Here we dive into the famous “Excellent Adventure” from Hedgefundie and how to implement it.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here are the highlights:

- Hedgefundie

iswas a member of the Bogleheads forum. - Hedgefundie created a thread in February 2019 proposing a 3x leveraged ETF investing strategy based on risk parity using the S&P 500 index (UPRO) and long-term treasury bonds (TMF) held in a 40/60 allocation. The thread later expanded into a Part 2.

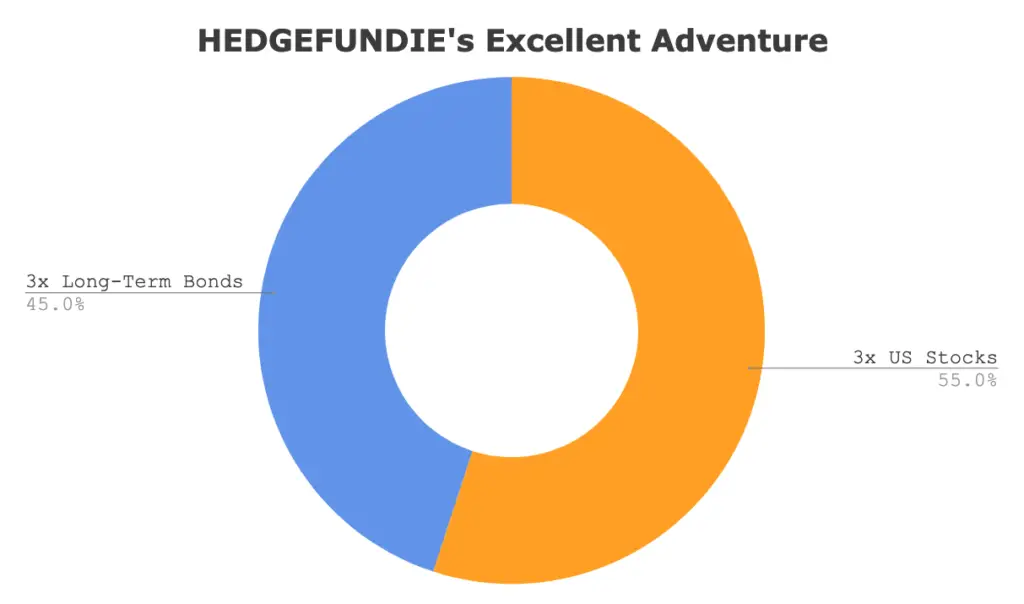

- Hedgefundie later updated the strategy's asset allocation in August 2019 to 55/45 UPRO/TMF.

- Extensive backtesting, discussion, and analysis within the thread by members of the Bogleheads forum supports the validity and potential market outperformance of the strategy.

- The proposed strategy calls for quarterly rebalancing.

- Several different protocols/variations of the strategy emerged in the Excellent Adventure thread, including monthly rebalancing, rebalancing bands, and volatility targeting with various lookback periods.

- Some users have added a dash of TQQQ (3x the NASDAQ 100 index) for a minor tech tilt, as Big Tech has had a stellar run recently.

- It is recommended to implement the strategy within a Roth IRA on M1 Finance, to avoid tax implications and to make regular rebalancing seamless and easy.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Contents

Video

Prefer video? Watch it here:

Who Is Hedgefundie?

Hedgefundie is was a member of the Bogleheads forum who created a now-famous thread on the forum proposing a 3x leveraged ETF strategy.

What Is the Hedgefundie Strategy?

The Hedgefundie strategy – the wild ride of which is known as “Hedgefundie's Excellent Adventure” – is based on a risk parity allocation of leveraged stocks (3x the S&P 500 index via UPRO) and leveraged long-term treasury bonds (3x the ICE U.S. Treasury 20+ Year Bond Index via TMF). Note that “HFEA” is the shorthand initialism for the name of the strategy, not the ticker for a fund.

Risk parity is a portfolio allocation strategy in which, consistent with Modern Portfolio Theory (MPT), risk is spread evenly among assets within the portfolio by looking at the volatility contributed by each asset, thereby attempting to optimize returns per unit of risk (Sharpe). I explained it more here. Parity between stocks and long treasuries is roughly achieved at 40/60.

The Hedgefundie strategy relies heavily on the negative correlation (or at least, uncorrelation) between stocks and long-term treasury bonds, wherein the bonds provide a buffer during stock drawdowns. Long-term treasuries are chosen precisely because they are more volatile than shorter-duration bonds and because of their degree of negative correlation to stocks, in order to sufficiently counteract the downward movement of a 3x leveraged stocks position in a crash. I delved into these specific benefits of treasury bonds here. This concept is based on the simple historical principle of improving risk-adjusted return (Sharpe) over long periods by holding uncorrelated assets, such as a traditional 60/40 stocks/bonds portfolio, as opposed to 100% stocks. In a nutshell, this is a way to hold UPRO long term in a much more sensible way.

Consistent with the idea of Lifecycle Investing, this heavily-leveraged strategy is better suited for young investors with a long time horizon who can afford to be risky early in their investment horizon. Hedgefundie advocates for treating this strategy like a “lottery ticket” and not using it with a significant portion of your total portfolio value.

Critics and naysayers reflexively exclaim the oft-cited, overblown, platitudinous “Leveraged ETF's aren't meant to be held long-term because of volatility decay,” but, in short, that doesn't concern me. Moreover, that same volatility decay can actually help when upward movement with positive momentum is occurring. I would also argue that as long as you can stomach the volatility, a major drop should [eventually] be followed by a major rebound; 3x hurts on the way down but helps on the way up. UPRO from ProShares and TMF from Direxion were chosen due to their low tracking error and high volume; again, we're getting 300% exposure to the S&P 500 and long-term treasury bonds, respectively.

The proposed strategy calls for quarterly rebalancing. Several different protocols/variations of the strategy emerged as the Excellent Adventure thread progressed, including monthly rebalancing, rebalancing using bands, and volatility targeting with various lookback periods. I'd keep it simple and avoid checking it often; I can see it being very easy to get emotional with this strategy and abandon your plan. It is recommended to implement the strategy within a Roth IRA on M1 Finance, to avoid tax implications and to make regular rebalancing seamless and easy.

I know this sounds saIes pitchy, but if you're wanting to use this strategy in a taxable account, I would argue it makes even more sense to use M1 Finance because if you're choosing to put in new deposits, the system will automatically rebalance the portfolio for you by directing new deposits to buy the underweight asset, thereby allowing you to avoid capital gains taxes that would otherwise be incurred with a manual rebalance. This is more impactful than it might sound at first. These are 3x leveraged ETFs; they can very quickly get out of balance. For example, let's say you start out at the prescribed 55/45 and stocks take off and bonds suffer, which causes it to stray to 75/25 after only a month. Not good. At this point you'd have to incur short term capital gains taxes (ouch!) just to get things back in balance. Granted, at a certain point, your new deposits may not be sufficiently large enough to provide the full rebalancing effect on their own, but that would be a great problem to have.

Utilizing a traditional, unleveraged 40/60 stocks/bonds portfolio, compared to an all-equities portfolio, has relatively low volatility and should produce higher risk-adjusted return (Sharpe) over long time periods, but would also likely underperform an all-equities portfolio in terms of total return. The solution, Hedgefundie maintains, is applying leverage. We're attempting to accept a risk profile similar to that of the S&P 500, but with much higher expected returns.

Hedgefundie updated the approach 6 months after posting the original strategy, opting to move to a 55/45 UPRO/TMF allocation from the previous 40/60 risk parity allocation. Hedgefundie's reasons are laid out here, based primarily on the premise that the stocks portion of the strategy is the primary driver of the strategy's returns and that the main purpose of holding the treasury bonds is essentially as “insurance” in case of a stock market crash.

Intrinsically, we're relying on US stocks and long-term treasuries not crashing in tandem. At the time of writing, these assets have a seemingly reliably negative correlation close to -0.5 on average. A key fundamental assumption of this strategy that Hedgefundie proposes is that the US will not return to pre-Volcker (pre-1982) monetary policy. That is, we'll be able to significantly mitigate or altogether avoid runaway inflation periods like the late 1970's, during which time bonds suffered greatly.

Stocks and long-term treasury bonds do not have a perfect -1 correlation. Sometimes they move in the same direction. This is actually a good thing. Historically, when these assets moved in the same direction, it was usually up. On days when stocks dropped, long-term treasuries fairly reliably rose significantly to mitigate the total loss.

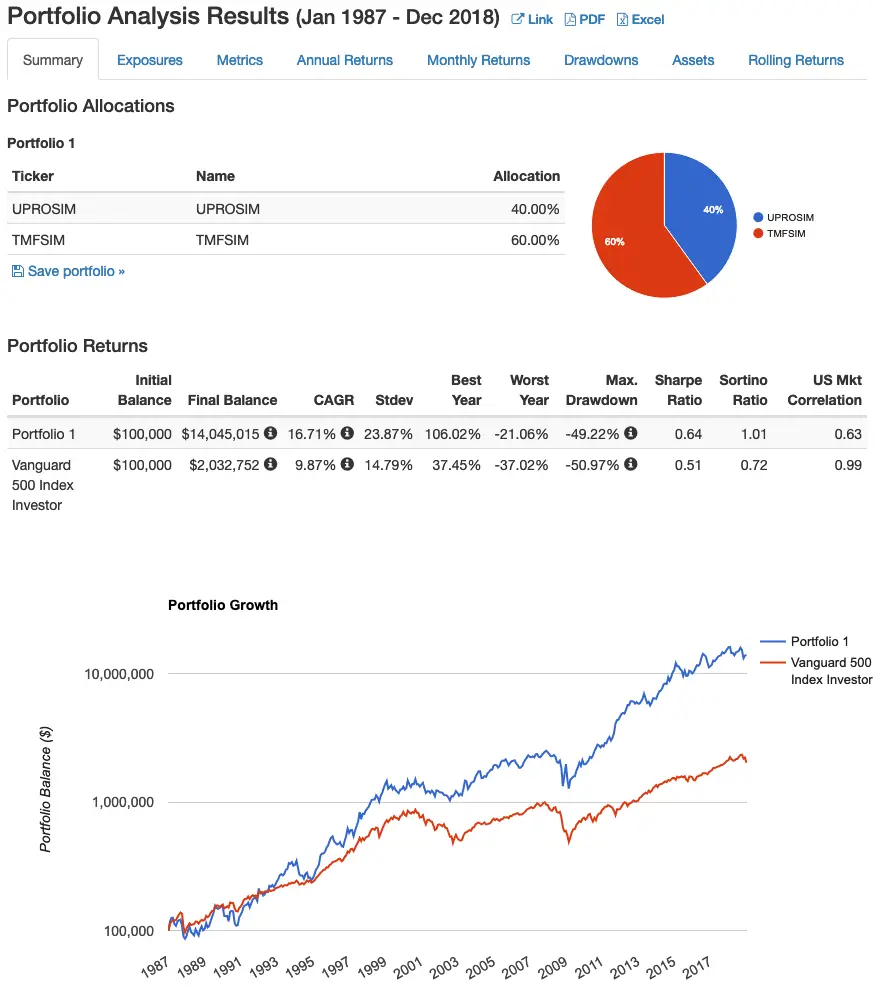

Simulated returns going back to 1987 look like this:

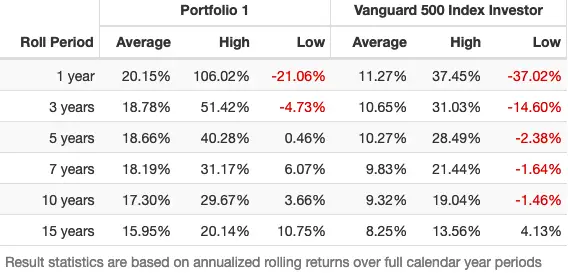

Here are the rolling returns:

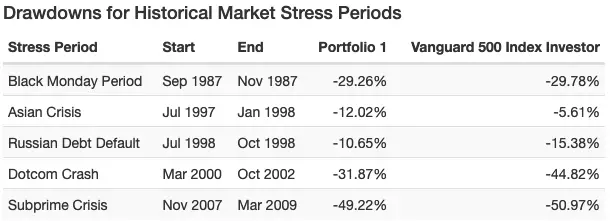

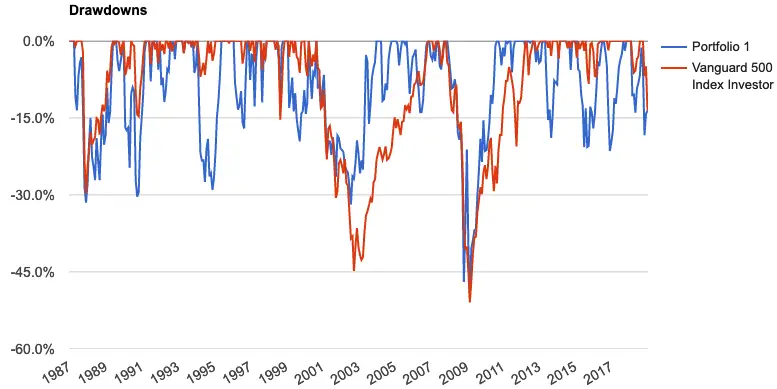

Below are the drawdowns. Notice the smaller drawdowns in most cases compared to the S&P 500:

I agree with Hedgefundie's assertion that extremely volatile assets like gold, commodities, small caps, etc. would suffer worse from volatility decay and would not improve the strategy's diversification and return. International developed markets may be a viable option to include, but Boglehead member siamond found issues with the DZK ETF, which ended up closing in October, 2020 anyway.

If you wanted to for some reason, you could also use the slightly more expensive SPXL instead of UPRO. Their liquidity and performance should be nearly identical.

Make no mistake that this is a risky strategy by its very nature. Read up on leverage and the nature of leveraged ETF's before employing this strategy. Do not put your entire portfolio in this strategy.

Read more details and nuances of the strategy on the original thread here. If you've got the time, there's a lot of learning to be had throughout the entire thread. The thread has expanded into a Part 2 here.

UPRO vs. TQQQ

Some users have added a dash of TQQQ (3x the NASDAQ 100 index) for a minor tech tilt, as Big Tech has had a stellar run recently. Others still are using TQQQ as the entire equities position for the HFEA strategy. I personally think this is unnecessary and is purely performance chasing as a product of recency bias.

