The RSSB ETF aims to provide a “return stacked” solution for global stocks and bonds in a single fund. It's called the Return Stacked® Global Stocks & Bonds ETF. Let's review it.

First, it's important to note that as of March 29, 2023, RSSB is not trading yet. The SEC filing happened on February 6, 2023.

Update on December 5, 2023: RSSB has launched!

Update on July 25, 2024: After about 6 months, RSSB has amassed over $170M in AUM.

“Return stacking” – a term that was actually coined by the creators of RSSB – simply refers to layering different sources of expected return on top of one another using leverage to simultaneously achieve asset class diversification and boost expected returns, in this case in a single fund with expected returns greater than or equal to that of a standalone unlevered equities fund. I delved into the concept of return stacking in detail in a separate post here.

Basically, this means that we're, in the words of the fund provider themselves, “achieving more than $1.00 of exposure for each $1.00 invested.” In that sense, we're improving capital efficiency. And doing so with uncorrelated assets can actually reduce risk. Return stacking may be particularly useful in the face of low expected returns for multiple core assets like stock and bonds.

NTSX from WisdomTree exemplifies this idea using 90% U.S. large cap stocks and 60% exposure to intermediate U.S. treasury bonds via futures contracts. It took a while for this fund to hit its stride in terms of popularity, but it now boasts nearly $1B in AUM 4 years later. Not too long after its debut, WisdomTree launched sister funds NTSI and NTSE for ex-US Developed Markets and Emerging Markets respectively. Compared to NTSX, those two have pretty low AUM.

To read more about the specifics of this idea of return stacking and its merits, go read my post on NTSX here first and then come back here. In a nutshell, we can show both theoretically and empirically that a portfolio of stocks and bonds using a modest amount of leverage would be expected to have a higher risk-adjusted return than that of a 100% stocks portfolio.

In the case of RSSB, we're effectively “stacking” 100% global stocks and 100% U.S. treasury bonds. That is, for every $1 invested, the ETF seeks to provide $1 of exposure to its Global Equity strategy and $1 of exposure to its U.S. Treasury Futures strategy. The ticker RSSB is an initialism for “Return Stacked Stocks Bonds.”

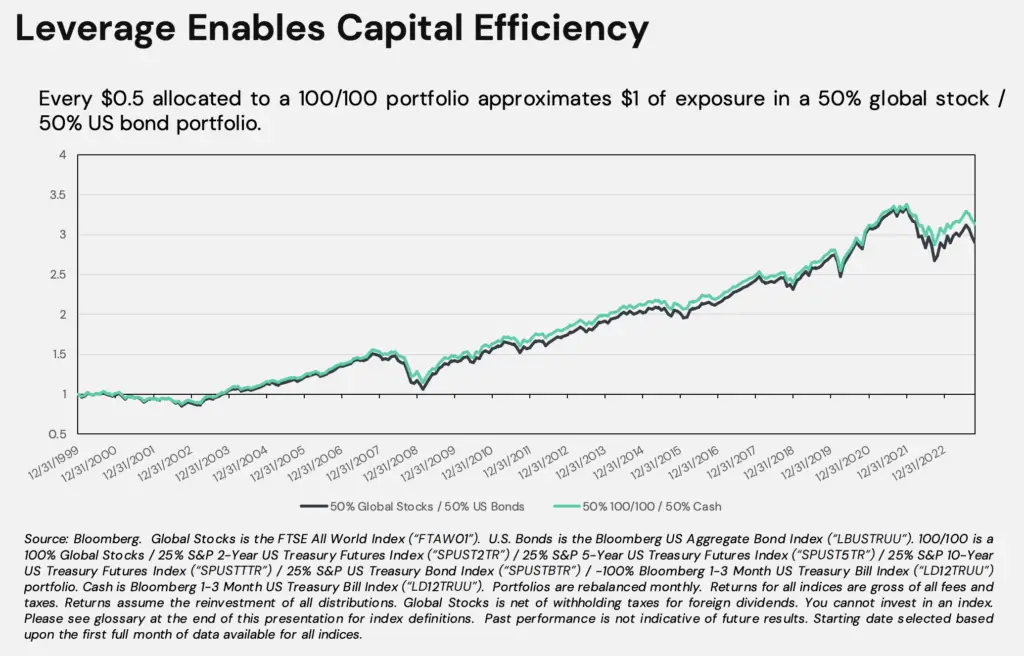

Capital efficient funds allow investors to achieve any given particular exposure with a smaller allocation. For example, a traditional 50/50 stocks/bonds allocation can be replicated with just 50% allocated to RSSB (which is 100/100).

