Two of the most popular stock market index ETFs are the Vanguard S&P 500 ETF (VOO) and the Vanguard Total Stock Market ETF (VTI). Here we'll dive into their differences, similarities, and performance.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here are the highlights:

- VOO and VTI are the two most popular U.S. stock market ETFs out there. Both are from Vanguard.

- VOO tracks the S&P 500 Index. VTI tracks the CRSP US Total Market Index.

- As such, VOO is entirely large-cap stocks, while VTI also includes small- and mid-cap stocks.

- Specifically, VOO comprises roughly 82% of VTI by weight.

- Consequently, VTI has been – and should be expected to be – slightly more volatile than VOO.

- Since it contains small- and mid-caps, which have outperformed large caps historically due to the Size factor premium, we would expect VTI to outperform VOO over the long term, and indeed it has historically.

- VOO has roughly 500 holdings and VTI has roughly 3,500 holdings, so VTI can be considered more diversified.

- Both VOO and VTI have the same expense ratio of 0.03%.

- VTI is much more popular than VOO.

Contents

VOO vs. VTI – Video

Prefer video? Watch it here:

VOO vs. VTI – Differences in Methodology and Composition

If you've landed here, you probably already know that stocks are a significant driver of portfolio returns, and that index funds are a great, low-cost way to get immediate, broad diversification across asset classes. You also probably already know that Vanguard has some of the lowest fees around and has a solid track record of providing ETFs that accurately track their indexes.

The Vanguard S&P 500 ETF (VOO) is one of the most popular stock ETFs out there. It was established in 2010. The fund seeks to track the famous S&P 500 Index, holding the 500 largest U.S. companies. This index is considered a sufficient proxy and barometer for “the market” in the U.S. The mutual fund equivalent for VOO is VFIAX.

The Vanguard Total Stock Market ETF (VTI) provides similar broad exposure to the U.S. stock market, with the addition of small- and mid-caps. It was established in 2001. The fund seeks to track the CRSP US Total Market Index. This ETF holds over 3,500 U.S. stocks across all cap sizes. Specifically, VTI is comprised of roughly 82% large-cap, 12% mid-cap, and 6% small-cap stocks. In other words, VOO comprises roughly 82% of the broader VTI. Put more simply, VOO is already inside of VTI. The mutual fund equivalent for VTI is VTSAX.

People hear of these two popular ETFs and wonder which one they should go with, or if they should utilize both. It is one of the questions I see asked most often on Reddit.

The only real difference between VOO and VTI is that VTI includes small, mid, and large cap stocks, while VOO is only large-cap stocks. Since VTI is market cap weighted, meaning weighted by the size (the market capitalization) of the constituent stocks, about 82% of VTI's weight is VOO, with the other 18% being those smaller companies. That 18% is about 3,000 stocks.

Since small- and mid-cap stocks tend to be more volatile than large-caps, VTI should be – and has been – slightly more volatile than VOO. Because VOO holds about 500 stocks and VTI holds about 3,500, VTI can also be considered more diversified than VOO.

Now let's look at the performance of VOO vs. VTI.

VOO vs. VTI – Historical Performance

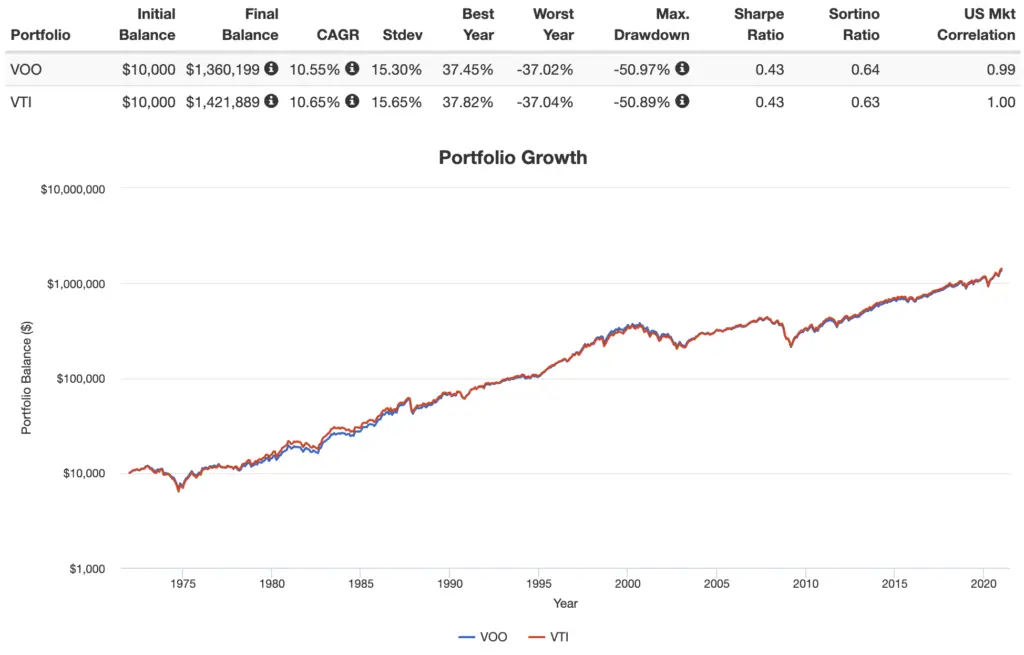

Note that small- and mid-cap stocks have outperformed large-caps historically because they are considered riskier; this is known as the Size risk factor premium. Thus, we would expect VTI to slightly outperform VOO over the long term, and indeed it has historically, using their underlying indexes going back to 1972:

As we'd also expect due to its inclusion of smaller stocks, VTI has been slightly more volatile than VOO, meaning its variability of returns – measured by standard deviation – has been greater. VTI has delivered a higher return, but the risk-adjusted return (Sharpe) of these funds is identical.