Imagine for a second that this is January, 2010. After the previous decade, the S&P 500 is down by about 10% for that time period versus the Nasdaq 100 being down about 50%. Would you still be as enthused about TQQQ? Logically, we should be more willing to buy when prices are low, but I’d be willing to bet the honest answer to this question for most folks would be “no.” A rational investor should want to avoid expensive stocks and buy cheap stocks, but this unfortunately isn’t how investors’ highly-emotional brains work.

TQQQ has beaten UPRO historically in terms of sheer performance. But don’t succumb to recency bias. Past performance does not indicate future performance. More importantly, large cap growth stocks are now looking extremely expensive relative to history and are at the valuations we saw in 2000 at the height of the tech bubble, meaning they now have lower future expected returns. To make things worse, fundamentals of these companies do not explain these valuations. The current situation is simply the result of an expansion of price multiples.

Value stocks, on the other hands, are looking extremely cheap, meaning they now have greater expected returns. Of course, we expect Value to outperform every day when we wake up anyway due to what we think is a risk factor premium. If you buy TQQQ, you won’t own any Value stocks. TQQQ is purely large cap growth stocks, the segment with lower expected returns. You also won’t own any small- or mid-cap stocks, which have outperformed large stocks historically.

The valuation spread between Value and Growth was recently as large as it’s ever been. Historically, wide value spreads have also reliably preceded massive outperformance by Value. At the end of the day, we’re still paying for a discounted sum of all future cash flows; Growth cannot get more expensive forever. Unfortunately, there's no leveraged Value ETF.

People like to claim “tech is the future!” That may be true, but that doesn’t have much to do with stock market returns, which are not correlated with GDP. The economy is not the stock market, and the stock market is not the economy. Remember that extremely high expectations for these tech firms are already priced in, and they will have to exceed those expectations in order to beat the market. Moreover, good companies tend to make bad stocks and bad companies tend to make good stocks.

Also remember that you don’t need a “tech tilt” anyway; the market is already over 30% tech at this point. The NASDAQ 100 is basically a tech index at this point; it's realistically about 70% tech, posing a sector concentration risk, which is uncompensated risk.

While I don't employ or condone market timing, we also must acknowledge the fact that we may see rising interest rates sometime in the near future, and TQQQ inherently has more interest rate risk than UPRO. Moreover, TQQQ by definition excludes Financials, which tend to do well when interest rates rise.

Now may be the worst time to overweight large cap growth, but my time machine is broken. Only time will tell which index outperforms. We can’t know the future, but I would argue that’s the reason for broad diversification in the first place.

Why Not 100% UPRO?

If we're expecting UPRO to be the driver of the strategy's returns, why not go 100% UPRO? Hedgefundie addressed this in the original Bogleheads thread by pointing out that in doing so, we'd probably expect super deep drawdowns from which it may take decades to recover. Here's a backtest showing 40/60 UPRO/TMF (Portfolio 1) vs. 100% UPRO (Portfolio 2) to illustrate:

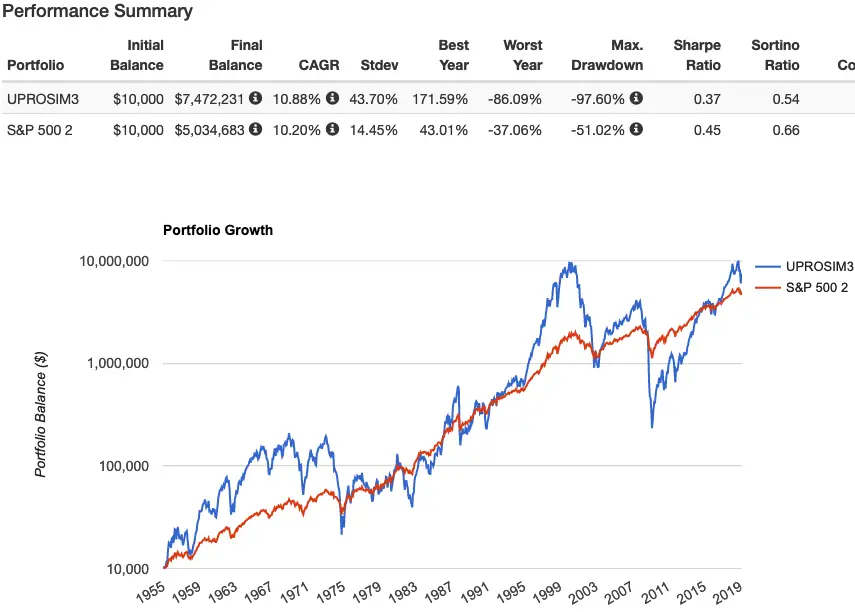

Here's UPRO vs. the S&P 500 going back to 1955:

My Hedgefundie Adventure Performance

Tracking the cumulative performance (quarterly change in performance relative to the initial value; no new deposits) of my Hedgefundie Adventure in my own portfolio starting October 1, 2019.