This frees up capital for the investor to use with additional alternative assets or strategies, effectively “stacking” sources of return on top of one's core portfolio, and provides flexibility of asset choice without having to sacrifice valuable space in the portfolio. The beauty here is we're able to achieve cap-weighted global equities exposure plus bonds exposure in a single, turnkey solution.

The original filing for RSSB indicated that it was going to use a 90/60 allocation – the same allocation used by WisdomTree's NTSX, NTSI, and NTSE – but later that was juiced up to 100/100. With some hand waving, we can think of RSSB as a “higher-octane” – to borrow a descriptor from one of the creators Corey Hoffstein – combination of those three funds.

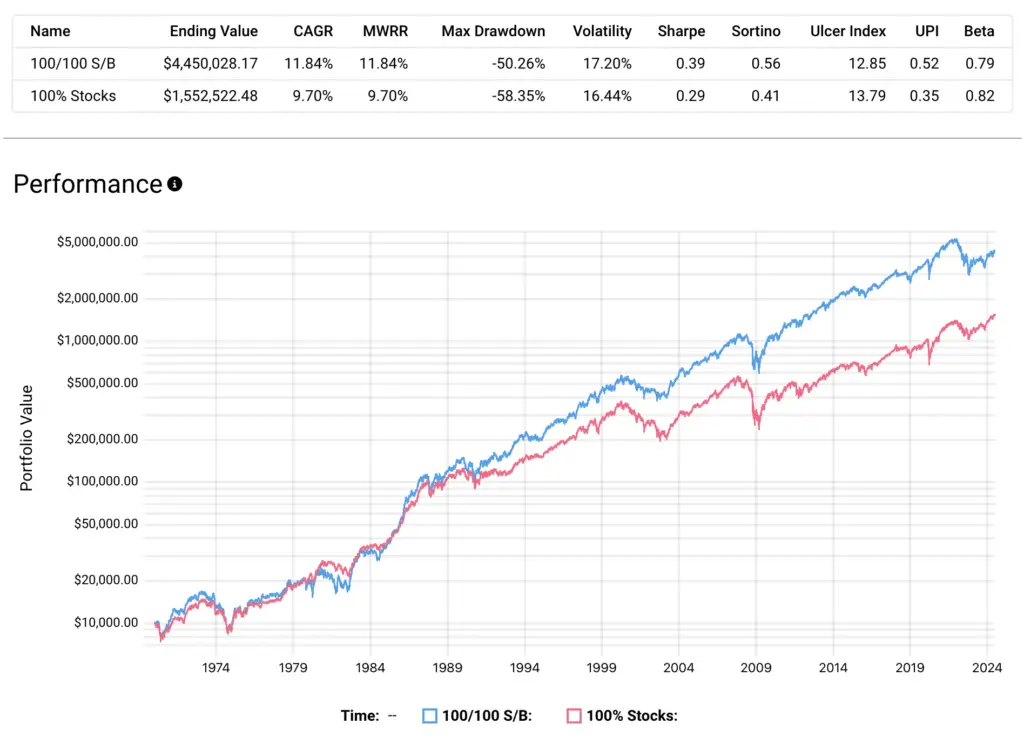

Using simulation data, here's a hypothetical backtest of how RSSB's exposure (100% global stocks and 100% U.S. treasury bonds) might have performed historically versus 100% global stocks:

If you need some ideas for implementation, use cases for RSSB include:

- Extra diversification – Again, the investor can use freed up capital to buy alternative assets and strategies in addition to traditional stocks and bonds.

- Reduced cash drag – Embedded capital efficiency allows investors to hold cash without losing core stocks/bonds exposure.

- Avoiding 100% stocks – I've said it countless times; I think everyone – even young investors – should own bonds. RSSB allows the investor to do so without losing that aggressive growth exposure of 100% equities typically seen in high-risk portfolios of young investors.

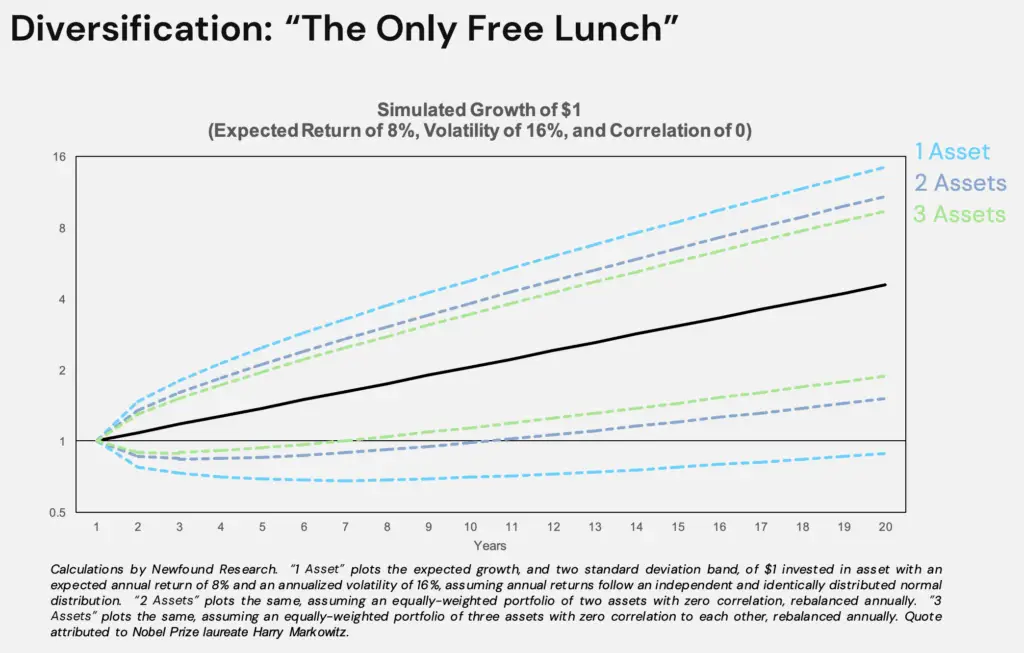

To illustrate that first one, here's how diversification decreases the dispersion of returns – measured by volatility – as we increase the number of uncorrelated assets:

In that sense, RSSB “unlocks” the benefits of diversification without sacrificing space. Here are some hypothetical examples to illustrate:

Suppose you want to naively equally weight stocks, bonds, and gold at 50% each (150% total notional exposure). You can easily build that now with 50% RSSB and 50% GLDM, for example, as illustrated here.

Or maybe you want to overlay a dash of 20% managed futures on top of 80% stocks and 80% bonds. You can achieve this now with 80% RSSB and 20% DBMF, for example, as illustrated here.

If you've stuck around here long enough, you know I'm a big fan of global diversification in stocks, so I'm pretty excited about RSSB. I've been in numerous Reddit threads over the past few years where people explicitly wished for “a global version of NTSX.” Now it's here.

Fun fact: RSSB is brought to you by some of the same names who initially discussed return stacking ideas that ultimately catalyzed the creation of NTSX and RPAR.

- Corey Hoffstein and the gang at Newfound Research LLC serve as the sub-adviser.

- Tidal Investments, LLC serves as the investment adviser.

- Rodrigo Gordillo, Adam Butler, and the folks at ReSolve Asset Management SEZC serve as the futures trading advisor.

- Foreside Fund Services, LLC is the distributor.

Another fun fact is that ReSolve and Newfound Research have actually trademarked the terms Return Stacking™ and Return Stacked™.

Conveniently, RSSB will aim to match market cap weights of global equities markets. According to the fund's prospectus, it will invest at least 40% of the fund's equity assets in international (ex-US) stocks. Mechanically, the fund has the freedom to achieve that exposure via global equities index funds like VT from Vanguard, regional U.S. funds and international funds (or even individual stocks), equity index futures, or any combination thereof. The latter choices would be more likely to provide pass-through foreign tax credits to investors for any given year.

