Financially reviewed by Patrick Flood, CFA.

The recent race to zero for fees and trade commissions from online stock brokers has made investing cheaper and more accessible than ever before. This has caused the brokerage landscape to change drastically over the last few years. Here we'll look at the 5 best stock brokers online for investing.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here's the list:

Contents

1. M1 Finance

Putting the best first. M1 Finance tops the list of the best stock brokers online for investing. Just note right off the bat that it's suited for long-term buy-and-hold investing and not day trading.

M1 Finance

Summary

M1 Finance is the best stock broker for long-term investors at the moment in my opinion, offering awesome features like dynamic rebalancing, fractional shares, pie visualization, and cheap margin, among other things.

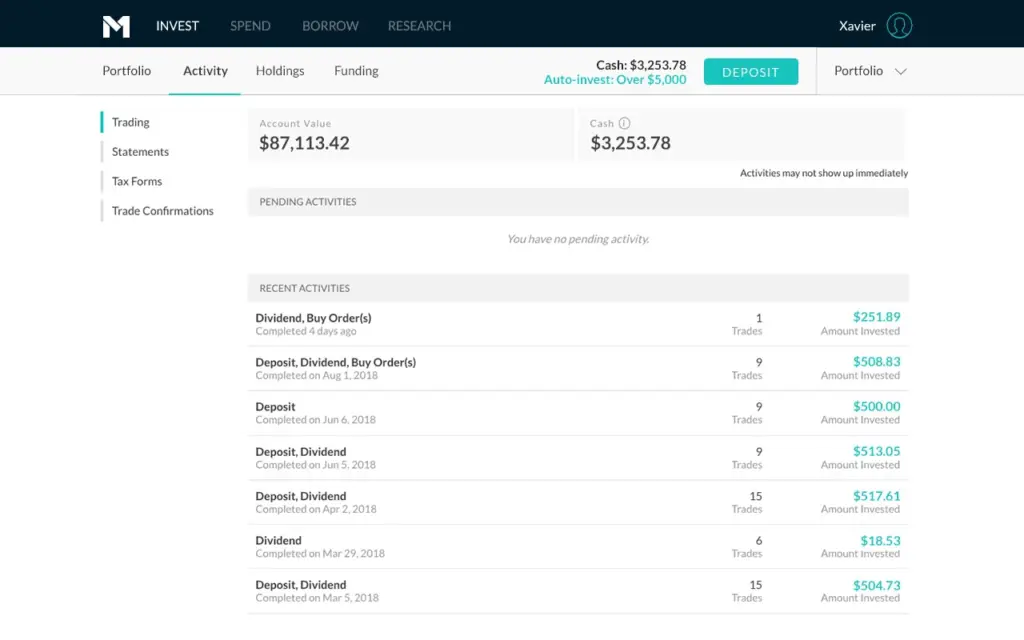

M1 is one of the newer kids on the block, much newer than everyone else on this list, but they've already been making waves in recent years with zero fees, pie-based visualization, dynamic rebalancing, dirt-cheap margin, fractional shares, and modern, intuitive interface and mobile app. No other broker matches them on this holistic offering.

M1 is great for beginner and seasoned investors alike. Beginners will enjoy their user-friendly interface, fractional shares, Expert Pies, education resources. Experts will still get value from some of the lowest margin rates around and easy rebalancing.

I wrote a comprehensive review of M1 Finance here if you're interested in reading more about the nuances of the platform. Here's a quick look at M1:

- Zero fees and zero trade commissions.

- Taxable, Joint, Traditional IRA, Roth IRA, Rollover IRA, SEP IRA, and Trust accounts. They currently do not offer SIMPLE IRA, 401(k), Solo 401(k), 529, Custodial, HSA, or Non-Profit accounts. If you need any of the latter account types, I'd go with Schwab.

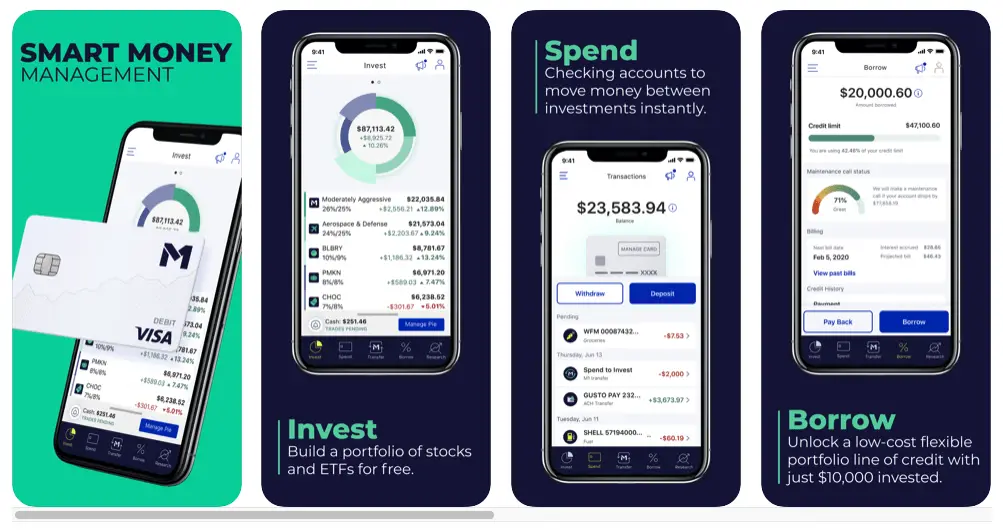

- Integrated FDIC-insured checking account with debit card called M1 Spend.

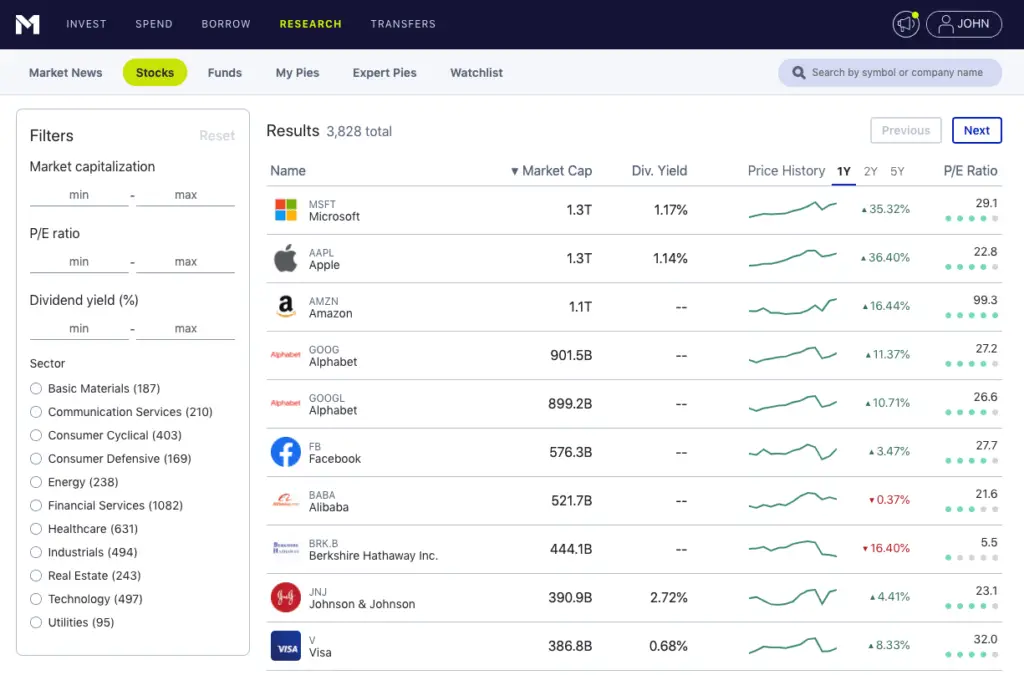

- Most stocks and ETFs traded on major exchanges. M1 does not offer mutual funds, OTC stocks, options, futures, forex, or crypto.

- Cheap margin at 3.5%. Most brokers are around 6-7% on average. Their premium membership known as M1 Plus, at a fee of $125/year, gets you access to a 2% margin rate.

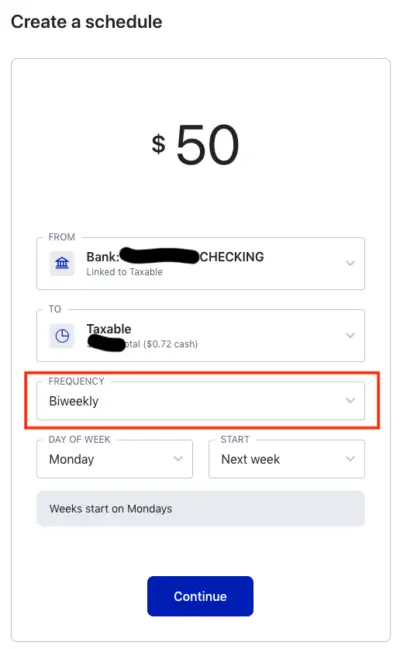

- Dynamic rebalancing – New deposits are automatically allocated to underweight assets to help maintain your target allocations without selling any of your investments. To my knowledge, no other broker features this.

- One-click manual rebalancing – If you do want to manually rebalance, there's a one-click button that says “Rebalance”. With other brokers, you'll be spending time calculating your positions and how much you need to buy or sell to rebalance your portfolio.

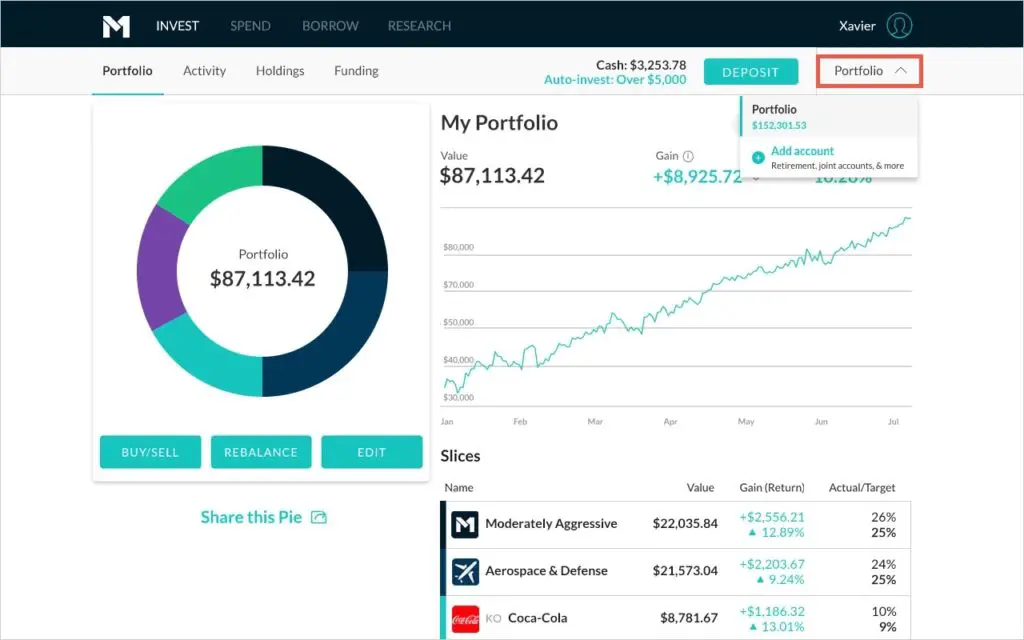

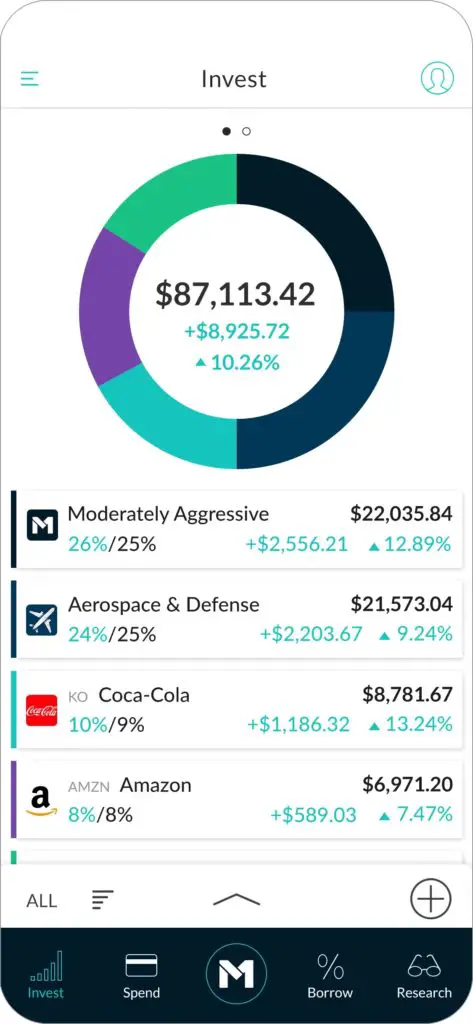

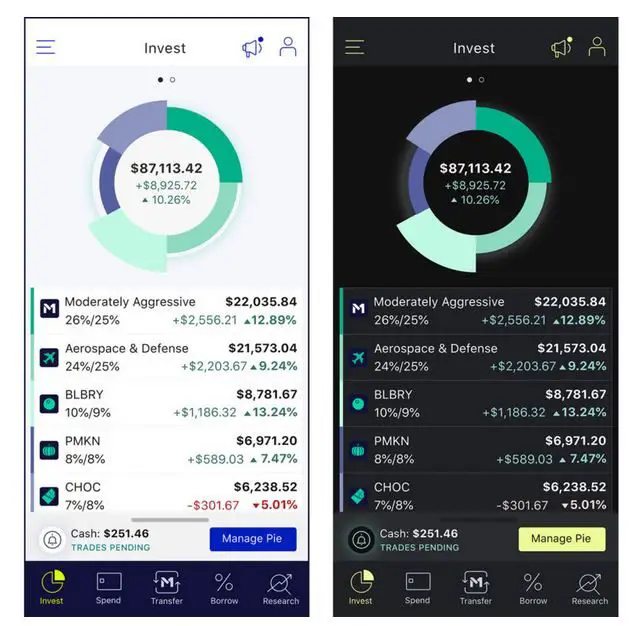

- Pie visualization – M1's pie-based visualization is something you didn't know you'd enjoy about an investing broker. This makes it easy to set, maintain, and adjust your portfolio's target asset allocation on the fly. This also allows you to see your positions more easily at a glance. You can also create and share your own custom pies of stocks and ETFs.

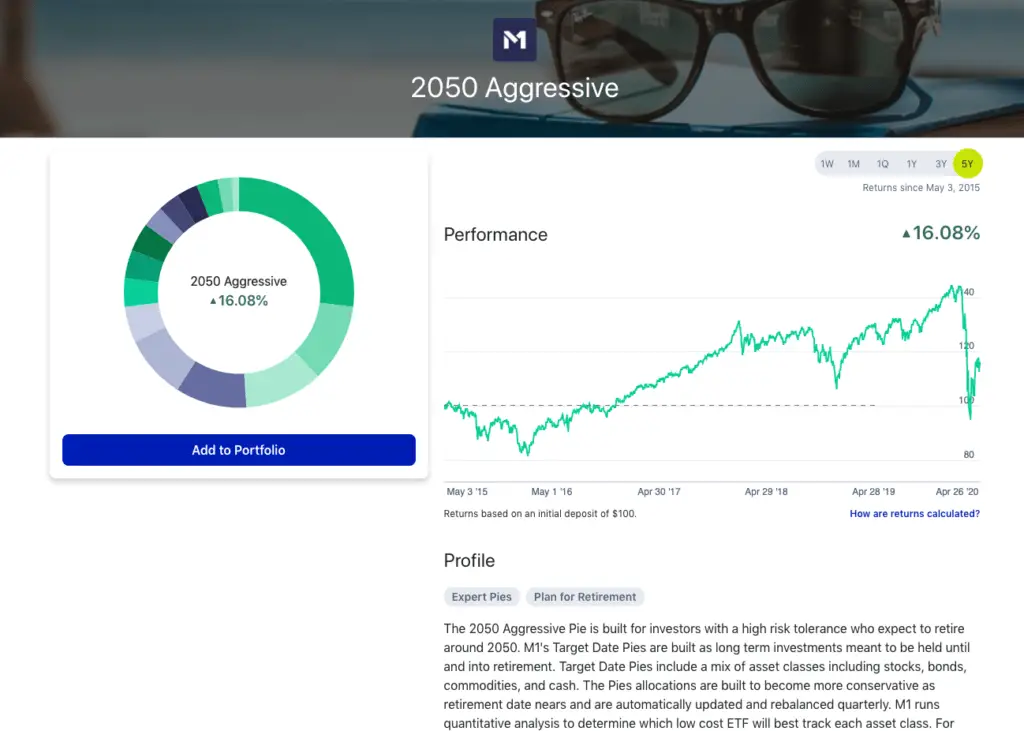

- Expert Pies – Don't feel like creating your own portfolio or don't know where to start? M1 offers expert-built, ready-to-go pies based on risk tolerance and time horizon. Best of all, they're free to use.

- Fractional shares – Fractional shares allow every penny to go to work for you. This means you can invest early and often with very little money, allowing your portfolio to grow faster instead of having to wait to buy one whole share of a stock or ETF. This is especially important for beginner investors.

- Note that M1 lacks order control (e.g. limit orders) and an all-day trading window, but this should be of no concern to a long-term buy-and-hold investor for whom the platform is designed. Again, don't try to do any short-term trading with M1.

- Dividend tracking dashboard for dividend investors.

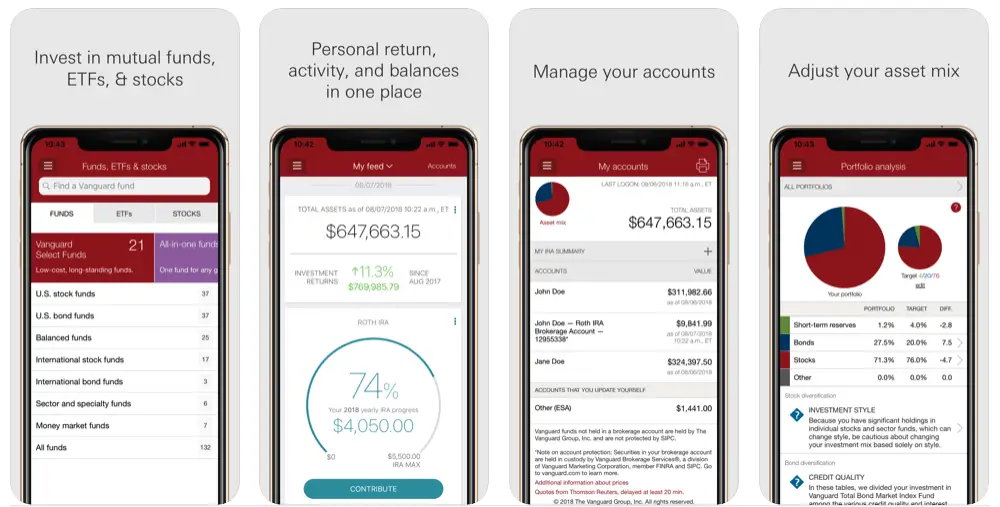

- Intuitive, modern web interface and mobile app. Most of the big brokers are still looking somewhat antiquated in this arena. M1 took the time to make their interfaces sleek and user-friendly. Here are some screenshots:

2. Schwab

Charles Schwab has made leaps and bounds in the past year or so in terms of lowering fees and innovating their mobile app. If you need special account types or investment products that M1 Finance doesn't offer, Schwab is the best choice.

Schwab

Summary

Schwab has made huge leaps recently to modernize its apps and features in a bid to attract a younger audience, but it still hasn't caught up to M1 Finance in certain aspects. Schwab does offer auto-rebalancing, but only with a premium fee-based option, and their fractional shares feature only applies to S&P 500 companies. Schwab has all-day trading and order control, and is thus good choice for day traders. Similarly, if you need access to things like options and futures contracts, a Solo 401(k), or 529 accounts, Schwab is a solid choice.

Here's a quick summary of Schwab:

- Zero fees and trade commissions for stocks and ETFs. Schwab does have commissions on options, mutual funds, and futures.

- Free robo-advisor option called Intelligent Portfolios® with a premium option that incorporates 1-on-1 guidance from a Certified Financial Planner, a digital financial plan, and interactive planning tools for a one-time signup fee of $300 and $30/mo. This service requires a minimum investment of $25,000.

- Schwab has basically every account type you can think of.

- Every investment product except forex and crypto: ETFs, individual stocks, mutual funds, options, futures, and over-the-counter (OTC) stocks aka “penny stocks.”

- Schwab's margin rate on a $100k margin loan is 6.83%.

- Robust charting, news, education, and analysis tools.

- Fractional shares, but only for S&P 500 companies.

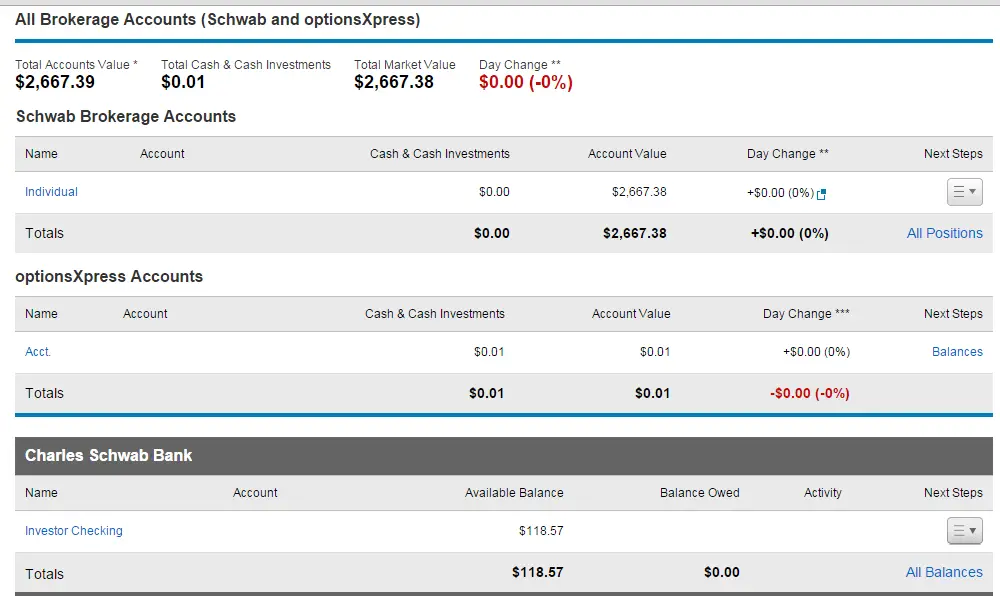

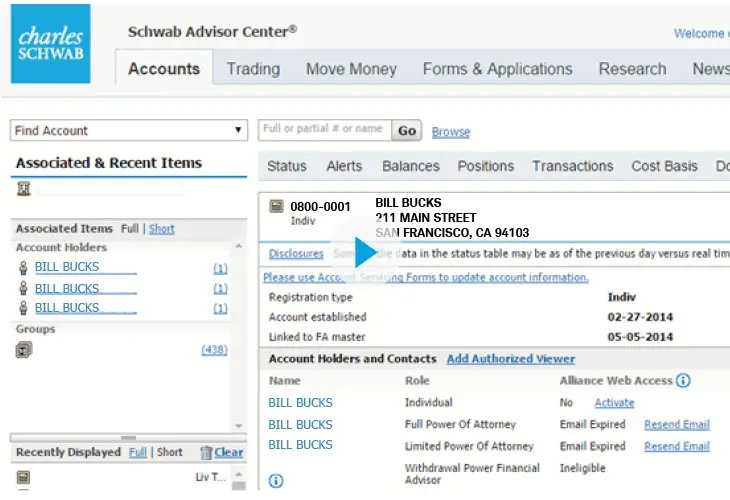

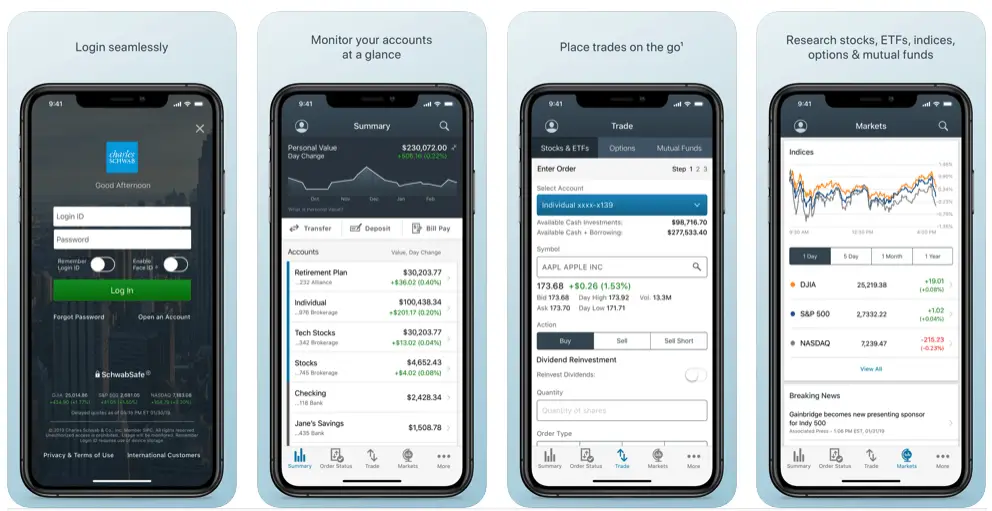

- Schwab's desktop web interface still looks pretty antiquated, but they've made recent renovations to their mobile app:

If you need access to things like options contracts, a Solo 401(k) or custodial accounts, and/or an all-day trading window, for example, Schwab is an excellent choice.

3. Fidelity

Right behind and almost identical to Schwab is Fidelity. Like Schwab, Fidelity has also recently overhauled their mobile app and dropped fees.

Fidelity

Summary

Fidelity has made huge strides recently to improve and modernize its apps and features, but is still slightly behind Schwab in my opinion.

Here's a quick look at Fidelity:

- Commission-free trades and zero account fees, aside from miscellaneous fees for things like paper statements, outbound account transfers, inactivity, etc. Fidelity announced zero-fee trading in January 2020.

- Fidelity offers a robo-advisor option called Fidelity Go® with a fee of 0.35%, and a hybrid robo-advising and coaching (in their words, “digital planning and professional investment management with advisors when you need them”) for a fee of 0.50%.

- Virtually all account types.

