Financially reviewed by Patrick Flood, CFA.

M1 Finance is an investing platform that has surged in popularity recently. Here I'll review everything you need to know about it.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

M1 Finance Review Summary

Summary

M1 Finance is great for medium- to long-term investors. It is not great for day traders. M1 makes investing quick, simple, and easy at little to no cost. M1 allows for as much or as little customization as you want, making it perfect for both seasoned and beginner investors. M1 has one of the cheapest margin rates around, and has powerful features that allow for automated, hands-off, passive investing.

M1 Finance Pros and Cons Summary

Pros

- Low to no cost investing

- Customization

- Auto-invest feature

- Fractional shares

- Dedicated dividend dashboard

- Intuitive pie interface

- Cheap margin

- Integrable high-yield cash account

- Dynamic rebalancing

- Model Portfolios

- Built-in tax efficiency

Cons

- No money market account

- Customer support might be slow.

- No advanced order control

- No Options/FOREX

- Two trading windows

- No automatic tax loss harvesting

Contents

What is M1 Finance?

M1 Finance is somewhat of a hybrid between newer “robo-advisors” and traditional brokerages. It has the technology, simplicity, and attraction of the former, with the customization and control of the latter, giving you the best of both worlds. M1 is not a robo-advisor; it is a self-directed platform. M1 is for long-term, buy-and-hold investing, and has zero commissions.

While robo-advisors usually [hopefully] ask you a series of questions to determine risk tolerance and goals, M1 gives you complete control over your portfolio construction. The former usually comes at the cost of limited investment options and additional fees.

M1 Finance gives you complete control over the customization of your portfolio, essentially allowing you to create your own ETF's (Exchange Traded Fund; just collections of stocks) in a pie format, consistent with Modern Portfolio Theory. M1 is particularly attractive to beginner and dividend investors.

