A 401k and a Roth IRA are two very different types of retirement accounts for U.S. investors. Is one better than the other? Let's dive in.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

401k and Roth IRA Similarities

First we'll briefly go over the few similarities between a 401k and a Roth IRA. They don't have much in common.

- These are both savings and investment plans to help U.S. citizens save for retirement.

- Both have limits on the amount you can contribute annually.

- Both offer tax-free growth of your investments inside the account.

- You must have earned income to be eligible to contribute to either.

401k and Roth IRA Differences

The bulk of the discussion about a 401k versus a Roth IRA is about the differences between these two accounts, so this section will be much longer and I've broken it up into subsections.

The 401k is much older and was established in 1978. The Roth IRA arrived much later in 1997.

Eligibility

The important fundamental difference between these account types is that a 401k is an employer-sponsored plan or ESP, meaning you have to be employed by someone else to be eligible to contribute to one, while a Roth IRA is an individual retirement account (that's what IRA stands for) that has nothing to do with your employer.

As such, you may be eligible for one and not the other, neither, or both. For example, your employer may or may not offer a 401k plan. If they don't, you can still open a Roth IRA on your own. Conversely, your employer may indeed have a 401k plan but your income may be high enough to prevent you from being eligible to contribute to a Roth IRA. We'll go over income and contribution limits for these accounts later.

If you use both, your 401k and Roth IRA won't be under the same umbrella, as you'll have to choose a broker on your own with whom to open a Roth IRA account.

Taxes

Aside from being two fundamentally different account types, the tax treatment between them is very different as well.

A 401k uses pre-tax dollars as contributions from your regular paycheck before taxes are taken out. In other words, you reduce your current taxable income by opting to contribute to your employer's 401k plan. You then pay taxes later down the road on the withdrawals from the account in retirement.

With a Roth IRA, you contribute post-tax dollars while working and then withdrawals later in retirement are tax-free. That is, you've already paid taxes on the money going in so you don't have to pay taxes on the growth in the future.

To put it simply, with the 401k, you pay taxes later, and with the Roth IRA, you pay taxes now.

Contribution Limits

401k's and Roth IRA's have two very different contribution limits, with the former being roughly 3x that of the latter. We'll go over these specific limits later.

Withdrawals

Another major difference involves required minimum withdrawals, or RMDs for short. The 401k requires you to start withdrawing money annually at age 73 because Uncle Sam wants his tax revenue. Specifically, by the time you retire, you've probably rolled over your employer's 401k into a Traditional IRA, which has that same required distribution rule. Failure to take RMDs can result in significant penalties. Roth IRAs, on the other hand, do not have RMDs because you've already paid taxes on that money.

While we're on the subject, Roth IRA contributions can be withdrawn anytime tax- and penalty-free because those are just earned dollars on which you've already paid taxes. In that sense, the Roth IRA can act as a backup savings vehicle for things like an emergency fund or education expenses. If you have converted another account to a Roth IRA, you have to wait 5 years to do this.

Most 401k plans allow for you to take out a loan on the balance, on which you'll pay interest, probably some fees, and potentially taxes. These loans typically have to be paid back within 5 years. Check with your 401k provider on the specifics of their loan options.

An early 401k withdrawal will be subject to taxes and a 10% penalty. The IRS does allow for some hardship exceptions to this like permanent disability, unreimbursed medical expenses, and funeral expenses. Consult your tax professional.

A few special circumstances allow for penalty-free early Roth IRA withdrawals of earnings before age 59.5:

- First time home purchase; you can withdraw up to $10,000.

- Higher education expenses

- Medical expenses

- Death

- Disability

- Substantially equal periodic payments

Consult your tax professional if any of those apply to you.

Investments

A significant difference between a 401k and a Roth IRA is the availability of investment choices. Your 401k menu will have a very limited selection of investment options selected by your employer and the provider. Since you open and manage a Roth IRA on your own, your investment options are virtually endless.

Granted, this may not be a huge concern for the index investor, as most 401k menus should have the usual suspects like a Vanguard index fund for the S&P 500, a total U.S. bond market fund, etc.

I'll touch on some nuanced implications of this difference in choice a bit later.

401k and Roth IRA Income and Contribution Limits

Now we'll cover the specific differences in income and contribution limits for the 401k and Roth IRA. Note that these typically change every year so the numbers here may be outdated depending on when you're seeing this.

If your income (MAGI; Modified Adjusted Gross Income) is above all these limits, you can use a technique called a “backdoor Roth IRA” where you make a nondeductible contribution to a Traditional IRA and then convert it to a Roth IRA, thereby allowing very high earners to legally get around the income limits.

Also note that your 401k or Roth IRA contribution cannot exceed the income you earned for that year.

Here's are those limits in a table:

| Rules | 401k | Roth IRA |

|---|---|---|

| 2023 Contribution Limits | $22,500; $30,000 if age 50 or older. | $6,500; $7,500 if age 50 or older. |

| 2024 Contribution Limits | $23,000; $30,500 if age 50 or older. | $7,000; $8,000 if age 50 or older. |

| 2023 Income Limits – Single | None | $153,000; phase-out begins at $138,000. |

| 2024 Income Limits – Single | None | $161,000; phase-out begins at $146,000. |

| 2023 Income Limits – Married Filing Jointly | None | $228,000; phase-out begins at $218,000. |

| 2024 Income Limits – Married Filing Jointly | None | $240,000; phase-out begins at $230,000. |

401k vs. Roth IRA – Which Is Better?

So which is better, the 401k or the Roth IRA? Well, hopefully by now you realize these accounts are so inherently different that one is not necessarily better than the other, and if you're eligible for both, it's probably best to just utilize both.

Even if you don't care to contribute to your employer's 401k, it's always recommended to contribute enough to qualify for the employer match if there is one, as that's free money you'd be leaving on the table otherwise. An employer match means the employer will match your contributions up to a certain amount. For example, if you elect to contribute 3% of your paycheck to the 401k, the employer may match 100% of those contributions, meaning an additional 3% for a total of 6%. The amounts and specifics vary, so check your employment contract for this information.

Depending on what particular investments are available in your 401k menu, you may have to strategically construct your portfolio in pieces across your different accounts. For example, a hypothetical 401k menu may only include U.S. stocks mutual funds and no products for bonds or international stocks. In that case, you'd obviously have to buy funds for bonds and international stocks in your other accounts like a Roth IRA, Traditional IRA, or taxable brokerage account.

This is particularly true for the factor investor who wants aggressive tilts with products from the likes of Avantis and Dimensional, which you're probably not going to find in your 401k investment choices. This also obviously means you'll want to keep track of your entire portfolio holistically to maintain your desired asset allocation.

Also note you're probably only going to find mutual funds in the 401k, and they can have a wide range of fees and methodologies. Be sure to do your due diligence and understand what you're buying. I've seen a number of colleagues over the years unknowingly invested in expensive actively managed mutual funds with fees above 1%, when they could have bought a Vanguard index fund for less than 1/10 of the cost in the same plan.

Note that the 401k is going to be a little more hands-off, which may be of significant value for some investors. Since contributions are automatically deducted from your paycheck, you don't have to see or think about it and your retirement account can grow somewhat invisibly behind the scenes without you being tempted to spend that money.

With the Roth IRA, on the other hand, unless you've set up automatic deposits from your bank account with your broker, you're going to have to be a diligent saver and make those contributions manually each year, which requires some planning and effort and may not feel fun, particularly in a bear market.

A major consideration would obviously be whether or not you want to deal with required withdrawals or RMDs. Remember that you're forced to start withdrawing from a 401k (or a Traditional IRA) at age 73, regardless of whether or not you need that money, and those withdrawals are taxed as ordinary income. If you still have income at that age, those required withdrawals are going to increase your taxable income and therefore your income tax liability.

Roth IRAs do not have RMDs. You're not required to withdraw at any age or even at all during your lifetime, making them a great wealth transfer vehicle. Beneficiaries of Roth IRAs won't owe taxes on distributions, either, as once again, that money was already taxed on the front end. Recall that you can also withdraw your Roth IRA contributions tax- and penalty-free anytime. This makes the Roth IRA more flexible.

Also realize that because of their very different tax treatment, utilizing both a 401k and a Roth IRA diversifies your taxation in that the 401k uses pre-tax contributions while the Roth IRA uses after-tax contributions. This effectively insures you against significant changes in tax law and tax rates between now and when you retire. Note that Roth 401k plans do exist but are pretty rare.

It's generally a good idea to maximize your annual contributions whenever possible, and of course I've detailed elsewhere how it's best to get money in the market as soon as possible on average, which is why savvy Bogleheads typically like to max out their contributions at the beginning of each year. This is a bit easier for the Roth IRA because of its much lower contribution limit. For the 401k, I made a calculator here to help you do that over the course of several months if you want to.

As I explained when comparing Traditional and Roth IRAs, most people are going to have a lower tax rate in retirement than they do while they're working, so for any given available dollar, it probably makes sense to contribute to the 401k first.

Note that you do have until tax day (usually around April 15) to make contributions for the previous calendar year for the Roth IRA, but for the 401k it's the end of the calendar year of that same year, so December 31. Maxing out your retirement accounts is a great problem to have, after which you'd want to contribute to a standard taxable brokerage account.

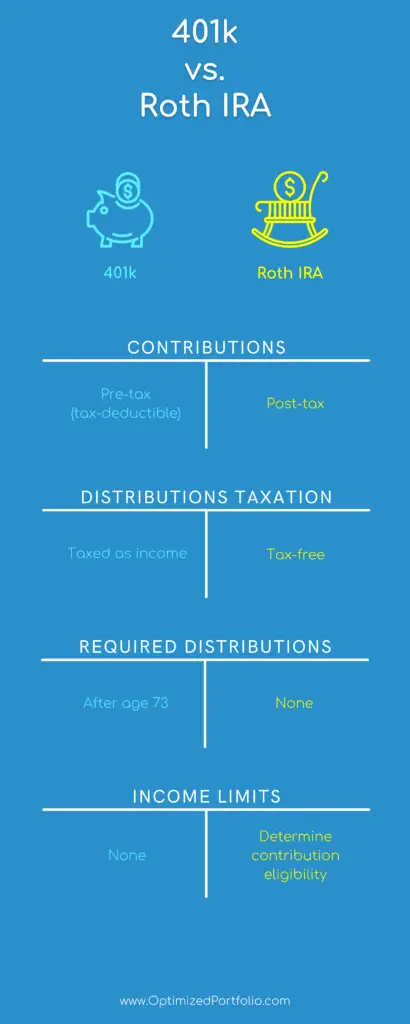

401k vs. Roth IRA Comparison Chart Infographic

To recap, here's a comparison chart in infographic form showing the main differences between a 401k and a Roth IRA:

How To Open a Roth IRA

Most brokerages like Schwab, Fidelity, Vanguard, etc. offer both Roth and Traditional IRAs. You'll just choose which one you want when opening a new account. My choice is M1 Finance. The broker has automatic deposits and withdrawals, a sleek mobile app, and dynamic rebalancing of new deposits, among other things. I wrote a comprehensive review of the platform here.

Do you prefer a 401k or a Roth IRA? When do you max out your contributions? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply