Floating rate bonds adjust quickly to interest rate changes. Here we'll compare the best floating rate ETFs – USFR, TFLO, and FLOT.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

What Are Floating Rate Bonds?

Floating rate bonds are debt instruments with variable interest rates, as opposed to a typical bond with a fixed rate. That interest rate is based on some benchmark, which could be things like the U.S. 3-month T-bill rate, the Federal Funds Rate (FFR), and the London Interbank Offered Rate (LIBOR).

Floating rate bonds are also called floating rate notes (FRN's) or simply floaters. Relatively speaking, FRN's are very new; they were created in 2013. They have gotten much more attention recently since interest rates have been going up.

Floating rate bonds capture current interest rates, plain and simple, for better or worse. If rates rise, you immediately get that higher rate. The opposite is also true, though; if rates drop, your bond's interest rate immediately drops as well. How often the FRN's rate updates is up to the issuer. This could be once a day or once a year.

Floating rate bonds are typically short-term, investment-grade debt issues from institutions, governments, agencies, or corporations.

In terms of floating rate bonds inside an ETF, investors will typically benefit more from floaters as rates rise, as the bonds inside the fund will reflect the new rate quickly, whereas a fund of fixed-rate bonds will have to sell old bonds and buy new bonds and will thus be slower to reflect a change in interest rates.

Again, this can help or hurt. All else equal, if rates rise, a fund of fixed-rate bonds will have a slightly lower yield than that of a comparable floating rate bond fund. If rates fall, however, the floating rate bond fund will reflect that quickly, while the fixed rate bond fund will still have the higher, “old” rate, at least temporarily.

That's why, practically speaking, it's a pretty close toss-up between floaters and a straight T-bills ETF like SGOV, to which you're probably wanting to compare. While floaters may seem like a free lunch right now with rates rising, there's really no objective benefit of FRN's over T-bills due to what I just noted about them immediately dropping if rates drop. But they are also no worse.

That said, because the floating rate bond has a variable rate, its price is usually less volatile than a fixed rate counterpart whose price would be expected to respond to a change in interest rates. It's worth noting, though, that the volatility of the total return of the FRN fund is invariably going to be higher than that of your favorite 3-month T-bill fund. Here's that visualized going back to 2014:

That outperformance you see is not guaranteed.

Keep in mind that trying to predict interest rate changes and the bond market is typically just as fruitless as trying to time the stock market. It's also worth noting that floating rate bond funds typically have higher fees than their fixed-rate counterparts, so a slightly higher yield may not compensate for that greater fee.

Under a “normal,” rising yield curve, we also expect longer term bonds to have higher yields, and floating rate bonds are indexed to short-term rates, so their yield may be lower than a fixed rate bond of a slightly longer maturity.

Lastly, beware of potential callability and default risk of floating rate notes. Just as with fixed-rate bonds, you can buy a diversified mix of investment-grade bonds or narrow in on U.S. Treasury bonds that do not have default risk. I'd probably go with the latter, but we'll cover both types below.

Also note that like T-bills and other U.S. Treasury bonds, interest from Treasury FRN's is federally taxable as income but is free from state taxes.

Now let's go over the best floating rate bond ETFs.

The 3 Best Floating Rate Bond ETFs

Below are the 3 best floating rate bond ETFs. They vary somewhat in size and scope. All 3 distribute monthly.

USFR – WisdomTree Floating Rate Treasury Fund

USFR from WisdomTree is the most popular floating rate bond fund out there with over $15B in assets. It launched in early 2014.

You'll note from the name that this fund only holds floating rate bonds from the U.S. Treasury. As such, USFR would help the investor reduce interest rate risk while generating income backed by the full faith and credit of the U.S. government.

USFR seeks to track the Bloomberg US Treasury Floating Rate Index and has a weighted average maturity of about 1.5 years, an effective duration of roughly 1 week, an expense ratio of 0.15%, and an SEC yield of 4.89%.

TFLO – iShares Treasury Floating Rate Bond ETF

TFLO from iShares is extremely similar to USFR. It also launched in early 2014, and it also has an expense ratio of 0.15%, but it is less popular with about $6B in assets.

TFLO even tracks the same index as USFR, the Bloomberg U.S. Treasury Floating Rate Index. It has a weighted average maturity of a little under a year and an effective duration of about 1 week.

TFLO has an SEC yield of 4.94%.

FLOT – iShares Floating Rate Bond ETF

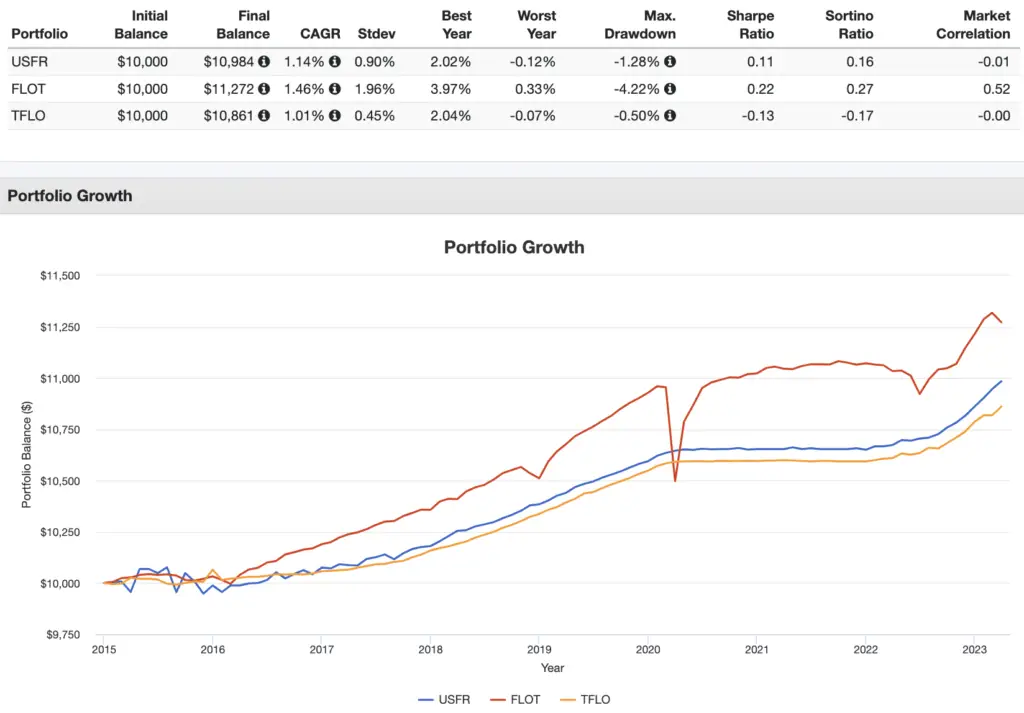

Whereas USFR and TFLO both hold treasury floaters, FLOT is iShares's offering for broader investment-grade FRN's, mostly from corporations, so we're talking more credit risk. That has shown up historically in its much greater volatility and drawdown:

FLOT has roughly $7B in assets, launched in 2011, and has an SEC yield of 4.74%.

The fund seeks to track the Bloomberg U.S. Floating Rate Note < 5 Years Index and has a weighted average maturity of nearly 2 years, an effective duration of about 2 weeks, and an expense ratio of 0.15%.

Where To Buy These Floating Rate Bond ETFs

All the above ETFs for floating rate bonds should be available at any major broker. My choice is M1 Finance. M1 has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, intuitive pie visualization, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

What do you think of floaters? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply