The term index fund bubble has been thrown around frighteningly often in recent years. In this post I'll explain why there's not one and why the primary fundamental argument itself doesn't make much logical sense.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Prefer video? Watch it below. If not, continue scrolling to keep reading.

If you've arrived on this page, hopefully you already know that index funds are just investable products like ETFs or mutual funds that track some index, such as the famous S&P 500. “Indexing” refers to the strategy of buying and holding index funds.

The evidence overwhelmingly indicates that indexing beats active stock picking over the long term. This has been known for a while, but blogs and YouTube and social media have allowed the message to spread rapidly and widely among DIY retail investors, and index investing has grown massively in popularity over the past 20 years or so as a result. This has led some to erroneously conclude that there is an “index fund bubble” that could burst – or at least slowly deflate – and derail everyone's portfolios and the securities markets as a whole.

The late Jack Bogle is considered the father of index investing. He founded the shareholder-owned brokerage firm Vanguard which is probably the most popular name in the biz for low-cost index funds. Bogle constantly espoused the benefits of low fees, diversification, and “passive” investment management. Adherents to his sage advice are known as Bogleheads, and their foundational model portfolio is called the Bogleheads 3 Fund Portfolio. I've got a detailed post on it here.

VOO and VTI, a couple ETFs that are commonly used as components in the Bogleheads 3 Fund Portfolio for the U.S. stock market piece, have assets of over half a trillion dollars combined.

So it makes sense, then, right? The piling into index funds is creating a bubble that has to burst or at least deflate at some point, right? Well, no.

The pervasiveness of this myth is likely simply due to it being touted by famed trader Michael Burry who won big on a single bet during the 2008 Global Financial Crisis by shorting the housing market. Burry even put on his hyperbolic hat to claim that index funds are like CDO's (collateralized debt obligations) that were a major part of the 2008 crash. His quote in Bloomberg's article made waves. A generous explanation would be that he was just going for a clickbait-y headline. At worst, he's forgotten how markets and asset pricing work.

But remember right off the bat that taking information as truth just because of its source is authority bias. We want to assess the information itself.

The logic of Burry's primary argument – and of most of the “index investing is a bubble” arguments – goes something like this:

- Index funds have seen huge inflows in recent years.

- This causes stocks inside the index to become artificially inflated.

- That's a bubble that may deflate when outflows happen, and prices will “snap back” to where they're supposed to be.

According to this argument, using an example of the popular S&P 500 Index, the 500 largest profitable publicly traded companies in the U.S., the 501st company that was excluded (and all those that follow) gets less attention and is undervalued, and the 499th company's price is inflated simply because it got included in the index. More generally, large stocks become overpriced and small stocks become underpriced according to this theory.

This is an argument of inefficiency.

An analogy I've seen to illustrate this idea is that previously, active trading was a cruise ship and indexing was a small canoe being towed by it. The canoe does not affect the speed or course of the cruise ship at all but simply gets to relax and take the same course at the same speed. However, Burry and others maintain that index funds have now grown large enough to be a cruise ship themselves.

But this argument suffers from a logical fallacy; it conflates assets and price discovery. Assets means the amount of dollars held in a fund. Price discovery just means buyers buying and sellers selling create an equilibrium that is the market price. In this context, using our analogy, the size of the ship is largely irrelevant to its course.

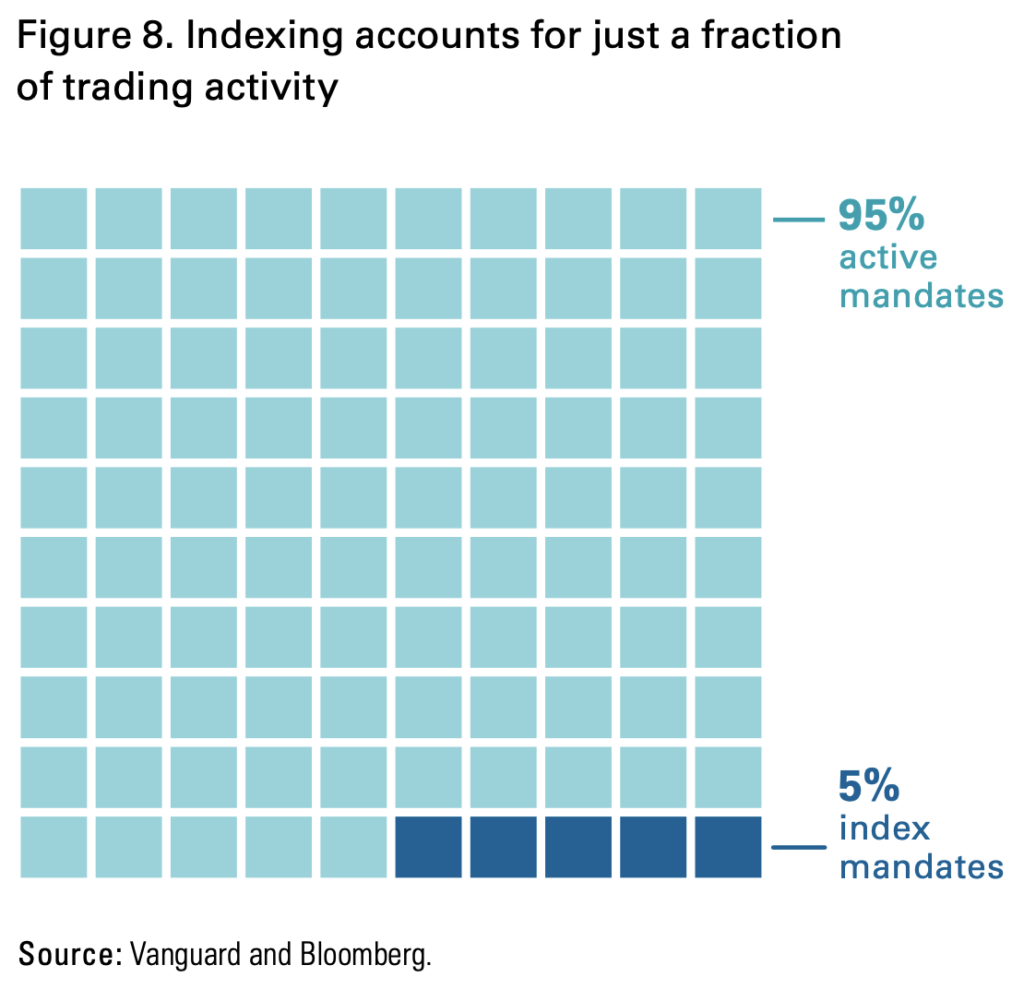

Trading sets prices. And index funds make up a whopping 5% of all trades.

In short, index investing doesn't affect price discovery. Don't confuse AUM with setting prices. The former can be huge without materially affecting the latter.

Put another way in terms of AUM itself, active and passive being close in size doesn't dismantle the functional integrity of markets. While we're on the subject, though, it's worth mentioning that “passive” doesn't exist anyway.

To hammer this point home yet another way, we don't really care about the amount of assets in index funds; we care about how much trading those index funds are doing. And it ain't much.

In the interest of full disclosure, the cruise ship analogy is also mathematically incorrect anyway; active traders still own the majority of shares of public companies at about 65%. In fairness, that balance may shift at some point in the not too distant future, but again that doesn't really mean anything.

Are mega-cap tech stocks at the top of the S&P 500 overvalued? Maybe. But it's not indexers who are causing the overvaluing. There are still enormous assets held and traded by active funds, hedge funds, day traders, and private managers. And stock prices still move on new information.

Our pals Fama and French submit that the rise of index funds is simply pushing bad managers out of the market, leaving skilled managers to set prices. Further, they maintain that it doesn't take much active trading to create an efficient market.

Other researchers have gone so far as to conclude that indexing makes short selling more efficient, thereby improving price discovery. Talk about a counterpoint.

But let's also circle back to the fundamental point about inefficiency. Burry suggests that because cap weighted indexes get all the attention, smaller, value-y-er stocks are undervalued and less efficient. Factor investors like myself already tilt small value for other reasons, but I'm hoping Burry doesn't cite the neglected firm effect if small value does indeed do well in the coming years. Something, something, narrative bias and hindsight bias.

This is itself another foundational fallacy upon which the bubble argument rests. Markets are not inefficient enough to allow for consistent exploitation. If Burry's proposed inefficiency did exist, skilled managers would simply arbitrage it away. In that sense, markets are self-correcting.

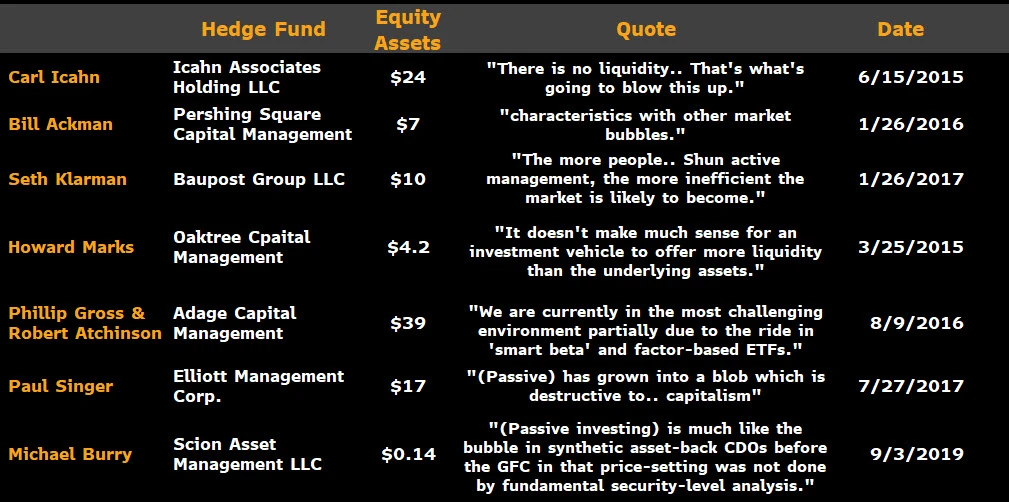

Let's also not forget that Burry and other private asset managers have a direct, tangible incentive to suggest that there's something wrong with indexing. And it's worth noting that his anti-index-fund fearmongering isn't really new. Here's a quote from the Director of Research at Chase from 1975:

A proliferation of index funds, though accounting for ever-increasing amounts of investment monies, would lead to an inefficient market. A stock’s price would become more a function of the monies flowing into index funds than a reflection of its investment merits. The efficient market hypothesis would be dead.

Here are some other quotes from high-profile hedge fund managers about index funds:

At the end of the day, though, if any of this bubble talk does sound plausible to you or has you feeling uneasy, the simple solution, as usual, is just maximizing diversification. Buy as many stocks as you can in the investable universe around the globe with a total market fund, and then buy other asset classes as well. Hopefully you do that already! Doing so means you now own the precise assets that Burry believes are inefficient and undervalued. Nonexistent problem solved.

This was a pretty brief, simplistic take on this topic. For ones much more comprehensive and eloquent than my own above, check out Ben Felix's YouTube video here and Ben Carlson's mic drop piece here.

Disclosures: I am long VOO in my own portfolio.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply