Financially reviewed by Patrick Flood, CFA.

The Bogleheads 3 Fund Portfolio is arguably the most popular lazy portfolio out there. Here we’ll investigate its components, historical performance, and the best ETF’s to use in its implementation in 2024.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Bogleheads 3 Fund Portfolio Review Video

Prefer video? Watch it here:

What Is the Bogleheads 3 Fund Portfolio?

The Bogleheads 3 Fund Portfolio is arguably the most popular lazy portfolio, which just means a portfolio that you don't need to constantly monitor or change.

“Bogleheads” are followers of the advice and path of the famous Jack Bogle, founder of Vanguard and considered the father of index investing. I am one. The Bogleheads Forum houses an exchange of knowledge surrounding Bogle's principles. The Boglehead philosophy and approach is as follows:

- Develop a workable plan.

- Invest early and often.

- Never bear too much or too little risk.

- Diversify.

- Don't try to time the market.

- Use index funds whenever possible.

- Keep costs low.

- Minimize taxes.

- Invest with simplicity.

- Stay the course.

The Bogleheads 3 Fund Portfolio, as the name implies, is a simple portfolio comprised of 3 broad asset classes – a total U.S stock market index fund, a total international stock market index fund, and a total U.S. bond market index fund.

The Bogleheads 3 Fund Portfolio draws on the idea of portfolio diversification's ability to reduce volatility and drawdowns, protect against black swan events, and maximize risk-adjusted return. Holding multiple uncorrelated assets invariably reduces risk and can result in higher returns – and almost always higher risk-adjusted returns – than holding one asset in isolation.

Interestingly, the Bogleheads 3 Fund Portfolio does not have a specific one-size-fits-all prescription for asset allocation. The investor is encouraged to choose their own based on time horizon and tolerance for risk. Assuming a retirement age of 60, my general rule of thumb is to use [age-20] for bond allocation, obviously titrating up or down based on risk tolerance. Vanguard has a useful tool here to help you choose. You can also view how different allocations have performed historically.

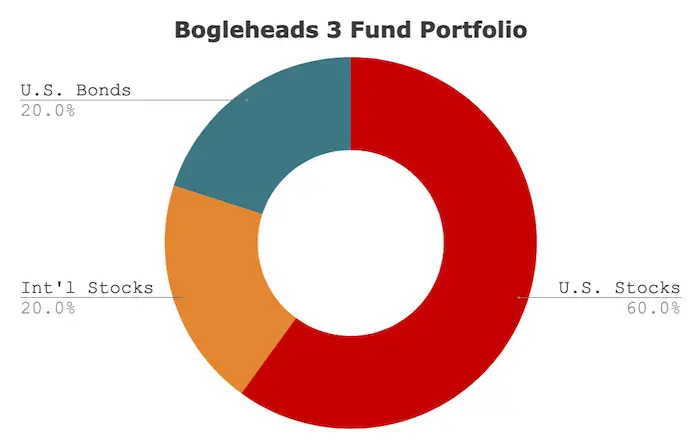

Given that, for the sake of simplicity in this post, let's assume a starting age of 20 and a retirement age of 60, yielding an average investor age of 40. Many U.S. investors like to overweight U.S. stocks, Jack Bogle himself suggested a maximum of 20% in international stocks, and a Vanguard study suggested a minimum of 20% to get any reasonable diversification benefit. A compromise between those would be 20% in international stocks. Based on those parameters, a one-size-fits-most 80/20 allocation for the Bogleheads 3 Fund Portfolio is:

- 60% U.S. Stocks

- 20% International Stocks

- 20% U.S. Bonds

Why Index Funds?

Bogle advocated for simply “buying the whole haystack” instead of trying to find the needle. Consider these facts:

- The evidence has shown that even most professional investors can't pick winners that beat the market over 10+ years, much less the average retail investor like you and me.

- On the 50th birthday of the S&P 500 index, only 86 of the original 500 companies remained.

- Blindfolded monkeys randomly throwing darts for stock picks have beaten top hedge fund managers not just once, but consistently.

- Most stocks underperform the market; only a select few drive massive returns. Specifically, for U.S. stocks from 1926 through 2017, in terms of lifetime dollar wealth creation, only 4% of stocks accounted for the net gain above T Bills. Looking at global stock returns from 1990 through 2018, only 1.3% of stocks accounted for the positive wealth creation in excess of T Bills.

In short, we should reliably expect to see the empirical results we've observed historically: that stock picking strategies, especially those that are poorly diversified, tend to underperform the market.

Even sector bets are usually not a prudent move, as they’re just stock picking lite. Betting on sectors increases uncompensated risk – additional risk without an increase in expected return. In doing so, investors increase their chances of underperforming the market. Just like with individual stocks, some sectors will outperform and some will underperform the market. How do we know which ones will do which? And during what time periods? What about different economic cycles? Tech has had a huge run recently. Will it continue? In short, no one knows. Diversification seems to be the only free lunch with investing.

This is why broad index funds like the S&P 500 and total stock market are recommended so often. Specifically, using total market index funds, one can be fully diversified across every sector and market cap size, in this case both domestically and abroad. You can brag to your friends that you own over 10,000 stocks in your portfolio. You get exposure to the success of any sector and any stock at any given time in a market index fund, while eliminating sector risk and single company risk. Index funds are also self-cleansing in that growing companies rise within the fund and bad companies drop off.

Bogle suggested the “majesty of simplicity.” The simplicity of the 3 Fund Portfolio is underrated. This simplicity in the use of total market index funds allows investors to not have to worry about choosing the correct asset styles and cap sizes, much less the correct sectors and individual stocks.

Buying the market guarantees market returns. Using narrower funds with the goal of market outperformance (usually as a result of recency bias and performance chasing) creates complexity and the potential for market underperformance and subsequent uncertainty, dissonance, and tracking error regret, especially for novice investors. This can lead to abandoning one's strategy altogether, usually at precisely the worst time. It is imperative that investors have strong conviction in their strategy in order to stay the course.

Why International Stocks?

At global market weights, U.S. stocks only comprise about half of the global stock market. International stocks don't move in perfect lockstep with U.S. stocks, offering a diversification benefit. If U.S. stocks are declining, international stocks may be doing well, and vice versa.

If you're reading this, chances are you're in the U.S. You also probably overweight – or only have exposure to – U.S. stocks. This is called home country bias. The U.S. is one single country out of many in the world. By solely investing in one country's stocks, the portfolio becomes dangerously exposed to the potential detrimental impact of that country's political and economic risks. If you are employed in the U.S., it's likely that your human capital is highly correlated with the latter. Holding stocks globally diversifies these risks and thus mitigates their potential impact.

No single country's stock market consistently outperforms all the others in the world. If one did, that outperformance would also lead to relative overvaluation and a subsequent reversal. Meb Faber found that if you look at the past 70 years, the U.S. stock market has outperformed foreign stocks by 1% per year, but all of that outperformance has come after 2009.

“But U.S. companies do business overseas,” people exclaim.

I’ve always found that argument pretty silly. The economy is not the stock market. We care about how international stock markets behave relative to the U.S. stock market. That imperfect correlation is the entire point of diversification.

The fact that some U.S. firms get foreign revenues means next to nothing. Coca-Cola is going to behave like a U.S. stock at the end of the day regardless of the fact that its sales are global in scope. Excluding stocks outside the U.S. means you’re missing out on leading companies that happen to be based elsewhere, which include some of the largest automotive and electronics companies in the world.

By that logic, international companies do a lot of business with the U.S., so I guess we don't need U.S. stocks…

