What if I told you there’s a way to get the risk-free return of T-bills but in a way that’s more tax-efficient than buying T-bills directly or buying a T-bills fund like SGOV? Here I review the BOXX ETF and why you might want to consider it over your favorite T-bills ETF or money market fund for your cash management needs.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it below. If not, keep scrolling to keep reading.

Intro – Cash and T-Bills (and SGOV)

So for short-term cash-equivalent investments, which you’d use for an emergency fund or for a short-term goal, you’ve got a few pretty standard options like a high yield savings account, certificates of deposit, treasury bills or T-bills for short, and money market funds. These are all about as low as it gets on the risk scale and pay something close to what’s called the risk-free rate, defined as the 3-month Treasury Bill rate. At the time of writing, that rate is around a very appreciable 5%, so these products have attracted more discussion and more investment recently.

The problem with all these is that you’re still taxed on that monthly interest or return because the IRS treats it as income, even if you’re just reinvesting it and letting that money grow inside the account. For example, if I earn $1,000 in interest throughout the year and I have a 22% marginal tax rate based on my income, I’m looking at a tax bill of $220 at the end of the year for that earned interest, even if I never withdrew and spent it. This scenario is actually what happened to me recently – and likely to many of you as well – with my favorite T-bills ETF SGOV.

And while obviously that interest is money you didn’t have previously so it’s all gravy even after taxes, I don’t know anyone who enjoys paying taxes, especially on money that’s not really being used for anything tangible.

But of course, that taxation is simply unavoidable, right? Well, maybe not anymore…

BOXX – The Alpha Architect 1-3 Month Box ETF

Enter BOXX, an ETF from Alpha Architect that aims to deliver the risk and return profile of T-bills but in a more tax-efficient manner. Its full name is the Alpha Architect 1-3 Month Box ETF.

So how does it work?

First, recall that a fund like BIL or SGOV is holding plain vanilla T-bills straightforwardly and just rolling them. Nothing complicated or proprietary going on.

While it may sound counterintuitive, in attempting to resemble T-bills, BOXX doesn’t actually hold T-bills or any bonds at all. It uses highly liquid derivatives to synthetically extract a return resembling the risk-free rate. It does this specifically by simultaneously holding a synthetic long position and a synthetic short position on the S&P 500, and the difference in strike price between those should be close to the risk-free rate of return.

Here's a video overview of the fund from Alpha Architect themselves. Keep scrolling to keep reading.

Box Spreads

This trade is known as a “box spread,” hence the name of the ETF.

If you’re reading this, chances are you’ve never even heard the term “box spread.” They’ve been around for a long time. Let’s look at how they work.

Specific to the S&P 500 Index, a box spread would consist of the following 4 option contracts:

- Long call on SPX

- Short call on SPX

- Long put on SPX

- Short put on SPX

We’ll use a hypothetical example from Alpha Architect themselves to illustrate how the trade works with these 4 contracts.

