Financially reviewed by Patrick Flood, CFA.

The oft-cited advice is to put your emergency fund in a safe, high-liquidity savings account or money market fund, but there may be a better way if you're willing to take on some additional risk. Here we explore how you can invest your emergency fund to beat a high-yield savings account and inflation.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – Why Invest Your Emergency Fund?

An emergency fund is exactly what the name suggests – an amount of money, usually in a separate account, saved for a rainy day in case of emergencies in the form of unexpected expenses, e.g. car repairs, loss of job, medical bills, etc. Professionals recommend having 3-6 months' expenses in an emergency fund. Even having one month of expenses saved up puts you ahead of most people in the world.

The advice usually heard is to put this emergency fund in a safe, low-risk, highly-liquid account like a savings account or money market fund, so that you can access it immediately when needed and not worry about it dropping in value. That is, safety and liquidity over returns. This is solid advice and obviously makes great sense. But there may be a better way.

High-yield savings accounts typically max out around 2% APY during relatively “normal” economic environments. With inflation at around 3% annually on average historically, you're still losing to inflation with a high-yield savings account or money market account. This has caused many to begin rethinking the common advice of not investing one's emergency fund in recent years with high inflation.

Those willing to assume a marginal amount of extra risk can invest the emergency fund in a well-diversified portfolio that can be expected to grow over time instead of staying flat or diminishing due to inflation. This is obviously a highly personal situation. Those with a low tolerance for risk may very well be perfectly happy losing money to inflation and keeping their emergency fund in a safe savings account, and that's totally fine. The emotional aspect of investing is very real. Peace of mind can absolutely be worth the expense of lost value to inflation and opportunity cost.

Similarly, if any of the following apply to you, investing your emergency fund is probably not a good idea:

- High-interest debt

- An unstable job

- Just starting an emergency fund

- Greater risk factors for emergencies (kids, commute, etc.)

But for others, investing your emergency fund can make sense in the right circumstances. Let's assume you have an emergency fund of 6 months' expenses saved and sitting in a savings account right now. Let's also suppose this amount you need – the value of the account – is $10,000. Consider these facts:

- It's unlikely that you'll need the entire emergency fund – all $10,000 – on a single day all at once.

- In the modern era of credit cards, you can use a credit card to cover any emergency expenses and pay off the balance within 30 days without incurring interest charges, meaning immediate liquidity/availability of cash at the time of the expense is not supremely important.

- As mentioned above, any savings account is still going to be losing to inflation, meaning the account value is slowly dwindling over time in terms of real dollars and actual purchasing power. Diligent savers will need to continually top off the account for this reason.

- Time that passes without needing to access the emergency fund is an opportunity cost where that money could have been invested to achieve a compound growth rate that beats inflation, allowing the account to grow over time instead of shrink or stay flat.

- Significant market downturns and black swan events are inherently rare. Diversifying the investment account mitigates volatility and the degree of drawdowns (risk).

- Traditional brick-and-mortar banks are unlikely to offer a competitive high-yield savings account, meaning you'd have to go with an online bank where transfer times to get liquid cash are likely similar to that of a brokerage account anyway.

Investing your emergency fund becomes particularly appropriate and attractive if you have:

- A large emergency fund saved, e.g. 6-12 months' expenses.

- High-limit credit cards.

- More than one stream of income or more than one person earning in the household.

- A stable job.

- Good health insurance.

- An HSA.

Of course the main criticism of investing one's emergency fund is the fact that a market correction can result in the account dropping in value at the precise time you need that money. Thankfully, there's a way to mitigate or even eliminate that risk.

How To Invest Your Emergency Fund

There's a simple yet beautiful way to ensure a market correction doesn't affect your ability to use the money in your emergency fund: overfund the account.

Specifically, we want to attempt to estimate the maximum degree (value) by which the account can drop from the initial value and then simply overfund the account by that amount. For example, if we estimate the max drawdown of the investment portfolio to be 10% and we need $10,000 in the emergency fund for 6 months' expenses, we would want to put an additional $1,000 in the emergency fund for a total of $11,000.

This maximum drawdown – and subsequently, the amount by which to overfund – correlates with the riskiness (and likely the expected return) of the investment portfolio in which you place your emergency fund. If the portfolio is low-risk, we may estimate the max drawdown to be 10%, as in the example above. A riskier portfolio may have an estimated potential drawdown of 30%, in which case you'd want to overfund by 30%. Keep in mind future drawdowns may be worse than the worst ones shown in the past on a backtest.

This concept becomes less important as time passes without using the emergency fund. The longer you go without using it, the more time the investments have to grow, making drawdowns less impactful. For example, if your investments appreciate and the emergency fund grows from $10,000 to $15,000 after 5 years without needing to access it, a market downturn of 10% still leaves you with $13,500 in the account.

Account Type

In terms of account type to invest your emergency fund, you can use a taxable brokerage account or a Roth IRA. For the former, depending on when you sell your investments, you'll incur short- or long-term capital gains taxes. For the latter, you can withdraw contributions from a Roth IRA tax- and penalty-free anytime, but the paperwork may be a bit more cumbersome. Also keep in mind IRA's have annual contribution limits which may be lower than the amount you need in your emergency fund.

Time Horizon and Asset Allocation

Consider the fact that the time horizon for your emergency fund is technically continuous and limitless, as unexpected emergencies are, by definition, unpredictable. You may never need to access your emergency fund, which would be a good problem to have. Conversely, you may need to access it within a year. As such, asset allocation must be set initially to be quite conservative and can later be made more risky as the account grows if you prefer.

For example, when starting out, we want a very conservative allocation with something like 10/90 stocks/bonds, but after 20 years, this may slide to 40/60 or even 60/40 stocks/bonds if you want.

Asset Selection

Remember, in investing the emergency fund, we want to minimize volatility and risk, at least when starting out. This means maximizing diversification across uncorrelated asset types, as well as diversifying risk factor exposure. This also means using broader, less volatile asset classes and styles, such as index funds over stock picking, treasury bonds instead of corporate bonds, and short-term bonds instead of long-term bonds.

Below are some ETF portfolios to consider for investing your emergency fund that check these boxes.

“What's the Best ETF for an Emergency Fund?”

I get a lot of questions asking what the “best ETF for an emergency fund” would be. Well, I'd argue that's sort of the wrong way to think about it.

In my opinion, there's no single fund that can adequately serve that purpose. Remember, for an emergency fund, we want to minimize volatility (the swinging movement of the portfolio) and risk (permanent loss of capital, in this case), because the money has to be there when we need it. To do that, we want to diversify broadly across different assets. And in order to do that, we need multiple ETFs; there's really no getting around it, at least with the current availability of financial products.

I've also heard the phrase “emergency fund in bonds” thrown around a fair amount. First, that phrase is too reductive. There are quite a few different types of bonds and different durations out there to choose from. Here we want to primarily make use of short-term treasury bonds. Secondly, while I'd argue we do still want mostly bonds here, bonds alone still don't get the job done. Bonds mitigate the risk of stocks, but stocks also mitigate the risk of bonds. Again, diversification.

I designed a pretty low-risk portfolio to invest one's emergency fund. Past iterations of this idea got a little more granular (and thus more complicated) with more funds. Einstein suggested to “make everything as simple as possible, but not simpler.” I've tried to do that here. It looks like this:

5% Total U.S Stock Market

5% Total ex-US International Stock Market

90% Short-Term U.S. Treasury Bonds

I've split up U.S. and international stocks purely so U.S. investors can get the foreign tax credit, which would not be available with the total world stock market fund VT in years in which the U.S. market comprises greater than 50%.

Why do we want stocks in there at all? Just like bonds reduce the risk of holding stocks, so too do stocks reduce the risk of holding bonds. We're basically holding stocks and short treasury bonds at roughly risk parity weights of 10/90.

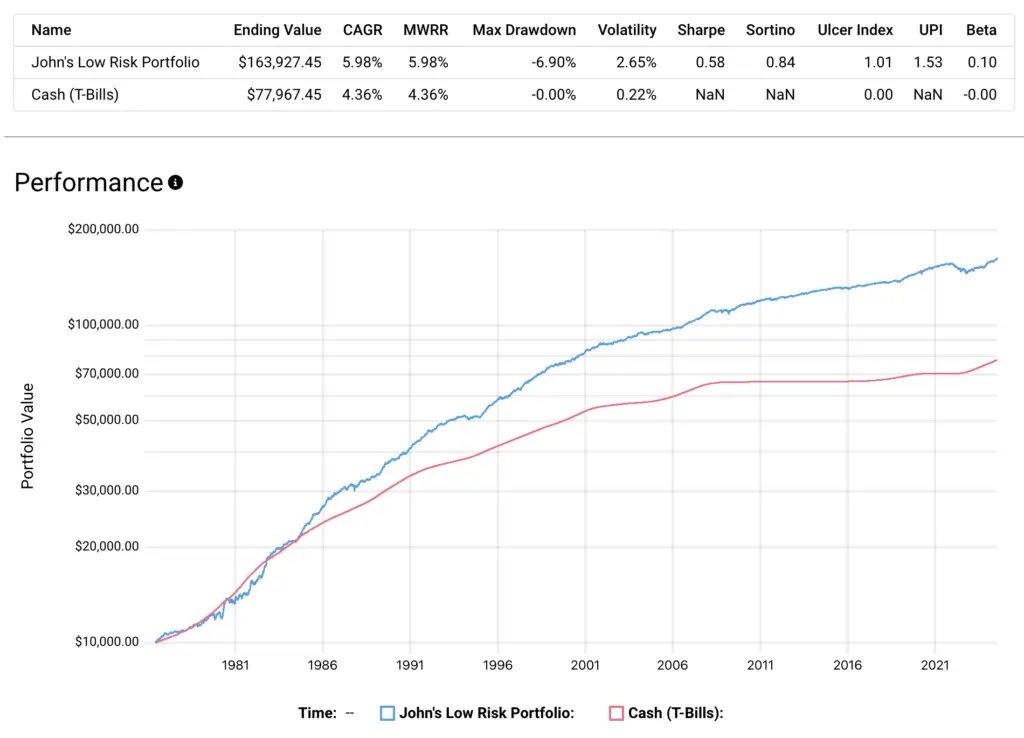

Below is a backtest for the period 1974 through mid-2024 comparing it to “cash,” which is really T-Bills:

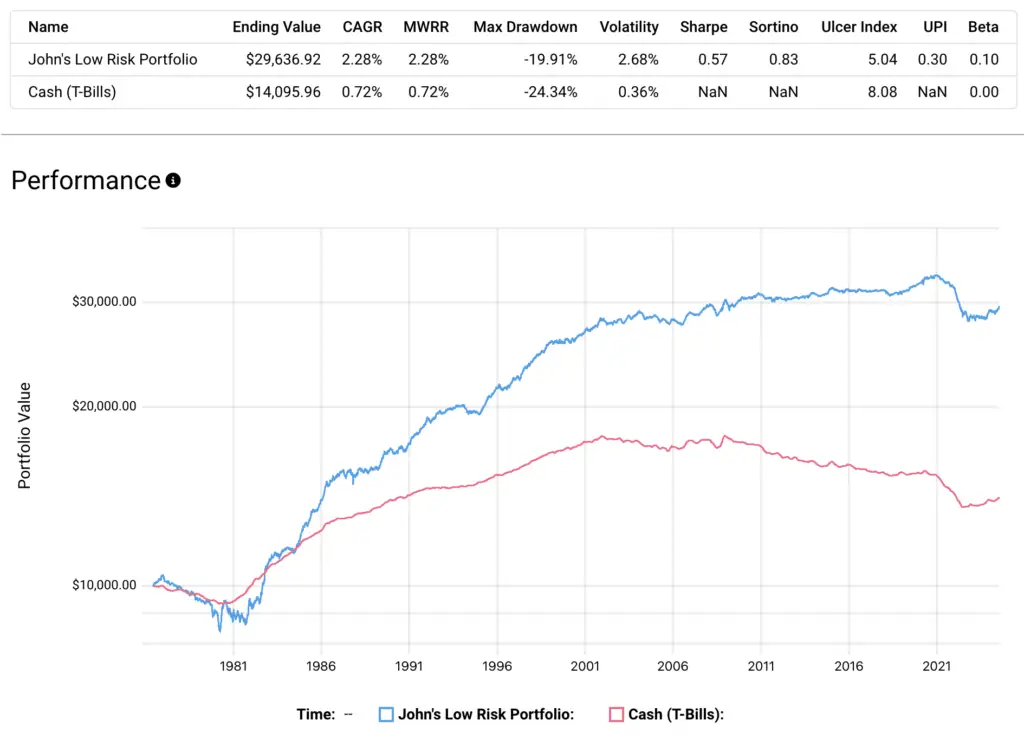

That doesn't look too exciting. But that's sort of the point. We're trying to take on a small amount of risk to edge out above inflation. Look at how the picture changes when we adjust for inflation:

In both scenarios, even though the CAGR's aren't too different, my suggested allocation resulted in more than double the final value over about 50 years due to the power of compounding over long periods. Basically, small differences add up.

Using mostly low-cost Vanguard funds, my low-risk emergency fund portfolio can be constructed using the following ETFs:

VTI – 5%

VXUS – 5%

SCHR – 90%

To add this custom low-risk emergency fund portfolio to your M1 Finance account, click this link.

Remember that if you want to use this idea, I would highly suggest overfunding you're emergency fund by 10%.

Again, I've split up U.S. and international stocks here using VTI and VXUS purely so U.S. investors can get the foreign tax credit with VXUS, which would not be available with the total world stock market fund VT in years in which the U.S. market comprises greater than 50%, which is currently the case at the time of writing in 2024.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

As an aside, I would suggest using M1 Finance if you don't already have an investment broker, because it has zero transaction fees, automatic rebalancing for new deposits, and a user-friendly interface, among other things. I wrote a comprehensive review of M1 Finance here.

Again, after your emergency fund grows and you can sustain a larger drawdown, you can explore riskier but still-well-diversified options like the All Weather Portfolio. This is essentially sliding further down the scale of risk and expected return. Earlier I said there's no single “best” ETF for an emergency fund. If I had to pick one, it would just be a plain ol' low-cost short-term treasury bond fund or T-Bills fund (or BOXX for those more savvy investors). Those are about as far down on the safe end of that aforementioned scale as you can get.

But that's obviously the boring answer that people aren't really looking for. And I'd argue that's appropriate, as emergency funds are supposed to be pretty boring out of necessity. But I'll oblige. So again, later on, provided the account value is sufficiently large, one could get away with something a bit more exotic. Risk and return tend to be inextricably linked.

Where To Invest Your Emergency Fund

Again, I think M1 Finance is an ideal platform to use to invest your emergency fund. The modern broker offers retirement accounts, taxable brokerage accounts, high-yield savings, and more. This allows you to house multiple accounts under one roof and seamlessly transfer between them. M1 features fractional shares, automatic rebalancing, a sleek mobile app, zero account fees, zero transaction fees, and some of the cheapest margin around.

M1 also has a premium account option called M1 Plus that gets you access to their new Smart Transfers, allowing users to set up chains of automatic transfers between accounts based on specified dollar amount thresholds, e.g. investing any excess cash above $1,000.

Conclusion

I fully support investing your emergency fund to avoid the opportunity cost of missed growth, provided it fits your personal situation and risk tolerance described above. But in doing so, make sure you're investing it in a relatively low-risk, well-diversified portfolio, especially when initially accumulating your savings. Look at historical risk metrics and overfund your invested emergency fund accordingly.

If you're still indecisive, you can always simply split the difference. Put 3 months' expenses in a highly-liquid savings account, and the other 3 months' expenses in an investment account. This allows you to cover short-term, immediate expenses with liquid cash while also allowing money in the investment account to grow, and allows you to potentially avoid capital gains taxes from selling investments to cash.

Do you invest your emergency fund? Do low interest rates have you rethinking the traditional advice of a plain ol' savings account? Let me know in the comments.

Disclosures: None.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Right now, I have a 3 ETF fund portfolio consisting of 85% Stocks (VT), 10% Bonds (BNDW) and 5% cash (I use ICSH ETF that behaves like a HISA).

I use that cash to either rebalance my portfolio if Bonds and stocks are down like in 2022 or I can use it as an EF since I definitely have more than 6 months of living expenses.

Would you recommend I replace the 5% cash portion to that modified EF or am I better off replacing both my bonds and cash for your modified Emergency Fund since the EF already has bonds in it?

I would like to test your EF, I just don’t know with which one to replace it with.

How about Simplfy BUCK Etf? Kinda works like Boxx with better return?

The entire point of BOXX is T-bills-like exposure with greater tax efficiency. BUCK is neither of those things – longer dated bonds and sizable distributions.

What about using the Boxx ETF here as well?

I’ll probably incorporate it, David. I’m a bit hesitant though because BOXX is much more complex and harder to understand than a simple bond fund.

First, thank you for your content. I enjoy reading articles from your website. Currently for cash positions and liquidity, what are your thoughts about ETF’s such as USFR that is Wisdom Tree’s Floating Rate Treasury Fund? What I like about these is that I don’t have to go through the ritual of participating in the T-bill auctions on T.D. website or at my broker but by buying this etf I get to participate in the going rate of the 13 week t-bill that is automatically adjusted weekly. Very liquid and with short term t-bills paying close to 5%, seems to be the safest bet for cash positions that need to be liquid.

Thanks, Bill! I’m fine with floating rate funds. I need to do a post on them.

Bill, wanted to circle back and let you know I just published a post on floating rate bond ETFs here.

Could this set of funds be used also for just parking extra money in a portfolio?

Say u need 25% of total emergency fund for an emergency – John would u draw down from each etf proportionally or take more from the ones that have a higher % of unrealized cap gain? Also would these etf’s be a good place to “park some of my usd cash” for regular investing/trading, which can get up there when the market is becoming insanely overbought so i sell off many of my holdings, and i am waiting until the market becomes at least well oversold to reinvest these funds. (for simplicity here i was thinking the vgsh.

Thirdly as a Canadian do not the etf’s above require usd to invest in and if so do u have any suggestions for Canadian etf’s for their Cad? (for myself overall, i have more american investment than Canadian)

I’d probably try to harvest any losses first, then prioritize LTCG over STCG obviously. T bills or money market to park cash to use as dry powder. But I don’t try to time the market; it’s usually more harmful than helpful. Not sure about Canadian options, sorry.

I know it’s been posted a long time ago, but if there are Canadian users, the more or less equivalent of the suggest etf would be:

10% XEQT -> for VT

45% XSB -> for VGSH

40% XSTH -> for STIPS

5% PHYS stays the same, it trades on the TSX

For Canadians like myself, I use these ETF’s that are more or less similar to what is suggested here:

10% XEQT (The whole stock market) which would be the equivalent to VT except with more exposure to the Canadian market than VT. If you don’t want the Canadian part, you can always opt for XAW which is the world market ex. Canada

5% PHYS.TO ETF is exactly like US one of PHYS. So not complicated there.

40% in XSTH.TO , this ETF mimics STIP that is suggested here, it tracks the exact same thing, but it is CAD-Hedged.

45% in XSB.TO which is the Canadian counterpart to VGSH etf listed by the author, except it holds Canadian Short term bonds Index

When you need to access the funds for an actual emergency, at what point do the capital gains taxes on your gains outweigh the cost of cash losing value to inflation? Or are market investments predicted to still be a net gain after capital gains are paid–in an emergency situation? (Assuming we don’t offset with losses.)

That scenario is mathematically impossible, as taxes only apply to gains. LTCG rate is 15% for most people and zero for other lower income earners.

I love this plan and have been contributing to it simultaneously along side my EF into a regular savings account. Correct me if wrong, but all of the bond funds seem to be US focused. Any ideas or plan to add an international bond? I’m using a taxable.

Thanks, Scott. Correct, these are U.S. treasury bonds which are the highest quality in the world. I touched on international bonds in my post on the Bogleheads 3 Fund Portfolio here. The consensus seems to be that int’l bonds neither help nor hurt the portfolio.

I noticed you changed the portfolio slightly… It used to be 8% VT, 2% VIOV, 45% VGSH, 20%VGIT, 20%VTIP, 5% SGOL. This version just seems a little simpler, are there any other reasons why you changed it? I ran a backtest to compare the two versions and I notice the original allocations were actually slightly less risky.

Indeed, Chris, just simplified it down a bit based on some feedback about it being overly complicated, which was valid.