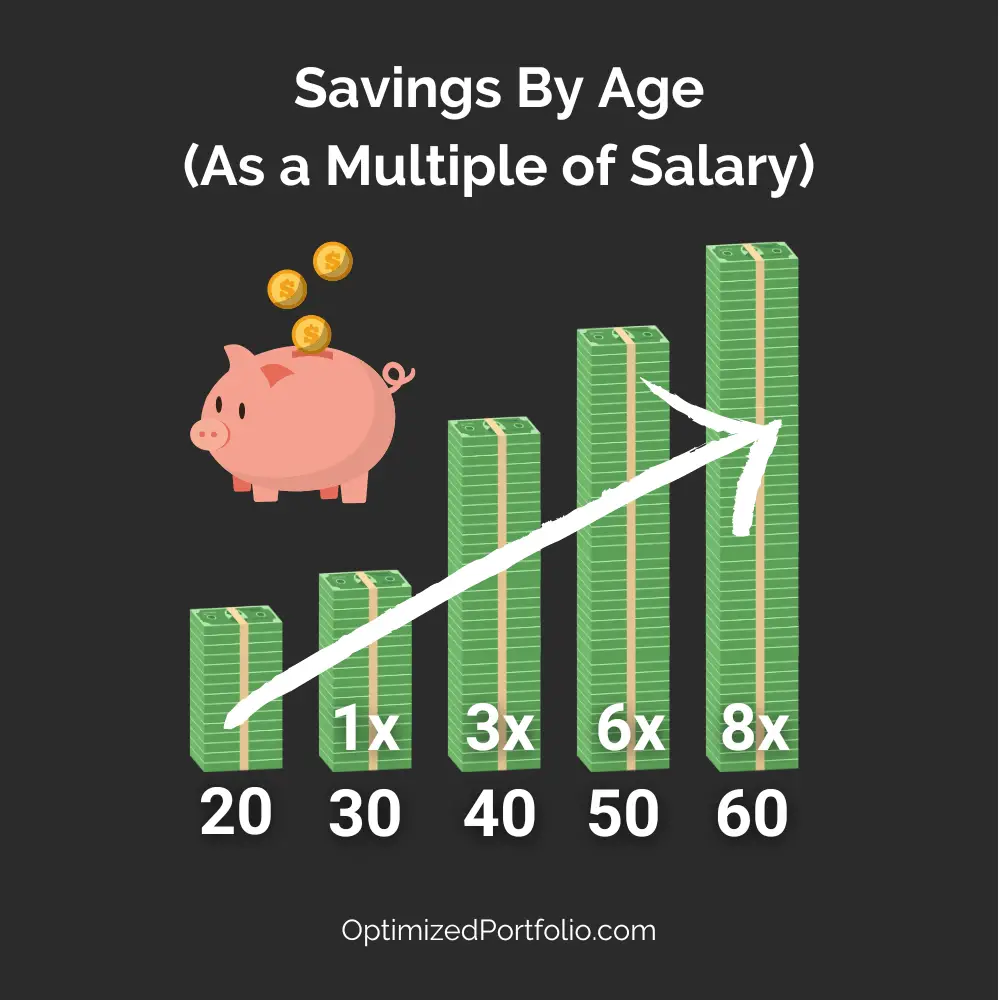

While there's no one-size-fits-all approach for how much one should save by age, here's a general framework to aim for as you progress on your financial journey to retirement.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

Introduction – Savings Benchmarks by Age

Obviously the specific amount of money you need as you get older will depend on your personal circumstances, lifestyle, and expenses. Speaking broadly, think of this framework as a general guideline; it should not replace comprehensive financial planning.

You also likely won't hit all the milestones perfectly, but they provide goals to strive for and a path to keep you on track. For more detailed tactical steps on building wealth, check out my resource page here.

And don't get discouraged if you haven't started yet. The best time to plant a tree was 20 years ago. The second-best time is today. The purpose of these goalposts is not to make you feel inadequate, but rather to simply spark action.

You also can't change the past. Instead of thinking “How much should I have saved?” instead think “How much can I save going forward?” You can always get back on track.

Age 20 – Any Savings Is Great

At age 20, you're relatively fresh out of high school and possibly in college. Maybe you had a summer job during high school and now have a part-time job during college.

If you've been lucky enough to avoid taking on student loans and credit card debt, maybe you've started putting some money aside. If not, it's likely best to pay down any high interest debt first.

At this age, any amount of savings is great.

An emergency fund is important, even for young people, for an unexpected expense like a car repair bill. If you've got earned income, you can open a Traditional IRA or a Roth IRA. Aside from that, a taxable brokerage account is of course an option as well.

Throughout your 20's, you'll likely be finishing school and starting a career with an entry-level salary and possibly an employer-sponsored retirement account like a 401k (invest enough for the employer match!). Though there will be many priorities competing for your income, this is the most powerful time to start saving for retirement, so you'll hopefully be making regular contributions to retirement accounts and/or your taxable brokerage account (and HSA if you have one). You may also have short-term goals like a downpayment on a house.

