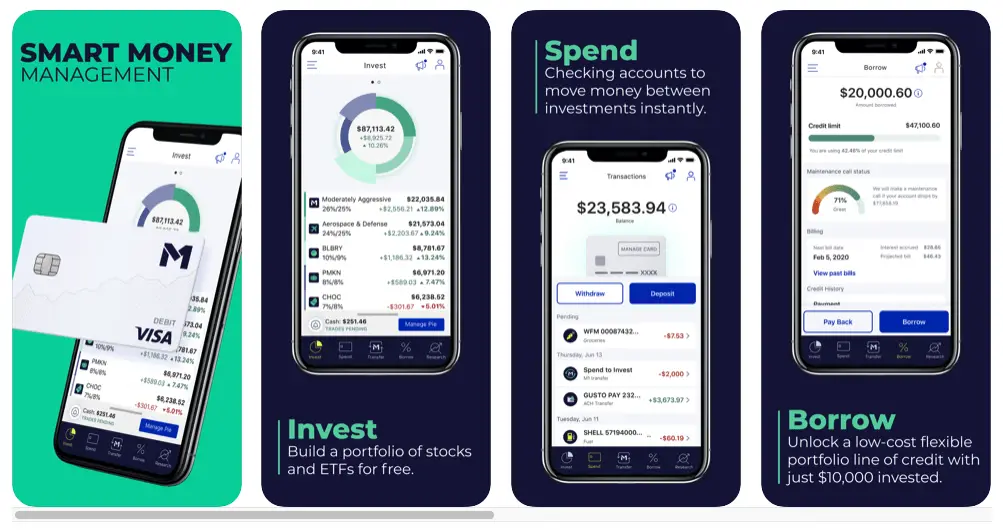

M1 Finance offers zero fees, auto rebalancing, fractional shares, pie-based portfolio visualization, low margin rates, and an excellent, intuitive mobile app. The desktop interface is also pretty great. No other broker currently matches them on all these fronts. Note that M1 is suited for long-term, buy-and-hold investing and not day trading.

I wrote a comprehensive review of M1 Finance here if you're interested in the specifics of the platform. Here's a quick look at M1:

- Zero fees and zero trade commissions.

- Account types: Taxable, Joint, Traditional IRA, Roth IRA, Rollover IRA, SEP IRA, and Trust. M1 currently does not offer SIMPLE IRA, 401(k), Solo 401(k), 529, Custodial, HSA, or Non-Profit accounts.

- Integrated FDIC-insured checking account with debit card called M1 Spend.

- Investment products: most stocks and ETFs traded on major exchanges. An ETF (exchange-traded fund) is just a basket of stocks sold as a single security, usually based on an index like the S&P 500. M1 does not offer mutual funds, penny stocks, options, futures, forex, or crypto.

- Auto rebalancing – M1 features what it calls “dynamic rebalancing,” where new deposits are automatically directed to buy underweight assets to maintain your target asset allocation without having to sell any of your investments or rebalance manually.

- Fractional shares – Again, fractional shares allow your money to go to work for you faster. This means you can invest early and often with very little money, allowing your portfolio to grow more quickly. This feature is particularly important for new investors.

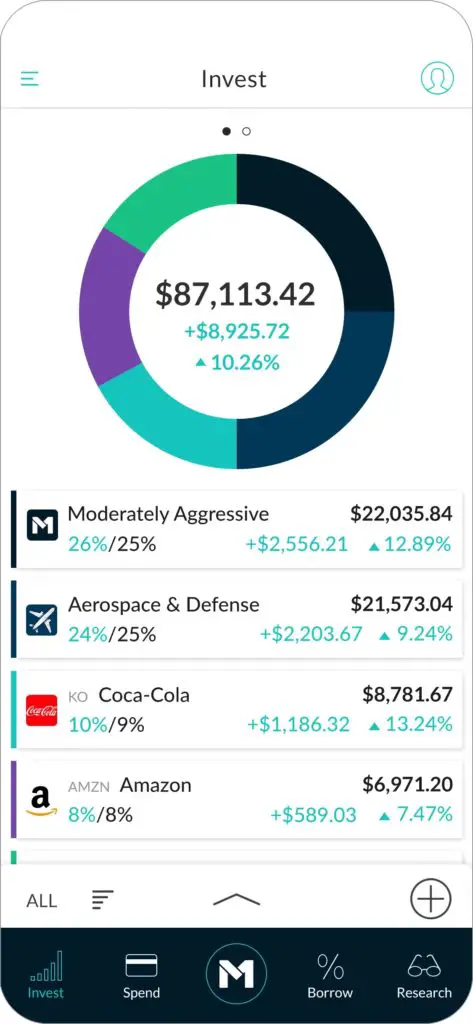

- Pie visualization – M1 Finance uses “pies” to visualize portfolios, making it easy to see allocations and holdings at a glance. You can also create and share your own custom pies of stocks and ETFs.

