Financially reviewed by Patrick Flood, CFA.

The David Swensen Portfolio, as the name implies, is based on the late David Swensen's management of the Yale endowment fund. Here we’ll take a look at its components, performance, and the best ETF’s to use in its construction.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

What Is the David Swensen Portfolio?

The David Swensen Portfolio – also called the David Swensen Lazy Portfolio – comes from portfolio manager David Swensen, who was the CIO at Yale University from 1985 until his death in May, 2021. You can get his book Unconventional Success: A Fundamental Approach to Personal Investment on Amazon here, which details how retail investors can use the portfolio outlined below to mirror the Yale Model, though note that the specific portfolio Swensen used for the Yale endowment is not exactly the same as the Swensen portfolio below because he was able to use somewhat “exotic” products only available to institutional investors like private equity, hedge funds, venture capital, etc.

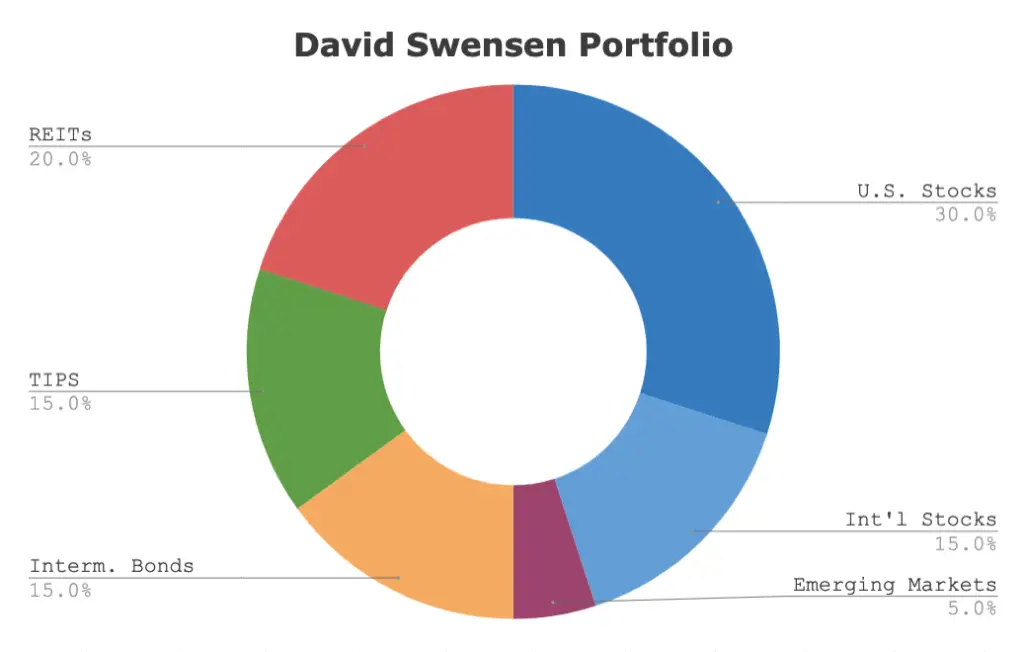

The David Swensen Portfolio asset allocation looks like this:

- 30% Total Stock Market

- 15% International Stock Market

- 5% Emerging Markets

- 15% Intermediate Treasury Bonds

- 15% TIPS

- 20% REITs

Similar to the Ivy Portfolio, we see a heavy 20% allocation to REITs. Unlike that one though, the Swensen Portfolio doesn't include commodities, and I like that. I also like that this portfolio does not use gold.

Swensen had a particular affinity for TIPS, or Treasury Inflation Protected Securities, a relatively new type of treasury bond indexed to the CPI, the common measure of inflation. This is interesting, as most lazy portfolios ignore TIPS altogether or give them a smaller allocation. Rick Ferri is fond of TIPS as well, suggesting that retirees should probably have them as half of their fixed income allocation.

In this sense, the Swensen Portfolio is not unlike the famous All Weather Portfolio, attempting to sail through different economic environments unscathed, though Dalio uses gold and broad commodities as an attempt at inflation protection instead of TIPS. In fairness, TIPS weren't even around yet when Dalio first proposed the All Weather Portfolio's components.

I also agree with Swensen's use of treasury bonds and exclusion of corporate bonds. He maintained, like I do, that treasury bonds offer superior downside protection alongside stocks, and corporate bonds don't sufficiently compensate the investor for their extra risk. That said, 15% in intermediate treasuries is not really going to provide much protection. I think it would probably be more sensible to make them long bonds instead of intermediate.

Furthermore, TIPS and intermediate bonds are likely unsuitable, unnecessary, and almost certainly suboptimal for the young investor with a long time horizon and high tolerance for risk. In my opinion, this portfolio is better suited for retirees and those approaching retirement, but at that point I'd also want to increase the bonds.

The Swensen portfolio relies heavily on REITs, having them comprise 20% of the total portfolio. This seems a bit odd to me, as we now know REITs are not a distinct asset class, are not a reliable inflation hedge, and don't offer much of a diversification benefit. Moreover, their returns seem to be explained by exposure to the Size, Value, and Credit factor premia, thus they can be replicated with small cap value stocks and lower-credit bonds. I don't have a problem with 10% or so in REITs, but 20% seems like too much in my opinion when that valuable space could be given to stocks or bonds.