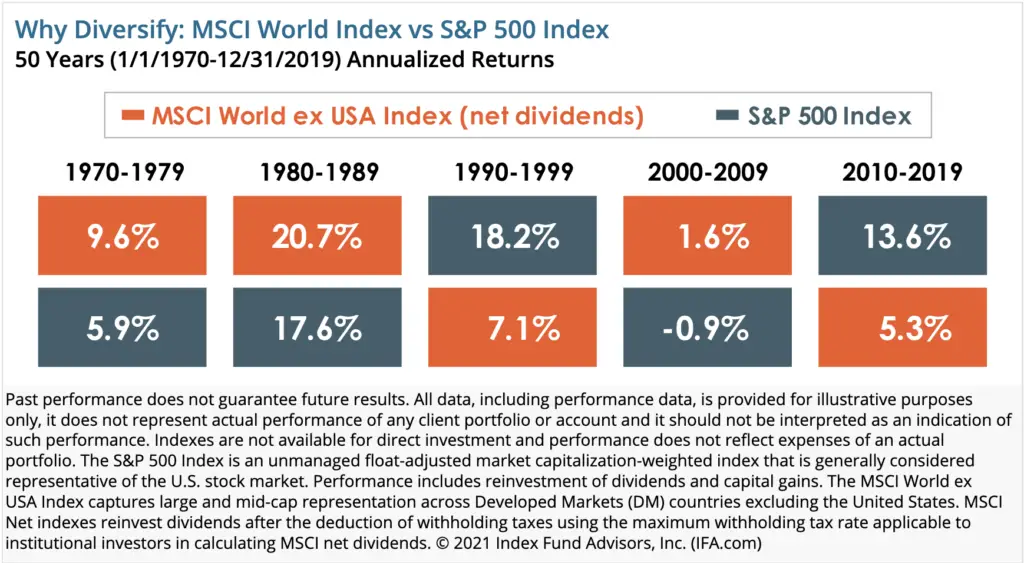

Similarly, there have been periods where a global portfolio outperformed a U.S. portfolio. During the period 1970 to 2008, an equity portfolio of 80% U.S. stocks and 20% international stocks had higher general and risk-adjusted returns than a 100% U.S. stocks portfolio. Specifically, international stocks outperformed the U.S. in the years 1986-1988, 1993, 1999, 2002-2007, 2012, 2017, and 2022.

International small cap stocks have crushed the U.S. market historically, for example, as they're considered riskier, and investors are compensated for that greater risk. And this is just talking about performance. The volatility and risk reduction benefits are another conversation entirely, which is of huge significance for a retiree. Such an effect was seen recently in 2022 when U.S. stocks performed worse than both bonds and international stocks, illustrating the beneficial impact of diversification.

Notice how U.S. or international outperformance tends to be cyclical:

If I were writing this in 2010 (or 1990, or 1980), we'd be talking about how a global portfolio beat a U.S. portfolio the previous decade. The important takeaway is that it's impossible to know when the performance pendulum will swing and for how long, much less how those time periods would match up with your personal time horizon and retirement date.

Moreover, U.S. stocks' outperformance on average over the past half-century or so has simply been due to increasing price multiples, not an improvement in business fundamentals. That is, U.S. companies did not generate more profit than international companies; their stocks just got more expensive. And remember what we know about expensiveness: cheap stocks have greater expected returns and expensive stocks have lower expected returns.

For U.S. investors, diversifying globally in stocks is also a way to diversify currency risk and to hedge against a weakening U.S. dollar, which has been gradually declining for decades. International stocks tend to outperform U.S. stocks during periods when the value of the U.S. dollar declines sharply, and U.S. stocks tend to outperform international stocks during periods when the value of the U.S. dollar rises. Just like with the stock market, it is impossible to predict which way a particular currency will move next.

Dalio and Bridgewater maintain that global diversification in equities is going to become increasingly important given the geopolitical climate, trade and capital dynamics, and differences in monetary policy. They suggest that it is now even less prudent to assume a preconceived bet that any single country will be the clear winner in terms of stock market returns.

In short, geographic diversification in equities has huge potential upside and little downside for investors.

I went into the merits of international diversification in even more detail in a separate post here if you're interested.

Bogleheads 3 Fund Portfolio Benefits

Taylor Larimore, considered “King of the Bogleheads,” and co-author of The Bogleheads' Guide to Investing and The Bogleheads' Guide to the Three-Fund Portfolio, succinctly summarizes the Bogleheads 3 Fund Portfolio's benefits as follows:

- No advisor risk such as incompetence or conflict of interest. These invariably lower your returns through market underperformance and/or greater fees.

- No asset bloat, meaning new money entering a managed fund that impacts prices and lowers expected returns. Total market index funds can easily spread new money among thousands of stocks.

- No index front running, meaning traders preemptively buying or selling securities before they're included or excluded in the index. Owning the total market means we're not exposed to that impact.

- No fund manager risk, such as a manager leaving an active fund, which changes its future performance. Index funds don't pick individual stocks.

- No individual stock risk. Picking individual stocks notoriously underperforms the market over the long term. We'll touch on some stats related to this later in the video.

- No overlap. The 3 funds in this portfolio have zero overlap, so we're avoiding concentration and maximizing diversification.

- No sector risk. Sector picking is just stock picking lite and is a source of uncompensated risk. A total market index fund already gets us exposure to every sector.

- No style drift, which refers to a fund's divergence from its stated investment focus, such as for something like a mid-cap value fund that hones in on a narrow subsection of the market. Since we're buying the total market here, we don't have to worry about style drift.

- Low tracking error. Tracking error refers to the difference between the fund's true value and its underlying index it's attempting to track. The types of funds we're using here famously have the lowest tracking error in the investable universe.

Bogleheads 3 Fund Portfolio – Choosing Assets and ETFs

Let's explore the selection of assets and corresponding ETFs.

U.S. Stocks

For the 60% U.S. stocks position, we have several choices. You could choose to use the S&P 500 index, the total U.S. stock market, the Russell 1000 index, etc. To broadly diversify across U.S. stocks, I’m suggesting the use of a total U.S. stock market fund, to get some exposure to small- and mid-cap stocks, which have outperformed large-cap stocks historically due to the Size factor premium. Vanguard's total U.S. stock market ETF is VTI.

International Stocks

Similarly, for the 20% allocation to international stocks, we can use a total international stock market fund like Vanguard's VXUS. This ETF covers both ex-US Developed Markets and Emerging Markets at their global market weights.

Bonds

For bonds, the obvious and popular choice is a total U.S. bond market fund, but since we know treasury bonds are superior to corporate bonds and since a total bond market fund is usually about 25-30% corporate bonds, I’m suggesting intermediate treasury bonds, which should roughly match the average duration of the total U.S. treasury bond market. At the time of writing, Vanguard doesn't offer a total U.S. treasury bond market fund, so we can use intermediate treasury bonds via VGIT.

Long-term bonds are likely too volatile – and too susceptible to interest rate risk – for older investors, and short-term bonds are too conservative for young investors at a 40% allocation, so intermediate-term bonds offer a happy medium that is suitable for most investors.

For that reason, my blanket recommendation for a one-fund, one-size-fits-most bond choice would be intermediate-term treasury bonds, which should roughly match the average maturity of the total treasury bond market.

That said, I'm actually a fan of the idea of putting the first 20% of your bond holding in long-term treasury bonds, especially if you're a young investor with a longer investing horizon. The higher volatility of long-term bonds is better able to hedge against stocks' downward movement. We'll illustrate this below. You can access long-term treasury bonds via Vanguard's VGLT. This ETF has an effective duration of about 18 years.

Investors can dial in a specific bond duration using a combination of different duration bond funds.

And remember, don't fear bonds at low, zero, negative, or rising interest rates, and don't fear long-term bonds.

Why No International Bonds?

The inclusion of international bonds in diversified portfolios and target date funds is a fairly recent occurrence. Until recently, costs of international bond fund products were prohibitive for retail investors, and international assets of all kinds were viewed with skepticism until about the 1990's. Vanguard didn't begin including international bonds in their target date funds until 2013.

The evidence seems to show that international bonds may offer a small diversification benefit in terms of credit risk on the fixed income side due to their low correlation with both U.S. stocks and U.S. bonds, but there’s no compelling reason to think it's any significant benefit. This potential diversification benefit is even less convincing for a portfolio that is not bond-heavy.

The legendary Larry Swedroe suggests, based on a 2014 Vanguard paper, that investing in foreign bonds may be prudent for reducing portfolio volatility if and only if the investor can do so with low fees and with currency hedging to eliminate currency risk. Without currency hedging, it's basically FOREX trading. Luckily, Vanguard's Total International Bond ETF (BNDX) satisfies those requirements.

Vanguard published another paper in 2018, proposing that “various local market risk factors (such as interest rates, inflation, and yield curves) have resulted in relatively low correlations of government bond yields across markets over the past 50 years, suggesting a diversification benefit to increasing the number of global markets in a fixed income allocation.” While the research is comprehensive, the tiny diversification benefit they illustrate is negligible in my opinion. Specifically, they showed that for a 60/40 portfolio during the period 1985-2013, diversifying internationally with fixed income resulted in a reduction of volatility as measured by standard deviation from 9.5 to 9.4, a reduction of 1%.

In short, there's no good reason to consciously avoid international bonds, but there's also no good reason to embrace them either; it's unlikely to help your portfolio, and it's unlikely to hurt it. Bogle suggested that “when there are multiple solutions to a problem, choose the simplest one.” Samuel Lee agrees, suggesting that utilizing international bonds appears to “be a case of diversification for the sake of diversification.”

If you still do want to incorporate international bonds, don't worry; that's just the Bogleheads 4 Fund Portfolio.

Bogleheads 3 Fund Portfolio Portfolio Historical Performance vs. S&P 500

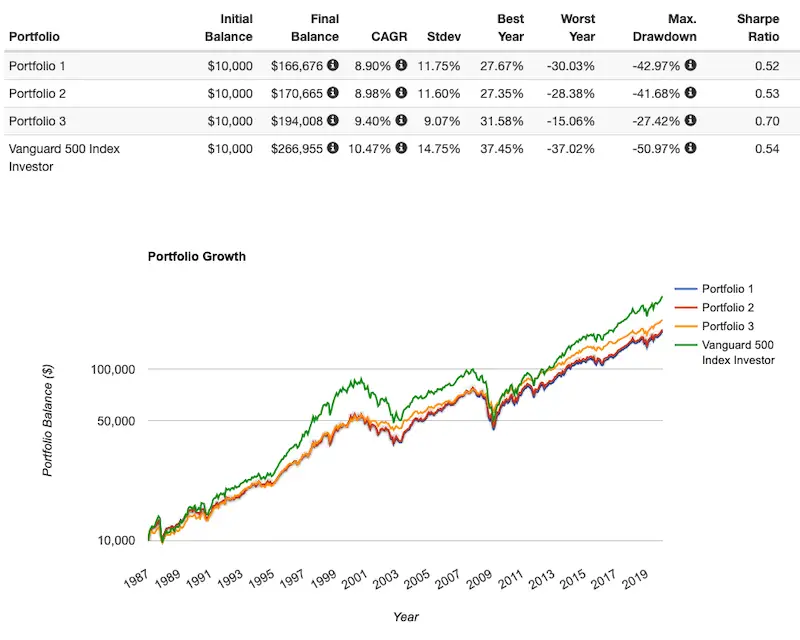

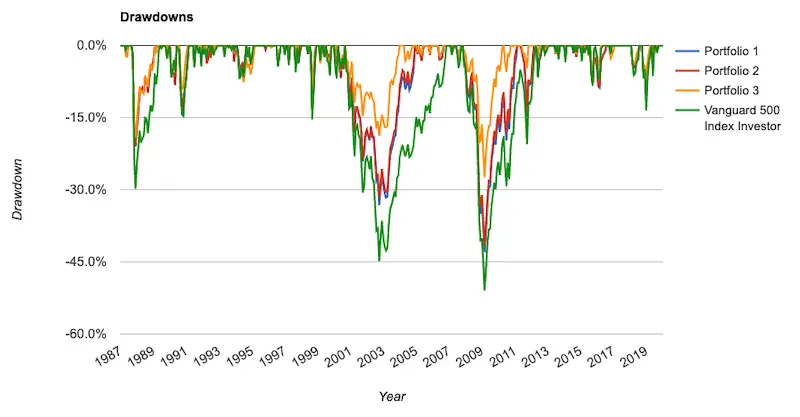

The backtests below are for the period 1987-2019 showing variations of the Bogleheads 3 Fund Portfolio vs. the S&P 500. Portfolio 1 uses the prescribed total bond market. Portfolio 2 is my suggested variation using intermediate treasury bonds. Portfolio 3, particularly suitable for a younger investor or one who desires to assume slightly more risk, uses long-term treasury bonds.

As we'd expect, Portfolio 2 with treasury bonds achieves higher general and risk-adjusted returns (Sharpe), lower volatility, and smaller drawdowns than Portfolio 1 that uses the total bond market. Again, this is because corporate bonds are inherently more correlated to stocks.

