A Health Savings Account (HSA) is an extremely powerful vehicle for both investing and paying for medical expenses, but a common question is how exactly to invest inside it. Here we'll explore the the properties, benefits, and investment options of an HSA.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here are the highlights:

- An HSA is a tax-advantaged account used to pay medical expenses and/or to save for retirement.

- You must meet certain eligibility requirements to be able to open an HSA, but there are no income requirements as with a Roth IRA.

- Contributions to an HSA are tax-deductible, investments inside it can grow tax-free, and withdrawals are tax-free if used to pay for qualified medical expenses.

- This “triple tax benefit” makes it the most powerful savings and investment account in existence.

- If you had a HDHP during the year, you can contribute to an HSA until tax day – April 15 – of the following year.

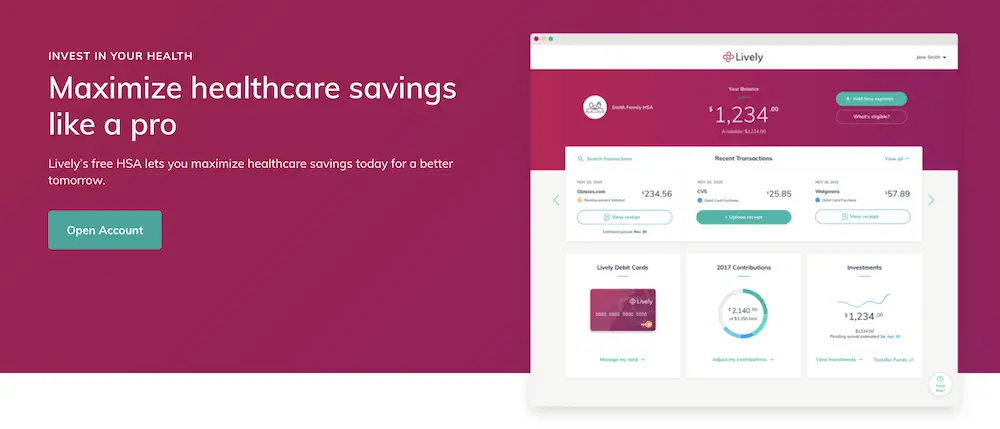

HSA Provider Suggestion: Lively

Contents

What Is an HSA?

A Health Savings Account, abbreviated HSA, is a tax-advantaged savings vehicle used to pay for medical expenses. Money you don't use in the account can be invested. HSA's are opened with a qualified trustee, usually a bank, insurance company, or other financial institution.

You can open your HSA with any qualified trustee you choose, but if your employer elects to contribute to it, they may have a trustee of choice. Your HSA is portable; if you switch employers, your HSA stays with you.

Your HSA acts as a typical bank account. You can make deposits, withdrawals, and write checks against the account. Some HSA providers (see my recommendation further down) give you a debit card to use for medical expenses.

You don't need permission to set up an HSA, but you must be eligible by meeting the following requirements:

- You are covered under a high deductible health plan (HDHP).

- You have no other health coverage (except for vision, dental, disability, and other special exceptions)

- You aren't enrolled in Medicare

- You can’t be claimed as a dependent on someone else’s tax return.

There are no income requirements to be eligible to contribute to an HSA. See the full eligibility details and expense requirements from the IRS here.

Benefits of an HSA

There are several benefits to opening an HSA:

- Contributions to an HSA are tax-deductible, even if you don't itemize your tax deductions.

- Contributions to your HSA by your employer may be pre-tax, allowing you to avoid FICA taxes.

- Unlike a flexible spending account (FSA), contributions to an HSA remain in your account until used.

- Earnings on the assets in the HSA are allowed to grow tax-free.

- Distributions may be tax-free if used for a qualified medical expense. Essentially, you are able to pay expenses with pre-tax money.

- An HSA is portable. You can transfer between providers if necessary.

- There are no income requirements for eligibility. Those unable to contribute to a Roth IRA due to income limits, for example, may be eligible to contribute to an HSA.

- HSA's have a “triple tax benefit” – with a Traditional or Roth IRA, you're choosing to exercise a tax benefit now (deduction) or later (tax-free withdrawal). With an HSA, you get both; your contributions are tax-deductible, they can grow tax-free, and your withdrawals are tax-free if used for qualified medical expenses.

- There is no time limit on reimbursing yourself from your HSA for medical expenses paid out of pocket, presenting a “loophole.” More on this later.

- Update April 2020: The Coronavirus Aid, Relief, and Economic Security (CARES) Act now also allows you to use your HSA for over-the-counter (OTC) drugs and medical supplies.

HSA Contribution Limits

At the time of writing, for the 2021 tax year, the annual contribution limit for an HSA is $3,600 for an individual plan and $7,200 for a family plan, plus $1,000 catch-up contributions if you are age 55+.

For 2022, this has increased slightly to $3,650 for individuals and $7,300 for families.

HSA Contribution Deadline

The deadline to contribute to an HSA for the previous year is tax day – April 15 – of the current year, provided you had a HDHP in the previous year.

How To Use an HSA

You can utilize an HSA in 2 primary ways: paying current medical expenses from it, or paying current medical expenses out of pocket and using the HSA as a savings/investment vehicle to pay for medical expenses in retirement. Let's break down why you may choose one of these options over the other.

Paying Current Medical Expenses from the HSA

If you're not maxing out contributions to retirement accounts, you should probably pay current medical expenses from your HSA. A $500 medical expense paid from the HSA allows you to make a $500 post-tax contribution to a Roth IRA, for example, which then grows tax-free. You can also obviously use those earnings from the Roth IRA to buy anything you want in retirement.

Paying Current Medical Expenses Out of Pocket

If you are maxing out contributions to retirement accounts, you should probably pay current medical expenses out of pocket and use the HSA as a vehicle for additional tax-advantaged savings, to then spend in retirement on medical expenses. Think of it as additional IRA space. A $500 medical expense paid out of pocket leaves $500 in the HSA to grow tax-free, and gives you the right to withdraw that $500 tax-free in the future. Had you paid the $500 expense from the HSA in this case, your $500 must be invested in a taxable investment account – to be taxed later – because you have run out of tax-advantaged space.

How To Invest Your HSA

Normally it's sensible to view your portfolio as a whole instead of as individual buckets, but that's not always the case with an HSA, as you may not know when you'll incur medical expenses, and the value of your HSA is likely much lower in comparison to the value of your other investment accounts. Moreover, you can see how the investment strategy for an HSA may differ slightly depending on which of the 2 situations above you choose.

We'll tackle the second situation first. If you are paying current medical expenses out of pocket, you can treat the HSA more or less like you do your other retirement accounts. That is, since you are viewing your HSA simply as additional tax-advantaged space and investing for the long term to use the money on medical expenses after retirement, you can invest in the same way you do in your other retirement accounts.

In the first situation, where you are paying current medical expenses from the HSA, the strategy changes slightly. First set aside an amount equal to your max out-of-pocket cost in cash in an easily-accessible high-yield savings account or in cash equivalents (T-bills, money market fund, short term bonds, etc.). After that, you can invest the rest as you would in your other accounts.

Note that this max-out-of-pocket amount obviously needs to be available at any given time each year. For example, if you incur medical expenses one year and that cash gets wiped out to pay the OOP, you would need to replenish it in case you incur another large medical expense the following year. This may require selling some of your investments in the HSA. Also, pay attention to whether or not your max OOP cost on your HDHP changes from year to year. If it goes up from $8,000 one year to $9,000 the next, for example, you would need an additional $1,000 allocated to cash.

There are a few specific caveats and considerations:

- If you are in a state that still imposes state income taxes on HSA contributions, treasury bonds and TIPS become an attractive choice, as they are exempt from state income taxes. At the time of writing, California and New Jersey do not recognize HSA's and therefore tax their contributions and earnings.

- If your 401(k) doesn't have attractive options for a specific asset class, invest in those assets in the HSA. For example, you may have a small handful of suboptimal choices for stocks in your employer's 401(k); in that case, place your bond holdings in the 401(k) and stocks in the HSA. The opposite may also be the case, where options in your HSA dictate what you invest your other accounts in.

- There's an argument to be made that an HSA is a better place to invest in bonds because, ironically, you may not want the account to grow too much, as your account value in retirement may be greater than your medical expenses on which you're able to spend the earnings. Of course this wouldn't be a terrible problem to have.

Vanguard Funds for HSA

Popular low-cost Vanguard index funds for broad market exposure and instant diversification in your HSA include:

- VOO – Vanguard S&P 500 ETF

- VTI – Vanguard Total Stock Market ETF

- VXUS – Vanguard Total International Stock ETF

- VT – Vanguard Total World Stock ETF

- BND – Vanguard Total Bond Market ETF

- BNDX – Vanguard Total International Bond ETF

The HSA Loophole

There's a perfectly legal loophole related to HSA's that the IRS itself has explicitly outlined and confirmed: If paying current medical expenses out of pocket and reimbursing yourself from the HSA, you are able to defer that reimbursement for as long as you want. There is no time limit. For example, you could pay a qualified medical expense this year out of pocket and reimburse yourself for it from your HSA 30 years later, provided the HSA was already established at the time the expense was incurred.

This of course can introduce some headache, having to save paperwork and receipts and stay organized, but it allows your HSA investments to stay in and compound quicker. This is yet another simple but powerful benefit of an HSA. Obviously this also means you can't deduct that medical expense that you paid out of pocket (double dipping).

Non-Medical Expenses

Note that any withdrawal from an HSA before age 65 not used for a qualified medical expense incurs both a 20% penalty and income taxes. Withdrawals for non-medical expenses after age 65 are not subject to a penalty but are still taxed as income.

Update April 2020: The Coronavirus Aid, Relief, and Economic Security (CARES) Act now also allows you to use your HSA for over-the-counter (OTC) drugs and medical supplies.

The Best HSA Provider

My suggestion for an HSA provider – and the one I use, after comparing many – is Lively. Here's the rundown:

- Free account; no fees.

- Available to individuals and employers.

- No investing threshold – you can invest your first dollar.

- No fees to access investment capabilities.

- Connects to TD Ameritrade for investing.

- Ability to set up automatic transfers.

- No-fee transfers.

- Paperless rollovers.

- Debit card provided for medical expenses.

- User-friendly interface and mobile app to upload and categorize expense receipts.

- Dedicated Resources and Support.

Conclusion

As you can see, an HSA is a no-brainer. It is essentially the most powerful savings and investment vehicle in existence due to its aforementioned “triple tax benefit.” Decide which of the 2 routes above you plan to take, map out an investment approach relative to your other retirement accounts, and go sign up for an HSA from Lively today.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Just a heads up – Your contribution limits section is a little off

Thanks, Matt! Looks like I had reversed the wording accidentally. Fixed now.

Hi John! first of all, sincere thank you for sharing such amazing knowledge through this platform. As a newbie to investing (only started in 2019), I truly appreciate everything I learn on your site. One of the common themes in company backed HSAs is that they provide very limited index funds, and mostly provide active funds (higher expense ratios). Even with those options, is it wise to stick to our planned portfolio allocations, or better to create a new portfolio with only the index funds provided (something like S&P500 + Small-Cap + Total Bond Mkt)? Have you had a chance to compare Fidelity’s HSA options with Lively? Thank you again!!

Thanks for the kind words, Sridhar! Not sure I understand your question. I’d maybe look into whether or not you’re required to use the company-backed HSA (or if there’s an incentive to do so, i.e. they contribute a %) or if you can go do your own. Secondly, Lively gives you a self-directed brokerage account through TD Ameritrade so the investment options should be the same as Fidelity. Hope this helps!