Financially reviewed by Patrick Flood, CFA.

Low-cost investment brokers like M1 Finance and Fidelity are becoming more popular as investors are wisening up to fees and commissions that have traditionally been largely overlooked. Here we'll compare the two. I wrote a separate comprehensive review of M1 Finance here if you're interested in seeing the specifics of the platform.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

M1 Finance vs. Fidelity – Summary Comparison

Contents

M1 Finance vs. Fidelity – Commissions and Fees

Fidelity and M1 Finance both offer commission-free trades and zero account fees, aside from miscellaneous fees for things like paper statements, outbound account transfers, inactivity, etc. We're seeing a race to the bottom for brokerage fees and commissions, and even traditional brokers like Fidelity and Schwab are following suit. Fidelity announced zero-fee trading in January 2020.

Fidelity does offer a robo-advisor option called Fidelity Go®, which has a fee of 0.35%, and a hybrid robo-advising and coaching (in their words, “digital planning and professional investment management with advisors when you need them”) for a fee of 0.50%.

M1 Finance is entirely self-directed, but they do offer “Model Portfolios” that you can invest in for free.

M1 Finance vs. Fidelity – Account Types

M1 Finance offers taxable, joint, Traditional IRA, Roth IRA, Rollover IRA, SEP IRA, Trust, and Custodial accounts. They currently do not offer SIMPLE IRA, 401(k), Solo 401(k), 529, HSA, or Non-Profit accounts.

Fidelity offers all of M1's account types plus Solo 401(k), SIMPLE IRA, 529, and HSA. Employers can also set up a 401(k) plan through Fidelity.

If you need any of the latter accounts, Fidelity would be the better choice.

Both M1 and Fidelity also offer an FDIC-insured checking account.

M1 Finance vs. Fidelity – Investment Products

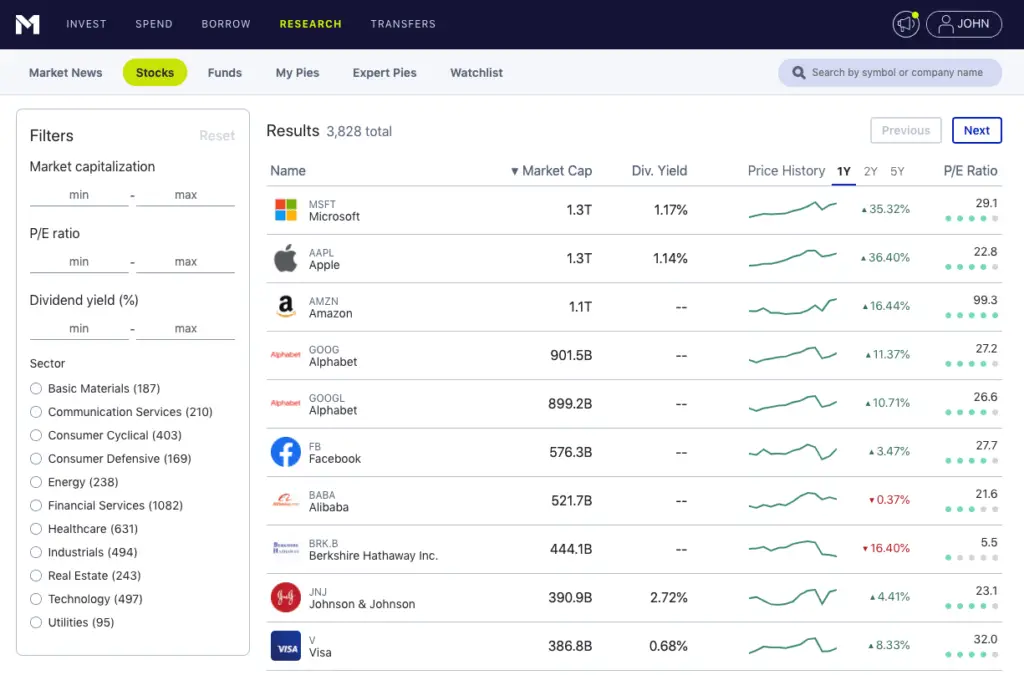

M1 Finance offers most ETF's and individual stocks that are traded on major exchanges.