For example, RSSB may hold 50% in a large-cap U.S. equity ETF, 40% in an international ex-US equity ETF, and gain the remaining 10% equity exposure through U.S. equity index futures.

- 50% Vanguard Total Stock Market Index Fund ETF (“VTI”)

- 40% Vanguard Total International Stock ETF (“VXUS”)

- 10% S&P 500 E-Mini Futures Contract

At the time of writing in December, 2023, the above combination is exactly what RSSB's holdings look like.

It sounds like RSSB's bonds exposure should be similar to that of WisdomTree's lineup in terms of being intermediate U.S. treasury bonds, aiming to deliver notional exposure of 100%, specifically with a target duration between 2 and 8 years. RSSB will do so by investing in futures contracts on U.S. Treasuries across most of the yield curve, with maturities ranging from 2 to 30 years. RSSB's collateral for those futures contracts will be held in ultra-short-term U.S. debt instruments, considered cash equivalents. An intermediate effective bond duration is a one-size-fits-most solution for accumulators and retirees alike.

In a nutshell, the expected behavior of RSSB would be roughly the same volatility of 100% stocks but with a higher long-term return. This has effectively been a free lunch historically – higher returns with lower volatility:

RSSB will rebalance based on a 5% allocation drift threshold.

At this point you're probably wondering what the fee looks like. It's not as high as you probably think.

Let's first consider what comparable exposure would cost using WisdomTree's lineup at current global market cap weights of roughly 60% U.S., 30% ex-US Developed Markets, and 10% Emerging Markets. So that's 60% NTSX, 30% NTSI, and 10% NTSE. These funds have fees of 0.20%, 0.26%, and 0.32% respectively, so we arrive at a weighted average expense ratio of 0.23%.

RSSB has a stated fee of 0.51%, but Tidal Investments have decided on a fee waiver of 0.15% through at least May 30, 2025, resulting in an effective net expense ratio of 0.36%.

So RSSB is a bit higher than the cost of comparable exposure using WisdomTree's lineup, but in my opinion that doesn't mean we should discount it. Remember that simplicity in portfolios is extremely valuable, both in terms of peace of mind and mitigating biases for retail investors and time savings in the case of advisors.

Also recall that RSSB will inherently provide market cap weighted global equities exposure, while the investor using the WisdomTree lineup can manually dial in that exposure to their liking. I like to overweight Emerging Markets, for example. And again, using the WisdomTree trifecta guarantees some foreign tax credits in a taxable environment, while that's not guaranteed for RSSB.

As an aside, remember the mutual fund PSLDX that has been around for over a decade and is roughly 100% S&P 500 and 100% total U.S. bond market, wherein which PIMCO are active on the bonds side. PSLDX costs 0.59%. RSSB seems like the clear choice over PSLDX now with a much lower fee and global equities coverage.

And at the end of the day, I'm always a fan of products that bring strategies to the hands of retail investors that were previously only accessible by institutions and sophisticated traders.

Lastly, as with any portfolio, remember that leverage is not a free lunch and can result in larger losses than an unlevered portfolio when multiple asset classes move down the same time (as we saw in 2022), and high financing costs can add insult to that injury. Derivatives are also not guaranteed to perfectly track their target exposure. Investors should fully understand these risks and read RSSB's prospectus before jumping in.

As I said years ago in regards to NTSX, I think RSSB is incredibly clever, elegant, and thoughtfully constructed, and it has a strong theoretical basis. In my opinion, it is definitely not just another exotic shiny object driven by marketing buzz.

RSSB will obviously be a close competitor to the WisdomTree lineup, but it may also sway some globally diversified, capital-efficient Bogleheads from “VT and chill” to “RSSB and chill.”

RSSB should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

RSSB has sister funds in the Return Stacked® family that are RSST, RSBT, and RSSY.

What do you think of RSSB? Let me know in the comments.

Disclosure: I am long NTSX, NTSI, and NTSE.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

John, it seems that PSLDX may still provide better returns over the long run even if VT matches SPY performance due to the longer duration of the PSLDX bond component (I also think bonds are the one thing that can be successfully actively managed). The volatility of 30 year STRIPs for example is quite different than a portfolio of 12 year average duration. If one wanted to replace PSLDX with RSSB might it make sense to add a sliver of GOVZ or EDV to better “match” the PSLDX bond component?

Hey John,

Long time viewer and 2nd post here! My first post was actually in your review of PSLDX asking you for your thoughts on RSSB and if you’d share your thoughts. Little did I know you’ve already reviewed it.

Just wondering what are your thoughts on holding RSSB in a taxable brokerage account?

To simply my portfolio, I was thinking RSSB + Small cap Tilt (AVUV and AVDV).

Thanks,

Michael

I haven’t dug too deep on the exact tax cost of RSSB. It’s not the most tax efficient but it shouldn’t be terrible.

John,

The duration on RSSB treasuries is almost 12 years vs about 7 for NTSX. Yet another notch to RSSB as the duration better matches the volatility on the equity side, which is what we want.

Thanks for sharing, Chris! I’ll add that info.

Have you ever considered buying treasury futures directly to implement a strategy like this yourself?

I have been on your site for the entirety of 2023 trying to find a portfolio like RSSB. I tried building my own, but as you elucidate, some people do not want to (or have time to) rebalance.

When I saw RSSB drop, I bought it that evening.

I’m 39 years old and dropped 50k into it.

It’s in my second taxable (the first being VOO + iShare’s intl/mid/small ETFs on Acorns, so basically just spare change that I don’t even pay much attention to).

My Roth is VT and chill. It feels nice to have a taxable chill account, haha.

I’m wondering what you think about this company’s other two (current) ETFs, and, regarding RSSB, what you may add to it, if anything.

For me, it just seems so complete, and I think the only thing I would add would possibly be Gold, considering it doesn’t tend to follow equities or treasuries.

Let me know your thoughts if and when you have time.

Thanks for all the work you do here. It has helped me tremendously.

Thanks, Matthew! I’m planning to expand my thoughts on the Return Stacked funds in future posts. I have one on RSSB but not the others.

The simplicity is incredible. I agree on the gold piece. 80% RSSB; 20% GDE looks pretty good except for the fact that GDE has not really taken off the AUM and spread is terrible on it.

what’s the difference between rssb rsst and rsbt? how much leverage do they have?

RSSB = Return Stacked stocks/bonds. RSST = Return Stacked stocks/trend. RSBT = Return Stacked bonds/trend. I believe all are 100/100.

Thoughts on RSSB instead of VOO + VEA + VWO in your Ginger Ale or Vigorous Value portfolios?

I imagine RSSB + AVUV + AVDV + DGS/AVEE hits the trifecta of global market exposure + strong factor tilt + uncorrelation with treasuries. I think the main issues are:

1. Fees

2. Inability to overweight your market cap weighted allocation. I know you like overweighting EM, and currently I favor underweighting US a tiny bit and overweighting EM a little.

3. You’d only be able to rebalance the SCV ETFs again RSSB, rather than rebalance against the treasuries since RSSB will rebalance itself at a 5% drift – a bit too tight of a margin in my opinion,

You basically hit my exact thoughts. I love simplicity wherever possible though, so certainly a viable idea.

How would this look in a taxable account? I was considering PSLDX but that seems pretty bad in a taxable account. wondering if this would be better

Much better than PSLDX.

Will rssb be market cap weighted like a total market portfolio or will it be similar to wisdom tree’s approach that targets only large cap exposure?

Unsure yet. Likely market cap.

John,

In a tax advantaged account at something like M1, I would just hold NTSX, NTSI, and NTSE rebalance annually and save the expense ration. In a taxable account that calculus may change. RSSB may be better in a taxable account notwithstanding 2x the expense ratio of equivalent NTS product holdings given you do not need to rebalance – ever, and take the tax hit. Hard to model that. Any thoughts?

Indeed, good points, Chris.

NTSX/NTSI/NTSE will move pretty much at market weights so no need to really worry about rebalancing. It will be minor and can be handled with self directing where dividends go if you want perfection.