Financially reviewed by Patrick Flood, CFA.

Small-cap value stocks have outperformed every other segment of the market historically. Below we'll review the 13 best small cap value ETFs for 2024. The list below includes my 3 specific picks for U.S., ex-US Developed Markets, and Emerging Markets small cap value stocks respectively.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here's the list:

- IJS – iShares S&P SmallCap 600 Value ETF

- SLYV – SPDR S&P 600 Small Cap Value ETF

- VIOV – Vanguard S&P Small-Cap 600 Value ETF

- AVUV – Avantis U.S. Small Cap Value ETF

- DFSV – Dimensional US Small Cap Value ETF

- IWN – iShares Russell 2000 Value ETF

- VTWV – Vanguard Russell 2000 Value ETF

- VBR – Vanguard Small-Cap Value ETF

- ISCV – iShares Morningstar Small-Cap Value ETF

- DLS – WisdomTree International SmallCap Dividend Fund

- AVDV – Avantis International Small Cap Value ETF

- DGS – WisdomTree Emerging Markets SmallCap Dividend Fund

- AVES – Avantis Emerging Markets Value ETF

Contents

Small Cap Value ETFs Video

Prefer video? Watch it here:

Introduction – Why Small Cap Value ETFs?

Small-cap value stocks have beaten every other style and cap size of stocks historically. Small-caps have outperformed large-caps historically, and Value has outperformed Growth historically, due to what we think are independent sources of risk.

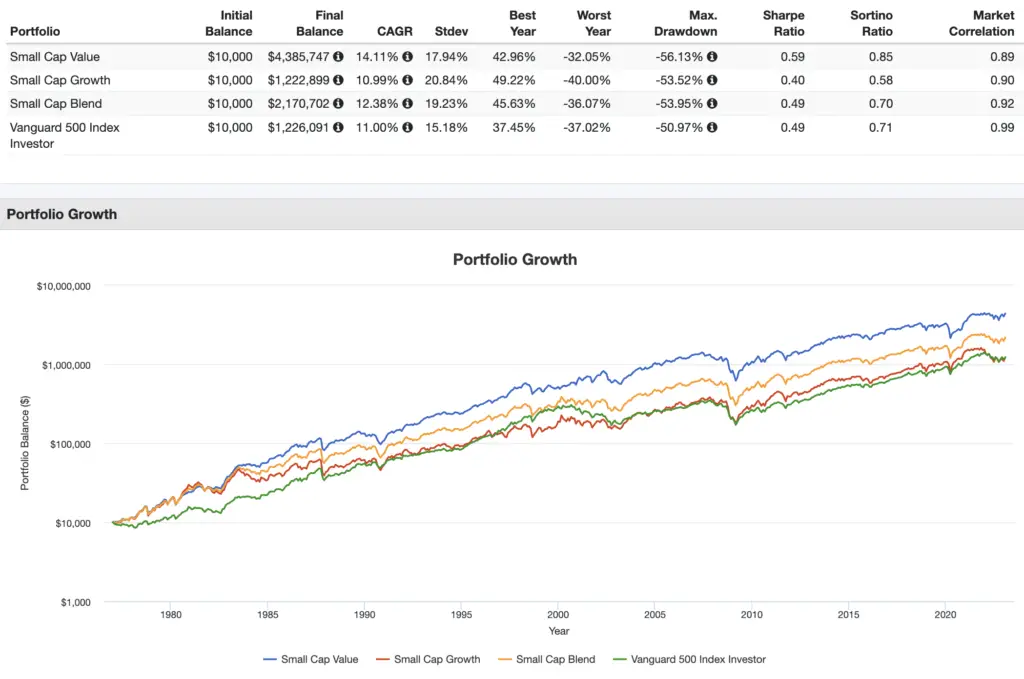

These are known as the Size premium and the Value premium, two of the Fama-French risk factor premia that explain the differences in returns between diversified portfolios. Here is small cap value vs. other small caps and the S&P 500 from 1977 through 2022:

Here are some more impressive stats illustrating the glamour of small value: From 1928 through 2016, the S&P 500 index had a CAGR of 9.7%, while small-cap value stocks delivered 13.5%. Looking at 40-year periods since 1928, the average return of the S&P 500 was 10.9%, compared to 16.2% for small-cap value stocks.