Fidelity offers ETF's, individual stocks, their own mutual funds, and options contracts.

M1 Finance vs. Fidelity – Margin

M1 Finance wins on margin rates. Their rate is typically far lower than Fidelity. See margin rates on this page.

Remember that margin is an additional risk, including the risk of losing more than you invest. Margin is not available for retirement or custodial accounts. Rates may vary.

M1 Finance vs. Fidelity – Mobile App

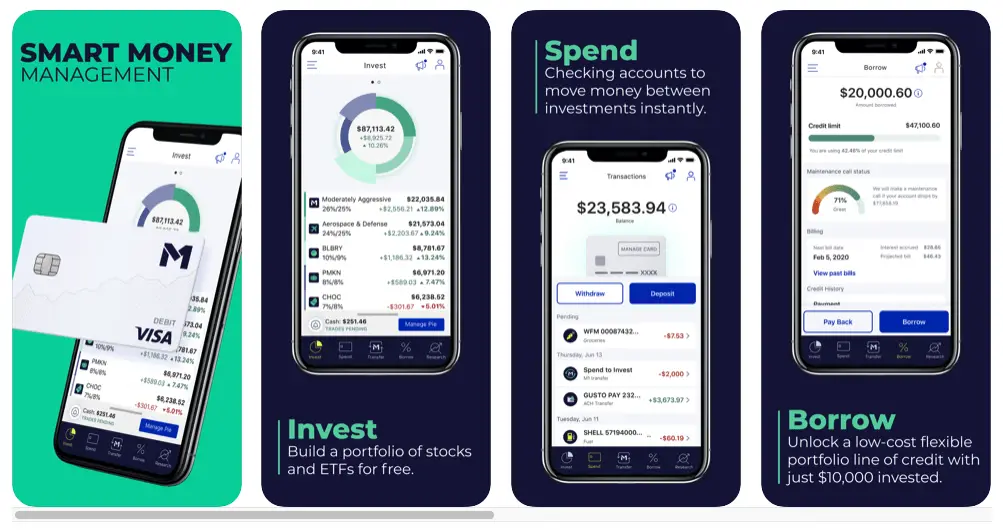

M1 Finance has a sleek, intuitive, user-friendly, robust mobile app for both Apple iOS and Android:

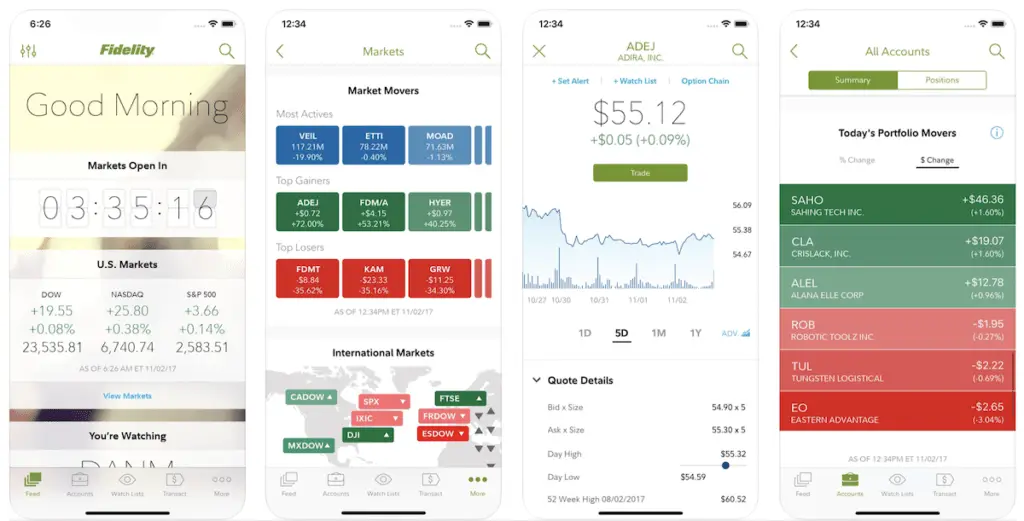

Fidelity has recently overhauled their mobile app, likely in a bid to capture more of today's young, tech-savvy audience. I would suggest it's slightly less intuitive than M1's. Also note that for some reason, Fidelity's fractional shares feature is only available through the mobile app. Here are some screenshots from the Fidelity app:

M1 Finance vs. Fidelity – Interface/Usability

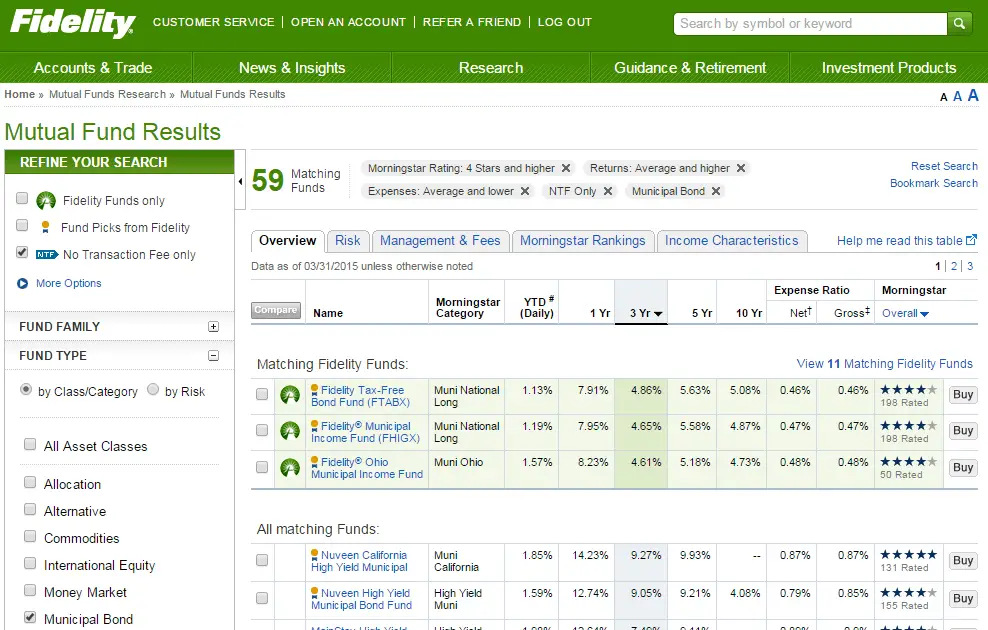

The Fidelity desktop web interface is still pretty antiquated. I'd like to think they're working on updating it to reflect their mobile app. It may be a little more confusing for a beginner investor. This is to be expected somewhat, as Fidelity obviously has more account types and investment products, as well as advanced order control. The Fidelity user interface looks like this:

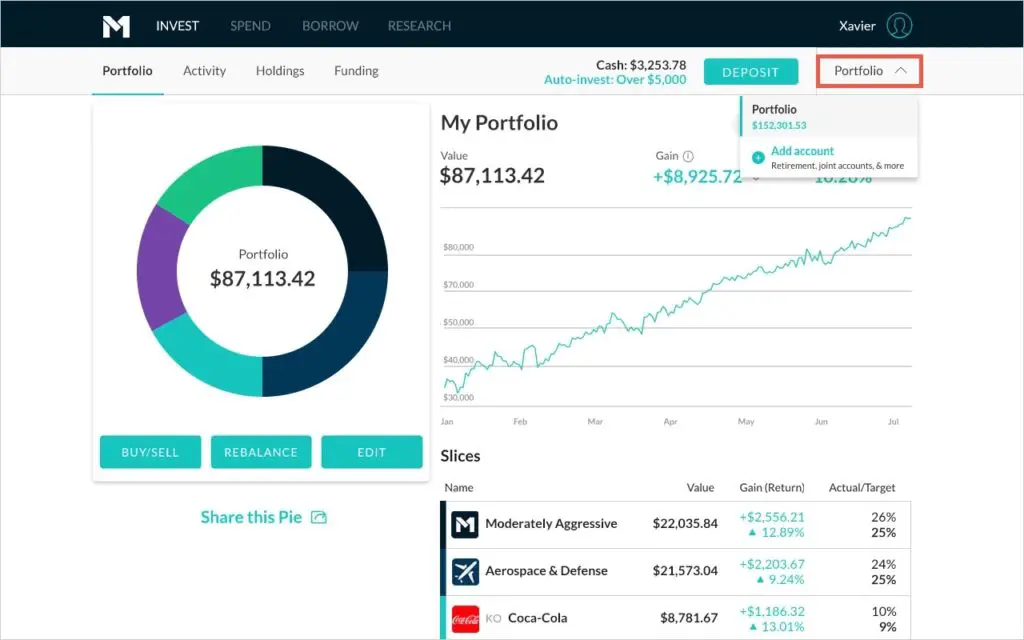

The interface for M1 Finance, on the other hand, is sleek, modern, simple, and intuitive with its pie-based visualization. It is great for beginner and experienced investors alike:

M1 Finance vs. Fidelity – Extra Features

Both M1 Finance and Fidelity offer an FDIC-insured checking account with a debit card.

As a full-fledged trading brokerage, Fidelity offers more robust charting and analysis tools than M1 Finance, and obviously has an all-day trading window and order control. Since M1 Finance is built for long-term, buy-and-hold investing, M1 has a once-daily trading window and no order control.

Fidelity does not employ M1's famous “dynamic rebalancing,” which automatically allocates new deposits to maintain your portfolio's target allocations. M1 Finance offers fractional shares or “dollar-based investing,” which allows every dollar to work for you. The mechanics that underlie the clearing of trades from Fidelity's mobile app may be different than its desktop web interface, because Fidelity only offers fractional shares through its mobile app.

M1 Finance vs. Fidelity – Summary and Conclusion

- Both M1 Finance and Fidelity offer zero-commission trades and zero fees.

- Fidelity has a few more account types than M1 Finance, notably Solo 401(k), SIMPLE IRA, 529, and HSA. Employers can also set up a 401(k) plan through Fidelity.

- M1 Finance offers most ETF's and individual stocks. Fidelity offers ETF's, individual stocks, mutual funds, and options contracts.

- M1 Finance offers lower margin rates than Fidelity, and M1's margin loan can be used for anything you want.

- Fidelity has a slightly less intuitive, older-looking user interface that would be more suitable for seasoned investors and traders. This is to be expected, as Fidelity offers a broader range of account types and investment products. M1 Finance has a simple and intuitive interface.

- Both M1 Finance and Fidelity seem to have great mobile apps.

- Both M1 Finance and Fidelity offer an FDIC-insured checking account with a debit card.

- Both M1 Finance and Fidelity offer fractional shares, but with Fidelity this feature is only available through the mobile app.

- Fidelity does not have automatic rebalancing like M1.

- Fidelity has the typical order control and all-day trading window that you'd expect of a traditional broker. M1 does not offer dedicated order control and only uses one trading window per day.

- Fidelity offers robo-advising for a fee of 0.35% of your invested balance, and personalized investing advice for a fee of 0.50% of your invested balance. M1 Finance offers its “Model Portfolios” for free. M1 is also probably better if you want to implement a “lazy portfolio” and have it rebalance automatically.

Both M1 Finance and Fidelity will provide significant savings in fees over other brokers. I think which of these platforms you choose depends largely on what account types, products, and features you need access to. If you need access to options contracts, a Solo 401(k), and/or an all-day trading window, for example, Fidelity is the platform for you. If you don't need those things and want access to fractional shares, automatic rebalancing, and cheaper margin, M1 Finance would likely be the better choice. I wrote a separate comprehensive review of M1 Finance here if you're interested in seeing the specifics of the platform.

Similarly, Fidelity may be better for seasoned investors who want control and who don't need robo-advising or investing advice from a certified professional. For beginner long-term buy-and-hold investors, M1's Model Portfolios will allow you to avoid Fidelity's advising fees.

I have to compliment Fidelity for making strides to improve and modernize its apps and features, on par with modern, new-age brokers like M1. Again, we're seeing a paradigm shift in investing and a race to zero for fees, with traditional brokers announcing major changes as recently as early 2020. I would argue Fidelity was one of the brokers that has long been viewed as one for an older generation. I suspect they will continue to improve and innovate into the future.

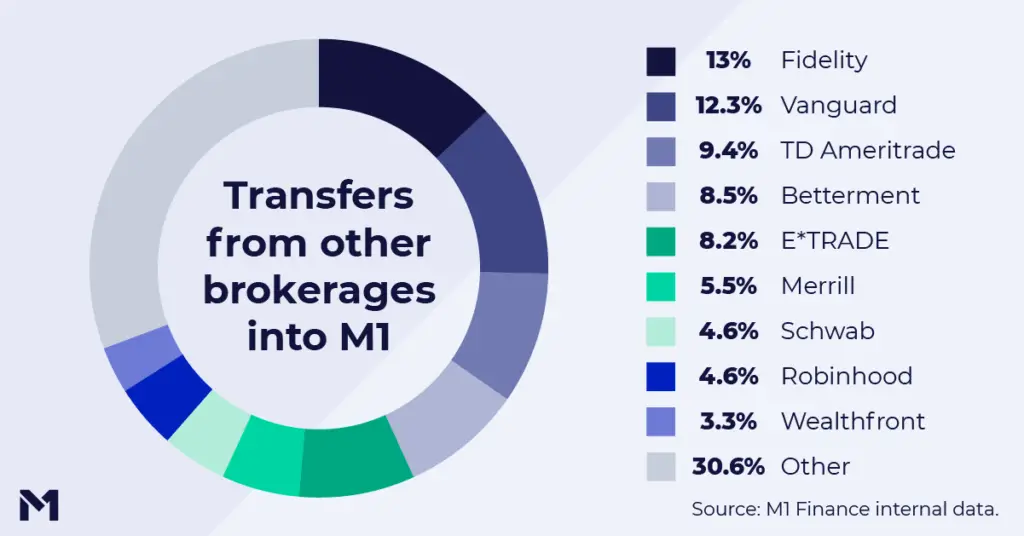

I've actually talked to people who utilize both – Fidelity for mutual funds in retirement accounts, and M1 for a taxable account to access extremely cheap margin. Fidelity also happens to be the brokerage from which M1 Finance sees the most transfers:

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

I have Fidelity, so I know that fractional shares are now available through the PC browser website as well. However, only during regular 9:30-4 eastern trading hours. Extended / after hours are complete shares only I think and you have to ‘register’ for extended trading (mostly just click some buttons and accept acknowledgements about liquidity and volatility).

Now that I’ve learned about Hedgefundie 2.0, I’m curious about a Roth IRA rollover from Fidelity. Do you know any specific details about it’s ease, potential pitfalls, or where to find specifics? So far it seems like both M1 and Fidelity just have ‘commercials’ about how “easy it is to rollover”. Many, MANY thanks. 😀

Rollover should be pretty easy and straightforward. Mine was. Once you sign up, it walks you through the steps.