Webull and Robinhood are probably the two most popular modern trading platforms with zero fees, offering simplicity and sleek mobile apps and interfaces. Here we'll compare Webull and Robinhood.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Webull vs. Robinhood – Summary Comparison

Contents

Webull vs. Robinhood – Commissions and Fees

Neither Webull nor Robinhood has commissions on trades. Neither has account fees aside from obvious miscellaneous one-time fees for things like paper statements, outbound account transfers, etc.

Robinhood does have a premium account option called Robinhood Gold that costs $5/mo. ($60/year) and gets you access to professional research reports, deeper market data, margin, and instant deposits.

Webull vs. Robinhood – Account Types

Webull offers these account types:

- Taxable

- Margin

- Traditional IRA

- Roth IRA

- Rollover IRA

Robinhood only offers a standard individual taxable account at this time, with optional access to margin trading with their premium $5/mo. membership. Robinhood does not offer retirement accounts.

Neither platform offers:

- Joint

- Custodial

- SIMPLE IRA

- Solo 401(k)

- 529

- HSA

- Non-Profit

Webull vs. Robinhood – Investment Products

Both Webull and Robinhood offer individual stocks, ETFs, cryptocurrency, and options.

Neither brokerage offers mutual funds.

Webull vs. Robinhood – Customer Service

Webull seems to have great customer service.

Robinhood has somewhat of a reputation for being slow or unresponsive at times with their customer service, and famously doesn’t have a published phone number.

Robinhood Outages and Other Issues

More concerning is the fact that Robinhood experienced outages on 3 days during one week in March 2020, which they stated was caused by “stress on our infrastructure—which struggled with unprecedented load.” One of these outages lasted an entire trading day. This was obviously very frustrating and concerning for users, especially considering these were high-volume, high-volatility days in the stock market.

Robinhood users have since filed a class-action lawsuit against the platform, alleging that “Robinhood had a duty to provide a system and platform ‘robust enough’ to handle that trading volume and have a backup system to handle outages.”

In December 2020, the SEC fined Robinhood $65 million for misleading users about its selling of order flow between 2015 and 2018, meaning users got worse trade execution prices than the platform claimed. Robinhood maintains that these were “historical practices that do not reflect Robinhood today.”

In the same week, the Massachusetts Securities Division filed a lawsuit against Robinhood, alleging that the broker uses “gaming strategies to manipulate customers” to execute more trades in order to boost fees, thereby taking advantage of inexperienced investors.

There are also many user complaints such as these of the site being “frozen,” orders not going through, inability to login, etc.

One could argue that these events may cause Robinhood to improve their infrastructure going forward to make sure this doesn't happen again in the future. On the other hand, it is concerning considering other brokers did not experience these outages and issues during that same time period. I’ve already seen many users running from Robinhood in droves and finding alternatives in platforms like Webull, M1 Finance, etc. It will be interesting to see how things go going forward for Robinhood.

Perhaps most importantly, Robinhood users have been fleeing en masse after the broker's recent stance on temporarily blocking users from buying stocks like GameStop ($GME) and AMC Entertainment ($AMC) during the massive short squeeze event. As of February 1, 2021, over 33 federal lawsuits have been filed against the platform across the country, citing securities trading and consumer protection violations, which add insult to injury after Robinhood hid the fact that it sold order flow and gave users worse trade execution prices.

The name of the platform now seems ironic, considering Robinhood seems to be placating hedge funds and Wall Street hotshots – at the expense of retail investors – at every turn.

On June 30, 2021, FINRA fined Robinhood $70 million for “systematic supervisory failures.”

Webull vs. Robinhood – Mobile App

Webull and Robinhood both have sleek, modern, intuitive, robust mobile apps for both Apple iOS and Android. I did find the Robinhood app slightly less intuitive than Webull's.

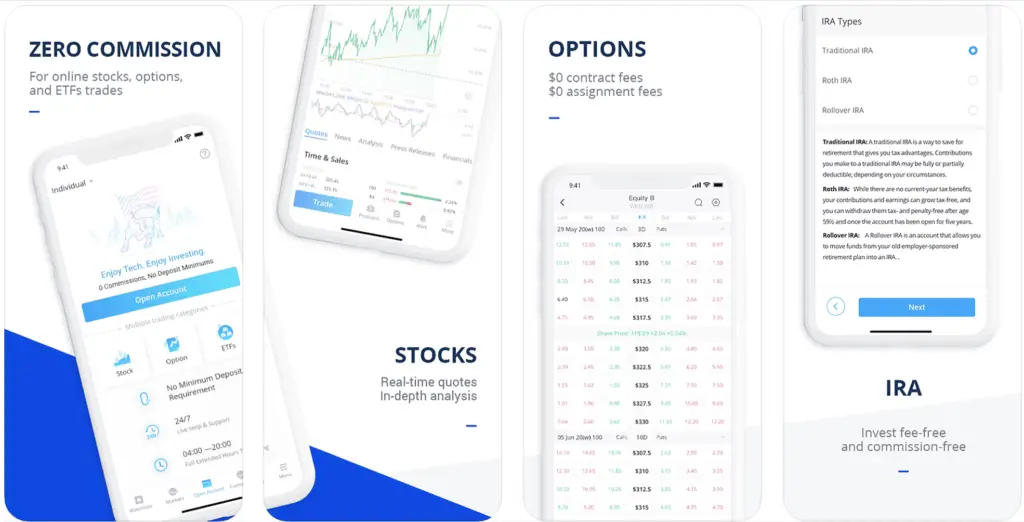

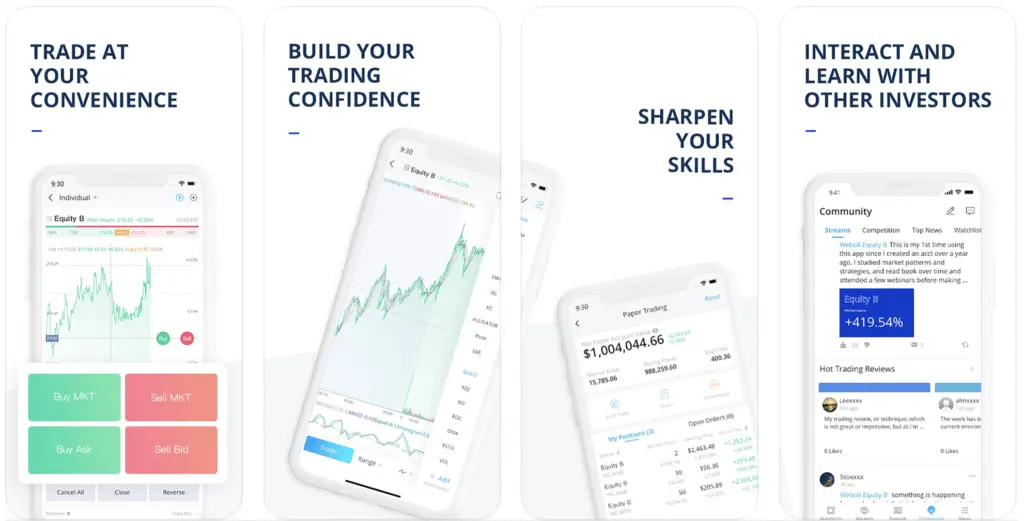

Here are some screenshots of the Webull app:

Here are some screenshots of the Robinhood app:

Webull vs. Robinhood – Interface/Usability

Webull and Robinhood both have intuitive, user-friendly interfaces that should be familiar to semi-experienced investors and traders. Again, I felt like the Webull interface was slightly better than Robinhood's.

Webull vs. Robinhood – Margin

Robinhood wins out on margin rates. Below are margin rates for a $100,000 margin loan:

- Webull – 6.49%

- Robinhood – 5.00%

Note that Robinhood requires you to pay for their $5/mo. premium membership to access margin, so depending on how much you're borrowing, you may actually come out cheaper with Webull if the difference in interest is less than $60/year.

