Financially reviewed by Patrick Flood, CFA.

The Harry Browne Permanent Portfolio is a simple, straightforward portfolio consisting of 4 equally-weighted assets. Here we'll look at its components, historical performance, and the best ETFs to use in its construction in 2024.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

What Is the Permanent Portfolio?

The Permanent Portfolio is a simple 4-slice portfolio created by investment advisor Harry Browne in the 1980's and presented in his book Fail-Safe Investing in 2001. It looks like this:

- 25% Total US Stock Market

- 25% Long-Term Bonds

- 25% Cash

- 25% Gold

Not unlike the All Weather Portfolio, the Permanent Portfolio was designed to be a simple, diversified portfolio that could perform well in all economic conditions. Browne called it the Permanent Portfolio because, in his words, “once you set it up, you never need to rearrange the investment mix— even if your outlook for the future changes.”

Having only 4 assets at equal weights, it is easily accessible and understandable. Those 4 assets' expected behaviors correspond to 4 economic climates as follows:

- Stocks – economic expansion

- Bonds – deflation

- Cash – economic recession

- Gold – inflation

Permanent Portfolio Review

I concede that Harry Browne's Permanent Portfolio is indeed simple and diversified, and the concept sounds nice on paper. But I have a few problems with it.

First, there's the relatively low allocation to stocks. We know that equities are usually the primary driver of a portfolio's returns. At just 25%, the Permanent Portfolio doesn't give enough room for stocks to shine, especially for the young investor with a long time horizon and a high tolerance for risk.

Secondly, 25% of the portfolio is in cash, which just means treasury bills. I'll be the first to admit that cash is an oft-overlooked investment, but giving it 1/4 of the portfolio creates a significant opportunity cost in my opinion, especially when considering economic depressions are the least likely environment of the 4 aforementioned economic climates and young investors with a long horizon probably shouldn't be holding any cash. As such, I would think it's intuitive to lower the allocation to cash, creating room for more stocks and/or more bonds. In fairness, cash is a decent inflation hedge.

Thirdly, there are no international (ex-US) holdings. International stocks and bonds have just fairly recently become “accepted” diversification-boosting holdings in the last 25 years or so. Prior to that, they weren't popular among institutional investors, so it makes sense that Browne didn't include any when he designed the Permanent Portfolio in the 1980's. Ideally I'd probably like to see at least an 80/20 split for both stocks and bonds between the US and ex-US assets. I delved into the benefits of geographical diversification here.

Similarly, 25% to gold is much too high for my tastes. If you've read any of my other posts on portfolios that utilize gold, you know I'm not a big fan of the metal. It has a nonnegative correlation to stocks, albeit low/small, is much more volatile than bonds, is not a value-producing asset (it has a real expected return of zero), and has not been a reliable inflation hedge historically. While it has offered protection in some inflationary periods in the past, we can't reliably predict how gold will behave in the future.

I suspect the large emphasis on gold may be due at least partially to Harry Browne's being the Libertarian Party presidential nominee in both 1996 and 2000. The Libertarian Party platform has a historical distrust of US monetary policy by the Federal Reserve and a suggestion of returning to the gold standard, wherein money is based on a fixed amount of physical gold.

Speaking of US monetary policy, your excitement – or lack thereof – over gold likely also depends on your view of it. I'm personally of the mind that monetary policy in the United States is a fundamentally different beast post-Volcker (1982), allowing us to [hopefully] avoid a runaway inflationary environment like we saw in the late 1970's, when bonds suffered and gold did well.

In my opinion, similar to my point about the cash position above, in a long-term investment portfolio with an investment horizon of 20+ years, holding gold only creates an opportunity cost where you could have held something else in its place. That said, I'll concede that it may offer a short-term diversification benefit due to its usual uncorrelation to both stocks and bonds, making for a lower risk profile and safer withdrawal rates in retirement, so adopting the Permanent Portfolio may very well be a prudent move at or near retirement, or for a risk-averse investor who wants to cover all bases for all environments to minimize volatility and risk, but even then I'd probably suggest the All Weather Portfolio or the Golden Butterfly Portfolio for that prescription. We can explore some comparisons of these below.

Because of all this, generally speaking, Browne's naive equal weighting of these assets doesn't make much sense intuitively and is almost certainly suboptimal. This becomes even more obvious when we consider the fact that the four aforementioned environments do not have the same probability of occurrence. Severe, protracted deflation, for example, is extremely unlikely. Browne makes the mistake I see far too often of viewing each asset in isolation instead of looking at the portfolio holistically.

As we would expect, compared to something simpler and more “traditional” like a 60/40 stocks/bonds portfolio, the Permanent Portfolio tends to look attractive during bear markets and unattractive during bull markets, evidenced by the mutual fund's capital inflows and outflows during those respective periods.

Permanent Portfolio Performance vs. S&P 500

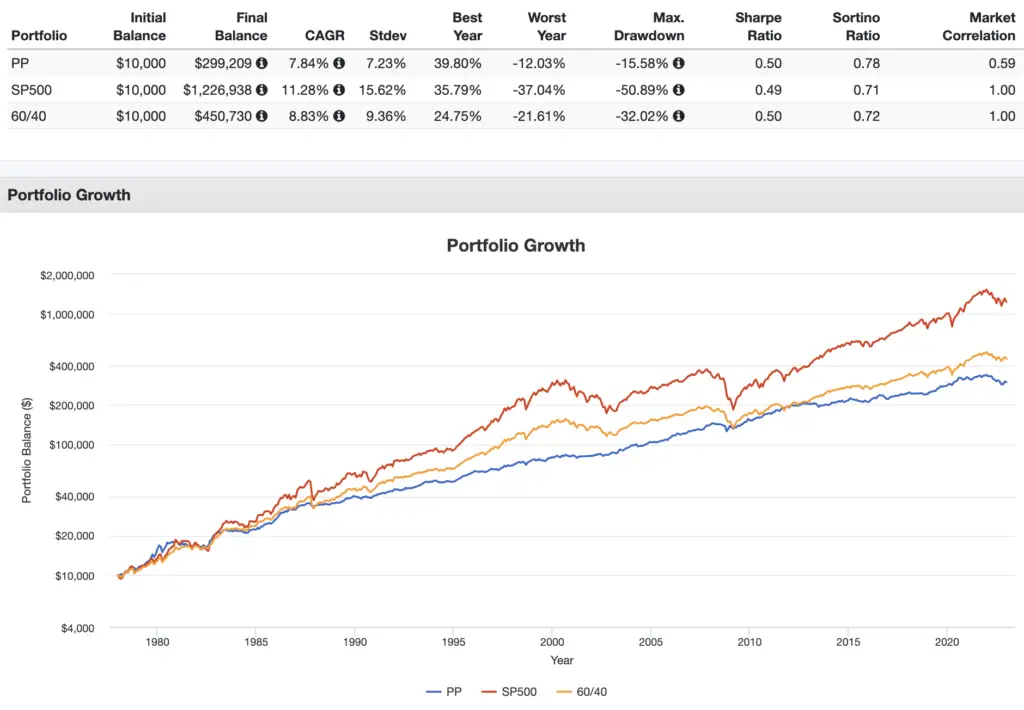

Going back to 1978, here's a performance backtest of the Permanent Portfolio versus the S&P 500 index and a classic 60/40 portfolio through 2022:

As we'd expect, the Permanent Portfolio does a pretty great job of mitigating volatility and drawdowns, providing a much smoother ride than the S&P 500. Its volatility has been roughly half that of the S&P 500, and its max drawdown during the Global Financial Crisis of 2008 was roughly 1/3 that of the S&P 500. It also does a better job on those things than the 60/40 portfolio.

But notice how the risk-adjusted return (Sharpe) is roughly identical for all three very different portfolios.

Basically, the Permanent Portfolio has still delivered a pretty low return given its risk profile. That's why I said I'd be more likely to use the Golden Butterfly Portfolio or the All Weather Portfolio. I'll show those comparisons in the next sections.

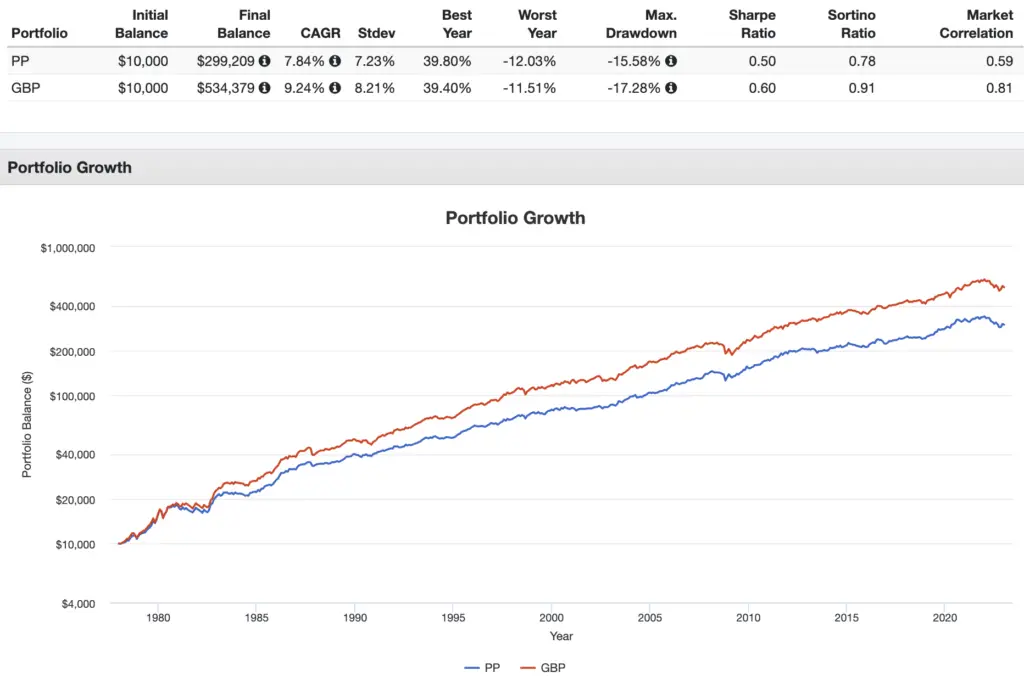

Permanent Portfolio vs. Golden Butterfly Portfolio

The Golden Butterfly Portfolio simply takes those same assets in the Permanent Portfolio and specifically adds Small Cap Value, a move that I'm a fan of. This invariably makes it comparatively more “aggressive” than the Permanent Portfolio, but we're still talking about a relatively low-volatility, well-diversified portfolio.

In taking up a larger stocks position, we're also tilting toward an expansionary economic environment. I'm okay with this; the economy grows more than it declines. Your adoption thereof may depend on your economic outlook. We're also simultaneously decreasing the allocations to cash and gold, which should also bode well for higher returns.

Here’s a backtest from 1978 through 2022 comparing the Permanent Portfolio and the Golden Butterfly Portfolio:

As we’d expect, going back to 1978, we see greater general and risk-adjusted returns for the Golden Butterfly Portfolio, with slightly more volatility and a larger drawdown. This is due again to its inclusion of small cap value stocks. Looking at the Sharpe and Sortino ratios, measures of risk-adjusted return, we can see that we were better compensated per unit of risk by going with the Golden Butterfly Portfolio.

I’d definitely take the Golden Butterfly Portfolio over the Permanent Portfolio. Again, I like small cap value stocks, and I don’t want the Permanent Portfolio’s extra 5% in gold. To be fair to Harry Browne, we didn't even know about the Size and Value factors and the glamour of small cap value stocks when he designed this thing in the 1980's, and even if we did, there weren't really any products available with which to invest in them.

Permanent Portfolio vs. All Weather Portfolio

Compared to Ray Dalio's All Weather Portfolio, we're talking about more gold, more cash, less stocks, and less treasuries with the Permanent Portfolio. Like the Permanent Portfolio, the All Weather Portfolio is designed to “weather” any storm by utilizing diversification.

Interestingly, like Browne, Dalio also chooses to be market-agnostic with the All Weather Portfolio, admitting that we don't know what the future will hold, yet the allocations therein are obviously very different.

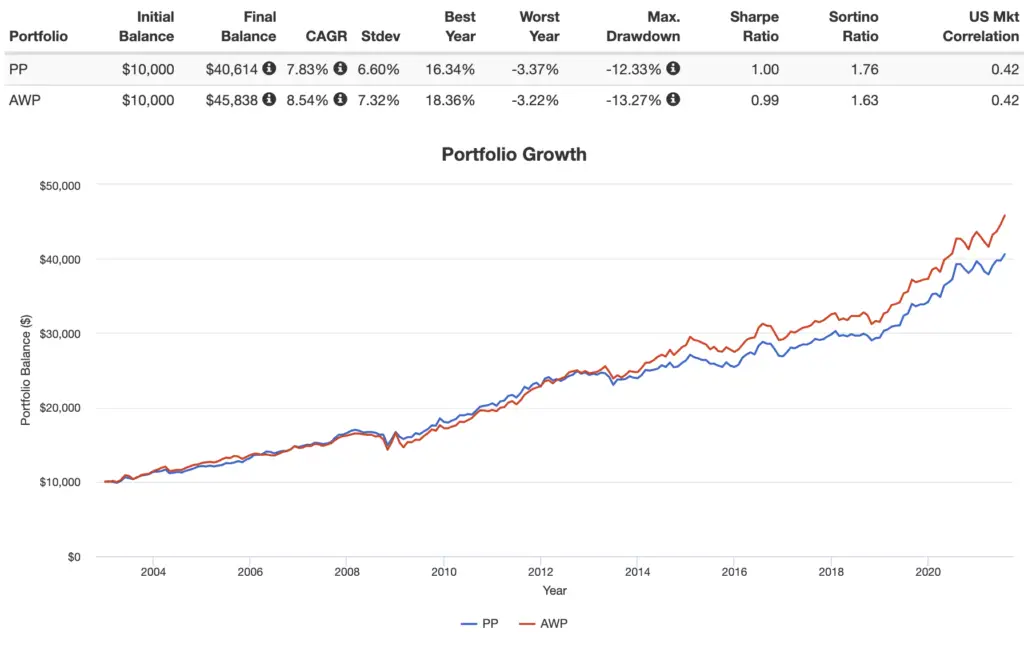

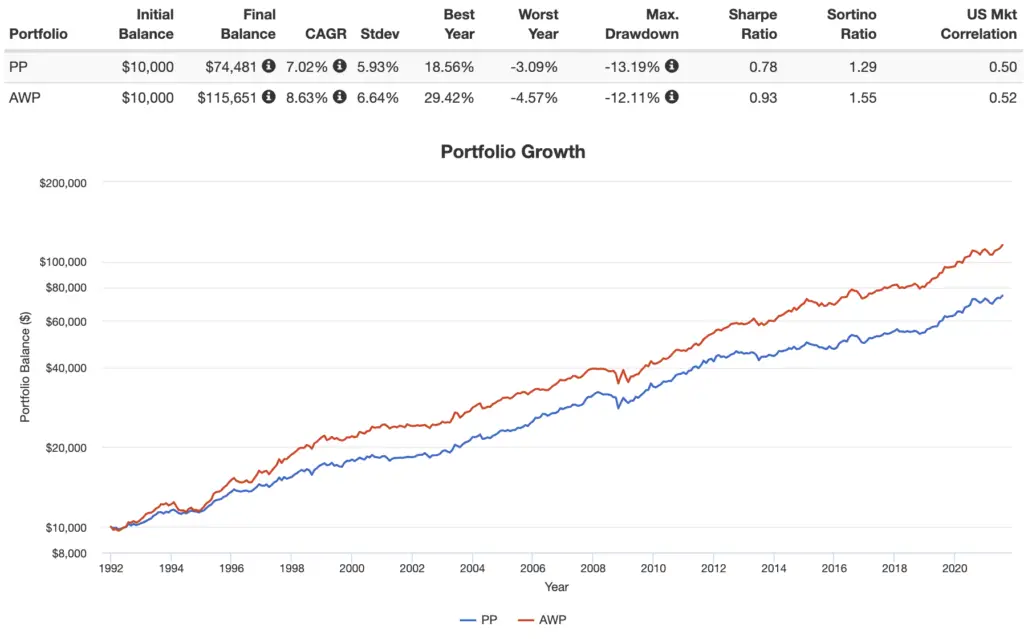

With data for Commodities funds only going back to 2002, here's what the comparison looks like through July, 2021:

Results have been pretty close for that time period, with returns being almost identical. The Permanent Portfolio won out on general and risk-adjusted return, but realize this is almost entirely due to just 2022 when its gold and cash kept it afloat when stocks and bonds both suffered greatly.

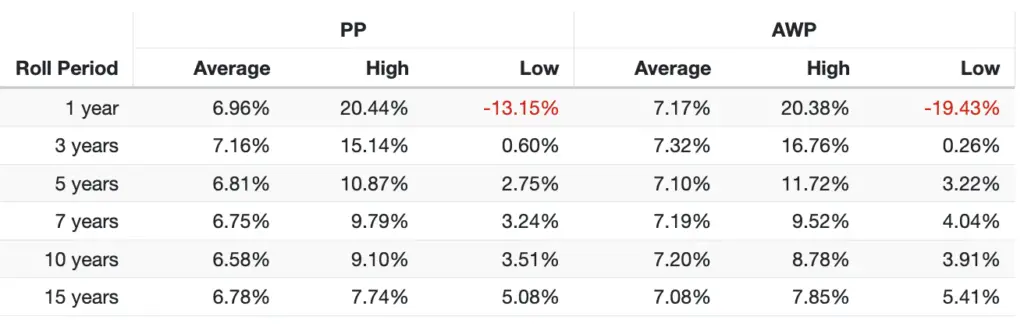

Looking at the rolling returns here gives us a more accurate picture of their relative performance:

Let's explore an alternative. If you're like me, you might replace Commodities (I think they're pretty awful) in the All Weather Portfolio with Utilities (I delved into this here). Making that change, we can get data going back to 1991, and the results are pretty different:

While the All Weather Portfolio (with utilities) had worse risk metrics (volatility and max drawdown), it handily beat the Permanent Portfolio on both general and risk-adjusted returns.

In this sense, again, while the Permanent Portfolio is very simple and easy to understand with its equal weighting of 4 assets, that's also its downfall. I'm of the mind that we can much more effectively deliver on the Permanent Portfolio's goal of de-risking the portfolio using different allocations, especially given our most recent understanding of asset pricing and how we might weight those assets more efficiently in diversified portfolios.

Permanent Portfolio Construction with ETFs Pie

If you do want to invest in the Permanent Portfolio, M1 Finance is a great fit thanks to its zero transaction fees, dynamic rebalancing for new deposits, and one-click manual rebalancing. I wrote a comprehensive review of M1 Finance here.

Utilizing mostly low-cost Vanguard funds, we can construct the Permanent Portfolio pie for M1 Finance with the following ETF's:

- VTI – 25%

- VGLT – 25%

- SGOV – 25%

- GLDM – 25%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Add to Portfolio.” Investors outside the U.S. can find these ETFs on eToro.

Taking the Permanent Portfolio International

As I noted earlier, the Permanent Portfolio doesn't have any international exposure. It's probably a good idea to diversify geographically in stocks. Taking the stocks global simply requires replacing VTI (Vanguard's total US stock market ETF) with VT (Vanguard's total world stock market ETF). The portfolio and subsequent pie then look like this:

- VT – 25%

- VGLT – 25%

- SGOV – 25%

- GLDM – 25%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Add to Portfolio.” Investors outside the U.S. can find these ETFs on eToro.

Leveraged Permanent Portfolio

What about creating a leveraged Permanent Portfolio? As I noted above, the Permanent Portfolio itself isn't super impressive in my opinion. But, as with the All Weather Portfolio, levering up those same assets may enhance returns while maintaining a reasonable risk profile similar to that of a 100% stocks position.

Just remember that using leverage – especially in the form of leveraged ETFs – increases portfolio risk and the potential for greater returns, but also the potential for greater losses. Do your own due diligence before blindly buying leveraged funds, and read the fine print on these products. They can potentially be extremely dangerous. I talked a bit more about leveraged ETFs and how they work here.

Having 25% cash and 25% long bonds is roughly the same as 50% intermediate bonds. Ideally, a 3x leveraged Permanent Portfolio would look like this:

- 25% 3x U.S. Stocks

- 50% 3x Intermediate Bonds

- 25% 3x Gold

Unfortunately, there are now no 3x gold ETFs available after UGLD went away. The next best option is UGL, which is 2x gold. Using that, we can achieve the intended exposure at 2.67x leverage like this:

UPRO – 22%

TYD – 45%

UGL – 33%

You can add this pie to your portfolio on M1 Finance using this link.

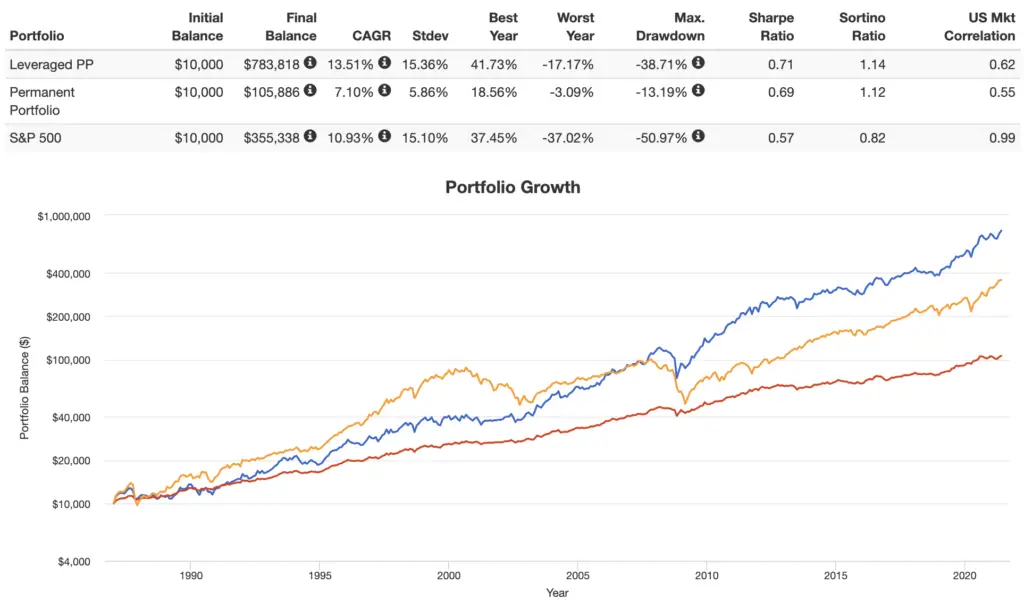

Here's how this would have worked out historically going back to 1987 versus the Permanent Portfolio and the S&P 500:

Interestingly, the leveraged version achieved higher general and risk-adjusted returns than the “normal” unleveraged Permanent Portfolio and the S&P 500.

You can add this pie to your portfolio on M1 Finance using this link.

Conclusion on the Permanent Portfolio

The Permanent Portfolio is basically a good introductory lesson on asset class diversification in my opinion. And props to Harry Browne for making the concept more mainstream.

The Permanent Portfolio does a great job of mitigating volatility and drawdowns, but in practice I'd be more likely to use the All Weather Portfolio or the Golden Butterfly Portfolio to achieve that goal. They seem demonstrably superior, as the Permanent Portfolio's simplicity is ironically also its weakness in my opinion. I created an arguably simpler, more aggressive portfolio with 3 assets called the Neapolitan Portfolio – and a much more complex one called the Factor Tank Portfolio – if this idea of extreme diversification intrigues you.

If all this multi-fund stuff still seems daunting, there's a Permanent Portfolio mutual fund for which the ticker is PRPFX. But it's pretty pricey at 0.83%. You'd come out far cheaper just using the funds I listed above and doing it yourself.

What do you think of the Permanent Portfolio? Let me know in the comments.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosures: I am long UPRO and VTI in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hey, John,

can you please list the tickers you have tested the leveraged permanent portfolio with?

Thanks.

They are listed.

Many thanks John for your contents in Youtube and in this web. They are all fantastic. I have a question: how do you get portfolio curves starting in 1985 from PortfolioVisualizer.com (for example the last one in this entry) while normally, when I run a comparison the curve is limited?

Typically, the curve is limited by the most recently founded ETF.

Many thanks in advance

Either using asset class or creating my own simulation data.

I’ve been reading about the Permanent Portfolio = your site is awesome, and also a couple books on the portfolio. I’m very close to retirement so I’m looking for something less volatile since many are calling for a recession in the next year or two and I want to avoid early return risks ruining my retirement.

My understanding is the “cash” part of the portfolio would be better represented by BIL (1-3 month treasuries) down .01% ytd rather than VGSH down 1.74% ytd. Seems like the intention of the cash portion is to avoid any risk of losses. Not sure if making that change changes the long term results any.

Also, how do you feel about bonds in general right now. TLT in particular is doing worse than the S&P YTD, down 12-13% which is killing investors that are trying to be defensive.

Thanks for your incredible site. I’m very happy I found it.

Thanks, Charles. T bills would definitely be the truer “cash.” I chose the 1-2 year treasuries for their much greater general and risk-adjusted returns. Using T bills just means lower returns historically. Bonds are indeed suffering right now, but I’ve got a long term view, so YTD is negligible for my horizon. But it does illustrate the importance of diversification for retirees.

Hi John,

Love your stuff. I have been trying to backtest some of these portfolios myself and I wondered how you backtest the PP portfolio so far back in time?

I’ve found historical returns for gold and the total US stock market dating back to before 1980; but I am confused how I should replicate etfs like VGLT (notes) and VGSH (bonds) before their inception.

Could you shed some light on this? Cheers!

Thanks, Thomas! The secret is to just find the mutual fund equivalent to the ETF, or at least a comparable mutual fund. For VGLT and VGSH, we’re talking about VUSTX and VFISX, for example.

Is the simulation with rebalancing or without ?

If with rebalancing, how would be the results for CAGR and Max. Drawdown without rebalancing ?

Which simulation?

Have you taken into account leverage cost for the levered strategy?

Yes

Hi John

I added the M1 dividend portfolio and the permanent portfolio but wondering why the Holdings on M1 it looks a little different than this article.? M1 shows it as:

VTI

BIL

VGLT

IAU

And this article shows it as:

VT/VTI

VGLT

VGSH

SGOL

Also BIL has a negative all-time performance except for the last 5 days- up .01% and the 5-year up .05%. Should I dump BIL?

Hey Mark, when did you add it? I’m always looking for lower fees so I may have updated the funds since you first added it.

You’re missing the point of the PP

Enlighten me.

What about those 3 mine leveraged portfolios ?

It includes also a leveraged x3 Permanent Portfolio and a leveraged x3 Golden Butterfly version

Backtest link

I’m not exactly sure what you’re asking here, mate. I think these portfolios you linked would be impossible to implement, as there are no 3x gold ETF products available now, and your third one does not add up to 100%. See my discussion above about having to adjust to a lower leverage ratio to compensate for this while still maintaining an equal cash position. I’m guessing you’d be intending to hold the 1/4 cash “outside” the brokerage account, but you’d have to keep increasing/decreasing the cash position “manually” as the other assets rise and fall in value.

For the second one called Obsidian, I definitely wouldn’t want to have nearly 1/3 of my portfolio in gold and the other 2/3 in stocks.

In my country there is available a x3 leveraged Gold ETF so the leveraged Golden Butterfly is the best option possible.

“I’m guessing you’d be intending to hold the 1/4 cash “outside” the brokerage account” yes,this is correct.

Your leveraged x2 Permanent portfolio isn’t that bad but has too low CAGR,I mean it had the same Cagr as standard spy ! You should consider to upper leverage stocks and bonds to x3.

Obsidian has a wild volatilty but it’s the one that has the best chances to survive a rising rates scenario in which Hedgefundie and almost all leveraged portfolios included your proposals would be absolutely destroyed because of bonds exposure.

Keep in mind past performance is not indicative of future performance.

Like I stated above, I designed the leveraged allocations to allow for an equal cash position to remain “inside” the account. It would be far too cumbersome to try to increase and decrease a cash position in a savings account outside the brokerage account relative to the other assets.

CAGR isn’t the only metric to look at and is not always the ultimate goal. The leveraged Permanent Portfolio I’ve outlined above achieved a higher CAGR historically with much lower volatility and smaller drawdowns compared to the S&P 500 Index, and thus a much higher risk-adjusted return.

Also remember that gold has a nonnegative correlation to stocks, albeit small/low, is much more volatile than bonds, is not a value-producing asset (it has a real expected return of zero), and has not been a reliable inflation hedge historically. I’d personally never have or suggest an entire portfolio consisting of only stocks and gold. If you’re willing to take on that level of risk and volatility, why not just go 100% stocks?

Both the leveraged Permanent Portfolio here and my leveraged All Weather Portfolio utilize gold for those wanting it in their leveraged strategy alongside bonds.

Bonds only suffer when rates rise faster than expected, and bond convexity provides an asymmetry of returns that favors the upside. The bond market will price in a slow and steady rise in rates. Bonds also may remain a flight-to-safety asset even in low, negative, and zero rate environments. Only time will tell what exactly will happen.