Financially reviewed by Patrick Flood, CFA.

The William Bernstein No Brainer Portfolio may indeed be a no brainer. Here we'll check out its components, historical performance, and the best ETFs to use for it in 2024.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

Who Is William Bernstein?

William (Bill) Bernstein is a retired neurologist, financial theorist, and prolific investing author. Like the other voices of wisdom in the investing world, William Bernstein maintains that index investing is superior to stock picking, and that asset allocation is far more important than the selection of those assets or timing the buying and selling thereof. He delineates the details and reasoning behind this approach in his first book, The Intelligent Asset Allocator.

Bernstein is one of the most prolific investing authors out there. Math/theory nerds like me and armchair investors alike will enjoy and get something from all of his investing-related books:

- The Intelligent Asset Allocator

- If You Can: How Millennials Can Get Rich Slowly

- The Four Pillars of Investing: Lessons for Building a Winning Portfolio

- The Investor's Manifesto: Preparing for Prosperity, Armageddon, and Everything in Between

- Rational Expectations: Asset Allocation for Investing Adults (more advanced; beginners should probably skip this one)

What Is the William Bernstein No Brainer Portfolio?

As the name suggests, the No Brainer Portfolio was created by William Bernstein. It is considered a “lazy portfolio,” being easy to implement and manage. I've also seen it referred to as the “Simpleton's Portfolio,” which makes sense, as this is arguably the simplest of all the portfolios Bernstein has created; no special asset classes here, and Bernstein admits he is an “asset class junkie.” He also designed the Coward's Portfolio.

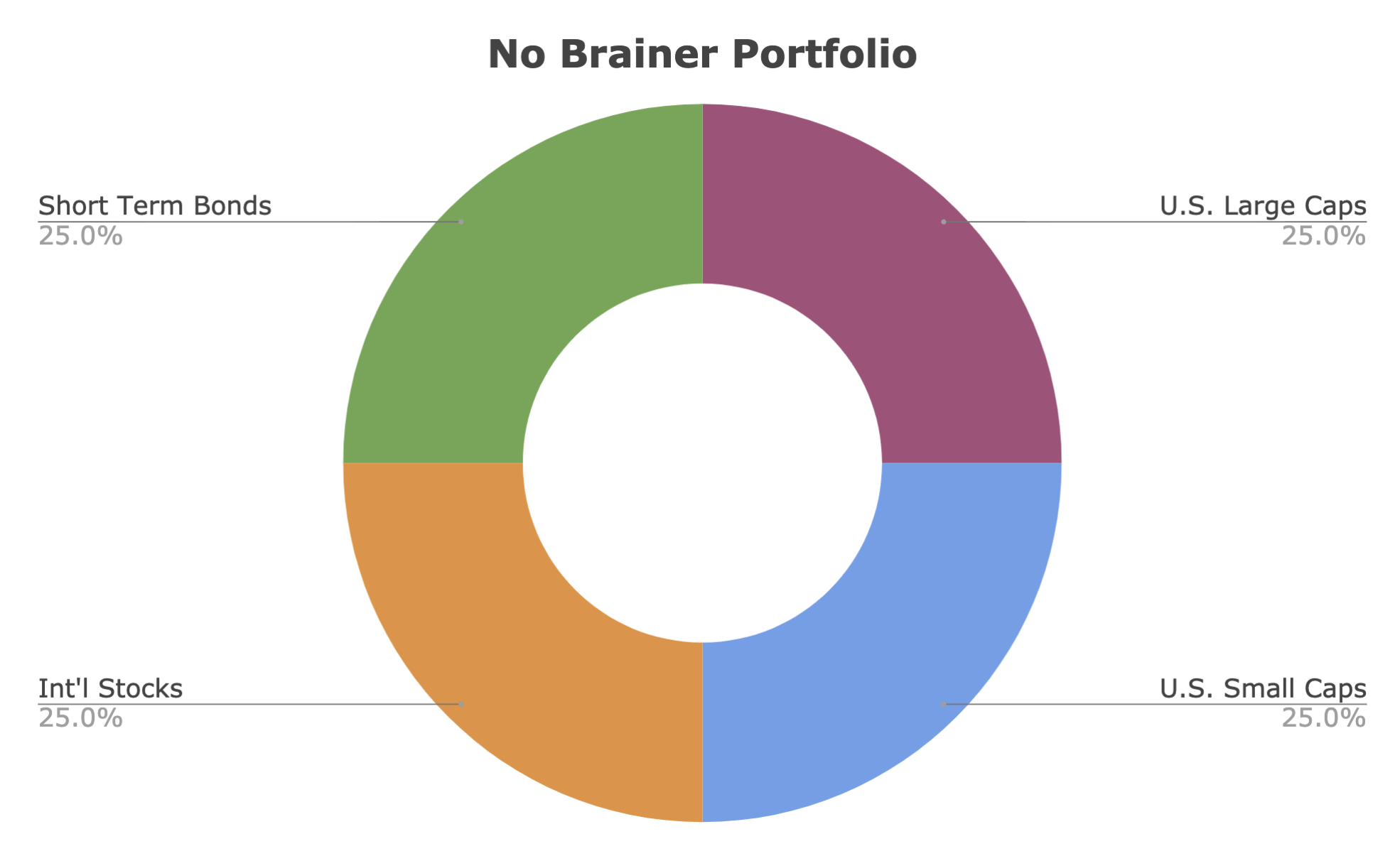

The William Bernstein No Brainer portfolio is a diversified blend of 4 equally-weighted asset classes:

- 25% US Large Cap Blend

- 25% US Small Cap Blend

- 25% International Stocks

- 25% Short-Term Bonds

William Bernstein No Brainer Portfolio Performance Backtest and Review

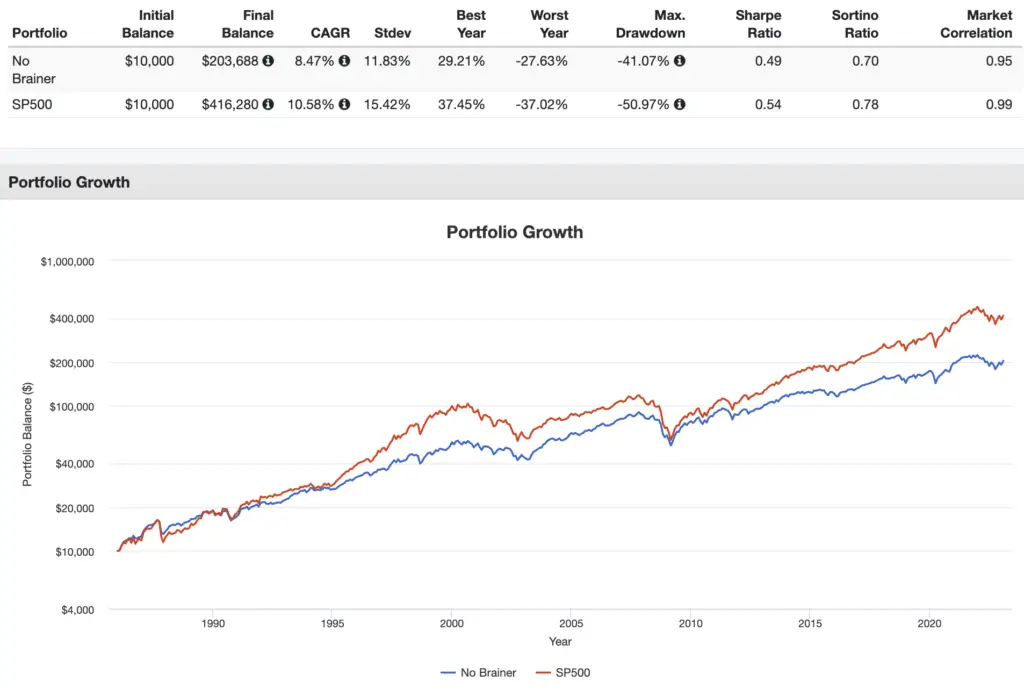

Going back to 1986, here's a comparison of the William Bernstein No Brainer Portfolio and the S&P 500 through 2022:

Well, had we invested in the No Brainer Portfolio during this time period, we would have ended up with an even lower risk-adjusted return (Sharpe) than the plain ol' S&P 500, so the diversification didn't really do much for us. What happened? Let's talk about the portfolio's components to figure that out.

So we're basically taking a barbell on stocks and excluding mid-caps. I don't have a problem with that; just something to note. I like that we're overweighting small caps, but if we're doing that, Bernstein would also know we should probably overweight/tilt small cap value, so I'd rather see small cap value stocks for that piece, which would not be an insignificant switch because they comprise 1/4 of the portfolio. Small cap growth stocks have been shown to not pay a risk premium like small-cap value stocks. Here's a longer explanation on why we'd expect smaller stocks to beat larger stocks and why we'd expect Value stocks to beat Growth stocks.

Also note that global market cap weights put the U.S. at around 55% and ex-US at around 45%, so we're overweighting the U.S. stock market, which for U.S. investors is called home country bias. Most people do this anyway. Again, I don't have a big problem with that, but it's just something to note. I'd prefer to see a tilt to Emerging Markets, but I think Bernstein was purposefully trying to keep it simple and have a small number of slices. I can understand that. Simplicity is underrated.

The confusing piece – and what dragged down the portfolio's performance – is the short-term bonds. Just like with his Coward's Portfolio, Bernstein seems to forget that more volatile assets make better diversifiers. When the portfolio is not bond-heavy (here bonds only get 25%), it doesn't make much sense to use short-term bonds. We want the greater volatility of longer-duration bonds because it is better able to counteract the downward movement of the 75% stocks.