Unfortunately the Size and Value factors have suffered in recent years, lagging the market. I don't employ or advise market timing, but AQR maintains that Value is still basically the cheapest it's ever been right now, suggesting that now may be the worst time to give up on the factor, and that it's due for a comeback. 2021 and 2022 were actually great years for small value, relatively speaking, so that comeback may indeed be happening. Fingers crossed.

We would also expect factors to have negative premiums from time to time, even for extended time periods.

Factors are simply unique or independent sources of risk. A typical 60/40 portfolio has more risk than one might realize at first glance. Due to the comparatively greater volatility of stocks compared to bonds, over 80% of the portfolio's risk is market beta.

Conveniently, diversifying across factors actually leads to a “stronger” portfolio by helping to mitigate adverse outcomes, but you must be able to live with tracking error regret, a term for giving up on a strategy after its underperforming its benchmark for some period of time. Adding in factors necessarily means your portfolio’s performance does not resemble the market, for better or for worse.

Including small caps also took the famous 4% Rule up to 4.5% historically.

So now that we know why small-cap value may be the golden segment of the market, let's explore the best small cap value ETFs.

The 13 Best Small Cap Value ETFs

Below are the 13 best small cap value ETFs to capture the Size and Value factor premia.

IJS – iShares S&P SmallCap 600 Value ETF

The iShares S&P SmallCap 600 Value ETF (IJS) is one of the most popular funds for the small-cap value segment, with nearly $5 billion in assets. This ETF seeks to track the S&P SmallCap 600 Value Index and was established in 2000. The fund has over 450 holdings and an expense ratio of 0.18%.

SLYV – SPDR S&P 600 Small Cap Value ETF

A very similar fund to IJS above that tracks the same index is the SPDR S&P 600 Small Cap Value ETF (SLYV). The ETF was also founded in 2000. It is slightly cheaper than IJS above, with an expense ratio of 0.15%. Of interest to day traders is the fact that spreads may be slightly larger for SLYV than for IJS since this is a slightly lower volume ETF than IJS.

VIOV – Vanguard S&P Small-Cap 600 Value ETF

The third and last ETF that tracks the S&P 600 SmallCap Value Index is the Vanguard S&P Small-Cap 600 Value ETF (VIOV). Similar to SLYV above, this ETF also has an expense ratio of 0.15%, but lower assets under management.

Any of these 3 funds would be fine choices to track the S&P 600 SmallCap Value Index. Their factor loading and historical performance are nearly identical. As an added bonus, the earnings screen from this S&P index conveniently provides some decent exposure to the Profitability factor as well.

AVUV – Avantis U.S. Small Cap Value ETF

Dimensional Fund Advisors (DFA) is probably the gold standard in this space of factor tilts in terms of investable financial products, but most of their funds – in this case, their small cap value funds – are not available to individual retail investors. A few former employees of DFA started a company called Avantis, which recently introduced some new funds for retail investors. Of interest to us here is AVUV, the Avantis U.S. Small Cap Value ETF.

Previously, the S&P SmallCap 600 Value Index (via IJS, VIOV, or SLYV) was the go-to index to capture U.S. small-cap value stocks. The earnings screen employed by the index even conveniently provides some decent exposure to the Profitability factor.

AVUV is a relatively new product, but in its short lifetime, it has achieved demonstrably superior factor exposure, and while it shouldn't mean much, it may also comfort you to know that it has outperformed its competitors on this list in its short lifespan thus far.

In a nutshell, AVUV has been doing a great job so far of capturing very small, very cheap stocks with strong financials. Because of this, AVUV replaced VIOV in my own portfolio. I crowned it the king for U.S. small value in a separate post here.

VIOV has an expense ratio of 0.15%. AVUV’s expense ratio is 0.25%. This difference of 0.10% is worth it for the better factor exposure in my opinion, and AVUV would be my choice from this list for U.S. small cap value.

DFSV – Dimensional US Small Cap Value ETF

DFSV is a relatively new small cap value fund from Dimensional that launched in early 2022. It is very comparable to AVUV and would also be a great choice for the dedicated factor investor.

DFSV and AVUV could even be considered a good pair for tax loss harvesting. I actually specifically compared the two in a separate post here and also wrote about DFSV alone in a post here.

DFSV still costs a bit more than AVUV, though, at 0.31%.

IWN – iShares Russell 2000 Value ETF

Those seeking broader diversification in the small cap value segment may desire to invest in the Russell 2000 Value Index, composed of 2,000 small cap value stocks, for which the iShares Russell 2000 Value ETF is the most popular fund.

This ETF has nearly 1,500 holdings, over $8 billion in assets, and an expense ratio of 0.23%. Investors deciding between the S&P SmallCap Value Index and the Russell 2000 Value Index don't have to make any tradeoffs in terms of factor exposure for Size and Value.

The iShares Russell 2000 Value ETF and the 3 ETFs above have identical loading on the Size and Value factors. Though note that the S&P index employs an earnings screen, so the 3 ETFs above should have comparatively more loading on the Profitability factor than IWN.

Day traders will appreciate the high liquidity of IWN.

VTWV – Vanguard Russell 2000 Value ETF

Another ETF that tracks the Russell 2000 Value Index is the Vanguard Russell 2000 Value ETF (VTWV). This fund is cheaper than IWN above with an expense ratio of 0.15%, but has a much lower AUM of only about $350 million. Performance of these 2 funds has been nearly identical.

VBR – Vanguard Small-Cap Value ETF

The Vanguard Small-Cap Value ETF is was the cheapest on the list with an expense ratio of 0.07% (now ISCV below is cheaper). The fund seeks to track the CRSP US Small Cap Value Index and has nearly 900 holdings.

Note that this ETF is not a pure small cap value play, as it has some exposure to mid-cap value as well. This may be desirable to investors seeking a value tilt across multiple cap sizes. This ETF also has comparatively smaller loading on the Size, Value, and Profitability factors compared to the funds above. I delved into those details in a separate post here.

ISCV – iShares Morningstar Small-Cap Value ETF

iShares came along in March, 2021 and undercut Vanguard's VBR above by 1 basis point while providing superior exposure to U.S. small cap value stocks with ISCV (formerly JKL), the iShares Morningstar Small-Cap Value ETF. For those who for some reason only want the cheapest fund, ISCV seems to be it and is a clear winner over VBR.

DLS – WisdomTree International SmallCap Dividend Fund

All the above funds focus on U.S. small cap value stocks. Those seeking international small cap value exposure can do so using the WisdomTree International SmallCap Dividend Fund (DLS). This is probably a prudent move, as the small cap value premium has been larger and statistically stronger in international stocks outside the U.S.

DLS tracks the WisdomTree International SmallCap Dividend Index and has an expense ratio of 0.58%. This index is composed of small-cap dividend stocks in developed countries outside the U.S. and Canada. Historically, this fund has arguably been the best proxy for retail investors to access the Size and Value (and some Profitability) premia outside the U.S.

WisdomTree uses some liquidity screens to weed out stocks that aren't investable, so DLS's holdings are not really as small as we'd ideally like to see. These screens – as well as the fund's weighting by dividend yield – also end up causing the it to be concentrated in a small handful of countries, namely Japan, the UK, and Australia, which comprise over half of the fund's assets.

AVDV – Avantis International Small Cap Value ETF

Avantis also introduced AVDV in late 2019 for international (ex-US developed) small-cap value at a cost of 0.36%. This is effectively the same segment targeted by DLS above.

In its short lifespan so far, AVDV has delivered impressive exposure comparable to that of DLS and would thus be a fine choice for small cap value in ex-US developed markets. If you already own DLS in a taxable account, AVDV provides a great alternative to harvest losses with.

AVDV would be my choice for a small cap value fund for ex-US Developed Markets, and I own it in my own portfolio.

DGS – WisdomTree Emerging Markets SmallCap Dividend Fund

DGS is the Emerging Markets version of DLS above. It also has the same fee of 0.58%, but investors seeking a diversification benefit will appreciate the slightly lower correlation of DGS to U.S. small cap value compared to DLS above. For a dividend fund, DGS provides some very impressive factor exposure.

Like DLS, DGS ends up having concentrated exposure in just a few countries, in this case Taiwan, Hong Kong, Korea, India, and Thailand, which account for about 75% of the fund's holdings.

DGS is my choice for Emerging Markets small cap value, and I own it in my portfolio.

AVES – Avantis Emerging Markets Value ETF

As you might expect, Avantis also launched an option for targeted factor exposure in Emerging Markets stocks. That fund is AVES.

This may seem like the obvious choice considering my comments on Avantis's other funds, but in this case DGS from WisdomTree still seems to provide superior factor exposure, albeit somewhat naively. In other words, it appears to be holding smaller, more value-y, more profitable stocks.

I already owned DGS when AVES launched and I don't feel the need to switch, but that doesn't mean AVES is not still a fine choice for this narrow market segment.

Avantis fans will also enjoy the comparatively lower fee here of 0.36%.

Where to Buy These Small Cap Value ETFs

To recap, my personal picks are as follows:

AVUV for U.S. small value,

AVDV for ex-US Developed Markets small value, and

DGS for Emerging Markets small value.

All these small cap value ETFs should be available at any major broker. My choice is M1 Finance. M1 has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, and a sleek, user-friendly interface and mobile app.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Small Cap Value FAQ's

Lastly here are some frequently asked questions about small cap value stocks in general.

What does small cap value mean?

The phrase “small cap value” in reference to stocks just means stocks that are smaller in size, measured by market capitalization, that are also thought to be underpriced relative to their fundamental earnings (which is the “value” part). In a market cap weighted total market index fund, small cap value stocks only make up about 3%.

What are small cap value funds?

Small cap value funds are simply investable funds that capture a basket of small cap value stocks, which are smaller stocks by market capitalization that are also thought to be underpriced according to some value metric like price-to-earnings ratio. A small cap value fund may or may not track some underlying index.

When does small cap value outperform?

It's impossible to know when the small cap value market segment will outperform, which is why a small cap value tilt in one's portfolio is necessarily a long-term bet. Broadly speaking, we would expect small cap value stocks to perform best when the market is recovering after a crash.

How much small cap value should I have in the portfolio?

This question has no simple answer and obviously depends on the investor's personal goal(s), time horizon, and risk tolerance. Tilting toward small cap value stocks may or may not be suitable for the investor. In a market cap weighted index fund, small cap value stocks only comprise about 3%.

Are small cap value stocks a good investment?

It's impossible to say whether or not small cap value stocks will be a good investment in the future. Historically, small cap value stocks have beaten every other segment of the market due to what we think are independent risk premiums for small stocks and value stocks.

Is small cap value dead?

It's impossible to say whether or not small cap value is “dead.” Historically, small cap value stocks have outperformed every other market segment due to what we think are independent risk premiums for small stocks and value stocks. There is no reason to think these premiums have disappeared. Remember that we would expect factor premiums to potentially have extended periods of underperformance. Small cap value stocks also beat the market in 2021 and 2022, so I certainly wouldn't call it “dead.”

Will small cap value recover?

It's impossible to predict whether or not a market segment like small cap value will recover. There is no reason to think these premiums have disappeared. Remember that we would expect factor premiums to potentially have extended periods of underperformance. Small cap value stocks also beat the market in 2021 and 2022, so it may indeed be recovering right now.

Why is small cap value underperforming?

It's impossible to say why exactly a particular market segment like small cap value is underperforming. Remember that we would expect factor premiums to potentially have extended periods of underperformance. There is no reason to believe the small cap value premium has disappeared. Small cap value stocks also beat the market in 2021 and 2022.