VOO vs. VTI – AUM and Fees

Though both funds are highly liquid and extremely popular, Vanguard's VTI is much more popular with over $910 billion in assets under management. VOO has roughly $550 billion in assets.

Expense ratio for these funds is the same at a low 0.03%.

Conclusion

VOO and VTI are highly correlated, as the former makes up about 82% of the latter by weight. Because of this, their historical performance has been very close, but we would expect VTI to slightly outperform VOO over the long term due to its inclusion of small- and mid-cap stocks, and indeed it has historically. Conveniently, VTI can also be considered more diversified, as it holds about 3,000 more stocks than VOO. This contrasting number of holdings and subsequent cap size exposure is the primary difference between VOO and VTI.

The investor who for some reason is only seeking lower volatility large-cap stocks will want to go with VOO, tracking the S&P 500 Index. Those desiring greater diversification and greater expected returns, at the cost of slightly greater volatility, will want to go with VTI to capture the entire U.S. stock market. Alternatively, you might use VOO in combination with a small cap value fund; that's what I do in my own portfolio.

In any case, both VOO and VTI are solid choices to get broad exposure to the U.S. stock market. Some employer-sponsored retirement plans may only offer one of these funds and not the other. Keep in mind you may see their mutual fund equivalents, which are VFIAX for VOO and VTSAX for VTI.

Conveniently, all these funds should be available at any broker, including M1 Finance, which is the one I'm usually suggesting around here.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Disclosure: I am long VOO and VTI in my own portfolio.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Thank you very much for the good article.

One question.

Which ticker symbol you utilized when you compare VTI and VOO with PortfolioVisualizer.com?

For VTI and VOO, we can trace back from 2001 and 2010 respectively and for these specific ticker symbols, we are not able to confirm the before period.

Thank you very much,

Mutual funds or their underlying indexes.

Nice write-up. Quick question – I know you’re a fan of VOO (Vanguard S&P 500) for large-cap exposure especially when pairing with Small Cap Value exposure, any thoughts of using VV (Vanguard Largecap ETF) instead or no real reason to?

And I’m not even sure it even makes a real difference as the differences between the 2 are fairly razor thin. The only minor difference is that VV will hold all stocks in its largecap sized index set (currently has about 590 stocks) whereas the S&P 500 may exclude a few stocks. For example, Tesla was left out of the S&P 500 index for quite some time before the committee decided to include it.

But yeah VOO is super cheap and has the bigger name from tracking the well recognized S&P 500 index.

Bullet point three at the beginning – “VOO is entirely large-cap stocks” appears to be incorrect. Using morningstar.com, under “portfolio”, the style box (by weight), shows that VOO contains 16% midcap. It seems odd, in that the S&P 500 has a reported minimum market cap of 11.8 billion (https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-brochure.pdf), and most define midcap as 2-10 billion. I discovered this when comparing RSP (an equal weight S&P fund) to VOO. According to Morningstar, RSP has 58% midcap, and 2% small cap! ETF.com confirms VOO’s inclusion of midcaps, and attributes it to the S&P 500 committee (https://www.etf.com/VOO#overview). NextAdvisor (https://time.com/nextadvisor/investing/sp-500-guide/) on 11/24/21 stated that the smallest stock in the S&P 500 is News Corporation Class B, with a market cap of 14.3 billion. Confusing, isn’t it!

Confusing indeed, Scott. Basically different definitions of cap sizes from different publications and indexes. It’s somewhat arbitrary.

Hi John. Thanks for your hard work.

I got a bit of a newbie question. You wrote above that “VTI is comprised of roughly 82% large-cap, 12% mid-cap, and 6% small-cap stocks.” But Fidelity lists VTI as 72.4% large-cap, 19.12% mid-cap, 6.21% small-cap, 2.27% micro-cap. https://screener.fidelity.com/ftgw/etf/goto/snapshot/portfolioComposition.jhtml?symbols=VTI

Why is there such a big difference between the numbers for large and mid cap? I ask because I’m trying recreate a total market index fund at my 401K. I looked up VTI on fidelity before remembering you recently wrote this article.

Thanks for your help and insight.

Just depends on where they put the dividers for defining the different cap sizes based on market cap. The S&P 500 is about 82% of VTI, and we refer to the S&P 500 colloquially as “large caps,” but technically you could argue some of them at the bottom are mid-caps. This page might help.

In any case, I wouldn’t worry about it too much.

Is vti on fidelity ?

Yes