- Expert Pies – Don't feel like creating your own portfolio or don't know where to start? M1 offers expert-built, ready-to-go pies based on risk tolerance and time horizon, including target date funds. They are free to use. M1 is also great if you want to use a lazy portfolio.

- Dividend dashboard – M1 is very popular among dividend investors due to its custom pies and dividend tracking dashboard.

- M1's margin rate is a low 3.5%. Most brokers are around 6-7%. M1 has a premium membership option called M1 Plus, at a fee of $125/year, that gets you access to a 2% margin rate.

- Note that M1 lacks order control (e.g. limit orders) and an all-day trading window, but this should be of no concern to a long-term buy-and-hold investor. Again, don't try to do any short-term trading with M1.

- Intuitive, modern mobile app and desktop interface. Most of the big traditional brokers are still lacking in this area. Here are some screenshots:

2. Schwab

Charles Schwab is no longer just your grandpa's brokerage, and it's the only traditional broker on this list. The firm has made huge strides in the past few years with renovating their mobile app and lowering fees. If you happen to need special account types or investment products that M1 Finance doesn't offer, Schwab is the next best choice.

Schwab

Summary

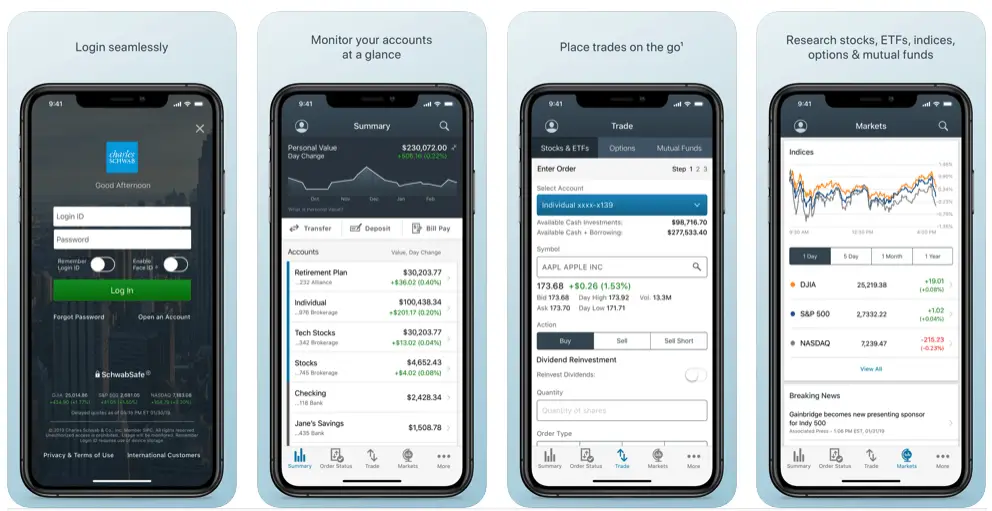

Schwab has been making efforts to modernize its platform in a bid to attract a younger audience, but it still hasn't caught up to M1 Finance in certain aspects. If you need access to things like options and futures contracts, a Solo 401(k), or 529 accounts, Schwab is a solid choice.

Here's a quick summary of Schwab:

- Zero fees and zero trade commissions for stocks and ETFs. There are commissions on options contracts, mutual funds, and futures.

- Free robo-advisor option called Intelligent Portfolios® with a premium option that incorporates 1-on-1 guidance from a Certified Financial Planner, a digital financial plan, and interactive planning tools for a one-time signup fee of $300 and $30/mo. This service requires a minimum investment of $25,000.

- Schwab has basically every account type you can think of.

- Schwab offers ETFs, individual stocks, mutual funds, options, futures, and over-the-counter (OTC) stocks aka “penny stocks.” No forex or crypto.

- Schwab does have fractional shares, but only for S&P 500 companies, which is a bummer.

- Schwab has robust charting, news, education, and analysis tools.

- Schwab's margin rate on a $100k margin loan is 6.83%.

- It's worth noting that Schwab has acquired TD Ameritrade.

- While the desktop interface still looks a bit antiquated, they did recently overhaul their mobile app:

If you need access to things like options contracts, a Solo 401(k) or custodial accounts, and/or an all-day trading window, for example, Schwab is an excellent choice.