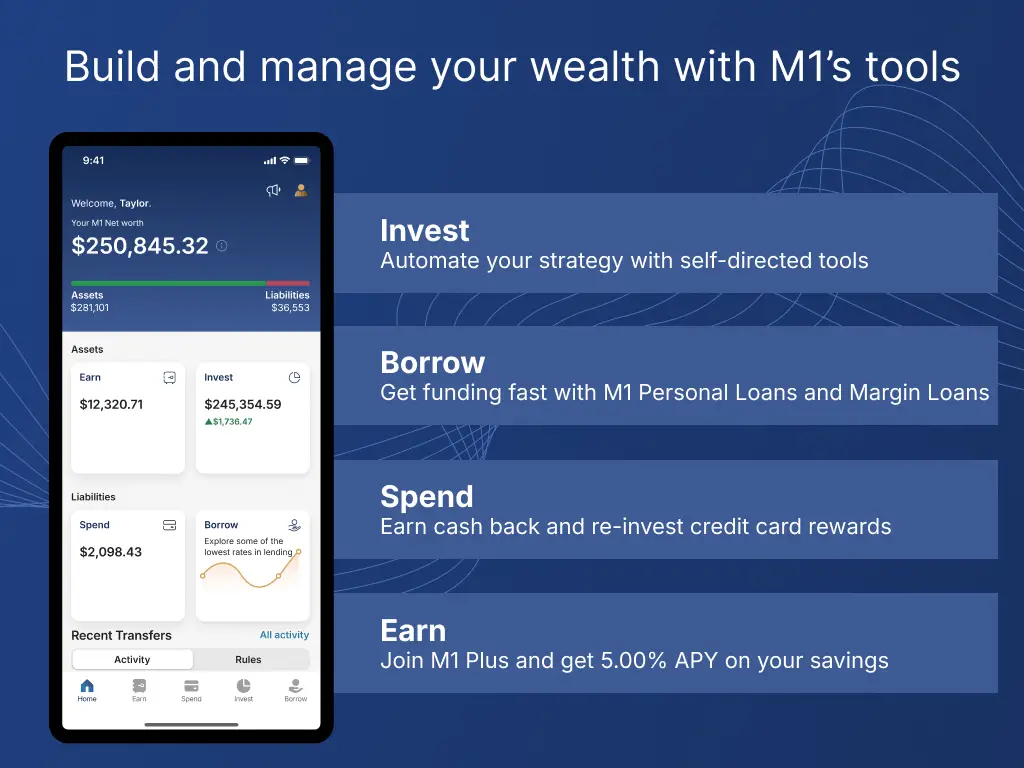

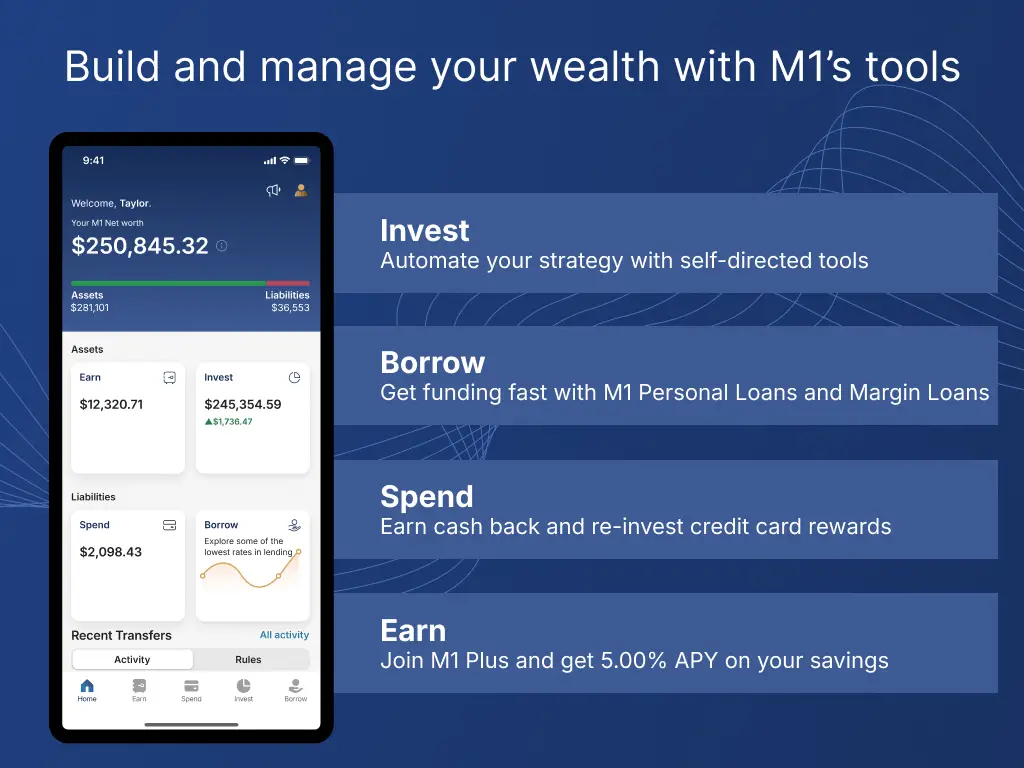

The main product users will likely be interested is M1 Invest, but M1 Finance also has other lesser known modules besides Invest all under a single user account umbrella:

- M1 Borrow: a collateralized loan in the form of a portfolio line of credit that uses margin, with one of the lowest rates on the market.

- M1 Earn: an FDIC-insured high-yield cash account with a very competitive interest rate.

- M1 Spend: a credit card with rewards based on purchases you make every day already with popular brands.

We'll explore each of these in detail later on in this post.

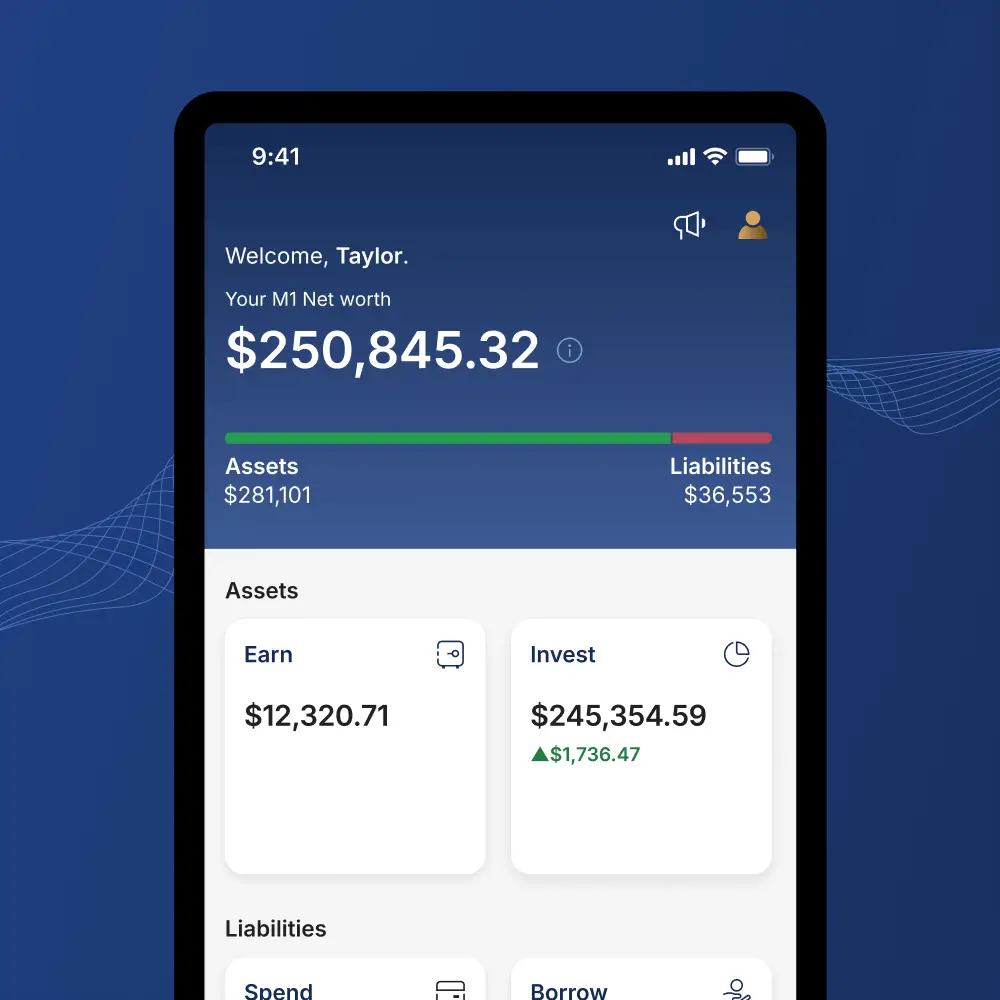

M1 becomes your one-stop financial hub to manage investments, savings, credit, and loans. It combines all these and shows an overall snapshot of your net worth upon signing in:

Here's what that looks like on mobile:

Just remember this is not investing advice and all investing involves risk.

Who is M1 Finance Ideal For?

M1 Finance is ideal for:

- Sophisticated investors

- Beginner investors

- DIY investors

- Dividend investors

- Frugal investors

- Medium- to long-term investors

- Passive investors who want to be hands-off

- Active investors who want complete customization

M1 is not ideal for:

- Day traders

- Those who need an adviser; M1 is self-directed.

- Those looking for a 529 account.

- Options contracts or FOREX traders.

M1 Finance Account Types

M1 Finance allows for the following account types:

- Taxable

- Joint

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

- Trusts

- Custodial

At the time of writing, M1 Finance does not offer the following accounts:

- SIMPLE IRA

- 401(k)

- Solo 401(k)

- 529

- Non-Profit

- HSA

M1 Finance Features

Let's explore the features of M1 Finance.

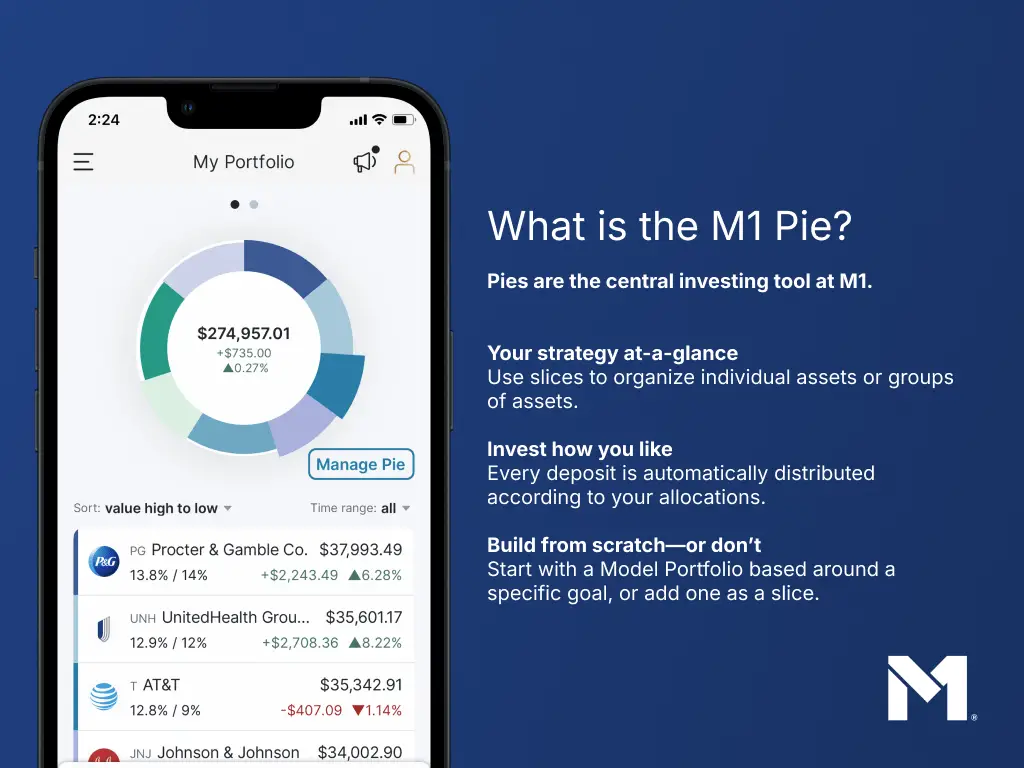

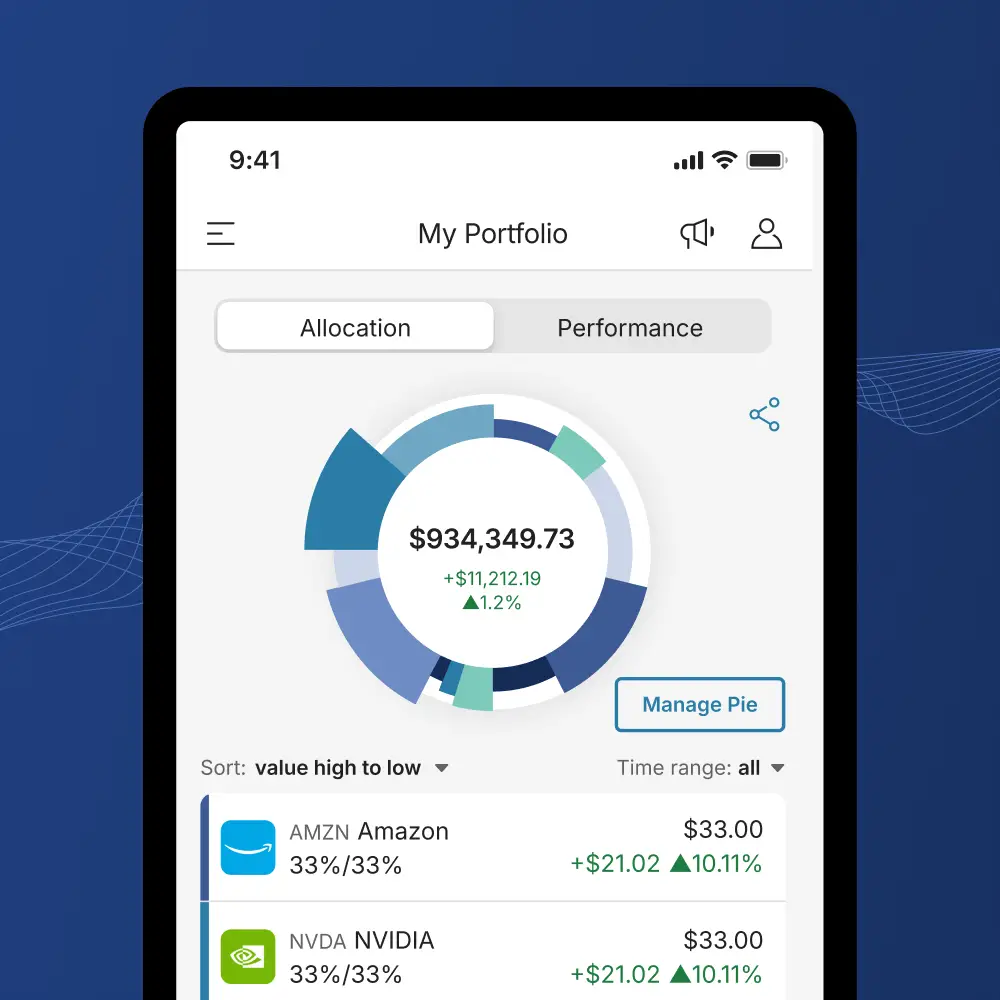

Pie-Based Interface

Perhaps the most popular and most unique feature of M1 Finance is its use of “pies” – portfolios that you can customize and assemble with individual securities, ETF's, and/or ETN's. You set the percentage allocations inside the pie. You can also create multiple pies and have pies within pies; I call them “sub-pies.”

The pie is the basis of the portfolio. You can customize yours as you see fit. For example, you could choose to have 50% of your pie in 30 different individual stocks and the other 50% in 3 different bond funds. Asset allocation is up to you. Whereas traditional brokers are showing you charting tools and technical indicators, M1 uses a visually intuitive pie-based interface to prioritize asset allocation and securities choices.

Creating pies is simple. You just choose your investments – individual stocks, ETF's, and/or ETN's – and specify the weight of each slice to where they add up to 100%, and save it. You can add, remove, or edit slices in the future whenever you want. M1 offers pretty much any stock or ETF you can think of as long as it's traded on any of the major exchanges.

Custom pies can be shared with other users via a hyperlink. Those users can easily choose to invest in your pie inside their portfolio. This brings a neat social aspect to investing. For example, I've created a number of popular “lazy portfolio” pies here.

The pie-based interface is intuitive and easy to navigate, making it particularly attractive to beginner investors. It also provides a nice visual representation of your portfolio, showing you each slice.

