The RSSY ETF aims to provide a "return stacked" solution for U.S. stocks and futures yield in a single fund. It's called the Return Stacked® U.S. Stocks & Futures Yield ETF. I review it here. If you've landed here, it's highly likely that you're already at least somewhat familiar with "return stacking" and you've probably even already checked out the other funds in … [Read more...] about RSSY ETF Review – Return Stacked® U.S. Stocks & Futures Yield ETF

Leverage

RSBT ETF Review – Return Stacked® Bonds & Managed Futures ETF

The RSBT ETF aims to provide a "return stacked" solution for bonds and managed futures in a single fund. It's called the Return Stacked® Bonds & Managed Futures ETF. I review it here. If you've landed here, chances are you're already at least somewhat familiar with "return stacking" and maybe you've even already checked out the other funds in this family like RSSB and … [Read more...] about RSBT ETF Review – Return Stacked® Bonds & Managed Futures ETF

RSST ETF Review – Return Stacked® US Stocks & Managed Futures ETF

RSST launched in late 2023 and aims to provide a "return stacked" solution for US stocks and managed futures in a single fund. Appropriately, it's called the Return Stacked® US Stocks & Managed Futures ETF. Let's review it. First, let's briefly cover what "return stacking" is. Essentially, it refers to borrowing (i.e. leverage) to free up space in the portfolio to then … [Read more...] about RSST ETF Review – Return Stacked® US Stocks & Managed Futures ETF

RSSB ETF Review – Return Stacked® Global Stocks & Bonds ETF

RSSB aims to provide a "return stacked" solution for global stocks and bonds in a single fund. It's called the Return Stacked® Global Stocks & Bonds ETF. Let's review it. First, it's important to note that as of March 29, 2023, RSSB is not trading yet. The SEC filing happened on February 6, 2023. Update on December 5, 2023: RSSB has launched! "Return stacking" - … [Read more...] about RSSB ETF Review – Return Stacked® Global Stocks & Bonds ETF

3 Hedge Fund ETFs To Invest Like a Hedge Fund in 2024

Hedge funds are typically only accessible by the ultra rich. Here we'll explore what hedge funds are, why you may or may not want to act like one, and some ETFs to invest like a hedge fund in . What Is a Hedge Fund? As the name suggests, a hedge fund is quite literally, in its simplest explanation, a fund that holds different assets as hedges to each other in an … [Read more...] about 3 Hedge Fund ETFs To Invest Like a Hedge Fund in 2024

The Hunt for a Leveraged Value ETF – 3 Contenders for 2024

So you like leveraged ETFs and you like Value. Can we combine them? Here I discuss the current options for a leveraged value ETF. Video Prefer video? Watch it here: Why a Leveraged Value ETF? If you've landed on this page, hopefully leveraged ETFs require no explanation. If they do, go read this post first explaining how they work. Basically, we're … [Read more...] about The Hunt for a Leveraged Value ETF – 3 Contenders for 2024

RPAR Risk Parity ETF Review – An All Weather Portfolio ETF?

RPAR is a single fund solution for an all-weather portfolio strategy based on risk parity - one ETF to be fully diversified across multiple assets. I review it here. RPAR ETF Review Video Prefer video? Watch it here: What Is the RPAR Risk Parity ETF? To discuss the RPAR ETF, we first have to talk about the concept of an "all-weather portfolio." As the … [Read more...] about RPAR Risk Parity ETF Review – An All Weather Portfolio ETF?

PSLDX – A Review of the PIMCO StocksPLUS® Long Duration Fund

PIMCO have been quietly beating the market and doing a version of the famous Hedgefundie Adventure for years with their mutual fund PSLDX. But is it a good investment? I review it here. PSLDX Review Video Prefer video? Watch it here: What Is PSLDX? To talk about PSLDX, let's first talk briefly about the famous Hedgefundie Adventure. Ironically, you're … [Read more...] about PSLDX – A Review of the PIMCO StocksPLUS® Long Duration Fund

SWAN – A Review of the Amplify BlackSwan ETF for Downturns

Black swan events are impactful and unpredictable. The Amplify BlackSwan Growth & Treasury Core ETF (SWAN) was designed to protect against them. Let's dive into it. Video Prefer video? Watch it here: What Is a Black Swan Event? The term black swan is used to describe an extremely rare, inherently unpredictable event that has severe negative … [Read more...] about SWAN – A Review of the Amplify BlackSwan ETF for Downturns

TQQQ – Is It A Good Investment for a Long Term Hold Strategy?

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in. Video - TQQQ ETF Strategy Review Prefer video? Watch it here: What Is TQQQ? TQQQ is a 3x leveraged ETF from ProShares that aims to deliver 3x the daily returns … [Read more...] about TQQQ – Is It A Good Investment for a Long Term Hold Strategy?

NTSX ETF Review – WisdomTree U.S. Efficient Core ETF (90/60)

NTSX from WisdomTree is a relatively new ETF designed to provide access to asset class diversification without sacrificing returns in order to free up space in diversified portfolios. I think the fund is pretty clever, simple, elegant, and useful. Here's my summary and review. NTSX ETF Review Video Prefer video? Watch it here: NTSX - The What, Why, and … [Read more...] about NTSX ETF Review – WisdomTree U.S. Efficient Core ETF (90/60)

How To Beat the Market Using Leverage and Index Investing

Most investors - even professionals - fail to beat the market. Can it be done? Perhaps. Here we'll explore how to beat the market using leverage and index investing. Can You Beat the Market? Yes and no. Technically, yes of course it's possible. Perhaps the most famous example is Warren Buffett. But you're not him. Moreover, for the most part, his investing style … [Read more...] about How To Beat the Market Using Leverage and Index Investing

The 3 Best Inverse ETFs to Short the S&P 500 Index in 2024

Inverse ETFs allow investors to bet against, or "short" the market. Here we'll look at the best inverse ETFs for the S&P 500 Index for to profit from stock market downturns. Inverse ETFs Video Prefer video? Watch it here: What Is an Inverse ETF and How Do They Work? So what is an inverse ETF? Inverse ETFs can be a market timer's best friend. … [Read more...] about The 3 Best Inverse ETFs to Short the S&P 500 Index in 2024

What Is a Leveraged ETF and How Do They Work?

Leveraged ETFs allow investors to increase exposure without additional capital outlays. Below we'll explore what leveraged ETFs are, how they work, and why you might want to use them. Prefer video? Watch it here. What Is a Leveraged ETF? A leveraged ETF, as the name suggests, is an ETF (exchange-traded fund) that allows investors to utilize leverage in their … [Read more...] about What Is a Leveraged ETF and How Do They Work?

The 9 Best Leveraged ETFs To Enhance Portfolio Exposure (2024)

Leveraged ETFs allow investors to enhance asset exposure without taking on a margin loan. Below we'll review the 9 best leveraged ETFs for . In a hurry? Here's the list: TQQQ - ProShares UltraPro QQQQLD - ProShares Ultra QQQTECL - Direxion Daily Technology Bull 3X SharesSSO - ProShares Ultra S&P 500UPRO - ProShares UltraPro S&P 500SPXU - ProShares UltraPro … [Read more...] about The 9 Best Leveraged ETFs To Enhance Portfolio Exposure (2024)

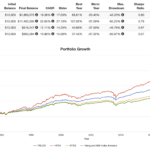

Harry Browne Permanent Portfolio Review, ETFs, & Leverage (2024)

The Harry Browne Permanent Portfolio is a simple, straightforward portfolio consisting of 4 equally-weighted assets. Here we'll look at its components, historical performance, and the best ETFs to use in its construction in . What Is the Permanent Portfolio? The Permanent Portfolio is a simple 4-slice portfolio created by investment advisor Harry Browne in the … [Read more...] about Harry Browne Permanent Portfolio Review, ETFs, & Leverage (2024)

Golden Butterfly Portfolio Review and M1 Finance ETF Pie

The Golden Butterfly Portfolio is a medium-risk portfolio similar to Ray Dalio's All Weather Portfolio. Here we'll look at its components and the best ETF's to use in its construction. Golden Butterfly Portfolio Review Video Prefer video? Watch it here. What Is the Golden Butterfly Portfolio? The Golden Butterfly Portfolio is essentially a modified … [Read more...] about Golden Butterfly Portfolio Review and M1 Finance ETF Pie

HEDGEFUNDIE’s Excellent Adventure (UPRO/TMF) – A Summary

Here we dive into the famous "Excellent Adventure" from Hedgefundie and how to implement it. In a hurry? Here are the highlights: Video Prefer video? Watch it here: Who Is Hedgefundie? Hedgefundie is was a member of the Bogleheads forum who created a now-famous thread on the forum proposing a 3x leveraged ETF strategy. What Is the … [Read more...] about HEDGEFUNDIE’s Excellent Adventure (UPRO/TMF) – A Summary

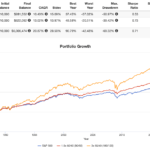

Ray Dalio All Weather Portfolio Review, ETFs, & Leverage (2024)

The All Weather Portfolio is a well-diversified, low-risk portfolio from Ray Dalio designed to "weather" any environment. Here we'll look at the All Weather Portfolio's components, historical performance, ETFs to use in , and various leveraged strategies. Video Prefer video? Watch it below. But note the video is just a general overview of the "base" portfolio … [Read more...] about Ray Dalio All Weather Portfolio Review, ETFs, & Leverage (2024)