3. Acorns

Acorns is one of the newer, true robo-advisor investing platforms. More of a mobile-based financial suite for consistent saving, less of a stock broker.

Here's a quick look at Acorns:

- Acorns has 3 tiered account levels with different fees and different features:

- All 3 account levels have a taxable investment account called Acorns Invest.

- Their Basic plan at $1/mo. is just a taxable investment account.

- The Plus plan at $2/mo. includes access to retirement accounts – called Acorns Later – in the form of a Traditional IRA, Roth IRA, or SEP IRA.

- The Acorns Premium plan is $3/mo. and adds access to an FDIC-insured checking account called Acorns Spend.

- Acorns only offers taxable, Traditional IRA, Roth IRA, and SEP IRA accounts. IRA’s are only available with, at minimum, their mid-grade “Plus” plan at $2/mo.

- Integrable checking account with debit card. Acorns offers a form of cash back that they call Found Money®, through which they’ve partnered with select stores wherein cash back from purchases at those stores goes into your Acorns account to be invested.

- Acorns is designed to be beginner-friendly and hands-off. As such, the investing app is extremely limited in its product offerings and you cannot choose your specific investments. You only get to choose one of 5 pre-built portfolios (Conservative, Moderately Conservative, Moderate, Moderately Aggressive, or Aggressive) comprised of low-cost ETF’s. This can be a pro or con, depending on your desire for simplicity. I’m personally not a big fan of these portfolios’ inclusion of small-cap growth stocks and corporate bonds, but that’s a separate conversation. I would suggest that the Expert Pies from M1 Finance are a superior alternative.

- Acorns does not offer individual stocks.

- Spare change and automatic deposits can be invested in your selected portfolio, and are automatically rebalanced.

- Acorns does not offer margin.

- Acorns has fractional shares and auto rebalancing.

- Like others on this list, Acorns, has a sleek, modern mobile app:

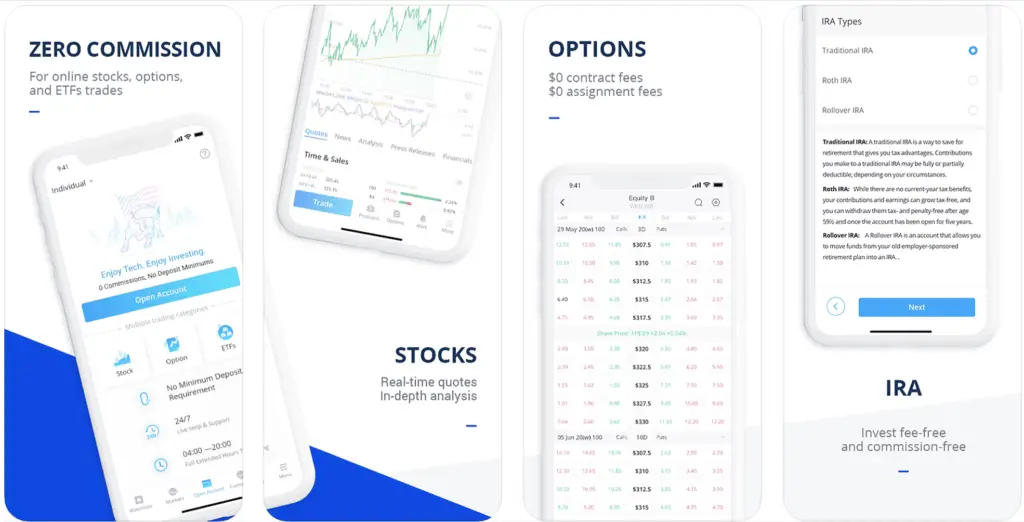

4. Webull

Webull is probably better suited for traders than others on this list. The platform has grown in popularity as a zero-fee stock trading and investing app for beginners and experts alike.

Here's a summary of Webull:

- Zero fees and commissions.

- Taxable, Traditional IRA, Roth IRA, and Rollover IRA accounts.

- Stocks, ETFs, and options.

- Margin rate of 6.49% for a $100,000 margin loan.

- Webull has more charting and technical analysis tools, which may make things slightly more complicated for a true beginner. Whereas M1 and Acorns are built for long-term, buy-and-hold investing, Webull is suitable for short-term trading.

- No checking account.

- No auto rebalancing or fractional shares.

- Get 2 free stocks when you sign up for Webull.

- Highly rated mobile app for both iOS and Android:

Honorable Mentions

Some apps didn't make the cut, but you've probably heard of them:

Betterment

Betterment is an extremely popular investing app for beginners. It is a true robo-advisor like Acorns where you simply choose a pre-built portfolio and you're off to the races. My problem with Betterment is that it's advertised as a “low-fee” broker when it's really not. Betterment carries a 0.25% annual fee for their basic plan and a 0.40% annual fee for their Premium plan. The Premium plan includes professional investing advice and financial planning advice, and requires a minimum invested balance of $100,000.

These fees sound low at first glance until you do the math. Using a starting balance of $100,000, $1,000 contributed monthly over 30 years, and an annualized rate of return of 8%, Betterment’s 0.25% fee costs you $132,700 in fees. The Premium 0.40% fee costs you $208,615 in fees.

Wealthsimple

Just like Betterment, Wealthsimple is a true robo-advisor investing app and is completely hands-off, but it has an even higher fee of 0.50% of AUM. It also has very limited investment options and does not offer fractional shares.

Wealthfront

Wealthfront is nearly identical to Wealthsimple and even has a very similar name. Like Wealthsimple, Wealthfront has limited investment options and a lower ongoing fee of 0.25%.

Stash

Stash is similar to Acorns, offering 3 low-fee account levels. Unfortunately, others on the list like M1, Schwab, and Acorns beat Stash at every turn, and Stash does not offer automatic rebalancing or dividend reinvestment. Stash only offers a small handful of ETFs in which you can invest; they seem to be more of a bank account product than an investing product.

Robinhood

Robinhood is almost identical to Webull and is a popular investing app for traders. Unfortunately, Robinhood does not offer retirement accounts, which is a major negative. Arguably more importantly, after a series of major outages in early March 2020, one of which lasted an entire trading day, Robinhood users have since filed a class-action lawsuit against the trading platform, alleging that “Robinhood had a duty to provide a system and platform ‘robust enough’ to handle that trading volume and have a backup system to handle outages.”

In December 2020, the SEC fined Robinhood $65 million for misleading users about its selling of order flow between 2015 and 2018, meaning users got worse trade execution prices than the platform claimed. Robinhood maintains that these were “historical practices that do not reflect Robinhood today.”

In the same week, the Massachusetts Securities Division filed a lawsuit against Robinhood, alleging that the broker uses “gaming strategies to manipulate customers” to execute more trades in order to boost fees, thereby taking advantage of inexperienced investors.

There are also plenty of user complaints such as these of the site being “frozen,” orders not going through, inability to login, etc., as well as complaints from Android users that the mobile app is problematic and unsupported.

Perhaps most importantly, Robinhood users have been fleeing en masse after the broker's recent stance on temporarily blocking users from buying stocks like GameStop ($GME) and AMC Entertainment ($AMC) during the massive short squeeze event. As of February 1, 2021, over 33 federal lawsuits have been filed against the platform across the country, citing securities trading and consumer protection violations, which add insult to injury after Robinhood hid the fact that it sold order flow and gave users worse trade execution prices.

The name of the platform now seems ironic, considering Robinhood seems to be placating hedge funds and Wall Street hotshots – at the expense of retail investors – at every turn.

eToro

International investors outside of the United States may enjoy eToro – stocks, ETFs, cryptocurrency, commodities, currencies, and more. eToro is at the forefront of social trading; you can copy the portfolios of top traders. eToro is also one of the few brokers offering CFDs. Sign up here. (Note that 76% of retail investors lose money trading CFDs with eToro. Consider whether or not you can afford to take that risk of losing your money.)

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hello,

I have an Inteligent Portfolio with Schwab. It is advertised as having no management fees. But that’s an illusion. Schwab tells their clients that each portfolio must have a percent assigned to cash. The minimum is a whoping 7%.

It is assigned depending on the risk tolerance of the client. And what is Schwab doing with that cash? It takes it and invests it in their bank and their own funds. But don’t take it from me here’s a report on their practice…

https://www.morningstar.com/articles/1068183/the-hidden-costs-of-free-investment-services

There are many reports about it. I’m not happy about it, and have considered moving to another broker.

Best

Carlos

I did hear about this recently. Thanks for sharing, Carlos.

Hi , Newbie here from the UK.

I would like to open an account via M1, can a retired UK guy do this please?

Hey Chris, unfortunately M1 is only available to U.S. customers right now, though I think they have plans to try to expand internationally at some point.

Hi John, pls can I open M 1 account here In Europe Belgium?

Unfortunately, at this time M1 is only available in the United States. eToro should be available though.