Notice the much higher general and risk-adjusted returns and lower overall volatility of Portfolio 3 with long-term treasuries. It also has a smaller max drawdown. Again, this is due to their higher volatility that is better able to counteract stocks' downward movement:

Bogleheads 3 Fund Portfolio ETF Pies for M1 Finance

Below are pies to use on M1 Finance for each of the 3 variations we've explored above, using an 80/20 asset allocation.

M1 Finance is a great choice of broker to implement the Bogleheads 3 Fund Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, allows fractional shares, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Canadian investors can use Questrade, and those outside North America can use eToro.

Traditional – Total Bond Market

Using entirely low-cost Vanguard funds and the original prescription of a total bond market fund, we can construct an 80/20 allocation of the Bogleheads 3 Fund Portfolio pie like this:

- VTI – 60%

- VXUS – 20%

- BND – 20%

You can add the this pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Intermediate Term Treasury Bonds

Using intermediate-term treasury bonds, the Bogleheads 3 Fund Portfolio becomes:

- VTI – 60%

- VXUS – 20%

- VGIT – 20%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Long Term Treasury Bonds

My preferred version is this one with long-term treasury bonds:

- VTI – 60%

- VXUS – 20%

- VGLT – 20%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Which 3 Fund Portfolio do you prefer? What's your asset allocation? Let me know in the comments.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosure: I am long VTI and VXUS in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Any drawback in doing 80% VT instead of 60% VTI and 20% VTXUS? Something like 80% VT and 20% VGIT would be even simpler and possibly provide even more diversification?

Fine to simplify with VT, but in taxable you wouldn’t get foreign tax credit.

John, thank you for this amazing article, excellent work!

What allocation would you suggest for a Boglehead 3 fund believer who’s under 40 years of age (we’re in our 30’s)? I noticed you suggested avoiding bonds till the age of 40 which I do agree with. With that said, what do you suggest replacing the bond allocation with till the age of 40? Do you suggest a bond proxy such as dividend or value stock index? Or, would you simply increase the allocation to VXUS and VTI? If so, what type of portfolio allocation percentages would you recommend for a Boglehead’s under the age of 40 and why?

Thanks, Matthew. Unfortunately I can’t provide personalized advice here. I actually don’t really subscribe to the “no bonds” idea, but most do that. There would be nothing to “replace” bonds; the idea would just be have 100% stocks. But many don’t have the risk tolerance for that. I myself am in my 30’s too and have 10% in long term treasury bonds. You may find my rant on them here useful in describing my own portfolio.

Why do they prefer BND over the objectively better VGIT?

BND tends to be the default rec for Bogleheads because it’s the total bond market. Many don’t realize the nuances of treasuries vs. corporates.

I am 60 and work part time. My home home paid for, and I have no debt but have never invested, and I am not retired.

My plan to work as long as it is possible. Do you recommended I open a Vanguard 2035-2040 TDF and max it out every year? Thank you and go easy on me.

Is Fidelity’s FUAMX a good alternative to VGIT?

Yes. FUAMX is slightly longer duration.

Is the 3 fund portfolio the best for someone who has a 5 year retirement time horizon and does not want to take

too much risk in the present (2022) climate?

Thanks for your sensible approach and recommendations.

Regarding the international bond findings, I noticed the studies suffer recency bias. They start in 1985, there was a bond bull market since. They could’ve included the 60s and 70s. It still wouldn’t be perfect as the modern world, all capital markers, are summed up as liberal democratic, free market US and has been a secular US bull market. But I won’t be this level of realistic because it is too much for most people.

I just posit that while we don’t know if great geopolitical schisms happen if transborder ownership would even be possible, diversifying with international bonds may provide some protection or added return.

As for the home country bias, I feel Americans have had home country negative bias recently. It’s true that the US is half the world by market cap, but I feel free markets have operated best and most efficiently in the US, with the free world coming in 2nd. Now this can revert on its head, but still

Bonds were callable before 1985.

To avoid the home country bias, would it be advisable to split the stocks evenly for both US and international? So for instance 40% VTI, 40% VXUS, 20% VGLT? Is there a reason your suggested portfolio overweighed US stocks?

Thanks – I really appreciate your site and work!

Sounds reasonable to me.

Thanks! Curious, is there a reason your suggested portfolios have a much stronger US weight vs international?

Most prefer that.

I have finally chosen the Bogleheads approach after keeping myself up at night worrying about my stock picks.