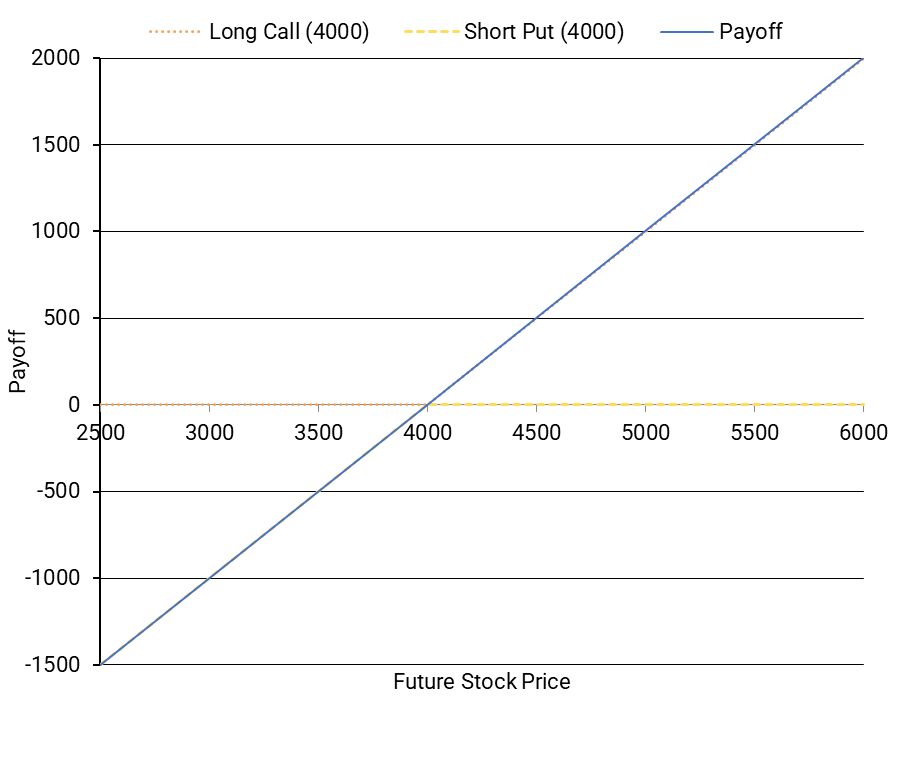

Suppose we buy a call and sell a put on the SPX (contracts 1 and 4 above) with the same 1-year expiration and the same strike price of $4,000.

Notice how the payoff profile in blue resembles that of a long stock position delivered one year from now – if the price goes above $4,000, you make money, and if the stock price goes below $4,000, you lose money.

This is effectively a replication of a stock future created using options, called a synthetic long position. These are also European options, so no early exercise risk.

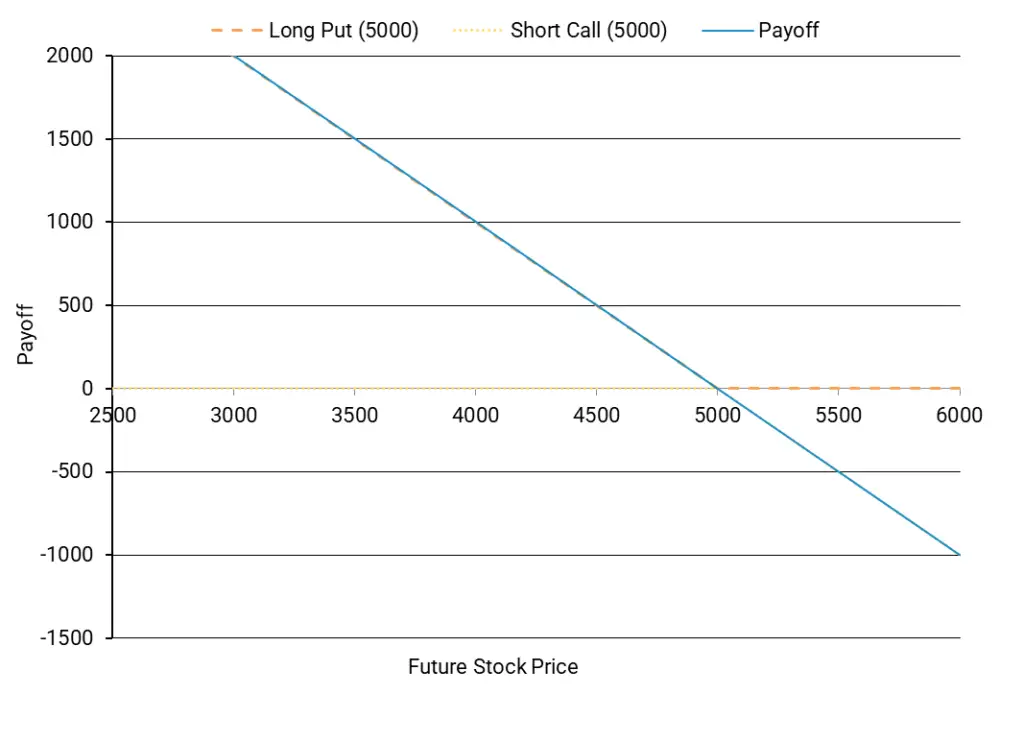

Now let’s look at another position using our other two contracts – buying a put and selling a call with the same strike price of $5,000 and an expiration one year from now.

Here’s what the payoff profile looks like for this position, effectively shorting the SPX, which we’d call a synthetic short. If the price goes below $5,000, we make money, and if the price goes above $5,000, we lose money.

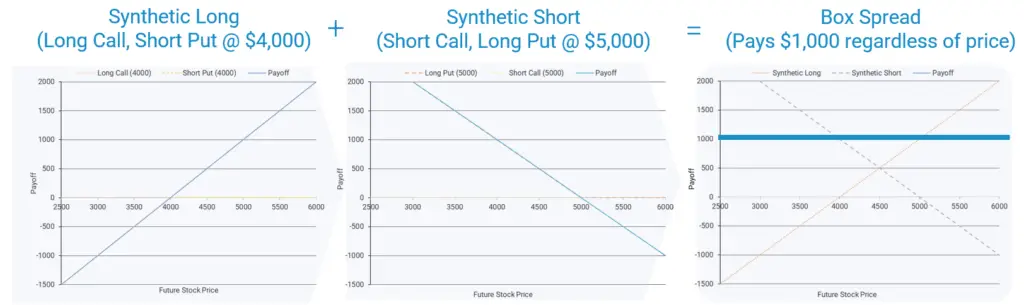

Combining these positions simultaneously effectively eliminates market risk and guarantees a payoff of the spread between the synthetic long and short positions, which is $1,000 in this case, and which is like the par value of a T-bill. Appreciate that this is not a mispricing arbitrage, but rather simply a natural byproduct of the way these contracts are correctly priced.

So we’re guaranteed to get $1,000 one year from now. How much does that $1,000 cost us today? The present value is likely an amount close to the future value of $1,000 discounted by the risk-free rate of 1-month T-bills. Again, using 5% as our implied rate, our hypothetical present value would be $1,000 divided by 1.05 which equals about $952.

Also realize that the price of the underlying index – the highly liquid S&P 500 in this case – and even the prices of the contracts themselves don't really matter that much for our purposes here. We're just concerned with the implied rate, which again is a T-bill-like interest rate, for effectively lending money in the options market.

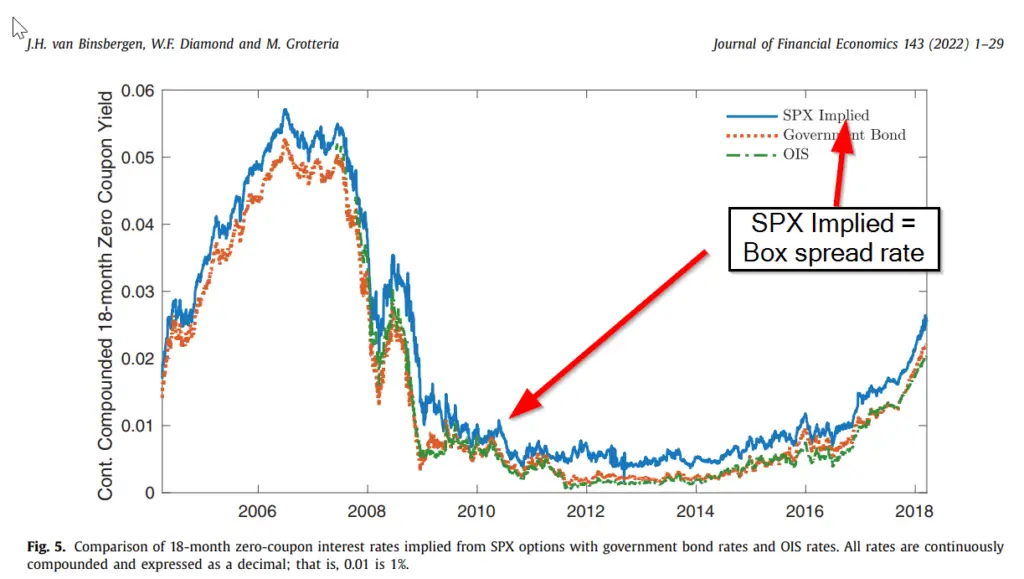

It’s worth noting that historically, box spread rates have always been higher than equivalent treasury bill rates (and we would expect that to continue), likely due to the comparatively greater risk of the former.

So now let’s talk about those risks…

Risks – Is BOXX Safe?

The primary question everyone asks is “Is BOXX safe?” What are the risks of this ETF?

Basically, we’re relying on the counterparty to pay on our options contracts. We call this counterparty risk.

The counterparty for U.S. Treasury Bills is obviously the U.S. government. The counterparty of box spreads is the Options Clearing Corporation, or OCC. While the former certainly sounds safer, S&P Global have actually given these two entities the same credit rating.

It’s also worth noting that the creditworthiness of the OCC has been tested throughout history, and the Fed would likely step in if anything went awry with the OCC (“too big to fail”), so for all intents and purposes, with some hand waving, OCC-backed options have similar counterparty risk to US government debt.

Taxes

Now we get to the reason we’re all here in the first place: taxes!

So again, gains from treasury bills are taxed as ordinary income. That’s about as bad as it gets.

Taxation of box spreads is pretty complicated, but the gist is that options on indexes like the SPX are taxed as 60% long term capital gains and 40% short term capital gains, so we’re already coming out ahead, and then the ETF wrapper provides some additional benefits due to the unique creation and redemption process of the structure (specifically called in-kind redemptions). Put simply, BOXX is using an old tax loophole for ETFs in a new way.

Capital gains are not as friendly for those who live in states with high taxes like California, so the comparison becomes murkier, as T-bills are exempt from state taxes. Obligatory disclaimer to consult your tax professional on your specific circumstances.

In short, BOXX is able to defer distributions and carry forward capital losses of some of the options contracts, and distributions that do happen can be classified as capital gains. The fund was able to avoid distributions completely for 2023.

Performance and Fees

At this point you’re probably thinking, okay, this all sounds nice in theory, but execution is another thing altogether. How has this thing actually performed in the real world?

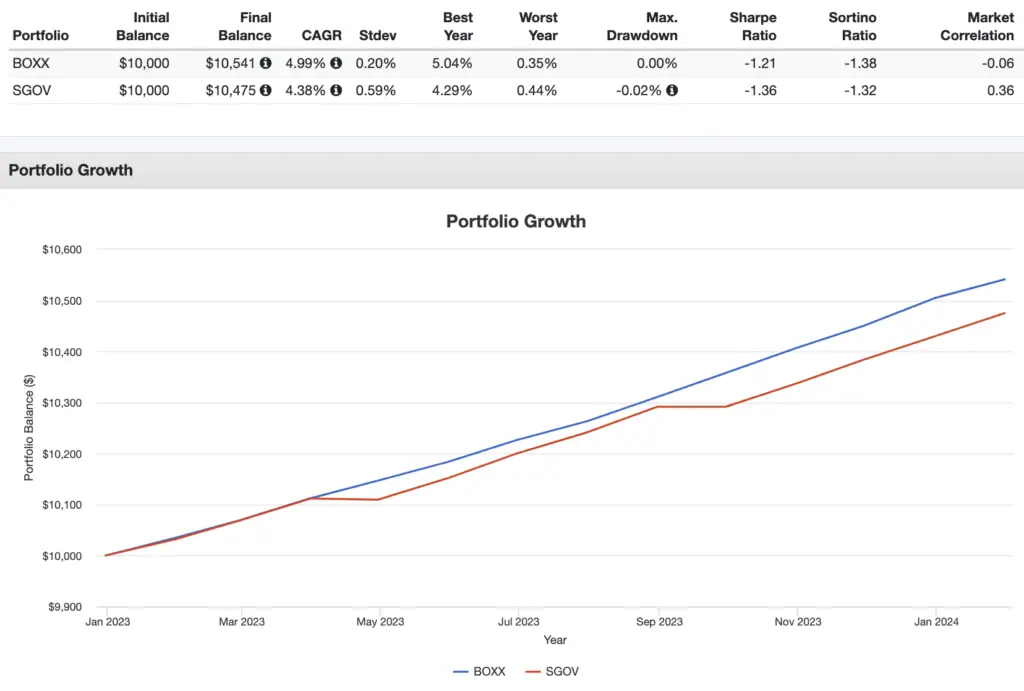

In its short lifespan thus far, BOXX has actually outperformed SGOV, even after its slightly higher fee of 0.19% and before taxes.

It’s worth noting that a fee waiver of 0.20% is in place through 2024 for this fund, so it’s possible it might increase to 0.39% after that, but my armchair estimation is that the box spread premium plus the tax savings should still outweigh that higher fee. Only time will tell.

Conclusion

Worst case is probably that the box spread premium and the fee cancel out, and we’re left with just the tax savings as the main benefit, but of course remember that’s the main reason we started looking at this fund in the first place. Cap gains over income and the deferral thereof are huge benefits for most people.

Savvy investors have wisened up to this idea, as BOXX now impressively boasts over $1 billion in assets after only a little over a year. I think it’s an incredibly clever, innovative product that provides retail investors access to institutional lending rates in an easy, low-cost, packaged solution that requires much less effort and intimidation than implementing a box spread on your own. Wes Gray and the Alpha Architect team spent 7 years figuring out this product.

In the interest of full disclosure, I plan to start gradually moving my own cash into BOXX from T-bills (via SGOV), but I am in no way affiliated with Alpha Architect.

Conveniently, BOXX should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of the BOXX ETF? Do you own it? Are you planning on buying it? Let me know in the comments.

Disclosure: I am long SGOV and plan to buy BOXX.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Could you use BOXX in place of a money market account for daily cash needs or would you need to hold it for at least a year to reap the benefits? Thanks. Love your site!

Great question. Comparatively less beneficial over the short term but still beneficial over MMF. Much greater benefit after a year.

Jon,

Ignore my previous question. I reread the article and found the answer. Thanks again.