This is where I've always fundamentally disagreed with Bernstein. He argues for portfolio efficiency and diversification but then seems to stop when it comes to the fixed income allocation. He subscribes to that unfortunately-widespread mental accounting idea of “taking risk on the equities side,” meaning he views the short term bonds myopically as a safe haven for cash, which they are.

But this is like covering one eye during a stock market crash, looking at the short-term bonds, and saying “well at least that piece didn't lose money,” which is demonstrably irrational. One should always attempt to optimize the portfolio as a whole, not each asset in isolation. The ironic thing is that Bernstein should know this better than anyone, as he's written several books on asset allocation.

Moreover, bond duration should be matched to the investor's time horizon. The investor using the No Brainer Portfolio clearly doesn't have a 1-2 year horizon, because it's still 75% stocks.

In the interest of full disclosure, I really enjoy Bernstein's writing style and I've gotten great entertainment from his books, but I fundamentally disagree with him on several other points as well. One, he has a weird aversion to ETFs and prefers mutual funds. I assume he just likes to stick with familiarity since he's older, because his reasons cited for this irrational preference hinge on commissions and spreads, which are immaterial concerns in my opinion, particularly with highly liquid funds that we'd be using here anyway.

Secondly, he advocates for dollar cost averaging and says it “boosts long-term returns.” We know this is demonstrably untrue over the long term. Similarly, he suggests market timing to buy more stocks during downturns. This is easier said than done, but more importantly, it requires holding cash as “dry powder” on the sidelines, which we also know is suboptimal on average. In fairness, the robust research on these last points came after most of Bernstein's writings.

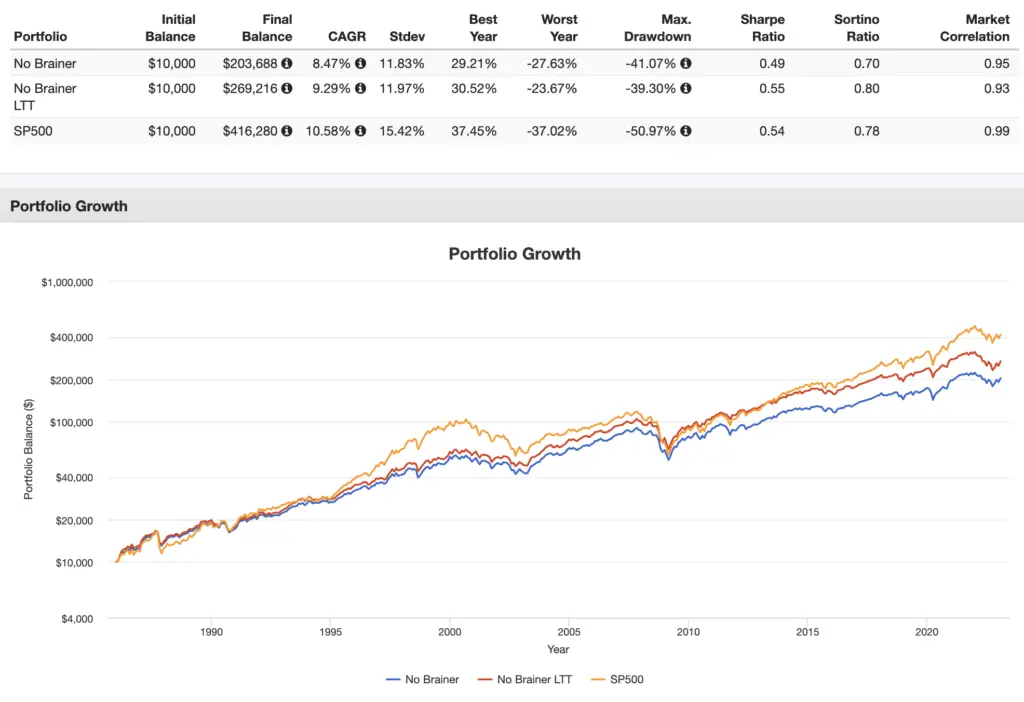

So anyway, back to the bonds. Here's how things would have worked out using long term treasury bonds, denoted by “LTT” in the name:

Much better. Note the lower volatility, smaller max drawdown, and greater general and risk-adjusted returns. This is because in using long bonds, we're giving the bonds piece more room to do its job of mitigating stock downturns.

William Bernstein No Brainer Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the No Brainer Portfolio because it makes regular rebalancing seamless and easy with one click, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

We can construct the No Brainer Portfolio pie with the following ETFs:

- VOO – 25%

- SPSM – 25%

- VXUS – 25%

- SCHO – 25%

You can add the No Brainer Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Add to Portfolio.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

If you're like me, though, you might want to use long term treasuries like I illustrated above. That pie would look like this:

- VOO – 25%

- SPSM – 25%

- VXUS – 25%

- VGLT – 25%

Here's an M1 link for that one.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

What do you think of the Bernstein No Brainer Portfolio? Let me know in the comments.

Disclosures: I am long VOO in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply