International assets are a crucial part of any well-diversified investment portfolio. Here we'll look at the best international ETFs to buy for 2024 for both stocks and bonds across developed and emerging markets.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

International ETFs Video

Prefer video? Watch it here:

Introduction – Why International Stocks and Bonds?

International stocks inarguably offer a diversification benefit to a diversified investment portfolio by not being perfectly correlated to the U.S. market, thereby lowering portfolio volatility and risk. That is, international stocks do not move in perfect lockstep with U.S. stocks.

At their global market weight, U.S. stocks comprise only about 50% of the global stock market. Top target date funds now allocate over 30% of equities positions to ex-US stocks. Moreover, considering the historical performance of emerging markets, excluding international stocks may mean missing out on great investment opportunities. Also consider that international markets contain most of the largest automotive, telecommunication, and electronics companies.

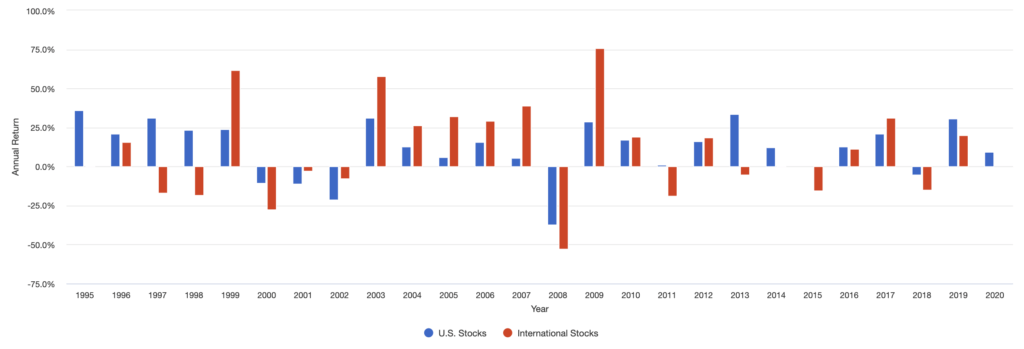

No single country consistently outperforms all the others in the world. If one did, that outperformance would also lead to relative overvaluation and a subsequent reversal. Meb Faber found that if you look at the past 70 years, the U.S. stock market has outperformed foreign stocks by 1% per year, but all of that outperformance has come after 2009.

During the period 1970 to 2008, an equity portfolio of 80% U.S. stocks and 20% international stocks had higher general and risk-adjusted returns than a 100% U.S. stock portfolio. Specifically, international stocks outperformed the U.S. in the years 1986-1988, 1993, 1999, 2002-2007, 2012, 2017, and 2022.

The important takeaway is that it's impossible to know when the performance pendulum will swing and for how long, much less how those time periods would match up with your personal time horizon and retirement date.

Moreover, U.S. stocks' outperformance on average over the past half-century or so has simply been due to increasing price multiples, not an improvement in business fundamentals. That is, U.S. companies did not generate more profit than international companies; their stocks just got more expensive. And remember what we know about expensiveness: cheap stocks have greater expected returns and expensive stocks have lower expected returns.

In short, geographic diversification in equities has huge potential upside and little downside for investors.

Similarly, the evidence seems to show that international bonds may offer a small diversification benefit in terms of credit risk on the fixed income side due to their low correlation with both U.S. stocks and U.S. bonds.

For U.S. investors, holding international assets is also a way to diversify currency risk and to hedge against a weakening U.S. dollar, which has been gradually declining for decades. International stocks tend to outperform U.S. stocks during periods when the value of the U.S. dollar declines sharply, and U.S. stocks tend to outperform international stocks during periods when the value of the U.S. dollar rises. Just like with the stock market, it is impossible to predict which way a particular currency will move next.

I went into the merits of international diversification in even more detail in a separate post here if you're interested.

Below we'll check out some of the best international ETFs across both stocks and bonds to reduce portfolio risk alongside U.S. assets.

The 9 Best International ETFs

Below are the 9 best international ETFs, segmented by asset type.

Best International Stock ETFs

Here we'll look at the best international stock ETFs:

VXUS – Vanguard Total International Stock ETF

Vanguard international ETFs offer some of the cheapest exposure to assets outside the U.S. The Vanguard Total International Stock ETF (VXUS) is the most popular broad international stock ETF, and for good reason. The fund has a very low expense ratio for this space at only 0.07%, providing affordable access to the total international stock market.

This ETF seeks to track the FTSE Global All Cap ex US Index and has over $420 billion in assets under management.

VEU – Vanguard FTSE All-World ex-US ETF

Similar to VXUS above is the Vanguard FTSE All-World ex-US ETF (VEU). The fund seeks to track the FTSE All-World ex US Index and also has an expense ratio of 0.07%.

Both VEU and VXUS are highly liquid, broad international stock ETFs. Their performance has been nearly identical historically. VXUS is arguably more diversified with roughly 7,500 holdings compared to 3,500 for VEU. I delved into this specific comparison of VXUS and VEU in more detail in a separate post here. Basically, one should objectively prefer VXUS over VEU, but they make a great pair for tax loss harvesting purposes.

IXUS – iShares Core MSCI Total International Stock ETF

The iShares Core MSCI Total International Stock ETF (IXUS) is another broadly diversified international stock ETF. The fund seeks to track the MSCI ACWI ex USA IMI Index and has over $20 billion assets and 4,300 holdings. This ETF is slightly more expensive than the above two with an expense ratio of 0.07%.

This one would also be a fine replacement for VEU or VXUS above to avoid a wash sale across multiple accounts if you plan to harvest losses.

VEA – Vanguard FTSE Developed Markets ETF

Investors seeking to only invest in Developed Markets outside the U.S. will enjoy the Vanguard FTSE Developed Markets ETF (VEA). This fund seeks to track the FTSE Developed All Cap ex US Index. It has over $120 billion in assets, over 4,010 holdings, and an expense ratio of only 0.05%.

For a U.S. investor, if you hold VEA, you'll also want some VWO. More on this in a second.

VWO – Vanguard FTSE Emerging Markets ETF

VWO provides exposure to Emerging Markets via the FTSE Emerging Markets All Cap China A Inclusion Index. As you can see from the index name, VWO includes China and other developing countries like Taiwan, India, Brazil, etc. VWO has a fee of 0.08%.

VWO may be the most important fund on this list. Developed Markets (VEA above, and most of VXUS) are highly correlated with the U.S. market and thus don't offer as much of a diversification benefit. Emerging Markets are a superior diversifier and have also conveniently paid a significant risk premium historically. They have beaten U.S. stocks historically. I purposely overweight Emerging Markets in my own portfolio for these reasons.

Emerging Markets comprise about 11% of the global stock market. Note that Emerging Markets as a whole are more volatile than Developed Markets. VXUS (total ex-US stock market) is roughly a 3:1 ratio of Developed Markets to Emerging Markets. Specifically, VXUS is about 75% VEA and about 25% VWO.

Best International Bond ETFs

Below we'll check out a few of the best international bond ETFs.

BNDX – Vanguard Total International Bond ETF

The Vanguard Total International Bond ETF (BNDX) provides broad, USD-hedged diversification across the entire foreign bond market. The fund has over $150 billion in assets, an average maturity of about 10 years, and an expense ratio of 0.07%.

This ETF seeks to track the Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). While I usually prefer to stick to treasury bonds, if I were wanting to buy a broad international bond fund, this would be the fund I'd choose, simply because it's much cheaper than IGOV below.

IAGG – iShares Core International Aggregate Bond ETF

The iShares Core International Aggregate Bond ETF (IAGG) is a broad international bond ETF from iShares. The fund seeks to track the Bloomberg Barclays Global Aggregate ex USD 10% Issuer Capped (Hedged) Index. This ETF is roughly equivalent to BNDX but with a slightly shorter duration. The expense ratio for this ETF is 0.07%.

IAGG would be a suitable replacement for BNDX for tax loss harvesting purposes.

IGOV – iShares International Treasury Bond ETF

Those seeking exposure to only foreign treasury bonds will appreciate the iShares International Treasury Bond ETF (IGOV). The fund tracks the FTSE World Government Bond Index – Developed Markets Capped Select Index and has an expense ratio of 0.35%. Note that this fund only holds foreign bonds from developed countries and does not include Emerging Markets government bonds. Its average maturity is about 11 years.

VWOB – Vanguard Emerging Markets Government Bond ETF

VWOB provides access to USD-denominated government bonds in Emerging Markets. This exposure may benefit investors who hold only U.S. bonds, as bonds from Emerging Markets are lowly correlated to U.S. bonds. They also diversify the investor's credit risk, as these bonds are inherently riskier than U.S. treasury bonds. Historically, investors have been compensated for taking on that extra risk. This diversification comes at a cost; VWOB has a fee of 0.20%.

VWOB seeks to track the Bloomberg Barclays USD Emerging Markets Government RIC Capped Index.

Where To Buy These International ETFs

All the above international ETFs should be available at any major broker. My choice is M1 Finance. M1 has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, intuitive pie visualization, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Disclosures: I am long VWO and VEA in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hello there,

Have you seen the fund SCHY? It’s a SCHD equivalent but for international equities, in my opinion one of the best international etfs out there.

SCHY has a total of 25 holdings, which isn’t as well diversified as some of the other ETFs mentioned in this post. VEA has over 4,000 holdings and better balanced across the various sectors. In addition, the expense ratios for all of the Vanguard funds are less than SCHY’s 0.12%. I would invest in VEA or VXUS for more diversified exposure to international equities.

Very good list, John. I’m thinking of adding VWOB and maybe VWO to my passive Vanguard portfolio that is too heavy on US stock and bond funds.

Typo: VGIT made it into IXUS! Masquerading as an international stock ETF!

Oops. Not sure where my brain was. Thanks! Fixed.