Webull vs. Robinhood – Extra Features

- Robinhood's extended trading hours are 9am – 6pm. Webull's extended trading hours are longer, from 4am – 8pm.

- Robinhood offers an optional checking account with debit card and 0.30% APY. Webull does not have a checking account.

- Robinhood Gold, at $5/mo. ($60/year), gets you access to margin, professional research reports, and deeper market data. Webull users get free access to NASDAQ TotalView for 90 days.

- Webull has a dedicated desktop trading application for advanced users. Robinhood does not.

- Robinhood and Webull both support fractional shares.

- Both platforms support dividend reinvestment.

Webull vs. Robinhood – Summary and Conclusion

- Neither Webull nor Robinhood charges trade commissions and account fees. Robinhood has an optional $5/mo. premium membership called Robinhood Gold that is required to access margin and professional research reports.

- Webull offers taxable, Traditional IRA, Roth IRA, and Rollover IRA accounts. Robinhood only offers taxable brokerage accounts. If you want access to retirement accounts, go with Webull.

- Both Webull and Robinhood offer stocks, ETFs, crypto, and options.

- Webull offers longer extended trading hours from 4am – 8pm. Robinhood's extended trading hours are 9am – 6pm.

- Webull has solid customer service. Robinhood’s customer service and overall stability seem questionable.

- Webull and Robinhood both have great mobile apps for both Apple iOS and Android.

- Webull's margin rate is 6.49%. Robinhood has a 5.00% margin rate but requires the $5/mo. subscription. If you want access to cheaper margin, consider M1 Finance.

- Robinhood offers an optional FDIC-insured checking account. Webull does not have a checking account option.

- Neither platform supports automatic rebalancing.

- Robinhood and Webull both support fractional shares.

Your choice between these two investing platforms should come down to whether or not you need access to retirement accounts, margin, and a checking account. If you're more of a long-term buy-and-hold investor and don't care about short-term trading and security analysis, go with M1 Finance.

Perhaps most importantly, the customer service and overall stability of Robinhood as a brokerage seem questionable to say the least, given the widespread user complaints and pending lawsuit over its March 2020 outages. I'd be inclined to go with Webull. You'll get 2 free stocks from Webull upon signing up and funding your account after using the link below.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

When I was growing up as a boy in Bulgaria…

ROBINHOOD made $330,000,000 in Q1 of 2021 in payments for order flow from Citadel Securities, who just happens to be the most crooked hedge fund sand market maker on Wall Street. There is a painfully obvious conflict of interest here. Orders placed on ROBINHOOD get routed through Citadel’s dark pool, which means the investor gets a worse execution prices on their trades. Not to mention the even more disgusting problem.. Citadel is a massive hedge fund, and the reason they want retail order flow coming through them is so they can front run your trades.

DO NOT USE ROBINHOOD. PERIOD.

Robinhood halted my request to sell right when my stock went up by 200%. What a RIP off robinhood is…I slammed my account closed with no recourse from the sec so you better think twice about Robinhood. I literally watched my entire balance disappear cuz of ” technical difficulty” it was restore minutes later but still terrifying… beware!

I dislike how Robinhood has no actual transaction fees, but they mark up the sale price by about 2%. Also, when you sell they chisel your sale price down about 3%. In the end, you wind up paying about a 4-6% fee. I don’t know if nor by how much WeBull manipulates prices to their advantage.

Yes, RH is being sued over their selling of order flow and miscommunication regarding price execution.

Robinhood offers limited extended trading hours. You’re allowed to trade from 9am to 6pm. Webull allows full extended trading hours. You’re allowed to trade 4am to 8pm.

Thanks!

I believe you overlooked an important factor. Trading hours. Robinhood only allows you to trade from 9am-6pm. Webull allows 4am-8pm. That was my reason for switching. You brought up other good points as well.

Thanks!