Avoid the temptation to spend frivolously on unfulfilling things, particularly with any unexpected windfalls. Aim to save at least 20% of your income and you should easily be able to hit these milestones. If you can't swing that, start small and increase that percentage as you're able to.

Setting these habits early of saving and contributing for retirement is a powerful psychological tool that will set you up for success later down the road. Automating those deposits is even better.

Moreover, because of the power of compound returns, starting earlier means greater and faster accumulation of wealth. Contributing just $5,000 a year starting at age 20 with an annualized return of 7% would result in nearly $1.8 million at age 65. Waiting until age 30 to start cuts that final number in half to less than $900,000. This is why increasing your savings rate as early as possible drastically improves your chances of adequately funding retirement.

Age 30 – One Year's Salary

Ideally at age 30 you've saved at least the equivalent of your annual salary. For example, if your salary is $50,000, you'd have $50,000 saved by age 30.

At this age you've maybe settled on a career and are earning more than you ever did in your 20's. As such, your annual contributions to investment accounts can hopefully be larger than ever before. Be sure to keep lifestyle creep – expenses rising with income – in check.

By your mid-30's, you should also have a healthy emergency fund of 3-6 months' expenses to help protect you from a sudden loss of income. Hopefully you've also locked in a low mortgage rate if you've bought a home.

Age 40 – 3x Annual Salary

At age 40, ideally you've saved at least the equivalent of three times your annual salary.

In your 40's you're probably at least somewhat established in your career and you're earning more than you ever have. Ideally this will allow you to maximize annual contributions to tax-advantaged retirement accounts like a 401k and IRA, and any excess savings can be invested in your taxable brokerage account.

During this time is when you'll really want to dial in your investing strategy and investment policy statement if you didn't already in your 30's.

Age 50 – 6x Annual Salary

At age 50, ideally you should have at least six times your annual salary saved.

In your 50's, your regular expenses may actually drop – kids will move out of the house, you may pay off your mortgage and car loans, student loans are no longer in the picture, etc. This means your savings rate can increase and you also may not need as large of an emergency fund as you previously had.

Retirement is also on the horizon, so dedicated planning with a financial advisor is likely a prudent move during this time to account for your individual lifestyle and goals.

Age 60 – 8x Annual Salary

At age 60, ideally you've saved at least eight times the equivalent of your annual salary.

At this age, you've probably either entered or are considering entering retirement. This is when estimates like the 4% Rule come into play to try to make sure you've got enough saved to last you through retirement as human capital dries up and expenses continue.

Obviously, delaying retirement as long as possible can decrease that multiple, as you'll have more earning and compounding years. On the flipside, retiring early necessarily means you'd need a higher multiple saved because you'll have fewer earning years when portfolio withdrawals for expenses are not being replenished.

Similarly, in terms of investments, having a lower multiple and saving more than needed means you may be able to get away with a more conservative asset allocation. If you need more growth, however, your need for risk may be greater than what would typically be recommended.

In your 60's, if you're well above your retirement savings goals, you can think about things like legacy, philanthropy, and estate planning. You'll also hit the eligibility age for Social Security benefits, which may lift some of the burden of no longer having earned income.

Expert Tips for Saving More

Here are some specific, actionable expert tips to keep in mind to help make saving easier and faster:

- Create a budget and meticulously analyze expenses. Saving will be much easier after you figure out where exactly your money is and should be going.

- If your employer offers to match 401k contributions, make sure you're contributing enough to get that match, as it's free money.

- Set up automatic transfers into savings accounts and investment accounts. Doing so allows you to avoid having to see or think about allocating that money.

- The rational way to pay down debt is in order of greatest to least interest rate, so it's usually going to be credit cards first followed by auto loans and student loans, if applicable. If the expected return on your investments is greater than your mortgage interest rate, it also makes sense to only make the minimum payment on the mortgage unless you place significant psychological value on paying off your house early.

- Consider getting a side gig for extra income if you need to catch up on savings. This will be much more powerful than trying to pinch pennies cutting small expenses, though obviously also cut unnecessary expenses where possible. A tool like Rocket Money can identify and cancel subscriptions you may have forgotten about.

- If you're disciplined enough to pay off the balance completely every month, consider utilizing cash-back credit cards for regular expenses whenever possible.

- Avoid impulse purchases. For nonessential purchases, walk away and give yourself 24 hours to consider whether or not you really want or need that item.

- Occasionally shop around for better rates on regular expenses like health insurance, car insurance, homeowner's insurance, mortgage rates, cell phone service, etc. Small savings on regular monthly expenses like these can add up over long time periods.

- Provided you've overfunded it, I'm actually a proponent of investing one's emergency fund in low-risk assets so that it's not simply losing to inflation. If not, check the interest rate on your savings account and shop around for what's called a high yield savings account, which will typically offer higher rates than a big bank.

Conclusion

The path to financial freedom will look different for everyone. For some it may be relatively straight and smooth, while for others it may be winding with fluctuating income year to year with some years seeing no savings. The important thing is to always get back on the path as soon as possible and to not focus on past shortcomings but rather look forward with purpose.

Remember that you're never too young or too old to start.

What are some tips and tricks you use to save more? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply