Roth IRAs and Traditional IRAs are two types of retirement accounts for U.S. investors. Is one better than the other? Let's dive in.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Roth IRA and Traditional IRA Similarities

First we'll briefly go over similarities between a Roth IRA and a Traditional IRA.

- These are both individual retirement accounts (IRA) that are designed to help U.S. citizens save for retirement.

- Both have contribution limits that cap the money you can invest in them annually. We'll go over these later.

- Both have annual income limits for eligibility to contribute. We'll cover these later too.

- Contributions can be made with cash or rollovers from other qualified retirement plans.

- Both have rules on when you can withdraw funds without incurring a penalty.

- Both offer the advantage of tax-deferred or tax-free growth of your investments inside the account.

- You must have earned income to be able to contribute to these accounts.

- There are no special fees or investment products that apply to one versus the other.

Also note that you can open either or both of these types of IRA's in addition to an employer-sponsored plan (ESP) like a 401k. Again, that's why these are called an individual retirement account.

Roth IRA and Traditional IRA Differences

Much of the conversation about a Roth IRA versus a Traditional IRA surrounds the differences between these two accounts, so this section will be much longer.

The Traditional IRA is much older and was established in 1974. The Roth IRA arrived later in 1997.

Taxes

The main difference of note between these two account types is how they're taxed. With the Traditional IRA, you contribute pre-tax money to the account while working and then pay taxes on withdrawals later in retirement. That is, you get a tax deduction at the time of the contributions.

With a Roth IRA, you contribute post-tax dollars while working and then withdrawals later in retirement are tax-free. That is, you've already paid taxes on the money going in so you don't have to pay taxes on the growth in the future.

To put it simply, with the Traditional IRA, you pay taxes later, and with the Roth IRA, you pay taxes now.

Withdrawals

Another major difference involves required minimum withdrawals, or RMDs for short. The Traditional IRA requires you to start withdrawing money annually at age 73 because Uncle Sam wants his tax revenue. Failure to take RMDs can result in significant penalties. Roth IRAs, on the other hand, do not have RMDs because you've already paid taxes on that money.

While we're on the subject, Roth IRA contributions can be withdrawn anytime tax- and penalty-free because those are just earned dollars on which you've already paid taxes. In that sense, the Roth IRA can act as a backup savings vehicle for things like an emergency fund or education expenses. If you have converted another account to a Roth IRA, you have to wait 5 years to do this.

A few special circumstances allow for penalty-free early IRA withdrawals of earnings before age 59.5:

- First time home purchase; you can withdraw up to $10,000.

- Higher education expenses

- Medical expenses

- Death

- Disability

- Substantially equal periodic payments

Consult your tax professional if any of those apply to you.

Roth IRA and Traditional IRA Income and Contribution Limits in 2024

Now we'll cover the specific differences in income and contribution limits for the Roth IRA and Traditional IRA. Note that these typically change every year so the numbers here may be outdated depending on when you're seeing this.

At this time in 2024, the annual contribution limit for individuals for both IRAs is $7,000 if below age 50 and $8,000 if age 50 or older, up from $6,500 and $7,500 respectively for 2023.

The current annual income limits to be eligible to contribute to a Roth IRA in 2024 are $161,000 if single and $240,000 if married filing jointly. Phase-outs for reduced contributions begin at $146,000 if single and $238,000 if married filing jointly.

The current annual income limits to be eligible to fully deduct Traditional IRA contributions in 2024 are $87,000 if single and $143,000 if married filing jointly. Phase-outs for reduced deductions begin at $77,000 if single and $123,000 if married filing jointly.

If your income (MAGI; Modified Adjusted Gross Income) is above all those limits, you can use a technique called a “backdoor Roth IRA” where you make a nondeductible contribution to a Traditional IRA and then convert it to a Roth IRA, thereby allowing very high earners to legally get around the income limits.

Also note that your IRA contribution cannot exceed the income you earned for that year.

Here's a recap of those limits in a table:

| Rules | Roth IRA | Traditional IRA |

|---|---|---|

| 2023 Contribution Limits | $6,500; $7,500 if age 50 or older. | $6,500; $7,500 if age 50 or older. |

| 2024 Contribution Limits | $7,000; $8,000 if age 50 or older. | $7,000; $8,000 if age 50 or older. |

| 2023 Income Limits – Single | $153,000; phase-out begins at $138,000. | No deduction above $83,000; phase-out begins at $73,000. |

| 2024 Income Limits – Single | $161,000; phase-out begins at $146,000. | No deduction above $87,000; phase-out begins at $77,000. |

| 2023 Income Limits – Married Filing Jointly | $228,000; phase-out begins at $218,000. | No deduction above $136,000; phase-out begins at $116,000. |

| 2024 Income Limits – Married Filing Jointly | $240,000; phase-out begins at $230,000. | No deduction above $143,000; phase-out begins at $123,000. |

Roth IRA vs. Traditional IRA – Which Is Better?

So which IRA is better? Well there's not a simple answer, and that's going to depend on multiple factors.

The first would obviously be whether or not you want to deal with required withdrawals or RMDs. Remember that you're forced to start withdrawing from a Traditional IRA at age 73, regardless of whether or not you need that money, and those withdrawals are taxed as ordinary income. If you still have income at that age, those required withdrawals are going to increase your taxable income and therefore your income tax liability.

Roth IRAs do not have RMDs. You're not required to withdraw at any age or even at all during your lifetime, making them a great wealth transfer vehicle. Beneficiaries of Roth IRAs won't owe taxes on distributions, either, as once again, that money was already taxed on the front end.

Another factor is obviously going to be your income. You may be above the income limit for deduction eligibility for Traditional IRA contributions but below the limit for contribution eligibility for a Roth IRA.

Flexibility may be a major consideration. Recall that you can withdraw Roth IRA contributions tax- and penalty-free anytime. This is not the case with a Traditional IRA.

Arguably the most important factor is going to be your best guess about taxes. That is, your choice of one account over the other is a tax planning decision, not an investing decision.

The Roth IRA gets all the press, is newer, and even just sounds cooler, so folks tend to think it's obviously the one to go with. But many don't seem to realize that for most people, the Traditional IRA is probably going to be the better choice. The simple reason for that fact is that most people will have little to no taxable income in retirement aside from investment income, so their marginal tax rate is going to be much lower than what it was when they were working and contributing.

We also know spending tends to decrease in retirement as we age, particularly if one has paid off their mortgage and no longer has expenses for dependents, further strengthening the argument for the Traditional IRA. Similarly, if you expect to retire in a state with no income tax like Florida after being in a state with higher income taxes like California while you were working, the Traditional IRA makes even more sense.

People point to the fact that tax rates tend to go up over the long term. However, we can't predict the future, and we saw tax cuts in just the past decade. So I wouldn't use this one as a major factor in your decision.

If for some reason you know you will be in a higher tax bracket in retirement, the Roth IRA would obviously be the better choice. Things that may contribute to a higher tax rate in retirement include:

- Social Security benefits

- Pension income

- Self employment taxes on freelance work

- Fewer tax deductions for dependents, mortgage interest, retirement account contributions, etc.

A common misconception is that because Roth IRA contributions are made with after-tax dollars and the compounded earnings over time aren't taxed later, this must mean it allows for more growth potential than a Traditional IRA, or in other words, that it's better to tax the seed than the harvest. Unfortunately that's not how math works. While it may seem counterintuitive at first glance, the resulting yield is the same whether you tax the seed first or the harvest later.

Here's an example to illustrate using a simplistic, hypothetical 10% tax rate, a 20% growth rate, and a one-time desired pre-tax contribution of $5,000.

With a Roth IRA, Roger earns $5,000 which is first taxed at 10% resulting in $4,500 which he invests, which then grows by 20% to $5,400.

($5000 x 90%) x 120% = $5,400With a Traditional IRA, Travis earns and invests $5,000 pre-tax, which grows to $6k, and he then pay $600 in taxes on it for a resulting amount of $5,400.

($5000 x 120%) x 90% = $5,400These scenarios are equivalent due to our old friend called the commutative property of multiplication that says the order of the things you're multiplying doesn't matter.

That said, the Roth IRA may be better for diligent savers who maximize their annual contributions because it allows you to shove more total dollars into the account. I'll modify our previous example to illustrate using a hypothetical contribution limit of $6,500 – the limit for 2023 – and again, a tax rate of 10% and a growth rate of 20%.

Suppose Roger contributes the maximum $6,500 to his Roth IRA using post-tax dollars. It grows by 20% to $7,800 which he can now spend tax-free in retirement.

Suppose Travis also contributes the maximum $6,500 to his Traditional IRA using pre-tax dollars. It also grows by 20% to $7,800 but he still has to pay 10% in taxes on it for a final amount of $7,020 to spend in retirement. Travis would have needed to invest an additional $722 initially in his Traditional IRA in order to match Roger's $7,800 in post-tax retirement savings. But of course that's impossible, since the contribution limit was $6,500.

Granted, Travis could have invested his $650 in tax savings ($6,500 x 10%) in a taxable brokerage account in the year of the contribution, but he would still owe long term capital gains taxes on it later in retirement.

Behaviorally speaking, the Roth IRA lends humans the advantage of effectively forcing the investment of the tax savings since the money is taxed on the front end and withdrawals on the back end are tax-free. With the Traditional IRA, tax savings are realized in each current contribution year and may be returned to you in the form of a tax refund, which you may be tempted to spend frivolously.

On the other hand, the Traditional IRA gives you the option to choose when and where you pay taxes. If you have one or multiple years of low or no income in which you find yourself in a low tax bracket, you may opt to convert some or all of your Traditional IRA contributions to Roth contributions while paying little to no taxes on the conversion during those years.

Another nuanced point is that if you already have a tax-deferred retirement plan like a 401k, using a Roth IRA diversifies your tax treatment in that the 401k uses pre-tax contributions while the Roth IRA uses after-tax contributions. Roth 401k plans do exist but are pretty rare.

If you're indecisive and eligible for both, you can hedge your bets by opening both types of IRAs and contributing half to each. Doing so effectively insures you against significant changes in tax law and tax rates between now and when you retire.

Taking that idea further, ideally it would be advantageous to make Roth contributions in low-income years early in your career and Traditional contributions in your higher income years later, as doing so would minimize the tax burden during your highest earning years.

One could also make the argument that indecisiveness and uncertainty about the future encourage the use of the Roth IRA because it has more flexibility and fewer restrictions. That's also the reason the Roth IRA is preferred by those in the FIRE movement who want to retire early. Just remember the annual contribution limit applies across both accounts together.

It's generally a good idea to maximize the annual contribution, and of course I've detailed elsewhere how it's best to get money in the market as soon as possible on average, which is why savvy Bogleheads typically like to max out their contribution at the beginning of each year. But you do have until tax day (usually around April 15) to make contributions for the previous calendar year. Maxing out your retirement accounts is a great problem to have, after which you'd want to contribute to a standard taxable brokerage account.

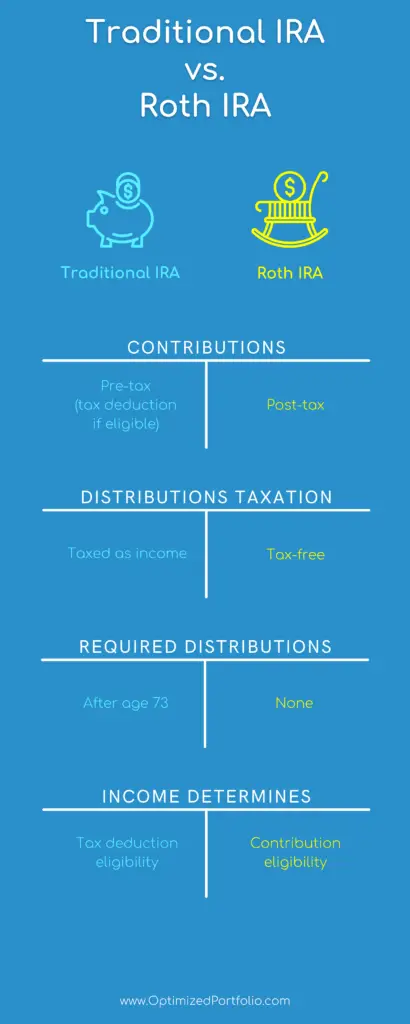

Traditional IRA vs. Roth IRA Chart Infographic

To recap, here's a chart in infographic form showing the main differences between a Traditional IRA and a Roth IRA:

How To Open an IRA

Most brokerages like Schwab, Fidelity, Vanguard, etc. offer both Roth and Traditional IRAs. You'll just choose which one you want when opening a new account. My choice is M1 Finance. The broker has automatic deposits and withdrawals, a sleek mobile app, and dynamic rebalancing of new deposits, among other things. I wrote a comprehensive review of the platform here.

Do you prefer a Roth IRA or a Traditional IRA? When do you max out your contributions? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply