Black swan events are impactful and unpredictable. The Amplify BlackSwan Growth & Treasury Core ETF (SWAN) was designed to protect against them. Let's dive into it.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

What Is a Black Swan Event?

The term black swan is used to describe an extremely rare, inherently unpredictable event that has severe negative consequences. It has also been noted that hindsight bias is unusually common with black swan events, with people later claiming the event should have been obvious at the time.

Notable examples of black swan events include:

- 1987: Black Monday

- 1997: Asian Financial Crisis

- 2000: Dot-com Bubble

- 2001: 9/11 Terrorist Attacks

- 2008: Financial Crisis

- 2010: Flash Crash

- 2020: Global Pandemic

Future black swan events could be:

- Trade war

- Inverted yield curve

- Economic recession

- Eurozone political issues

- Policy shift on technology companies

- etc.

The idea of black swans was proposed by famed professor, author, and former trader Nassim Taleb. He has written several popular books on the concept of black swans and human beliefs related to risk and the asymmetry thereof. Some black swans do not necessarily result in bear markets. The point is we can't predict how markets will react to them. Taleb asserts that because of the inherent unpredictability and significant impact of black swan events, investors – and people in general – should remember that they are possible and should plan accordingly.

Enter the SWAN ETF from Amplify

The BlackSwan ETF from Amplify was designed to do just that – protect against these unpredictable, adverse events. Appropriately, its ticker is SWAN. The fund, which launched in 2018, is designed to be a relatively safe, conservative investment vehicle that is still able to capture some upside while being more concerned with protecting the downside. Roughly 90% of the fund is invested in intermediate U.S. treasury bonds, with the other 10% in long-dated call options (LEAPS) on the S&P 500 (specifically, the SPY ETF) that target 70% participation (i.e. option delta of 70). In this sense, the fund's target notional exposure can be described as 70/90 stocks/bonds. The fund's proprietary index is the S-Network BlackSwan Core Total Return Index, which is rebalanced and reconstituted on a semi-annual basis.

Just like NTSX, the classic 60/40 Portfolio, and the famous Hedgefundie Adventure strategy, SWAN relies on the uncorrelation between stocks and treasury bonds, which tends to be conveniently amplified during periods of market turmoil, as treasury bonds tend to be the best diversifier (i.e. lowest correlation) for stocks. This diversification takes advantage of the flight to safety behavior that typically causes investors to rush into treasury bonds when the stock market is crashing. Interestingly, unlike other defensive funds that use active management to attempt (unsuccessfully) to time the market, SWAN doesn't change its asset allocation and doesn't limit upside gains in order to provide its defense. We would expect it to lag the market in bull markets, but it is still able to participate in them.

An intrinsic feature of SWAN's ITM LEAPS on SPY is that its call option exposure grows as the stock market rises, and shrinks as the market falls. This means the fund participates increasingly more in stock market gains in bull markets and gets more protective as the market drops. That said, the fund still rebalances twice per year.

Here's the video from Amplify themselves:

SWAN vs. NTSX

This fund reminds me of and is similar to NTSX from WisdomTree, but whereas NTSX is built for stock market participation with a secondary goal of downside protection, SWAN was sort of built for the opposite – downside protection and volatility minimization as the primary goal, with market participation (and specifically, above-inflation returns) being secondary. Also keep in mind that WisdomTree's stated use case for NTSX is to use it to make room for other assets.

That said, these funds are pretty similar. In terms of exposure, NTSX is 1.5x 60/40 for effective 90/60, and SWAN is roughly 1.6x 44/56 for effective 70/90. Note that NTSX's treasury bond futures ladder has an effective average duration of about 7 years, while SWAN's treasury bond ladder aims to match the duration of the U.S. 10-Year Treasury Note.

Also note that SWAN is slightly less tax-efficient than NTSX, as SWAN is holding 90% treasury bonds and 10% SPY call options, while NTSX is holding 90% straight stocks and 10% treasury futures.

Both funds are suitable for use as the core of the portfolio.

SWAN vs. DRSK

Let's briefly touch on DRSK from Aptus. This fund launched around the same time as SWAN and is similar in terms of allocations, but different in terms of actual holdings. My guess is they got wind of the existing BlackSwan index and basically copied it but also tried to differentiate just so they don't look exactly the same, but this might be totally false.

Unlike SWAN, DRSK is very much actively managed. Like, actual active management.

The fund invests “75-95%” (pretty vague, wide range if you ask me) of assets in a bond ladder with an effective intermediate duration, not unlike SWAN, but for some weird reason, DRSK uses entirely corporate bonds. We know treasury bonds should probably be preferable in diversified portfolios, especially in this context of mitigating volatility and risk.

The fund then takes about 5% of assets and buys call options on stocks, again not unlike SWAN. But here, DRSK buys call options on a handful of “10 to 20” individual stocks and sectors, and purposefully avoids indexes for this piece. That seems pretty silly to me, considering we know the data indicates that stock picking tends not to work. In their words, “a basket of options is greater than an option on a basket.” I disagree.

Then the fund takes 1% of assets and buys an undisclosed “market hedge,” which seems to change. This sounds like it would be something like gold, right? I think that'd be useful. But nope. Most recently, this allocation went to put options (betting against) on the NASDAQ 100 Index and the S&P 500 Index. So we're simultaneously betting on the growth of a handful of individual stock picks and betting against the broader market. Seems weird to me.

In their brief history, SWAN has outperformed DRSK.

And of course, all this comes with a higher fee of 0.78% for DRSK. No thanks.

SWAN ETF Performance

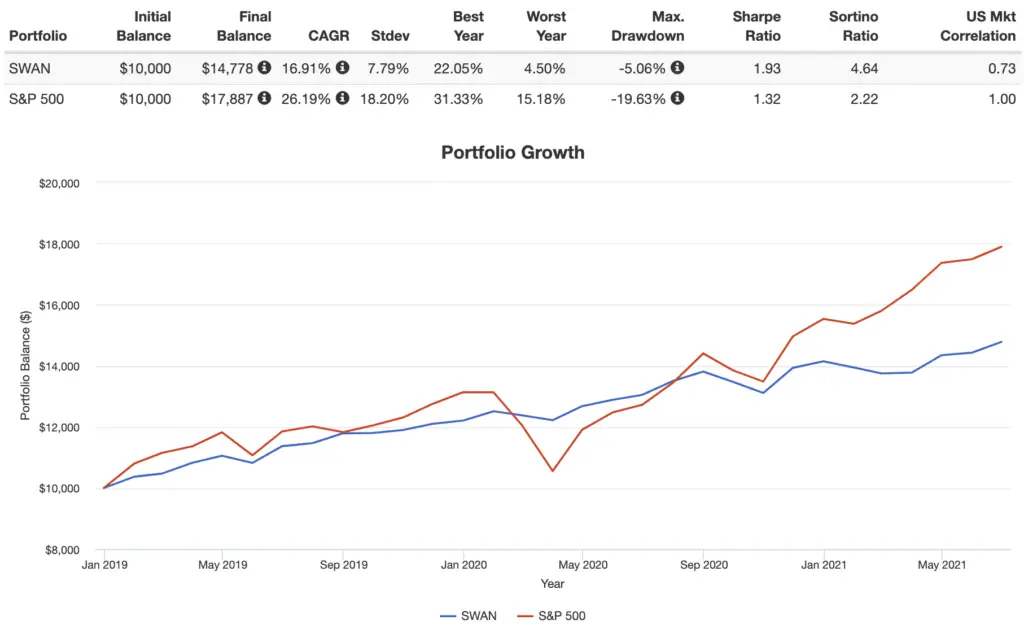

SWAN has definitely delivered on its promise in its relatively short lifespan thus far. When the market fell roughly 17% in the Q4 2018 correction, SWAN fell only about 4%. When the market dropped by 30% in the crash in March, 2020, SWAN dropped by 8%. Here's a backtest going back to SWAN's inception in December 2018, through June, 2021:

As we'd expect, SWAN has lagged the market in terms of total return but has delivered a much higher risk-adjusted return. Notice its volatility is less than half that of the S&P 500, and its max drawdown during this time period was 1/4 that of the market.

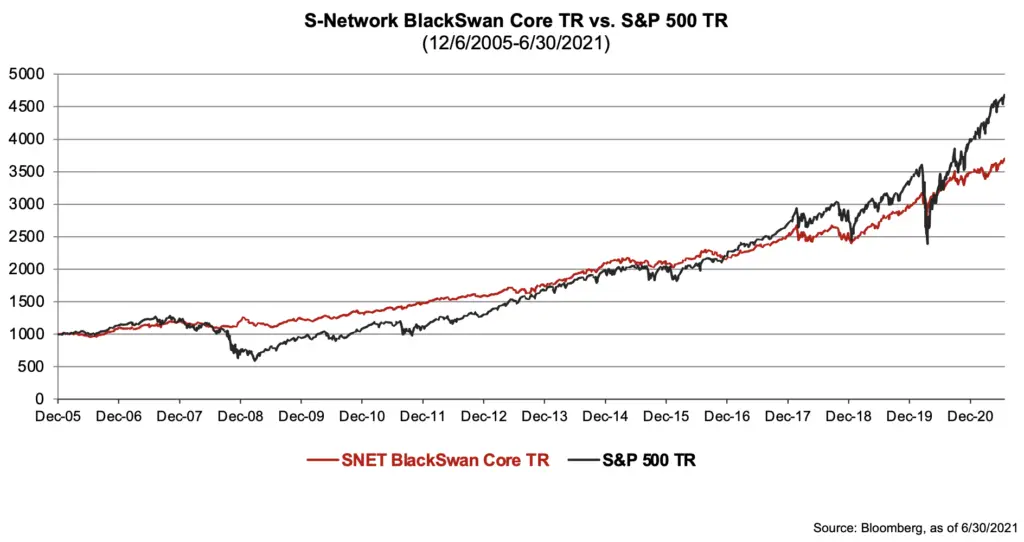

We can go a little further back to 2006 using SWAN's index data directly from their website. Here's the historical performance versus the S&P 500:

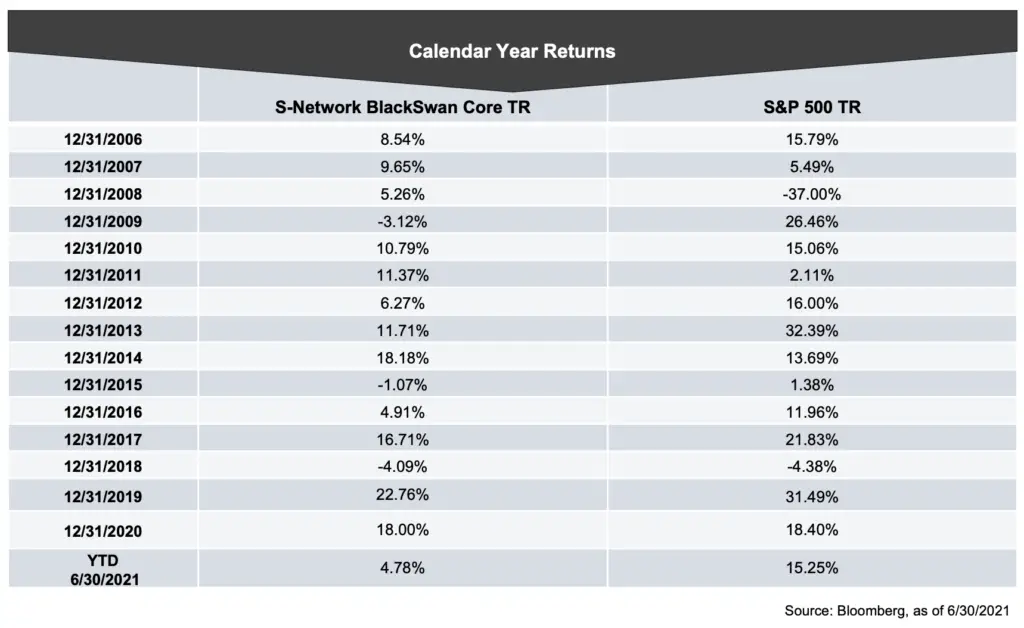

Here are the annual returns for that:

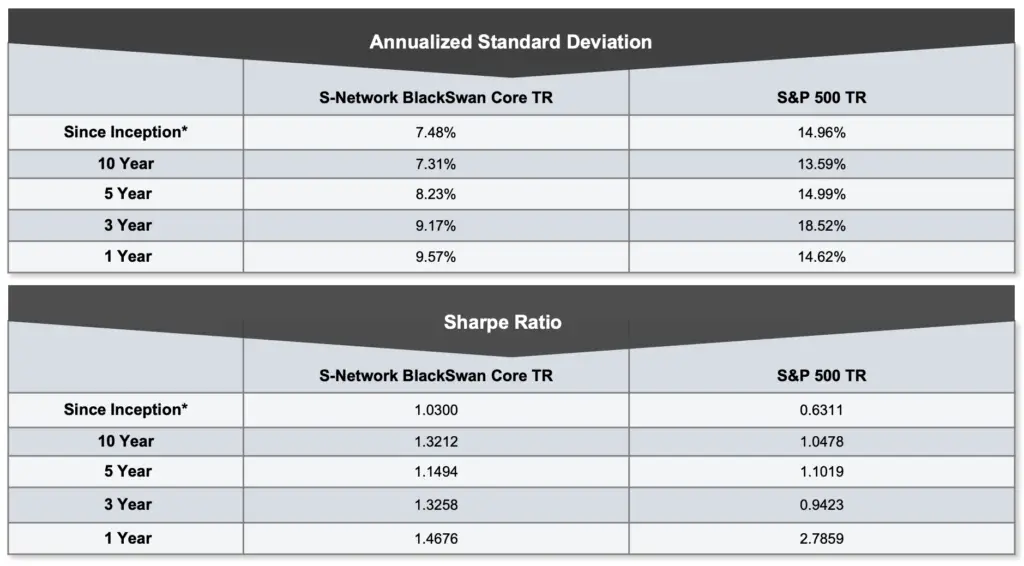

Here are the volatility (st. dev.) and risk-adjusted return (Sharpe) metrics over that time period:

Here's another stat illustrating SWAN doing its job. Looking at the GFC of 2008, the S&P 500's peak-to-trough drawdown was 55%. SWAN's index was less than 1/4 of that at a mere 13%!

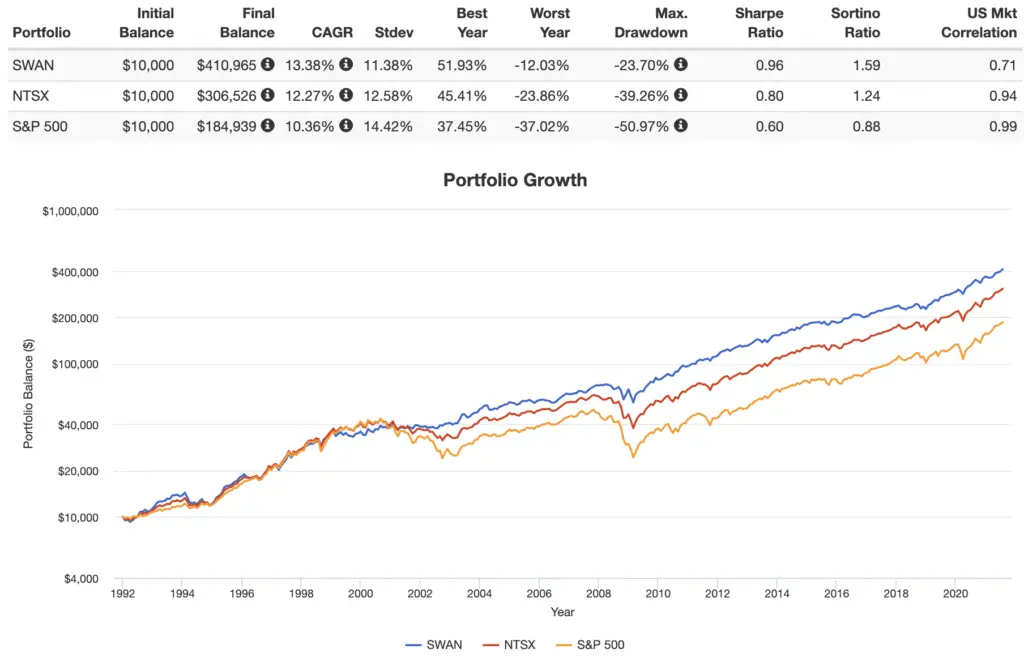

While we can't backtest options, we can get a very rough idea of how SWAN might have behaved prior to the inception of its index using its target notional exposure of 70/90 using the S&P 500 and 10-year treasury bonds. Again, this is a very rough approximation and the fund itself would have certainly looked different due to the aforementioned dynamic nature of the allocation from the 70-delta options. I've compared it to another rough approximation of NTSX and the S&P 500 below going back to 1991, during which period these funds would have provided returns above that of the market with lower volatility and risk:

Keep in mind this period was a great time for bonds, which helped result in the market outperformance. Moreover, since both SWAN's exposure to bonds and its bond duration are considerably greater than that of NTSX, this also would have allowed for SWAN's comparatively greater performance over this time period. The future may look different.

So we know SWAN is for de-risking the portfolio and for protecting against black swan events. Let's briefly talk about a way to do that further.

As I've noted many times elsewhere, I'm not a big fan of gold, but there are a couple things it does do: reduces portfolio volatility and risk due to its usual uncorrelation to both stocks and bonds, and hedges against uncertainty. A perfect descriptor of a black swan event is uncertainty. And since the SWAN investor is likely more concerned with the portfolio's volatility and risk than with maximizing its returns, I'd argue this is one of those instances where the addition of gold may make sense.

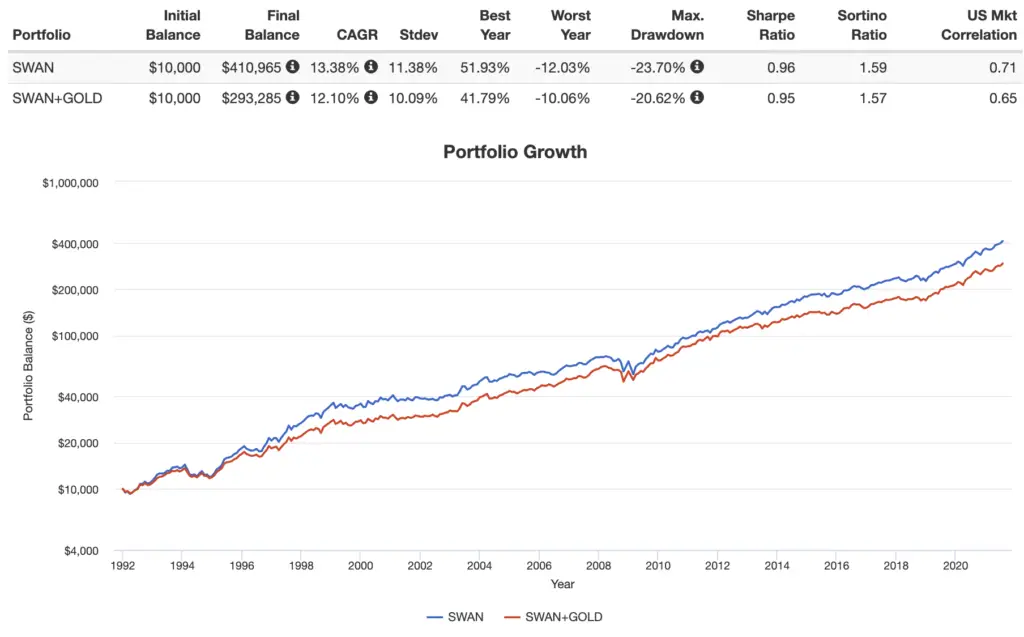

Let's look at a rough idea of how this might have played out historically for SWAN if we set it at 80% and add 20% gold, again from 1991 through June, 2021:

Notice how we would have sacrificed a bit of CAGR for slightly lower volatility and, arguably more importantly, a slightly smaller max drawdown. Admittedly, the results don't look super impressive, but I'd argue this will likely be a more prudent move for the future given the current historically-low yields of bonds, as bonds may not provide the same level of protection (or returns) in the future that we've seen in the recent past. So as usual, it comes down to how far you want to slide on that scale of risk and expected return.

I've created that 80/20 SWAN/gold pie here for anyone interested.

Conclusion, and Where To Buy SWAN

In my opinion, SWAN looks extremely attractive for a risk-averse investor looking to minimize volatility and protect against drawdowns but still get some market participation so as not to miss out on any potential upside. It is also appropriate for those at or nearing retirement, for whom market crashes are more detrimental. This fund focuses on minimizing volatility and drawdowns and navigating them unscathed, which it has demonstrated it can do quite effectively. Adding a dash of gold may improve that effort even more going forward.

SWAN provides what I'm a fan of: leveraged exposure to uncorrelated assets. Funds like SWAN make it more likely that the investor will stick with their strategy and “stay the course” through market turmoil, and I'm always trying to encourage that.

SWAN's fee of 0.49% is obviously high compared to simply broad index funds from Vanguard like VTI, for example, but is actually on par with others for this type of options rolling strategy. You can choose to buy these same assets and roll the LEAPS yourself, or pay 49 basis points for the convenience of having someone else do it for you. I still wish SWAN were a bit cheaper, considering NTSX is less than half the price at only 20 bps, but you're paying for a slightly more complicated strategy. You can arguably get cheaper SWAN-like exposure by just buying NTSX plus some extra longer-duration treasury bonds and then levering that up a bit more with margin, if you wanted to go that route, but admittedly I haven't done the math on whether or not that would actually save you anything.

In January, 2021, Amplify launched an international version, for which the ticker is ISWN, which may be a good addition for diversification considering SWAN only uses U.S. stocks. However, it's only amassed about $30 million so far.

At this point, SWAN should be available at any major broker. My choice is M1 Finance. The broker has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, and a modern, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

What do you think of SWAN? Let me know in the comments.

Disclosure: I own NTSX.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hi, is there an equivalent for the UK investor?

Not sure.

Hey John,

Any thoughts on SWAN’s performance during the first quarter of 2022? For an ETF that was supposedly designed to have good downside protection, it doesn’t seem to be fairing too well as its down over 18% from its November 2021 high. SPY for comparison, is only down 8% from its high to today.

While we saw some level of upward movement in SPY during the latter half of March, SWAN has continued to nosedive. Is it worth sticking with it at this time? And how much should I be kicking myself for purchasing SWAN to hedge against a market downturn in early January instead of just buying the underlying index?

SWAN is leveraged stocks and bonds. Stocks and bonds are both down YTD. SWAN is designed to protect against black swan events based on the “flight to safety” aspect of US Treasuries. As usual, always understand exactly what you’re buying and why you’re buying it, take a long term view, stay the course, and ignore the short-term noise.

I think swan is only useful for fairly short term instantaneous events with a fairly short recovery time. Not so good for secular slow motion downtrends/general stagnation. Someone needs to come up with a portfolio for that. I think this will be the case for the next couple of years. I’ve been selling puts just below where I think they’ll get assigned on only ETFs I wouldn’t mind getting stuck with. The general fear is working for me. Haven’t been assigned in a few months. making around 5k a month

Is there a place on your website I can easily compare a list of all the lazy portfolios for draw down, returns, and other stats all in one list/page without looking at each one?

No. I may try to create this in the near future.

Did you ever create this?

I actually completely forgot about this idea and never did. I’ll start working on it this week!

Emily, I ended up cranking that out today. It’s now on the Lazy Portfolios page here.

SWAN’s 2022 performance doesn’t seem impressive. It fell the same as the market. Probably because of increasing interest rates. You might get hit from both stocks and bonds for the next few months as rates rise and stock market falters, SWAN could be worse than SPY. I wonder how it would have done from 1960 to 1985. Makes you wonder what uncorrelated asset one can use to protect us from the next downturn coming? Bonds 40yr bull run might be over.

Did you mean 2021? We’re less than 2 months into 2022. Gold may be a prudent addition, or put options via something like SPD or TAIL.

No he means 2022. SWAN has been on a downside since the third week of December 2021. Deviating from DIVO significantly. The last three months for SWAN have been the historically worst performance of the ETF.

I questioned it because I’m not sure why anyone would focus on 3 months of performance. SWAN is leveraged stocks and bonds. Stocks and bonds are both down YTD.

Less than 1% yield? We sure can see you don’t need money to pay for your daily stuff

You don’t need “yield” to “pay for your daily stuff.”

Hi John,

I am learning a lot from your posts! Thanks so much for your efforts, etc.

After reading about SWAN, I am considering using it instead of TMF in a Hedgefundie type portfolio. Just curious. What do you think?

Thanks again!

Tony.

SWAN is not a bond fund and would not make sense as a TMF replacement. SWAN itself is actually basically a watered version of the original risk parity Hedgefundie strategy.

Hello from South Korea. Thx for your insightful post-! I really appreciate it. If you don’t mind, could let me know how you backtested SWAN in Portfolio Visualizer? I for myself want to know how SWAN would have fared at least including 2008 financial crisis. It doesn’t mean that I don’t trust your material. I just want to find out by and for myself :). Again, Thank you very much for your detailed post -!!!!

As noted, I just used mutual funds for the S&P 500 and intermediate treasury bonds to get a very rough idea of what SWAN might have looked like, since we can’t backtest options.

As a retired investment advisor I recently found SWAN and like it a great deal. My strategy is to fund my securities account 100% SWAN and use aggressive long and inverse ETF’s as short term trading vehicles with margin. Too soon to tell the outcome but looks very promising.

I only discovered this site yesterday and I have been reading several of your articles. You write very well and your analyses are spot on. Although, I am a retired oldie, I am particularly keen on trying out SWAN, NTSX OR UPRO/TMF strategies on a small portion of my retirement assets. I am not sure if I should start with SWAN or try out the more exotic Hedgefundie.. I am writing this comment just to tell you that you are providing very useful information to potentially any type of investor. Keep up the good work.

Thanks, Mal!

Something like a 70/10/10/10 allocation of SWAN, TAIL, TIPS, and gold seems like it could make sense for someone nearing retirement age and needing to limit drawdowns and hedge against inflation or a major crash. SWAN is your primary market fund and the other assets do their diversification job through being relatively uncoordinated with the market. Thoughts?

Wanted to add, I just found your site a couple of weeks ago and it’s been an absolute wealth of information to dive into. It’s really appreciated.

I was thinking the same thing. Or perhaps a portfolio something like 35% NTSX; 17.5% NTSI; 17.5% NTSE; 10% EDV; 10% VGIT; 10% VGSH for an effective exposure more like 63 stocks/72 treasuries with a lot cheaper expense ratio.

This was an excellent article! I still had a question: might an ETF like this be used to achieve better protection? https://www.globalxetfs.com/the-case-for-tail-risk-etfs/

Thanks. Possibly; impossible to say. In order to move, OTM put options require a significant and sudden market crash like ’08. I just covered SPD and this idea of tail risk here.

Hey John,

Wanted to thank you for the great content you’re making available. Feeling that I’ve learned a lot from the various Lazy portfolios that you’ve dissected for us. I’m a newbie but I hope that I am at the point where I’ve gain enough knowledge to start building out my own portfolio and I wanted to get your input on whether or not i was thinking about them correctly. I really like the simplicity of the traditional 60/40 but I am thinking that 60/40 NTSX/SWAN portfolio would be even better. By better I mean improved returns for similar volatility and drawdowns compared to a traditional 60/40 portfolio. I also really like the extra protection from the call options in the event of market crash. Please let me know if that combination has a reasonable expectation to surpass the traditional 60/40 or if I should just be better off with the traditional approach considering the added complexity and fees for the NTSX/SWAN combo.

Thank you

Thanks for the kinds words, Julian! Wouldn’t make much sense to combine NTSX and SWAN; they’re pretty similar. Both NTSX and SWAN are just leveraged versions of the traditional 60/40. Impossible to know the future.

Thank you for reviewing this interesting ETF. Is there a way to backtest its performance using the My Portfolio feature on the portfoliocharts website? I’d like to see how it held up during the 1970’s, as some financial advisors are saying the foreseeable future might be similar to the stagflation of that decade.

Not sure. Probably not. You can get a very rough idea using its target allocation of 70/90, but this shifts substantially with the actual fund so it would not match the fund’s actual behavior.

Planning for and now retired, SWAN has been an important part of my financial protection and appreciation plan. SWAN has worked well. Often, I have considered going all into SWAN. But, I need monthly income too and diversification is most important. Thanks for the info.

Awesome. Thanks for commenting, Pete!

Hello John,

Thanks for your fine investment site. So if I wanted to have an allocation of 50;50 stocks:bonds and I used SWAN, IVV and a foreign bond fund (FBF) what would the pie look like? Thanks, Carolyn

You’d have more than 50/50 if you’re using SWAN at all. It is leveraged. SWAN’s target exposure is 70/90 stocks/bonds. A simple 50/50 would be something like 50% VT and 50% GOVT.

John,

Sorry. I must be thinking of risk parity. I read somewhere that SWAN can help make room for further asset diversification in a defensive portfolio. Not sure it was you who mentioned it on this site (?) also that an estimated risk parity for SWAN is 40:60 stocks;bonds? Am I still talking apples/oranges here?

Thanks!

Probably not “defensive” but you may be thinking of Wisdomtree’s proposed use case for NTSX.

John,

Yes. I must’ve read that on your write up of NTSX and confused it with SWAN. It was under subsection “NTSX vs. SWAN” that you wrote:

“NTSX is not unlike SWAN, though SWAN is designed more specifically for downside protection to hedge against black swan events, as the name suggests, aiming for 70/90 stocks/bonds exposure through options contracts on the stocks side. SWAN also commands a much larger fee and would be comparatively less tax-efficient than NTSX. Also keep in mind that WisdomTree’s stated use case for NTSX is to use it to make room for other assets.”

Any idea why NTSX would be better than SWAN to use to make room for other assets (in a portfolio of someone of retirement age)?

thanks, Carolyn

They could be used similarly. I probably wouldn’t be using leverage in retirement anyway though.

I recently found your web site and have been reading it voraciously. Thank you for all your hard work in presenting this information.

About SWAN, do you consider it a replacement for bonds? Could someone do the 60/40 porfolio with all 40% in SWAN and have the same diversification and low correlation that bonds normally provide?

Glad to hear it, Jay! Thanks for the kind words. I’m happy that you’ve found the content useful. No, SWAN would definitely not be a replacement for bonds. Its target exposure is 70/90 stocks/bonds, so you could think of it basically like a moderately conservative 40/60 portfolio that is levered up a bit to juice returns so that we don’t have to sacrifice return for more downside protection from the bonds. That’s the idea, at least; of course we can’t know what the future holds, which is why I noted it may be prudent to toss in a dash of gold as well if one desires lower risk.

Great site; thanks. I don’t understand the SWAN allocation. You say in your introduction that; “roughly 90% of the fund is invested in intermediate U.S. treasury bonds” but then in this post that the SWAN target exposure is 70/90 stocks/bonds.

What am I not understanding? Thank you.

Those statements are both correct. 70% stocks, 90% bonds.

Happy 2022 John!

So I noticed that SWAN lost @ 4% today. Am I correct that it might have something to do with interest rate increases in treasuries? There was a lot of selling activity today, and I’m not sure what that was about, Selling LEAPs maybe? Anyway, I’m thinking of trying to buy on the open, but I would rather be more certain about what is going on re: the 4-5% drop and the relatively large selling volume.

Thanks!

Stocks rose modestly and treasuries dropped pretty significantly. SWAN is 90% treasuries. Usually impossible to say for sure what causes market movement on a single day. Would suggest not trying to time the market.

Some things worth noting:

It seems that (unlike NTSX) SWAN isn’t very tax efficient. It keeps all the interest from Treasuries as ordinary income, and turns some qualified dividends and LTCG into ordinary income.

Additionally, I recall the bogleheads forum discussing this fund in March 2020 and determining that one thing to potentially be wary of is the current holdings at the time of purchase. At that time it had only 1% S&P options contracts and 99% Treasuries. That’s a little scary to buy into to say the least and emphasizes the riskiness of this fund imo.

Not something I’d own, but it’s an interesting fund to wrap one’s head around.

Replying to myself to note that I looked into the fund more and find it interesting. It’s certainly worth consideration for a loss-averse investor.