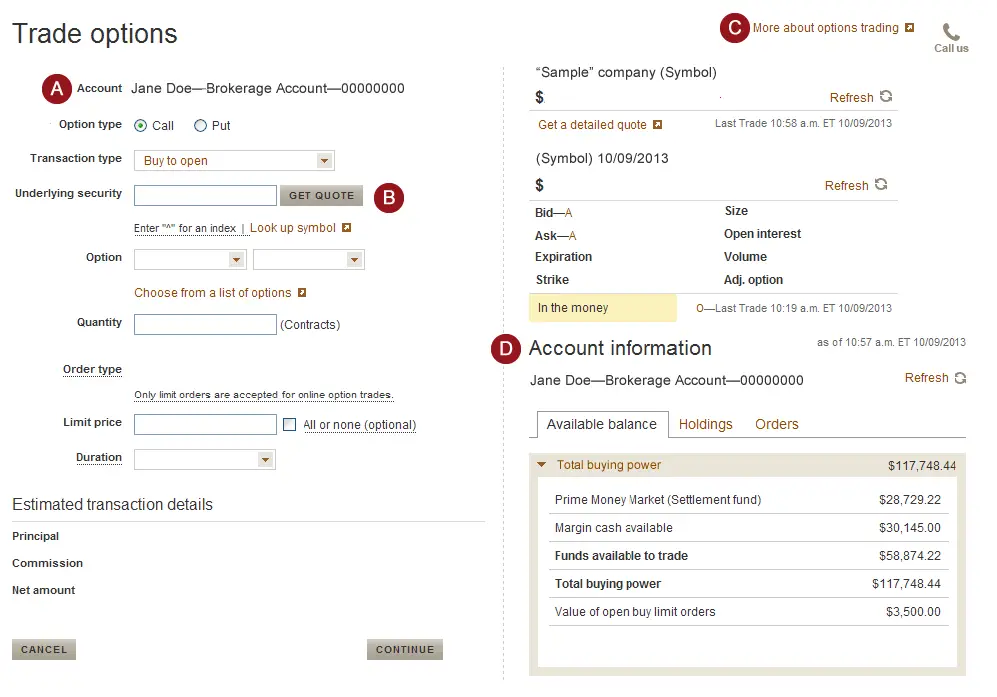

- ETF’s, individual stocks, Fidelity's own mutual funds, and options contracts. No futures, forex, or crypto.

- Margin rate on a $100k margin loan is 6.83%, the same as Schwab.

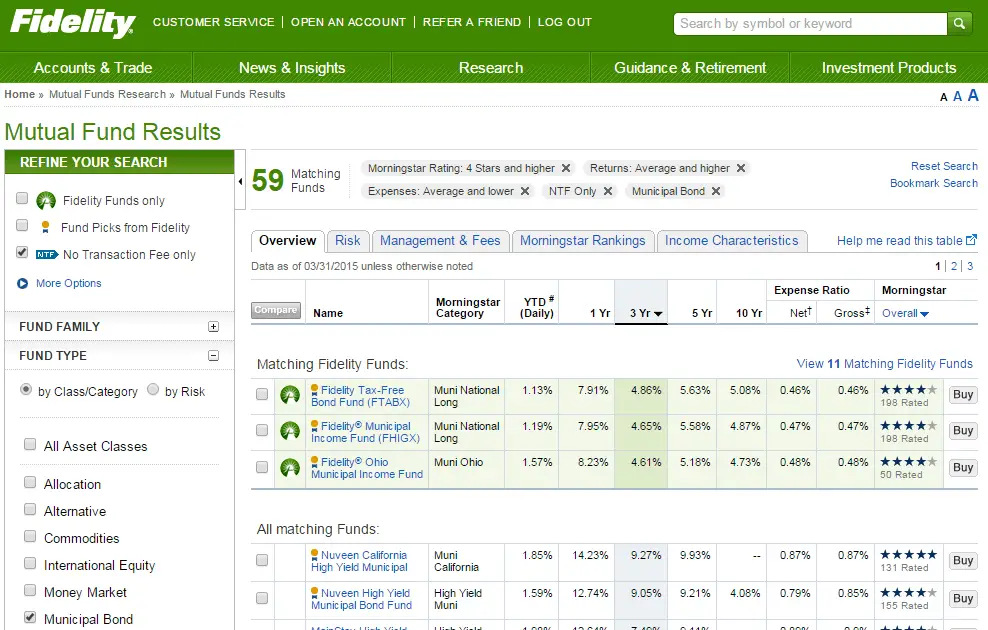

- Robust charting and analysis tools for traders.

- No auto rebalancing.

- For some reason, Fidelity only offers fractional shares through the mobile app.

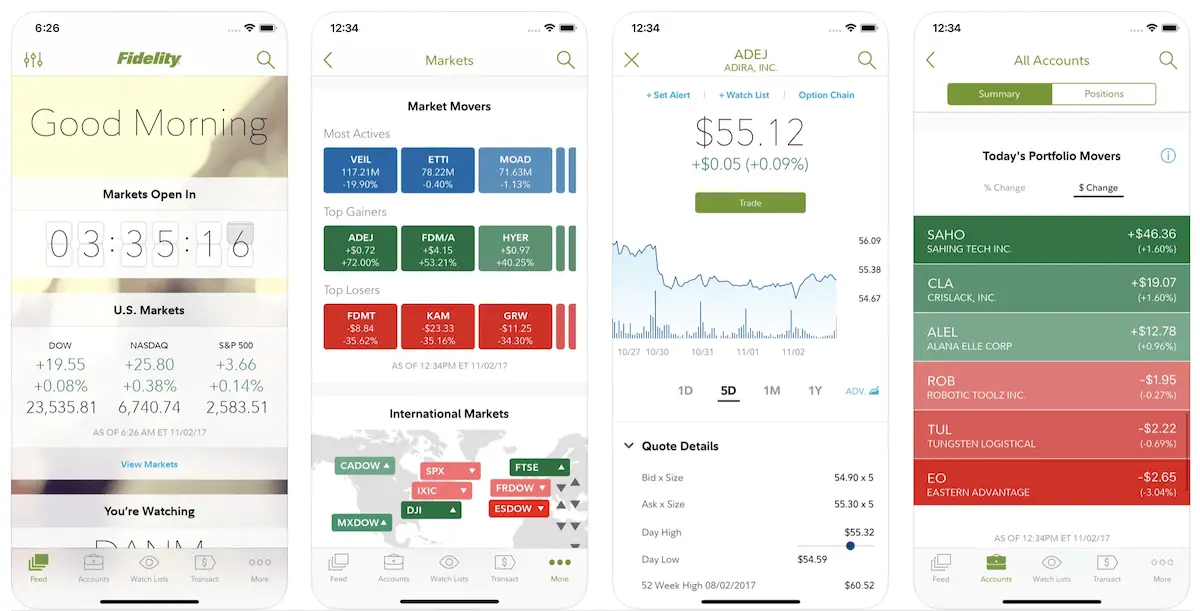

- Fidelity has a slightly less intuitive, older-looking user interface that would be more suitable for seasoned investors and traders. This is to be expected, as Fidelity offers a broader range of account types and investment products. They do have a great mobile app. Here are some screenshots of both:

4. Interactive Brokers

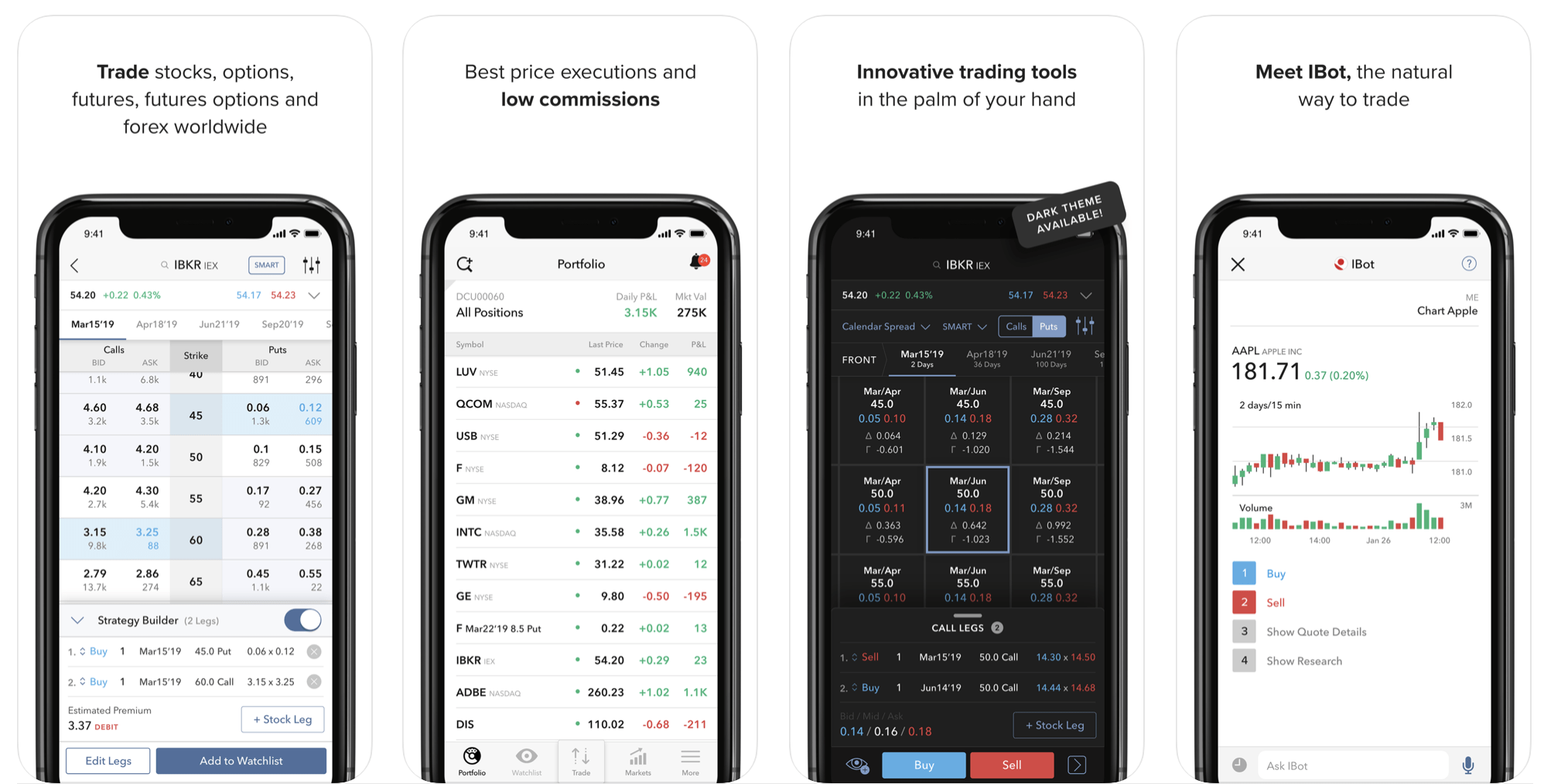

Interactive Brokers is a lesser known broker that has become popular with experienced investors for its zero fees, extremely cheap margin, and availability to customers outside the U.S. Unfortunately, you'll need some experience and some patience to be able to navigate their interface and mobile app.

Here's a summary of Interactive Brokers:

- Zero fees and commissions.

- Taxable, Joint, Traditional IRA, Roth IRA, Rollover IRA, SEP IRA, and Trust accounts. They currently do not offer SIMPLE IRA, 401(k), Solo 401(k), 529, Custodial, HSA, or Non-Profit accounts.

- Offers trading for stocks, ETFs, options, futures, and forex.

- No checking account offering.

- No automatic rebalancing.

- Fractional shares.

- Charting and technical analysis tools, albeit in a clunky interface.

- IB offers the lowest margin rates around. For a $100k margin loan: 2.55% with IB Lite and 1.55% with IB Pro.

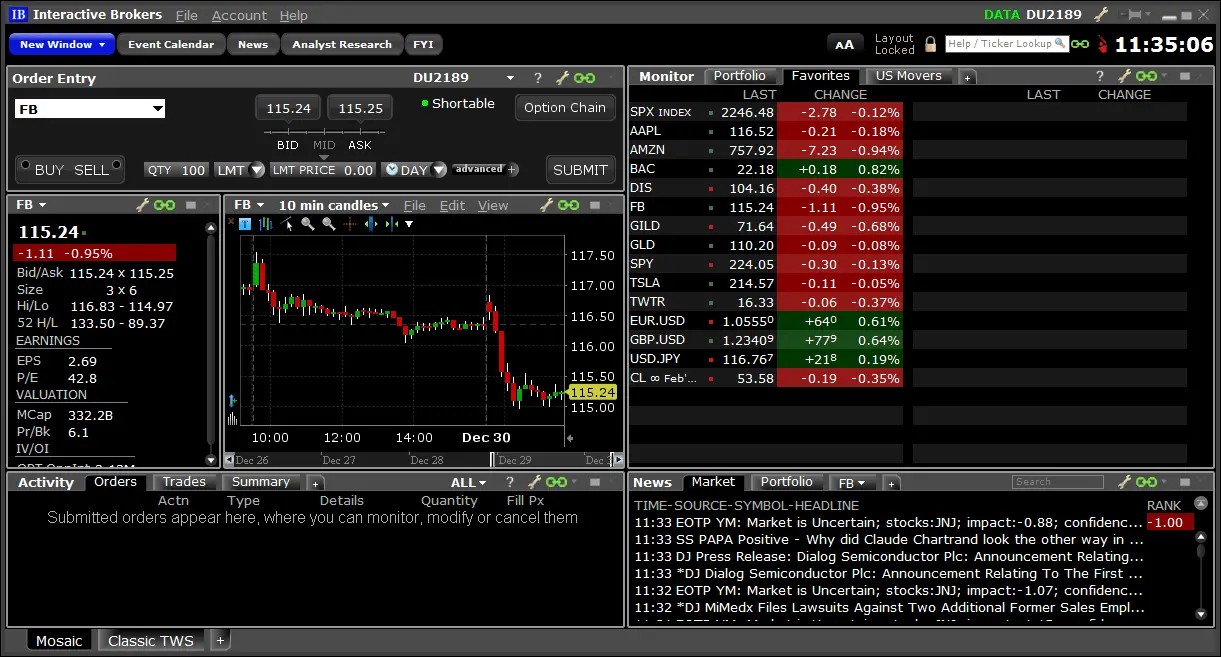

- The desktop interface of IB is not great, and will only be familiar to experienced investors. The mobile apps of Interactive Brokers seem to be notoriously buggy and not well-supported:

5. Vanguard

Vanguard used to be the gold standard for the lowest fees. Nowadays, they've fallen behind on technology while other brokers have matched them on low fees. Moreover, you can simply buy Vanguard ETFs with other stock brokers.

Here's a quick summary of Vanguard:

- Commission-free trades and zero account fees. Vanguard just recently announced commission-free trades in January 2020. They do still have a $1 fee for options contracts.

- Account types: Taxable, Joint, Traditional IRA, Roth IRA, Rollover IRA, SEP IRA, Trust, Solo 401(k), SIMPLE IRA, custodial, and 529.

- ETFs, individual stocks, mutual funds, and options. No futures, forex, or crypto.

- Vanguard's margin rate for a $100k loan is slightly higher than Schwab and Fidelity at 7%.

- No checking account.

- No fractional shares.

- No auto rebalancing.

- Vanguard offers their Personal Advisor Services if your account value is over $500,000 for a fee of 0.30% of your invested balance.

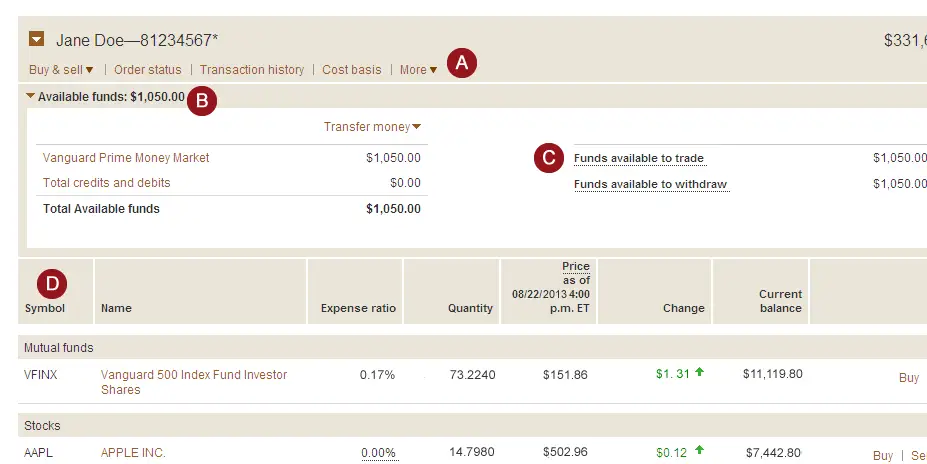

- The Vanguard interface is a little antiquated. It may be a little more confusing for a beginner investor. Vanguard has worked on improving their mobile app recently, but their Android app specifically still seems to be notoriously bad. Users assume that Vanguard doesn’t care to support and update the Android app. Here's what they look like:

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Interesting reading. Thanks for all the info.

I noticed that you listed Vanguard PAS as having a minimum of $500,000 for the fee of 0.3%. It’s actually $50,000. FYI Might want to update that error.

Thanks! Must have been a typo unless they recently dropped it. Will correct.

This review for Fidelity is already out of date — their Fractional Shares investing has been available on their website for quite some time now. It is great – available for just about any stocks and ETFs.

Thanks.

Marvelous!

Dear Mr Willamson,

I didn’t know even the first letter A in the alphabet of the stock market and how to start. Now I know that first I got to see a broker first, how many they are and what to expect from each of them. With this first baby step, I am still confused in the ocean of terms or phrases like IRA, Roth IRA, Rollover IRA, SEP IRA, and Trust accounts and so on. Can you please provide some explanation somewhere about those acronyms?

Thank you!

Best Regards!

Thanks, Jean! Maybe I’ll do a post on the different IRA types at some point. Here’s a good overview.