For example, an initial investment of $100 on October 1, 2019 means it became $126 (+26%) as of April 1, 2024.

01/01/2020: +7%

04/01/2020: -2%

07/01/2020: +35%

10/01/2020: +54%

01/01/2021: +79%

04/01/2021: +67%

07/01/2021: +105%

10/01/2021: +105%

01/01/2022: +150%

04/01/2022: +98%

07/01/2022: +14%

10/01/2022: -14%

01/01/2023: -10%

04/01/2023: +5%

07/01/2023: +11%

10/01/2023: -14%

01/01/2024: +16%

04/01/2024: +26%

07/01/2024: +28%

Alternative Options To the Hedgefundie Portfolio

If you want to utilize a leveraged strategy similar to that proposed by Hedgefundie but be completely hands off, PIMCO has been doing something similar for years with their StocksPLUS Long Duration Fund (PSLDX) since 2007. I reviewed the fund here. Note that you can only access this fund through certain brokers, and it may have a minimum investment requirement and transaction fees. Those details are beyond the scope of this post; ask your broker if it's available to you.

Similarly, if you're doing this with a small portion of your portfolio or if you want to employ a leveraged strategy in a taxable account, WisdomTree's NTSX may be a suitable option, effectively providing 1.5x leverage on a traditional 60/40 stocks/bonds portfolio. It holds 90% straight S&P 500 stocks and 10% treasury futures to achieve effective notional exposure of 90/60 stocks/bonds. I reviewed the fund here.

Bogleheads user MotoTrojan proposed a variant by which you can match the volatility of Hedgefundie's 55/45 UPRO/TMF, tone down the leverage a bit, and save some on the expense ratio of TMF by utilizing Vanguard's Extended Duration Treasury ETF (EDV) in a ratio of 43/57 UPRO/EDV. Here's an M1 pie for that. This variant would also be more tax-efficient than the original strategy that uses TMF if you're doing this in taxable.

Rapidly rising interest rates and/or runaway inflation are the primary risks for this strategy. If those concerns are material to you and make you hesitant about this strategy, or if you simply want more diversification across asset types, then a leveraged All Weather Portfolio may appeal to you. There are also some diversifiers listed below.

Addressing Concerns Over Long-Term Treasury Bonds

I've gotten a lot of questions about – and a lot of the discussion in the original Bogleheads thread has been about – the use, utility, and viability of long-term treasury bonds as a significant chunk of this strategy. I'll briefly address and hopefully quell these concerns below.

Again, by diversifying across uncorrelated assets, we mean holding different assets that will perform well at different times. For example, when stocks zig, bonds tend to zag. Those 2 assets are uncorrelated. Holding both provides a smoother ride, reducing portfolio volatility (variability of return) and risk.

Common comments nowadays about bonds include:

- “Bonds are useless at low yields!”

- “Bonds are for old people!”

- “Long bonds are too volatile and too susceptible to interest rate risk!”

- “Corporate bonds pay more!”

- “Interest rates can only go up from here! Bonds will be toast!”

- “Bonds return less than stocks!”

So why long term treasuries?

- It is fundamentally incorrect to say that bonds must necessarily lose money in a rising rate environment. Bonds only suffer from rising interest rates when those rates are rising faster than expected. Bonds handle low and slow rate increases just fine; look at the period of rising interest rates between 1940 and about 1975, where bonds kept rolling at their par and paid that sweet, steady coupon. Rates also rose steadily from 2016 to mid-2019, during which time TMF delivered a positive return.

- Bond pricing does not happen in a vacuum. Here are some more examples of periods of rising interest rates where long bonds delivered a positive return:

- From 1992-2000, interest rates rose by about 3% and long treasury bonds returned about 9% annualized for the period.

- From 2003-2007, interest rates rose by about 4% and long treasury bonds returned about 5% annualized for the period.

- From 2015-2019, interest rates rose by about 2% and long treasury bonds returned about 5% annualized for the period.

- New bonds bought by a bond index fund in a rising rate environment will be bought at the higher rate, while old ones at the previous lower rate are sold off. You're not stuck with the same yield for your entire investing horizon.

- We know that treasury bonds are an objectively superior diversifier alongside stocks compared to corporate bonds. This is also why I don't use the popular total bond market fund BND. It has been noted that this greater degree of uncorrelation between treasury bonds and stocks is conveniently amplified during periods of market turmoil, which researchers referred to as crisis alpha.

- Again, remember we need and want the greater volatility of long-term bonds so that they can more effectively counteract the downward movement of stocks, which are riskier and more volatile than bonds. We're using them to reduce the portfolio's volatility and risk. More volatile assets make better diversifiers. Most of the portfolio's risk is still being contributed by stocks. Let's use a simplistic risk parity example to illustrate. Risk parity for UPRO and TMF is about 40/60. If we want to slide down the duration scale, we must necessarily decrease UPRO's allocation, as we only have 100% of space to work with. Risk parity for UPRO and TYD (or EDV) is about 25/75. Parity for UPRO and TLT is about 20/80. etc. Simply keeping the same 55/45 allocation (for HFEA, at least) and swapping out TMF for a shorter duration bond fund doesn't really solve anything for us. This is why I've said that while it's not perfect, TMF seems to be the “least bad” option we have, as we can't lever intermediates (TYD) past 3x without the use of futures.

- This one's probably the most important. We're not talking about bonds held in isolation, which would probably be a bad investment right now. We're talking about them in the context of a diversified portfolio alongside stocks, for which they are still the usual flight-to-safety asset during stock downturns. Specifically, for this strategy, the purpose of the bonds side is purely as an insurance parachute in the event of a stock crash. Though they provided a major boost to this strategy's returns over the last 40 years while interest rates were dropping, we're not really expecting any real returns from the bonds side going forward, and we're intrinsically assuming that the stocks side is the primary driver of the strategy's returns. Even if rising rates mean bonds are a comparatively worse diversifier (for stocks) in terms of future expected returns during that period does not mean they are not still the best diversifier to use.

- Similarly, short-term decreases in bond prices do not mean the bonds are not still doing their job of buffering stock downturns.

- Historically, when treasury bonds moved in the same direction as stocks, it was usually up.

- Interest rates are likely to stay low for a while. Also, there’s no reason to expect interest rates to rise just because they are low. People have been claiming “rates can only go up” for the past 20 years or so and they haven't. They have gradually declined for the last 700 years without reversion to the mean. Negative rates aren't out of the question, and we're seeing them used in some foreign countries.

- Bond convexity means their asymmetric risk/return profile favors the upside.

- Again, I acknowledge that post-Volcker monetary policy, resulting in falling interest rates, has driven the particularly stellar returns of the raging bond bull market since 1982, but I also think the Fed and U.S. monetary policy are fundamentally different since the Volcker era, likely allowing us to altogether avoid runaway inflation environments like the late 1970’s going forward. Bond prices already have expected inflation baked in.

David Swensen summed it up nicely in his book Unconventional Success:

“The purity of noncallable, long-term, default-free treasury bonds provides the most powerful diversification to investor portfolios.”

Ok, bonds rant over. If you still feel some dissonance, the next section may offer some solutions.

Reducing Volatility and Drawdowns and Hedging Against Inflation and Rising Rates

It's unlikely that any of the following will improve the total return of the portfolio, and whether or not they'll improve risk-adjusted return is up for debate, but those concerned about inflation, rising rates, volatility, drawdowns, etc., and/or TMF's future ability to adequately serve as an insurance parachute, may want to diversify a bit with some of the following options:

- LTPZ – long term TIPS – inflation-linked bonds.

- FAS – 3x financials – banks tend to do well when interest rates rise.

- EDC – 3x emerging markets – diversify outside the U.S.

- UTSL – 3x utilities – lowest correlation to the market of any sector; tend to fare well during recessions and crashes.

- YINN – 3x China – lowly correlated to the U.S.

- UGL – 2x gold – usually lowly correlated to both stocks and bonds, but a long-term expected real return of zero; no 3x gold funds available.

- DRN – 3x REITs – arguable diversification benefit from “real assets.”

- EDV – U.S. Treasury STRIPS.

- TYD – 3x intermediate treasuries – less interest rate risk.

- UDOW – 3x the Dow – greater loading on Value and Profitability factors than UPRO.

- TNA – 3x Russell 2000 – small caps for the Size factor.

- TAIL – OTM put options ladder to hedge tail risk. Mostly intermediate treasury bonds and TIPS.

- CAOS – Very similar to TAIL but more complex and impressively has had positive carry.

- PFIX – OTC payer swaptions on interest rate changes; effectively shorting long bonds.

The Hedgefundie Portfolio ETF Pie for M1 Finance (UPRO/TMF)

Again, most users are utilizing M1 Finance to deploy the Hedgefundie strategy due to its dynamic rebalancing with new deposits, zero transaction fees, and its simple, 1-click rebalance that you can do quarterly. It takes no more than 30 seconds every 3 months. I wrote a comprehensive review of M1 Finance here.

The risk parity 40/60 portfolio would be this pie which looks like this:

- 40% UPRO

- 60% TMF

To add this pie to your portfolio on M1 Finance, just click this link and then click “Save to my account.”

The updated 55/45 portfolio would be this pie which looks like this:

- 55% UPRO

- 45% TMF

To add this pie to your portfolio on M1 Finance, just click this link and then click “Save to my account.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Disclosures: I am long PSLDX, NTSX, UPRO, and TMF in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hi, I’m a spanish investor and don’t have a non taxable account. Given the tax implications for rebalancing, would it be better to just hold UPRO? What tool could I use to figure this out? I haven’t been able with portfolio visualiser… Any pointers would be greatly appreciated! Thanks!!

