Financially reviewed by Patrick Flood, CFA.

Dollar cost averaging and “lump sum investing” are two different timing strategies for getting cash into the market. Let's compare them.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

What Is Dollar Cost Averaging (DCA)?

Dollar cost averaging (DCA for short), also sometimes called a constant dollar plan, is a systematic investment timing strategy in which the investor divides up a total amount equally across regular periodic purchases in their investment portfolio. The idea is that purchasing shares in this way may reduce short-term volatility and risk by mitigating the impact of a change in share value over the time period. It also allows the investor to avoid any dissonance over potentially incorrectly timing the market with purchasing those shares all at once on a single trading day, e.g. purchasing right before the market tanks.

Here's an example. You get a sudden windfall. This could be a bonus from work, a tax refund, or an inheritance. Let's suppose this amount is $5,000. You decide the time period over which you want to dollar cost average is 5 months. This means you'd deposit $1,000 on the same day each month for 5 months regardless of changes in share price. You could also choose to do $500 every 2 weeks for the 5 months. Some shares will be bought at a higher price and some shares will be bought at a lower price. In this sense you are averaging out your cost basis with those dollars (by averaging into the market), hence the term dollar cost averaging.

Dollar cost averaging can be applied to individual stocks, index funds, mutual funds, and ETFs. DCA may very well be most useful for individual stocks, as they're more volatile and less predictable than the broader market.

Dollar Cost Averaging vs. Lump Sum Investing

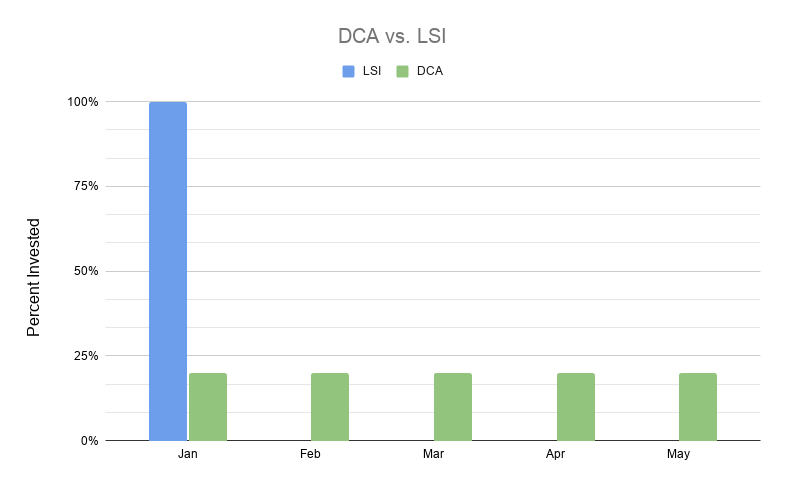

Lump sum investing, as the name suggests, is simply taking a lump sum of cash and investing it all at once. Continuing on our previous example, if you receive a windfall of $5,000, you would take that entire amount and put it into the market on a single trading day. Here's what that difference looks like visually:

With dollar cost averaging, you would get an objective benefit in the form of greater total return only if the share price of whatever you're buying drops on average over your selected time interval, which lowers your average cost basis. For a hypothetical example, let's suppose your first $1,000 deposit happens when the share price is $100, the second month's investment occurs when the share price is $90, and so on and so forth until your fifth and final investment of $1,000 happens in the fifth month when the share price is $60. So you've invested $1,000 five times at respective share prices of $100, $90, $80, $70, and $60. Thus, your average cost basis is $80. Had you invested the lump sum all at once on the first day, your cost basis would be $100.

This is the type of example you'll see on most blogs discussing dollar cost averaging and praising its use.

However, on average, it doesn't work out like this.

The simple reason is that, on average, over the long term, the market tends to go up. We're investing in the market precisely because of that fact. So the case is usually the opposite of the hypothetical example above. This should be somewhat intuitive. In a nutshell, by dollar cost averaging over those 5 months, you also risk the market going up over that time and increasing your cost basis, thereby missing out on gains you would have achieved had you invested the full lump sum on day 1. Because the market tends to go up, this scenario is more likely.

In other words, by employing a dollar cost averaging strategy, we're either exposing part of the total sum to losses or to gains. DCA helps during the former but hurts during the latter, and the latter occurs more often. Thus, it is usually advantageous to get more money in the market as soon as possible, so all things being equal, investing the lump sum all at once should be preferable over dollar cost averaging.

We can illustrate the intuitiveness of the suboptimality of dollar cost averaging versus investing a lump sum with a simple, extreme example. Suppose you receive a windfall of $1 million at 20 years old and want to invest it. Your 2 choices are to invest the full $1 million all at once or to invest 2% ($20,000) per year over the next 50 years. Hopefully it appears obvious that the latter would be a poor choice, because in investing in the market at all, we're intrinsically assuming that it will go up on average in the future. By definition, if you're unwilling to invest a lump sum over a period of 50 years, you shouldn't be willing to do the same over a period of 1 year. The principle and the math are the same, albeit to a less detrimental degree for the shorter time period.

To put some numbers to what we're talking about, Vanguard found in a 2012 study that for rolling 10 year periods in the U.S. from 1926 to 2011, using a 12-month DCA investment period, lump sum portfolios outperformed DCA portfolios 67% of the time. This number was virtually identical for markets outside the United States as well. Plenty of other researchers found the exact same results as early as over 40 years ago, but the recent Vanguard paper put things in concise, easily digestible terms for retail investors.

As you might imagine, this also means that the longer you extend the DCA time interval, the worse the results get for the DCA investor in terms of both probabilities and returns. For any given single trading day, the market is slightly more likely to go up than down. For any given month, that probability of the market going up is higher; and for a year, even higher. On average, any uninvested cash sitting idly is missing out on more market gains over a longer time period, and the longer that time period gets, the more likely it is that the market has gone up.

In Vanguard's study, increasing the DCA investment period from 12 months to 36 months took the LSI portfolio's winning percentage from 67% to 90%! Nick Magguilli over at Of Dollars and Data constructed some awesome gifs illustrating this concept. As a math nerd, I find these graphs super cool:

He also shows the leftward shift of the distribution of returns as the DCA investment period increases:

In Vanguard's words, “on average, an immediate lump-sum investment has outperformed systematic implementation strategies across global markets. This conclusion is consistent with finance theory, as immediate investment exposes cash to (historically) upward-trending markets for a greater period of time. … If an investor chooses to invest systematically, we recommend keeping the time frame to no longer than one year.”

Vanguard also pointed out in their study that investors may overlook the fact that using DCA and holding cash creates a temporary but significant deviation from one's target asset allocation toward a much more conservative one, creating a different overall exposure to risk. This deviation becomes more impactful (in a negative way) as the cash balance or the DCA investment period grows. This means LSI with a lower-risk portfolio (e.g. 60/40) is basically the same as DCA-ing into 100% stocks due to holding that cash. I personally wouldn't use a DCA period longer than 3 months.

The data showing lump sum investing to be superior to dollar cost averaging is also ignoring trading costs. If you happen to have a broker that charges trade commissions, the suboptimality of DCA is exacerbated since you have to make more trades. The financial blogosphere at large also uses phrases like “a simple strategy to build wealth over time” to describe DCA. I think this is sort of a linguistic sleight of hand that paints DCA as having some inherent magic. Yes, DCA does allow you to “build wealth” in the sense that it is just a timing protocol for putting money into the market, but it does not mean it's the optimal way to do so.

Also note that the environment in which DCA shines – a falling stock market – is going to be the hardest time for a risk-averse investor (for whom DCA is said to be ideal) to stay the course with their investing strategy. Another subtle but important point is that in a mean-variance framework, DCA usually doesn't even beat LSI on a risk-adjusted basis either!

A Brief Note on “Buy the Dip”

An important corollary to all this is that you should never hold cash on the sideline as “dry powder” to try to time the market (e.g. “buy the dip”), especially since we already know attempting to time the market is usually more harmful than helpful in general, as that cash is missing out on the gains and compounding on average.

This “buy the dip” conversation usually happens when markets reach all-time highs, suggesting that one should hold some cash and wait for the market to drop and then buy in. This sounds nice in theory, but reality tells a very different story. The simple fact is that the market hits all-time highs quite often, and they're usually not followed by dips, so you're more likely to get stuck just sitting around on cash that keeps piling up. Here's a pretty staggering statistic to illustrate: 24% of months have been record highs for the U.S. stock market historically, and only 1.14% of those months have been followed by a decline greater than 10% within the 12 months following.

Because of this, a “buy the dip” strategy is even worse than dollar cost averaging. Again, we always want to get any cash in the market as soon as possible. You can extend this to illustrate why you should turn dividend reinvestment on and not hold them as cash, or worse, withdraw them as “income.”

Advantages of Dollar Cost Averaging

While we know lump sum investing beats dollar cost averaging on average, DCA has some benefits related to the psychological and emotional aspects of investing. In averaging out your cost basis over intervals, you are reducing the impact of short-term volatility of the investment. This can be particularly attractive for risk-averse investors.

If the investor deposits a total amount in the market on a single day, they may feel uneasy about the prospect of a market crash in the near future. Dollar cost averaging quells this fear. Similarly, the market may indeed drop immediately after the lump sum is invested, in which case the investor will likely feel regret over investing the lump sum all at once. This is known as the principle of loss aversion – humans are more sensitive to losses than to gains. Dollar cost averaging again remedies this. This is similar to how income investors may prefer chasing dividends for the psychological benefits even though selling shares as needed should be mathematically preferable.

Depending on the size of the windfall in question, investing the lump sum all at once may require a high tolerance for risk; it's more of a gamble in that the market can immediately tank or immediately skyrocket. Remember though that on average, this is probably a risk worth taking if you're getting a windfall every year.

Meir Statman maintains that “rational investors are immune to the emotional influence of pride and the regret on choices, but normal investors are not immune. The purchase or sale of stocks today can result in a possibly large gain or large loss during the coming month, while cash would bring a sure but small gain. If the purchase of shares by normal investors results in gains, these gains are supplemented by the joy of pride. If the purchase of shares results in losses, however, those losses are magnified by the pain of regret.”

DCA also helps remove the temptation to try to time the market and make trades on emotion, e.g. overconfidence in expectation of a market upswing. A DCA strategy can thus mitigate the impact of the investor's own biases. This may be a major benefit for novice investors.

Unfortunately, the behavioral aspects of investing are very real. While we should objectively prefer lump sum investing on paper, dollar cost averaging offers clear psychological benefits that are perfectly reasonable and even desirable for certain risk-averse investors.

What kind of tradeoff are we talking about? Vanguard found that for the rolling 10-year periods and a DCA period of 12 months, the value of the LSI portfolios on average was 2.3% greater than the DCA portfolios. Are the above psychological benefits worth 2.3% of your portfolio's estimated value at retirement?

Vanguard state: “Even though LSI’s average outperformance and risk-adjusted returns have been greater than those of DCA, risk-averse investors may be less concerned about averages than they are about worst-case scenarios, as well as the potential feelings of regret that would occur if a lump-sum investment were made immediately prior to a market decline. These concerns are not unreasonable. … As with any asset allocation decision, investors must determine for themselves whether or not reducing their portfolio risk in an attempt to avoid losses and regrets is worth reducing the potential for higher returns.”

Dollar Cost Averaging vs. Regular Deposits

The term dollar cost averaging per se unfortunately has led to some disagreement over its precise meaning, largely due to its being discussed in different contexts by different types of investors throughout the years. The vast majority of investors are simply regularly investing from their paychecks every 2 weeks and never encounter a significant windfall of immediately available cash that they have to decide how to invest. Technically this is dollar cost averaging, in that you're putting money in the market at regular intervals throughout the year.

But there's really no windfall involved for which you have to choose how to time the investment of those dollars. In choosing a percentage of your paycheck to invest, you are not holding some of that investable cash to invest later. In investing circles, the term dollar cost averaging refers to the conscious strategy of taking a lump sum and spreading it out at even intervals to invest. Again, for most investors, this situation will only apply in instances like receiving an annual bonus at work, a tax refund, an inheritance, winning the lottery, etc.

So no, you are not using a dollar cost averaging strategy by just investing normally from your paycheck into your 401k. This continuous, automatic investing is actually more like lump sum investing, because you are investing every cash allocation in full as soon as it becomes available.

Conclusion

Dollar cost averaging may be a useful behavioral tool, but it won't get you greater returns. DCA may offer real benefits for risk-averse investors, but those benefits are entirely psychological in nature, and they only work if the investor sticks with the timing strategy through market downturns, which is easier said than done. This tradeoff of lower returns via a suboptimal timing strategy for these psychological benefits may be perfectly reasonable and desirable for some investors. Investors utilizing DCA should try to keep the time interval as short as their risk tolerance allows, as the results worsen as the time interval increases.

On average, if you can stomach it, investing a lump sum all at once should be mathematically preferable to dollar cost averaging, thereby allowing the investor to get more money in the market sooner with a lower cost basis for greater gains over the long term. Similarly, investors should avoid holding cash on the sideline as “dry powder” for the purpose of trying to time the market. On average, investing today is better than waiting until tomorrow.

Vanguard's conclusion regarding DCA vs. LSI was as follows: “…the prudent action is investing the lump sum immediately to gain exposure to the markets as soon as possible. But if the investor is primarily concerned with minimizing downside risk and potential feelings of regret (resulting from lump-sum investing immediately before a market downturn), then DCA may be of use. Of course, any emotionally based concerns should be weighed carefully against both (1) the lower expected long-run returns of cash compared with stocks and bonds, and (2) the fact that delaying investment is itself a form of market-timing, something few investors succeed at.”

Keep in mind too that historical data is only a guide and all crystal balls are cloudy. What happened in the past may not happen in the future. As with most things, I'm of the mind that whatever keeps you invested and allows you to stay the course is the right strategy for you.

Do you employ DCA in your portfolio? Let me know in the comments.

References

Constantinides, G.M. “A note On The Suboptimality Of Dollar-Cost Averaging As An Investment Policy.” Journal of Financial and Quantitative Analysis, Vol.14, No. 2 (June 1979), pp. 443-450.

Dubil, R. “Lifetime Dollar-Cost Averaging: Forget Cost Savings, Think Risk Reduction.” Journal of Financial Planning, Vol. 18, Issue 10 (October 2005), pp. 86-90.

Greenhut, J.G. “Mathematical Illusion: Why Dollar-Cost Averaging Does Not Work.” Journal of Financial Planning, Vol. 19, Issue 10 (October 2006), pp. 76-83.

Knight, J.R. and Mandell, L. “Nobody Gains From Dollar Cost Averaging: Analytical, Numerical And Empirical Results.” Financial Services Review, Vol. 2, Issue 1 (1992/93), pp. 51-61.

Leggio, K. and Lien, D. “Comparing Alternative Investment Strategies Using Risk-Adjusted Performance Measures.” Journal of Financial Planning, Vol. 16, No. 1 (January 2003), pp. 82-86.

Milevsky, M.A. and Posner, S.E. “A Continuous-Time Re-examination of the Inefficiency of DollarCost Averaging.” International Journal of Theoretical & Applied Finance, Vol. 6, Issue 2 (March 2003), pp. 173-194.

Rozeff, M.S. “Lump-sum Investing Versus Dollar-Averaging.” Journal of Portfolio Management, Vol. 20, Issue 2 (winter 1994), pp. 45-50.

Statman, M. “A Behavioral Framework For Dollar-Cost Averaging.” Journal of Portfolio Management, Vol. 22, No. 1 (Fall 1995), pp. 70-78.

Thorley, S.R. “The Fallacy of Dollar Cost Averaging.” Financial Practice and Education, Vol. 4, No. 2 (Fall/Winter 1994), pp. 138-143.

Trainor, William J Jr. “Within-horizon exposure to loss for dollar cost averaging and lump sum investing.” Financial Services Review; Vol. 14, Issue 4 (Winter 2005), pp. 319-330.

Williams, R.E. and Bacon, P.W. “Lump-sum Beats Dollar Cost Averaging.” Journal of Financial Planning, Vol. 6, No.2 (April 1993), pp. 64–67.

Statman, Meir. “Dollar Cost Averaging: A Behavioral View” (June 2015).

Vanguard. “Dollar-cost averaging just means taking risk later” (July 2012).

Vanguard. “Invest now or temporarily hold your cash?” (2016).

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Really cool website, certainly a lot more in depth than the JL Collins guy who turned me on to index funds in the first place.

I had a question regarding this topic though, is it a bad idea if someone were to invest a lump sum to start off their portfolio and then invest a percentage of every paycheck afterwards? It seems like it would be no better than dollar cost averaging, so would the solution then be to save that paycheck percentage into larger lumps? Or would it be worse considering the loss of that moneys’ time in the market?

You’ll have to forgive me, I’m terribly new at this.

Thanks! On average, it’s best to invest as soon as money becomes available, so yes from each paycheck, which I noted is technically more like LSI than DCA.

John,

Love the website. Just found it a few weeks back.

Question. Any recommendations or data to support the best strategy for continually adding funds to your portfolio? I am always adding new funds into my work and personal accounts every month. Some have advocated just keeping it simple by adding into just your single or few underweight asset classes at that moment. This will keep your investing in fewer tax lots and theoretically have you investing in an “underperforming” asset. The other option I was considering was investing in each asset class according to my desired asset allocation every month and only rebalance when the ratios really get out of whack. This might prevent some theoretically ill timed large allocation into any single asset class but will end up with lot more tax lots to deal with.

Thoughts? Over thinking it?

Thanks. Keep up the good work.

You already made this comment and I already responded to it here.

Love your site. Just found it a few weeks ago.

Any data or rational to support specific strategies when adding in new funds to the portfolio? I am steadily adding new funds every month to invest. Seems that like many people just adding into the most underweight asset of allocation. Buying just one asset at a time means fewer tax lots but seems to average in price fluctuation less.

However, if my overall allocations aren’t totally out of whack it seems more comforting to divide up the money into all my asset categories every time I invest and only do a big rebalancing when proportions get very out of whack. This creates a lot more tax lots but seems to me to be able to spread out the chance you are accidentally buying into a smaller peak or consequently not buying a relative smaller dip in another asset group.

Any thoughts?? Great work on the site BTW

Thanks! A broker like M1 will automatically buy the underweight asset for you. Doesn’t make much sense to purposefully keep your target asset allocation unbalanced by dividing deposits evenly among assets. That’s more akin to market timing. Rebalancing is quite literally buying low and selling high.

Hi John,

First time commenting — really enjoying the content so far.

What would you say to converting a regular investment plan (e.g. at each payday) to an LSI plan, specifically in the context of a Roth IRA? For example, one could max out their Roth by contributing $400 per month from their paycheck — this is, as you say, not a DCA per se since the cash is invested immediately when available. But what if, for one year, one saved that $400 contribution each month and then made a LSI on the first trading day of January? One could then propagate this forward for the remainder of one’s accumulation phase, thereby taking advantage of the findings you’ve enumerated.

Thanks,

Kai

Thanks Kai! Not sure I’m following. Saving up cash on the sidelines is what I illustrated you shouldn’t do. All that cash misses out on a year of potential gains. Like I noted, investing from your paycheck is more like LSI than DCA. Don’t overthink it.

Hi John,

what is your thought on a very “fast paced” DCA to compensate for possible short term volatility (being a complete newbie and having no feeling if the current market is strong or weak).

E.g. 10k are invested and the DCA used is: 1k every 2 days. So, the whole 10k are invested within 20 days.

I would assume that it provides some degree of averaging out the market volatility, adds the psychological benefit you outlined in this post, but reduces the loss of having the money as cash.

What do you think? Would you still stick with LSI if you have no idea how a portfolio is currently doing?

Thanks!

-Robert

Hey Robert, it sounds like you would indeed value the psychological/emotional benefit of DCA. Doing it every 2 days would be fine but cumbersome, and probably wouldn’t even provide any of the benefits of DCA. Maybe divide the $10k into 4 deposits of $2,500 each and invest once every 2 weeks over a 2 month period. I regularly invest from my paycheck anyway so I don’t DCA.