M1 Finance offers some of the cheapest margin around. But what is margin and what does it have to do with your portfolio? I'll answer that here and review M1 Borrow, the margin loan from M1 Finance.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

What Is Margin?

The term margin simply refers to money borrowed against your portfolio to enhance your exposure, where your investments are collateral for the loan. “Buying on margin” means using that margin loan to buy more securities in your investment portfolio, thereby leveraging it.

Margin is similar to a HELOC. Just as a bank can lend you money if you have equity in your home, your brokerage firm can lend you money against the value of your investment portfolio.

Different brokers have different requirements for using margin. Some require explicit approval of a margin account. Most require a minimum invested balance. Periodic interest payments are paid to access margin. Margin becomes advantageous when your rate of return is higher than the interest on the margin loan. The margin's interest rate is called the margin rate.

A “maintenance” amount must be maintained in your account. If the value of your investments falls below this maintenance requirement, you'll incur a margin call, where the broker demands funds to bring the account back to the maintenance level. This requires either depositing cash or selling your investments. If you cannot meet the requirement, the broker will automatically close your positions to bring your account to the maintenance level.

Advantages of Margin

Margin allows you to enhance your investment exposure, increasing your position. This is great if the market is going up, but can be bad if the market tanks. If you have an account in which you deposit $10,000 and your broker allows you to borrow $10,000, you now have $20,000 in buying power and can therefore double your exposure to your investments.

Margin can also be a source of credit with no credit check and no repayment schedule. You can borrow against your portfolio and use the margin loan to cover emergency expenses. This allows you to avoid selling securities in your account and incurring capital gains taxes. Margin loans are generally cheaper than other forms of credit like a bank loan or credit card.

Let's look at an example.

Suppose you invest $10,000 of your own money and your investment increases in value by 50% to $15,000, a gain of $5,000. Had you invested with margin, borrowing an additional $10,000 for a position of $20,000, your investment would be worth $30,000 after the 50% gain, doubling your return.

Now let's make it a more complete example by including the margin interest at an 8% interest rate. With your $10,000 margin loan above, your interest on the loan is $800.

With an account with $10,000 and a margin loan of $10,000, your portfolio is said to be 2x leveraged – your buying power is 2x the amount of your initial capital. Unlike leveraged ETF products, with margin loans, your leverage ratio changes based on the performance of your investments. Because of this, the amount you can borrow changes daily. You can borrow more if your investments increase in value, and you can borrow less if your investments decrease in value.

Margin Risks

Margin is not all sunshine and rainbows. Hopefully you can imagine that since you're borrowing money, you can lose more than the amount deposited in your investment account. Suppose in the previous example the investment had instead dropped by 75%. Your $20,000 investment with margin would be worth $5,000, lower than your initial collateral. This is when a margin call occurs where you have to cover the deficiency. This example doesn't even include the interest on the margin loan – $800 (8% of $10,000). In short, margin can magnify your gains but can also magnify your losses.

Most firms have a maintenance requirement around 30%, meaning you must have at least 30% in actual equity of the value of your account. Maintenance requirements from your broker may change without written notice. Furthermore, when you incur a margin call, brokers can sell your securities without notice if you are unable to replenish the discrepancy with newly deposited cash. The broker will likely notify you, but they are not required to. In such a case, you're unable to choose which specific securities are liquidated. You are also not entitled to an extension of time on a margin call.

It's important to diversify your investments when investing with margin, so that you're not concentrating your risk and increasing your chances of incurring a margin call, also known as a maintenance call. That is, don't use margin to buy a single stock. Furthermore, if margin investing doesn't fit your particular risk tolerance, don't entertain the idea to begin with.

You get to choose the amount you borrow. Buying 25% on margin (33% borrowed) is much more sensible, for example, than buying 50% on margin (100% borrowed). The more money you borrow, the more risk you take on. This is why diversification is increasingly important with margin loans as your amount borrowed increases. A higher amount borrowed also increases your chances of a margin call. You can be responsible with margin by only borrowing a small amount, paying margin interest regularly, and monitoring your investments.

Note that certain securities cannot be bought on margin, such as penny stocks. Brokers may also exclude certain high-risk securities at their discretion. Also note that margin loans cannot be used in retirement or custodial accounts.

Should You Use Margin?

Again, whether or not you employ margin/leverage comes down to your investing strategy and risk tolerance. You must use a sufficiently-diversified portfolio if you are going to use margin/leverage. Carefully weigh the pros and cons and understand how margin works before diving in.

Historically, the optimal long-term leverage ratio for the S&P 500 index has been about 2 (100% borrowed). I think 1.5 (50% borrowed) is reasonable for most investors and 1.25 (25% borrowed) is sensible for new investors. Assess what leverage ratio will allow you to sleep easily at night. Consider starting low and slow and work your way up as your investments [hopefully] appreciate in value.

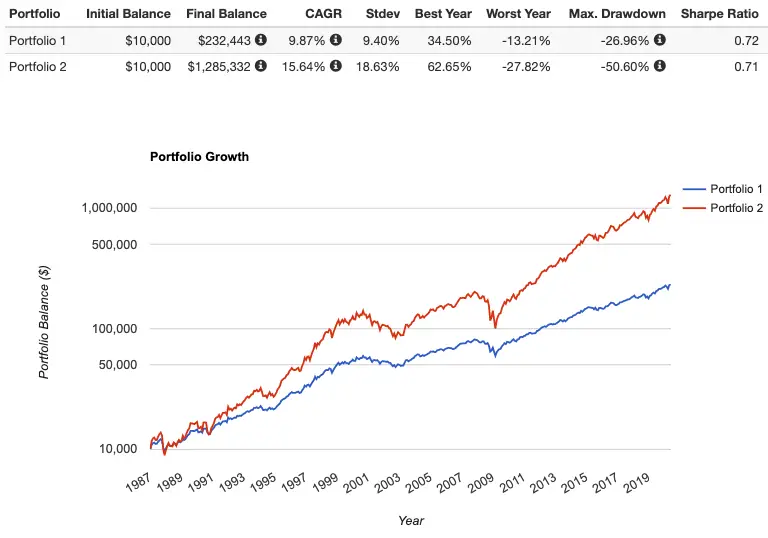

Here's how a 60/40 portfolio with 50% margin (2x leverage) – resulting in 120/80 exposure – would have performed historically versus a “normal,” unleveraged 60/40 portfolio:

Alternatively, if you need access to short-term emergency credit for emergencies, margin is a perfectly suitable alternative to credit cards or bank loans and will likely have a lower interest rate. Check your broker's margin rate for comparison. M1 Finance has one of the lowest margin rates around. Let's explore.

M1 Borrow Review

M1 Finance has some of the cheapest margin around. I wrote a comprehensive review of M1 Finance here. Their portfolio lending program is called M1 Borrow.

Most traditional brokers have margin rates typically much higher than the competitive rates offered by M1. Rates may vary. M1's cheap margin is one of its most attractive features. The rate is typically far lower than any credit card or bank loan I know of, making it perfect for emergency expenses or things like:

- portfolio leverage.

- a home improvement project.

- refinancing higher-interest debt from student loans, credit cards, auto loans, etc.

- financing major purchases like a new appliance.

- etc.

With M1 Borrow, you can borrow up to 50% of your invested balance. That means for a $10,000 portfolio, you can borrow up to $5,000, resulting in a leverage ratio of 1.50. No denials, loan officers, credit checks, or paperwork. You can utilize M1 Borrow once your account reaches $2,000.

Disclosure: Again, remember that margin (in this case, via M1 Borrow) is an additional risk, including the risk of losing more than you invest. M1 Borrow is available for margin accounts with $2,000 or more in equity. M1 Borrow is not available for retirement or custodial accounts. Rates may vary.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

I know that standard margin requirements vary by security leverage (i.e. 25% for 1x, 75% for 3x leveraged ETF). Is this the same with M1’s 35% margin offering or is there any difference with the way M1 does things?

Yes, Apex Clearing sets the maintenance requirement for each individual security.

Hey John Great article! I have been looking into using long term leverage via margin with M1 borrow with broad market ETFs like VOO. I’m interested in learning more about where you found/derived this info from

“ Historically, the optimal long-term leverage ratio for the S&P 500 index has been about 2 (100% borrowed). I think 1.5 (50% borrowed) is reasonable for most investors and 1.25 (25% borrowed) is sensible for new investors”

Also you mentioned

“You can be responsible with margin by only borrowing a small amount, paying margin interest regularly, and monitoring your investments.”

So given those 2 lines could I assume you are suggesting using M1 borrow with broad market ETF’s at somewhere between 1.25-1.5 leverage and paying down the interest as opposed to letting it build would provide optimal risk adjusted returns?

Just trying to understand what kind of strategies you might suggest when using constant long term leverage with a diversified portfolio..

Thanks! Obviously the future is unknowable but yes, basically modest leverage on a broad index. That historically optimal leverage was from this famous article.