I find it curious that you have your allocations set to 60/20/20 whereas most other websites suggest 50/30/20. Is there a particular reason why you chose to ‘overweight’ US stocks? Many of your other articles advocate for matching market weight.

Somewhat arbitrary. Investors can choose themselves. Most feel good with home country bias.

Hi John,

I see you have not included a levered up version of the Boglehead portfolios (like for the AWP and Neapolitan ones).

Is that because you don’t recommend it?

I would be interested in your thoughts on using Portfolio 3 (above) in a leverage strategy.

Thanks for this website. Its absolutely awesome!!

-Rudy

Thanks, Rudy! No great options for leveraged international funds. Would basically end up looking like HFEA.

Where can I see a comparison of the 3 fund vs 4 fund performance?

This backtest provides a rough idea.

I think it would be helpful if you would post quarterly updates of your Ginger Ale portfolio as matched against a Boglehead 3- Fund portfolio with the same about in bonds.

That way we could evaluate if the more complex portfolio is really worth it.

Not a bad idea I guess, but they serve different purposes and are for different audiences. Factors are a long-term play, so something like rolling 5-10 year periods would make more sense than quarterly.

Hi John,

I’m 66, retired, and getting ready to leave my

Amerprise financial planner of 17 years. I’m looking at VT and VCSH for a two fund approach. If I were to add a 3rd fund It would probably be VNQ.

Curious what you think, I’d be Looking at 60% VT, 10% VNQ,, and 30% VCSH.

Hey Rick. I can’t provide personalized advice, but I’m a fan of treasury bonds over corporate bonds, REITs don’t offer much of a diversification benefit since they’re not a distinct asset class (and their returns can be replicated with small cap value stocks and lower credit bonds), and I’d probably have some TIPS and/or short bonds in retirement to help protect against inflation.

https://www.ft.com/content/fdb793a4-712e-477f-9a81-7f67aefda21a

Like in this article, if you were betting on the lower performance of US equities/bonds for the next decade due to inflation, how would you change your portfolio?

My idea would be to replace bonds with commodities, include some crypto, and increase shares for emerging markets and value equities.

I’ve already got some TIPS in my portfolio.

We should expect lower future returns from bonds, but that doesn’t mean they’re not still the best diversifier for stocks. I also don’t try to time the market. Stocks in general do well from inflation. Separately, banks specifically do well from rising interest rates as they make more from loans, so maybe overweight Financials if that’s a concern.

I hate commodities.

Hi John,

Great read; thanks for breaking it all down. I currently have all of my money in the Vanguard 500 fund (VFIAX). I’m still learning and getting familiar with the Bogleheads philosophy.

Just one question – I’m a little confused as to why you didn’t get into the 500 fund’s run and final balance compared to the other 3. It ‘wins’ and finishes with a higher return right? I’m obviously still learning. Just trying to decide if I switch over to a 3 fund portfolio completely, or just add the 500 fund to the others and live with the overlap (is it that bad?)

Thanks again!

Mike

Hey Mike, glad you enjoyed it.

The S&P 500 is used as a benchmark for comparison with most lazy portfolios. We wouldn’t expect the 3-Fund to beat it on pure total return, as stocks tend to outperform bonds. That’s not its intended purpose. The 3-Fund Portfolio is for someone who wants less volatility and risk – and thus likely a higher risk-adjusted return – than an S&P 500 index fund. As such, an investor seeking out the Bogleheads 3 Fund Portfolio does not want an S&P 500 index fund as their entire portfolio, and vice versa. Moreover, a 100% stocks portfolio would not be appropriate for a retiree.

Thus, the “winner” is subjective and personal in this case. The S&P 500 had better general returns over the period, but the 3 Fund had better risk metrics such as volatility and max drawdown. As usual, it comes down to time horizon and personal risk tolerance.

Had you needed to withdraw anytime between 2008 and 2012, the 3-Fund would have come out ahead with higher general returns as well.

If you read my post on asset allocation, I advocate for the same thing you suggested – going 100% stocks for a while until about age 40.

Hope this clears things up!

I had the same question so thanks for answering, John. I’m currently 75% S&P 500 index so this information about risk management in diversification is very helpful. I am in the process of rebalancing now and look forward to many great years in retirement. 🙂