The RSSY ETF aims to provide a "return stacked" solution for U.S. stocks and futures yield in a single fund. It's called the Return Stacked® U.S. Stocks & Futures Yield ETF. I review it here. If you've landed here, it's highly likely that you're already at least somewhat familiar with "return stacking" and you've probably even already checked out the other funds in … [Read more...] about RSSY ETF Review – Return Stacked® U.S. Stocks & Futures Yield ETF

Funds

RSBT ETF Review – Return Stacked® Bonds & Managed Futures ETF

The RSBT ETF aims to provide a "return stacked" solution for bonds and managed futures in a single fund. It's called the Return Stacked® Bonds & Managed Futures ETF. I review it here. If you've landed here, chances are you're already at least somewhat familiar with "return stacking" and maybe you've even already checked out the other funds in this family like RSSB and … [Read more...] about RSBT ETF Review – Return Stacked® Bonds & Managed Futures ETF

RSST ETF Review – Return Stacked® US Stocks & Managed Futures ETF

RSST launched in late 2023 and aims to provide a "return stacked" solution for US stocks and managed futures in a single fund. Appropriately, it's called the Return Stacked® US Stocks & Managed Futures ETF. Let's review it. First, let's briefly cover what "return stacking" is. Essentially, it refers to borrowing (i.e. leverage) to free up space in the portfolio to then … [Read more...] about RSST ETF Review – Return Stacked® US Stocks & Managed Futures ETF

CAOS ETF Review – Alpha Architect Tail Risk ETF

The CAOS ETF from Alpha Architect aims to address left tail risk during tumultuous periods of "chaos" in the stock market. I review it here and explore how CAOS does this and why you might want to consider it in your investment portfolio. Introduction - Tail Risk To set the stage for a discussion of the CAOS ETF, let's first very briefly talk about tail risk to … [Read more...] about CAOS ETF Review – Alpha Architect Tail Risk ETF

CALF ETF Review – Pacer U.S. Small Cap Cash Cows 100 ETF

The CALF ETF from Pacer seeks to capture US small cap stocks with higher free cash flow yield, which it calls "cash cows." I review it here. CALF ETF Overview Small cap stocks have greater expected returns than large cap stocks because they tend to be riskier and more volatile. Small stocks have beaten large stocks historically, compensating investors for taking … [Read more...] about CALF ETF Review – Pacer U.S. Small Cap Cash Cows 100 ETF

AVMA ETF Review – Avantis Moderate Allocation ETF (60/40 + Factors)

Avantis has launched AVMA, a factor-tilted asset allocation ETF with global stocks and bonds. I review it here. Prefer video? Watch it below. If not, keep scrolling to keep reading. I've written plenty elsewhere about factor investing, diversification, and asset allocation. Avantis has now combined all three in a single fund that they call their Moderate Allocation … [Read more...] about AVMA ETF Review – Avantis Moderate Allocation ETF (60/40 + Factors)

COWZ ETF Review – Pacer U.S. Cash Cows 100 ETF

The COWZ ETF from Pacer seeks to hold "cash cows" - US large cap stocks with higher free cash flow yield. I review it here. COWZ ETF Overview For any kind of reliable stability within stocks, we probably want to invest in a company that is profitable, meaning its revenue is greater than its expenses. Some perhaps don't realize that the famous S&P 500 Index for … [Read more...] about COWZ ETF Review – Pacer U.S. Cash Cows 100 ETF

BOXX ETF Review – Alpha Architect 1-3 Month Box ETF

What if I told you there’s a way to get the risk-free return of T-bills but in a way that’s more tax-efficient than buying T-bills directly or buying a T-bills fund like SGOV? Here I review the BOXX ETF and why you might want to consider it over your favorite T-bills ETF or money market fund for your cash management needs. Video Prefer video? Watch it below. If … [Read more...] about BOXX ETF Review – Alpha Architect 1-3 Month Box ETF

Avantis Launches 3 New ETFs – AVMC, AVMV, AVEE

Avantis launched new ETFs on November 9, 2023 - AVMC, AVMV, and AVEE. I briefly summarize them here. Avantis launched 3 new ETFs to provide narrow exposure to corners of the market that they previously didn't have dedicated funds for. AVMC - Avantis U.S. Mid Cap Equity ETF AVMC, the Avantis U.S. Mid Cap Equity ETF, provides exposure to the arguably … [Read more...] about Avantis Launches 3 New ETFs – AVMC, AVMV, AVEE

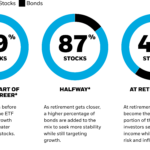

BlackRock iShares Launches First Target Date ETFs

Previously you could only get a target date fund in the form of a mutual fund. Now they're available as ETFs. Prefer video? Watch it below. If not, keep scrolling to keep reading. The enormous asset manager BlackRock has launched the industry's first lineup of target date ETFs. I've noted elsewhere why ETFs are usually preferable to mutual funds for a number … [Read more...] about BlackRock iShares Launches First Target Date ETFs

3 Best Floating Rate Bond ETFs – USFR vs. TFLO vs. FLOT

Floating rate bonds adjust quickly to interest rate changes. Here we'll compare the best floating rate ETFs - USFR, TFLO, and FLOT. Video Prefer video? Watch it here: What Are Floating Rate Bonds? Floating rate bonds are debt instruments with variable interest rates, as opposed to a typical bond with a fixed rate. That interest rate is based on some … [Read more...] about 3 Best Floating Rate Bond ETFs – USFR vs. TFLO vs. FLOT

Avantis Files for 6 New ETFs – AVGV, AVDS, AVMG, AVTD, AVTV, AVLC

Avantis filed for 6 new ETFs on March 21, 2023 - AVGV, AVDS, AVMG, AVTD, AVTV, and AVLC. I briefly summarize them here. Update May 2024: The ticker for AVTV ended up being AVNV and is the Avantis All International Markets Value ETF. Avantis clearly provides great factor funds. They're expanding their offering with 6 new ETFs. Most are "fund of funds" … [Read more...] about Avantis Files for 6 New ETFs – AVGV, AVDS, AVMG, AVTD, AVTV, AVLC

AVGV ETF Review – Avantis All Equity Markets Value ETF

AVGV is a new ETF from Avantis that is a single fund solution for the global stock market investor who wants to go all in on Value stocks. I review it here. Prefer video? Watch it here. If not, continue scrolling to read below. If you've arrived here, I'd guess you already know Avantis is one of the best names in the biz for factor funds, that Value has the most … [Read more...] about AVGV ETF Review – Avantis All Equity Markets Value ETF

Return Stacking Explained – Greater Returns With Lower Risk?

Return stacking refers to applying a modest amount of leverage to a diversified investment portfolio of different asset classes in an attempt to ratchet up expected returns while simultaneously potentially lowering or at least maintaining risk. Here we'll look at what return stacking is and when, why, and how to do it. What Is Return Stacking? Return stacking is … [Read more...] about Return Stacking Explained – Greater Returns With Lower Risk?

SGOV vs. BIL – Which ETF for U.S. T-Bills in 2024?

SGOV and BIL are two popular ETFs for U.S. Treasury Bills. Is there a clear choice for ? Let's compare them. Treasury bills, or T-bills for short, are just ultra-short-term bonds from the U.S. government. These short bonds with maturities of less than a year are called bills. T-bills are referenced as the "risk-free asset" because they are backed by the full faith and … [Read more...] about SGOV vs. BIL – Which ETF for U.S. T-Bills in 2024?

RSSB ETF Review – Return Stacked® Global Stocks & Bonds ETF

RSSB aims to provide a "return stacked" solution for global stocks and bonds in a single fund. It's called the Return Stacked® Global Stocks & Bonds ETF. Let's review it. First, it's important to note that as of March 29, 2023, RSSB is not trading yet. The SEC filing happened on February 6, 2023. Update on December 5, 2023: RSSB has launched! "Return stacking" - … [Read more...] about RSSB ETF Review – Return Stacked® Global Stocks & Bonds ETF

AVES ETF Review – Avantis Emerging Markets Value ETF

AVES is a relatively new ETF from Avantis for targeted factor exposure in Emerging Markets. I review it here and compare it to its counterparts that are usually included in the same conversation, AVEM and DGS. Prefer video? Watch it here: If you've arrived on this page, you probably already know that overweighting or tilting with certain risk factors may offer … [Read more...] about AVES ETF Review – Avantis Emerging Markets Value ETF

Optimized Portfolio “Best in Class” ETFs List for 2024

Every year the legendary investing author and educator Paul Merriman and his team release their recommendations of "best in class ETFs" for each market segment suggested for his model portfolios, so I figured I'd do the same. Introduction - Read This First Paul Merriman publishes his list of "best in class ETFs" every year for his model portfolios. I've got quite a … [Read more...] about Optimized Portfolio “Best in Class” ETFs List for 2024

Paul Merriman Best in Class ETFs List for 2024

Every year the legendary investing author and educator Paul Merriman and his team release their recommendations of "best in class ETFs" for each market segment suggested for his model portfolios. They usually line up with my own research and suggestions. The list for 2023 is below. Introduction By "best in class," Merriman aims to identify funds with low fees and … [Read more...] about Paul Merriman Best in Class ETFs List for 2024

SARK ETF – The Inverse ARKK ETF To Bet Against Cathie Wood

The SARK ETF allows investors to directly bet against Cathie Wood by aiming to deliver the inverse return of her ARKK ETF. It has returned a whopping 95% in a little over a year. Let's check it out. Prefer video? Watch it here: Cathie Wood is at the helm of ARK Invest, whose flagship fund ARKK - the ARK Innovation ETF - saw record inflows after it returned 153% … [Read more...] about SARK ETF – The Inverse ARKK ETF To Bet Against Cathie Wood