UPRO alone makes little sense in my opinion. Maybe consider 2x with something like SSO, or NTSX that you commented on the other post about.

Hi John,

Any updates for the October 2023 and January 2024 HFEA performances in your portfolio? Also would you recommend any change to this strategy moving forward considering rate cuts are anticipated, or 55/45 UPRO/TMF is still fine (any other suggestions or diversification appreciated!)?

Been going through your content and videos, love them so far! amazing amount of info!

Updated.

Trying to time interest rate changes and the bond market is typically just as fruitless as trying to time the stock market.

Thanks!

Hi John,

What are your thoughts on the TMF reverse split that recently occurred? What would be the next steps for those in this strategy prior to the RS? Does it change the approach of HFEA strategy?

Hey Mike, doesn’t change anything. Splits are a neutral event.

Hi John – can you elaborate more around the potential tax implications of Hedgefundie and why you suggest having it in a Roth? Thanks!

LETFs are relatively tax-inefficient vehicles and then the likely-necessary rebalancing would incur capital gains taxes every time it’s done.

Cap gains when rebalancing.

Hey John, any update? I imagine things are looking much better now, even with TMF still being down. I started DCAing into this strategy in 2021 with some TQQQ weight thrown in and I’ve already regained all of the 2022 loss despite TMF still being down, which feels like it is at a long term bottom anyway.

Just added April 1, 2023. Up 5% as of that date.

Sorry, didn’t realize you were doing quarterly updates. Considering how volatile the last couple of years were and having an Achilles heel of high inflation actually happen, I’d say that it’s holding up well compared to just straight S&P. Interested to see where it goes from here.

Indeed. Fingers crossed.

How did you get the portfolio analysis to back test further then the start date of the fund/etf? I don’t see that option in the. analyzer and therefore do not see the same results. Thanks.

Need to either create your own simulation data or for a rough approximation use the underlying 1x funds and set leverage %.

What’s the latest on this strategy? I know it got massacred during the last year, but does it still show promise long term?

No one knows. The viability of an inherently long term strategy doesn’t change based on its recent performance, either bad or good.

Question on M1, can I set my HFEA account there up for quarterly rebalancing? My understanding of the rebalancing with HFEA is I need to sell every share and re-buy at the proper allocations. Doesn’t M1 just sell the percentage you need moved to rebalance and then buy the same percentage on the other side of the ledger? In other words, if I’m at 57/43 in a traditional 60/40 portfolio, wouldn’t M1 sell 3% of bonds and buy 3% stocks? My understanding is that the HFEA rebalancing won’t work with that and I’ll need to sell all UPRO/TMF and buy it back to avoid time decay. Is that wrong?

Rebalancing is simply selling the overweight asset(s) to buy the underweight asset(s). This is 1 click with M1. Not sure where you got the idea that you need to sell everything.

With all the impact on HFEA strategy, I wonder if 2x SSO/UBT/UBS makes better sense now? Also, NTSX’s can be seemingly balanced out with DBMF fund. Here is what I came up with after back-testing in Portfolio Visualizer for various tax-sheltered DIY retirement accounts to move from NTSX/SPGP/IWY 40/40/20:

NTSX/NTSI DBMF/KMLM 35/35 15/15

SPGP/RWJ/PDBC 75/15/10

SSO/UBT/UST 75/15/10

Any feedback would be much appreciated.

Many thanks!

Can you please share how you simulated the returns for UPRO prior to 2009 (when UPRO was formed). Thanks.

Download historical returns of S&P 500, 3x daily and subtract fees.

Hey John,

Any thought on why both UPRO and TMF and moving down in tandem.?

High inflation, rising interest rates, less demand for long bonds.

Hi John,

I’m hanging in there with this strategy. Hard to time the market, of course, but I should have known that buying bonds in the fall of 2021 with rates at historic lows wasn’t the best idea…UPRO and TMF have been moving down together since January 2022. Ouch. Hindsight is 20/20.

Good for us all to remember that losses aren’t realized unless you’re selling at a loss. If you’re 10+ years from needing/wanting this money, relax, don’t panic, stay the course.

With that, I’m wondering if you might be willing to update your great charts and graphs in your post to give us all a better sense of where the strategy is now as compared to other strategies?

Thanks a million for the great info!

Tyler

Good idea, Tyler. I should update some things. Thanks!

Hi John

Great work and detailed blogpost. Can you please update your quarterly reurns?

Thanks! Just did. You might need to clear your browser cache to see the updated page. I added 04/01/2024: +26%

Is this a disasterous strategy for taxable? I can’t put more money into tax-advanatged as this point, but would like to top up more. in taxable? Is this a bad move?

Definitely not ideal in taxable. NTSX is a very tax efficient watered down version of it.

Did you ever find a way to add additional diversification with international exposure?

60% / 55% UPRO any real difference? Why not just go for 60% UPRO for 3x 60/40?

Hi John,

I’m curious to hear your thoughts on the following allocation that has been popping up on Reddit. The premise is that the 55/45 strategy worked great in the bull market over the past 30 yrs, but since yields can’t really go down too much further now, the author is proposing a 75/25 strategy with DAILY rebalancing instead.

https://www.reddit.com/r/trueHFEA/comments/uh1eeg/optimal_asset_allocation_for_hfea/

I personally probably wouldn’t go less than 30% TMF. Daily rebalancing would be too cumbersome for me unless it was automated somehow. But I’d stick with quarterly rebalancing anyway. Note that the author there was not proposing daily rebalancing but simply used that for modeling.

Hi John, I’ve learned so much over the past 2 years thanks to your site. The wealth of information and ideas for a beginning investor such as myself is priceless and I can’t thank you enough for the work you’ve done and continue to do!

Quick question – in your portfoliovisualizer backtest, you used the 40/60 pie. What are results for the 55/45? I’m not quite sure how to simulate as far back as you did.

How does Mototrojan’s version returns compare to that of the 55/45 HFEA? I’m looking to employ one of the two into a taxable account, would Mototrojan’s version end up being better in a taxable account? I’m looking for absolute returns so should I still go with HFEA or do you think Mototrojan’s tax efficiency will be better?

This would be my extremely aggressive portfolio account so it is whatever money that I’m willing to lose all on.

I love your articles have read a majority of them, thank you for having such great information so readily available!

Less leverage. MT’s should be slightly more tax efficient, yes. Thanks, Justin!

They’re new, but have you looked at RPAR and UPAR? Levered up TIPS/Commodities/VT/Gold. UPAR is a juiced RPAR. Only 2 years of data on RPAR and only 7 months of UPAR. UPAR has been trading at a premium to NAV. I don’t like market timing bets, but with commodities getting crush, bonds crush, equities crushed, should be interesting to see how this year stress tests those two funds.

No COI. I don’t own either.

Yep, I discussed them here. Interesting one-fund solutions indeed for a more “all weather” approach.

Excellent article, thanks for breaking it down. Seems a good time to start DCA-ing into that strategy.

I worry that in an inflationary 1970s type environment, in which both stocks and long term bonds get slowly killed, this portfolio will get annihilated. The backtesting needs to include an inflationary regime, or else in my view this is criminally misleading / risky.

I know you call out the key assumption about not going into a pre-Volcker era, but I think that is an assumption that no long-term investor could responsibly make. I really think this blog post should come with a huge warning sign, and perhaps the inflation disclaimer should be in bold red ink ^.^

Indeed it would. It’s what we’re currently seeing. The backtest does include that period. I noted several times one should assess their own beliefs about future inflation. This was discussed at length in the original Bogleheads thread.

So what are folks using doing these days using HedgeFundie’s leveraged idea? I’m seeing some folks have as much as 25% of their portfolio in this concept? What’s the word on the street – are folks hanging in there on the UPRO/TMF combo?

You’d need strong stomachs – the idea was that TMF would provide some downside protection but it is DOWN -55% YTD – while UPRO is also down about 38%.

Instead of using the S&P500 leveraged 3x as with UPRO – what about a bit more tamer/moderate leverage approach using SSO (S&P500 2x leverage ETF) – and combined with EDV?

As we’d expect, some are sticking with it and others are realizing they don’t have the risk tolerance for such a strategy and are deleveraging or bailing altogether. This was always the achilles heel of the strategy.

The drawdown has been rough over the last 6 months. I’m holding this portfolio in my Roth for the long-term, It looks like I moved into it at a bad time (July 2021).

Hello John, I have learnt a lot about investing from your website, deeply appreciate you sharing your knowledge and breaking down complex topic, to a level understandable to most of us.

Can you share if your HEFA investment is in taxable or tax advantage account?

Thanks! IRA.

I saw elsewhere a 2x leveraged version that is more tax efficient (similar backtested returns to PSLDX):

50% NTSX

30% UPRO

20% TMF

It seems great in theory. In addition, when I’m ready to exit, I would only have to sell UPRO and TMF and can keep NTSX as a core position.

Thoughts?

This would end up being more expensive and no more tax efficient than just using equal parts UPRO/VOO and equal parts TMF/TLT. It’s also 135/90 exposure, so not quite the same thing as just 2x. Don’t overthink it.

John, what do you think on below allocation? Goal would be to lower volatility in high inflation times but still capture most of the advantages of HFEA. Quarterly rebalancing.

Normal times

60%UPRO, 35%TMF, 5%GLD

Inflation above 4.5%

60%UPRO/20%TMF/5% GLD / 15% UGL