Disclosures: I am long AVUV, AVDV, and DGS in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

You noted that AVUV and VIOV are especially suited to taxable accounts for tax-loss harvesting. Are there any better suited to tax-protected accounts?

Hey Nick, by that I meant if you hold either in taxable, the other may be a suitable substitute fund for a tax loss harvesting strategy.

How do you compare the Factor loadings (size, value, profitability) between these few Avantis and DFA ETFs?

US Small Cap Value: AVUV vs DFSV

Int’l Small Cap Value: AVDV vs DISV

US Equity: AVUS vs DFAC

You can use Portfolio Visualizer to do this. I actually just published a post on DFSV vs. AVUV here.

Note that another contender – DFA US Small Cap Value ETF (DFSV) – just recently launched.

Btw, the Small Equity versions from Avantis (AVSC) and DFA (DFAS) could also be a nice consideration for some investors who want an all-in-one investment with only a moderate value tilt but gets you the profitability tilt as well.

Thanks.

Thank you so much for sharing your knowledge and perspective, John! It is very much appreciated. I hope your future is filled with growing wisdom and wealth.

Thanks, Rob! Likewise!

From 2001 to Present, S&P 600 beat out S&P 600 Value correct?

Looks like it, yes.

So from 2001:

Extended Market > S&P 600 > S&P 600 Value

I see no basis for SCV investing

Then you seem to have missed some things and seem to be succumbing to recency bias. That said, all crystal balls are cloudy.

I’m having trouble trying to figure out the preference for SCV myself. But I admit to not understanding what time frame is “recency bias”. Going back 40 years, SCV outpaced MCV only 12.4 to 12.1. It was really 1977-1982 when SCV’s CAGR was 24.9 that the stage was set for pace for its outperformance over the past 40-50 years. How valuable really is that 1977-1982 timeframe in favoring SCV today over MCV or other asset classes? How is recency bias defined for backtesting purposes? I’m hard-pressed to favor SCV over MCV because of what happened over 40 years ago.

Thank you, John, for this site and your hard work. I’m relatively new to managing my own portfolio, and your site has been a MAJOR part of my learning. Greatly appreciated.

Glad it’s been helpful, Mark! By “MCV” do you mean mid cap value or mega cap value?

Definition of “recent” probably depends on the context. For SCV performance in this context I’d probably say 10 years is “recent.”

Excellent read. I am planning to dump my WSML holding as I thought I was holding an all world small cap value ETF, but I guess it doesn’t cut it.

Have you looked at a combination of SVAL and ISVL, both from ishares? I thunk they would capture the entire small cap value universe.

I was keen on DFA and Vanguard but am glad you mentioned they are flawed in this space.

Thanks again!

Thanks! See my comment here on SVAL.

I understand that small cap value outperforms historically but it still wouldn’t be smart to go 100% into VIOV right? I was thinking of doing 50/50 VUG/VIOV in my 401k. It seems to outperform VTI during any time frame without tilting too much to one side. The only thing I can account for this is that all the mid caps are dragging down VTI, but why would that be the case? Thank you for your time!

Correct, Ryan, at least in my humble opinion. There have been extended periods where large caps beat small caps and Growth beat Value, just as we’ve seen in the last decade. These periods can potentially last most or all of one’s entire investing horizon. I also wouldn’t have the conviction to go 100% small cap value like Larry Swedroe. We also have to consider the possibility that we’re wrong about a future SCV premium.

Small cap value stocks only comprise a tiny 3% of VTI. But in doing your suggested combo, you’d also be missing out entirely on large cap value. I also briefly explained here why we wouldn’t expect great long-term performance from small- and mid-cap growth stocks.

Hi – I’m a newbie here, just noticed that Small cap growth delivered a higher CAGR than S&P 500 in the chart shown in this article, while you do say small cap growth is not good in another article and referred to black hole of investing. Can you please explain why do you say so?

I just choose to get my small cap exposure purely in small cap value, as small cap growth stocks tend to not compensate investors adequately for their greater risk.

John, I am a UK-based investor and all of these ETFs are unavailable on the platforms I use. Any idea where I can buy these or similar ETFs in the UK? I am particularly interested in AVDV as am looking for global small cap value exposure (I like the Dimensional offering but this is only available to advisors). Thanks,

It’s worth looking at Schwab’s RAFI Fundamental Index funds as well. While they aren’t structured to specifically target Fama-French factors, they end up doing so quite significantly because of their structure and have relatively low expense ratios.

Especially in the world of international, where options are more limited, FNDC is worth looking at if you haven’t already.

Indeed. FNDE is in my recent list of Value ETFs across all cap sizes.

I’m in a position where it makes sense for me to tax loss harvest out of AVUV, but wary because it really does seem like a head above the rest. In the US here, for what it’s worth, and have short term gains to offset from earlier this year in a high tax bracket.

Would you hesitate to tax harvest AVUV for IJS/VIOV due to the downgrade in factor exposure, or just not something I should worry about?

Thanks for all the great content!

Hard to say, Taylor. I’d say the napkin math would come down to the greater of the value of the tax loss benefit versus the expected premium delta of AVUV over VIOV. Also, the former is a short term gain while the latter would be more long term. We also don’t know for sure if/when SCV will make its full resurgence. But also keep in mind with the TLH you’re just delaying those taxes, not eliminating them, as you now have a new lower cost basis with VIOV, unless your income is lower in a future year when you realize those gains.

Glad you’ve found the content useful!

I have three additional small cap value funds you should look into:

RWJ – Invesco S&P SmallCap 600 Revenue ETF (52% Small Cap Value, 42% Small Cap Blend, 4% Small Cap Growth)

XSVM – Invesco S&P SmallCap Value with Momentum ETF (60% Small Cap Value, 37% Small Cap Blend, 1% Small Cap Growth)

CALF – Pacer U.S. Small Cap Cash Cows 100 ETF (59% Small Cap Value, 37% Small Cap Blend, 2% Small Cap Growth)

IJS (BENCHMARK) – iShares S&P Small-Cap 600 Value ETF (54% Small Cap Value, 40% Small Cap Blend, 4% Small Cap Growth)

All dominate on a 3 year return basis (RWJ 15.98%, XSVM 16.24%. CALF 15.10% vs IJS 8.03%). Also, RWJ and XSVM are dominant on a 10 year return (RWJ 15.24%, XSVM 14.97% vs IJS 12.53%) .I just thought I would share my finds in small cap value. I will probably incorporate 1-2 of these etfs for my small cap value exposure. Keep up the good work!

Thanks, Matt. I’ll check them out.

To be frank, 3-year returns – and even 10-year – mean nothing to me in this context. If they’ve outperformed, it’s actually more likely that they have less loading on Size and Value because those factors have suffered over the past decade.

Just gave them a glance. All 3 have terribly low loading on Value, and RWJ is even negative, so I wouldn’t call these small cap value funds at all. Their Value exposures pale in comparison to both VIOV/IJS and AVUV.

However, looking at Size, XSVM and RWJ are able to capture slightly smaller stocks than AVUV. What stands out more is their considerable loading on the Investment factor (CmA). If one wanted to specifically target Investment, these might be good options, but their high fees might scare me off from the start. CALF just looks pretty bad across the board; I’d throw that one out. RWJ has greater loading than XSVM on Size, Profitability, and Investment, but RWJ is also the one with negative loading on Value.

Hope this helps!

What percentage of your portfolio do you recommend investing into small cap?

Hard to say. In a total market index fund like VTI, small caps comprise only about 6% by weight, meaning small cap value is about half that. So anything above 3% is a tilt, a bet on small cap value. In my own personal portfolio, my SCV tilt is about 15%.

You’re missing disclosures on this page. Just a heads up 🙂

Noticed this when comparing with the Ultimate Buy & Hold portfolio.

Thanks!

SLYV is not a Vanguard fund, it’s SPDR S&P 600 Small cap value etf, but it’s one of the best!

Thanks for catching that, Matthew! Not sure where my brain was on that typo. It’s fixed now.