David Swensen Portfolio Performance

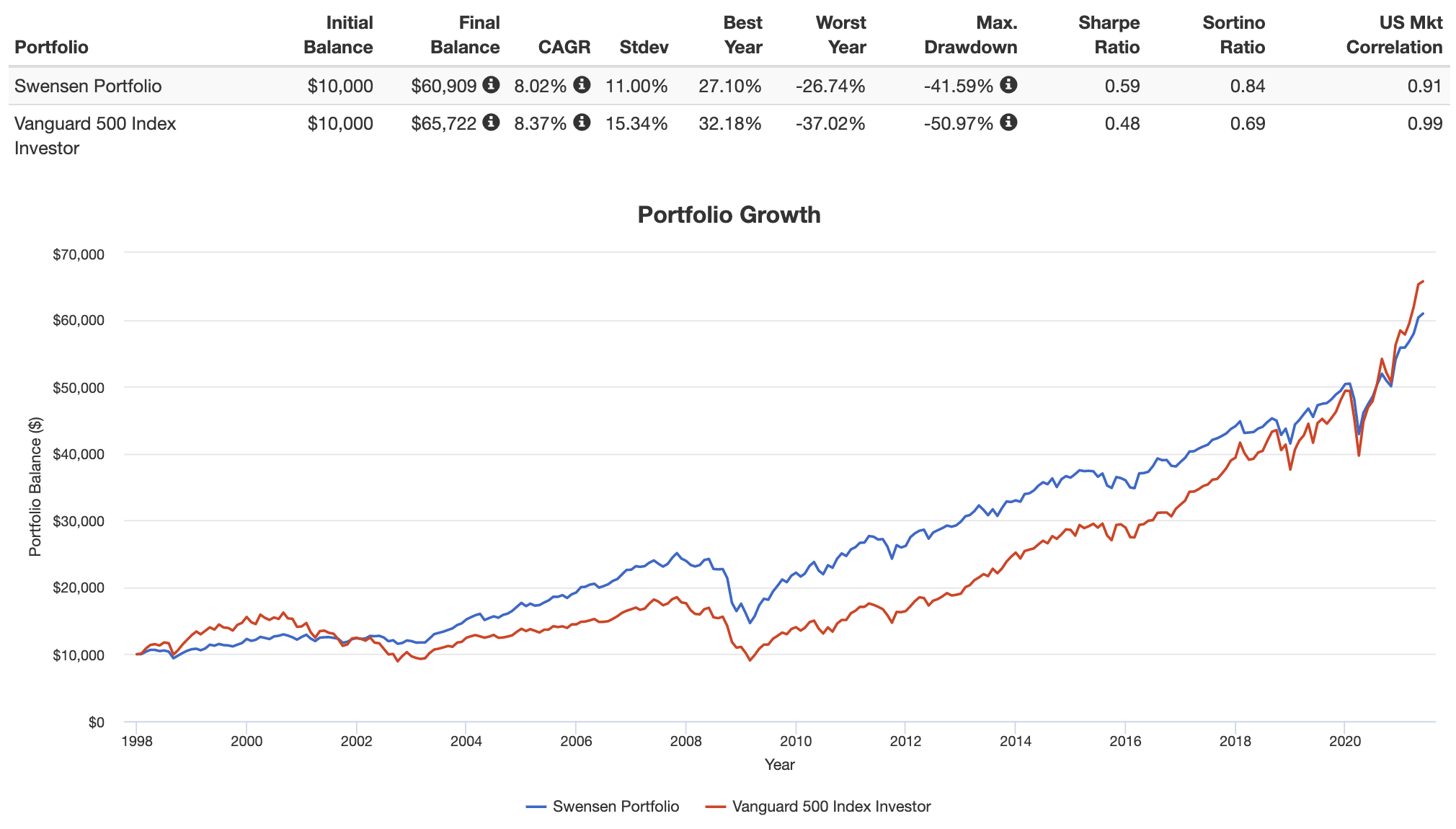

For the period 1997 through May, 2021, the David Swensen Portfolio and the S&P 500 have been pretty close from a pure returns perspective, with the former obviously having a higher risk-adjusted return (Sharpe) due to its lower volatility:

David Swensen Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the David Swensen Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Utilizing mostly low-cost Vanguard funds, we can construct the David Swensen Portfolio pie with the following ETF’s:

- VTI – 30%

- VXUS – 15%

- VWO – 5%

- VGIT – 15%

- SCHP – 15%

- VNQ – 20%

You can add the David Swensen Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Add to Portfolio.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosures: I am long VWO in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

From reading the book, swensen says to use 15% for developed market equities and 5% with developing market equities. VXUS holds the total foreign market equities and should be replaced with VEA which holds foreign developed market equities.

VXUS should already have emerging market, why add VWO again?

What are your thoughts about mixing in other REITs into the REIT allocation from https://www.optimizedportfolio.com/best-reit-etfs/ and perhaps NURE since the allocation to REITs is larger?

Thanks.

Swensen’s already includes 20% to REITs.

Would you consider David Swensen portfolio as low-risk, medium, or high-risk?

I think I’d say medium risk.

Dear Sir: I looked at your recommended funds, and iShares’ TIPS fund has an expense ratio of 0.19 percent. I thought that was a bit high, so I looked at Vanguard’s comparable fund, VTIP, and its expense ratio is only 0.05 percent, almost one-quarter of iShares’ fund. Why did you selecte a higher-cost fund (iShares TIPS)? Is it so much of better quality than Vanguard, the least expensive, and how is it better?

Hey Lee. VTIP is short-term TIPS. Its effective avg. maturity is less than half that of TIP. You can see the historical effects of that difference here.

I’m slightly puzzled by your question. The lazy Swensen portfolio on this page uses a Schwab TIPS fund (ticker SCHP) and not any iShares TIPS funds. SCHP’s expense ratio is 0.04%, just like VTIP’s. There are, however, two TIPS funds from iShares :

iShares 0-5 Year TIPS (ticker STIP, expense Ratio 0.03%), and

iShares TIPS (ticker TIP with expense Ratio 0.19%)

As far as maturities, it looks to me that SCHP and TIP are comparable (avg. maturity/duration for both are around 7.4/6.87 years) while VTIP and STIP are around half that … so around 2.6/2.5

(as of May 2023)

M1 has the holdings listed incorrectly. As of 5/18/20 it shows only 15% in VTI (total Stock market)- not 30 %. Instead of showing 15% for Intermediate Bonds it has it at 30%.

Alfonzo, sorry about that and thanks for letting me know! I must have accidentally switched those 2 ETF’s. It should be correct now!