Model Portfolios

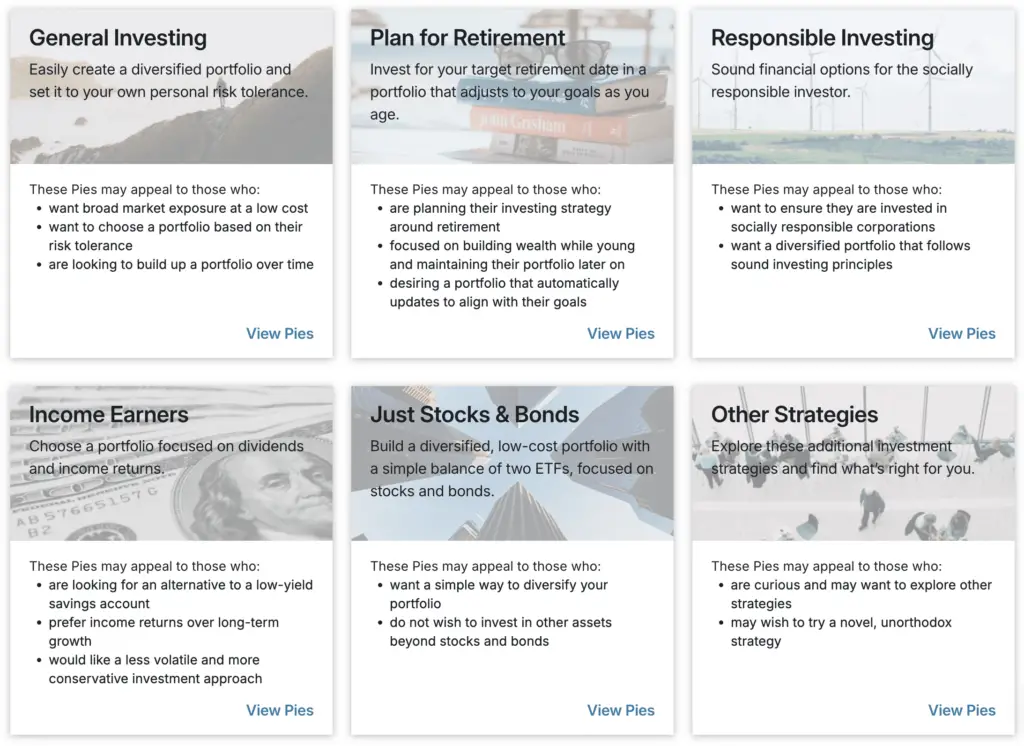

Don't feel like creating your own pie? M1 Finance offers pre-built Model Portfolios that you can passively invest in and be completely hands-off. Or you can combine Model Portfolios with your own pie(s). The possibilities are endless.

Model Portfolios are diversified baskets designed to align with a particular investing strategy. They include:

- General investing pies for broad market exposure based on risk tolerance (Conservative, Moderate, Aggressive, etc.).

- Target date pies to invest for retirement.

- Responsible investing – referred to as ESG (Environmental, Social, and Governance) – invest in socially responsible companies that align with your personal values.

- Income pies for those looking for an alternative to a traditional savings account.

- and more.

M1 employs typical investing methodology to select funds for its Model Portfolios – looking at things like ETF fees, volume, size, and tracking error. When M1 updates a Model Portfolio, the change will automatically reflect in your portfolio.

No Trade Commissions

With M1 Finance, there are no commissions or management fees. All M1 clients have access to the best of M1 including premium features and competitive rates.

A $3 monthly fee is waive for clients who have $10,000 or more in M1 assets at least one day during each billing cycle or an active Personal Loan.

M1 Finance, LLC does not charge commission, trading, or management fees for self-directed brokerage accounts. You may still be charged other fees such as M1’s platform fee, regulatory fees, account closure fees, or ADR fees. There are of course miscellaneous fees for things like paper statements, account inactivity, account transfers, etc. that are outlined here.

Fractional Shares

M1 Finance supports the buying and selling of fractional shares. If the share price is $100 and you only have $50 to invest, you can buy 0.5 shares. This allows you to maintain your target allocations in your pies without having to worry about whole shares, which is particularly important for young investors with less capital, and especially with stocks like Google where the share price is close to $1,000.

Another subtle but significant benefit of fractional shares is you won't have cash sitting idly in your account missing out on growth – you can invest everything you have.

If you choose to transfer your account to another broker-dealer, only the full shares are guaranteed to transfer. Fractional shares may need to be liquidated and transferred as cash.

Dynamic Rebalancing

Dynamic Rebalancing is of the most important features of M1 Finance.

Rebalancing your portfolio is necessary from time to time as your allocations among assets stray over time. Let's say you have a 60/40 asset allocation of stocks to bonds and after 6 months, your stocks have increased in value more than your bonds to where your allocation has become 65/35. With a traditional brokerage, rebalancing would require some time and effort – manually calculating the number of shares you need to buy and sell on each side relative to the value of your portfolio to get back to your target allocation of 60/40, and incurring transaction fees in doing so, as well as capital gains taxes if it's a taxable account.

Dynamic rebalancing with M1 simply refers to how new deposits are allocated to buy orders based on your specified target allocations. That is, underweight assets are automatically bought with new deposits to bring them back to your target allocation. This means your new deposits will be doing the rebalancing for you. This is especially significant in a taxable account, because it means you can rebalance without doing any actual selling of your securities, thereby avoiding capital gains taxes.

You can also manually rebalance with one click if you want to.

Built-in Tax Efficiency

M1 Finance utilizes built-in “tax minimization” when you sell by prioritizing tax lots in the following order:

- Losses to offset gains.

- Lots that have long-term capital gains.

- Lots that have short-term capital gains.

This is another subtle but significant feature that saves you money over the long term.

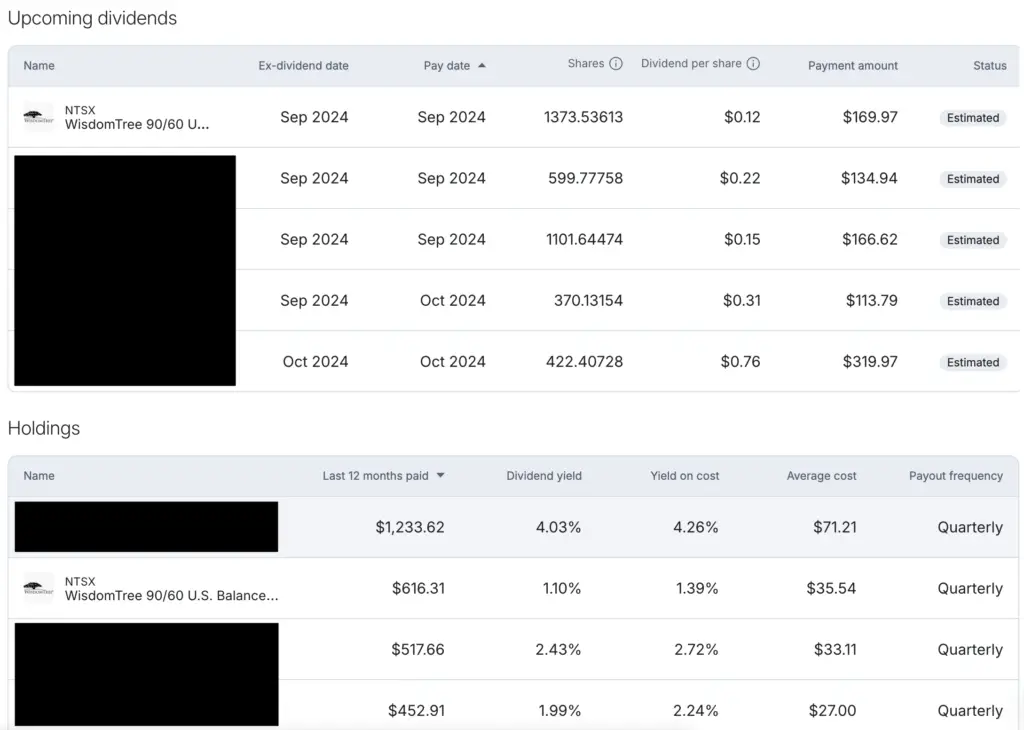

Dividend Activity Dashboard

M1 Finance is extremely popular among dividend investors, and for good reason, with its customized pie interface, low fees, and automatic reinvestment. There is an entire dashboard dedicated to dividends showing things like:

- dividends from previous year

- dividends for current year

- dividend estimates for the next 12 months.

- upcoming dividends for each individual holding including the ex-dividend date, the pay date, number of shares, the dividend amount per share, what that payment equates to, and the status of confirmed or estimated.

- metrics like dividend payments over the last 12 months, dividend yield, yield on cost, average cost, and dividend payout frequency.

When securities you own pay you a dividend, you'll see it reflected in both your performance summary and a separate detailed dividend activity section.

Dividend Reinvestment

M1 Finance offers automatic dividend reinvestment at both the portfolio level (buying underweight assets aka dynamic rebalancing) and the individual security level (like a true DRIP), allowing for faster compounding. Traditional brokers usually charge a fee for this. We'll cover this in more detail below.

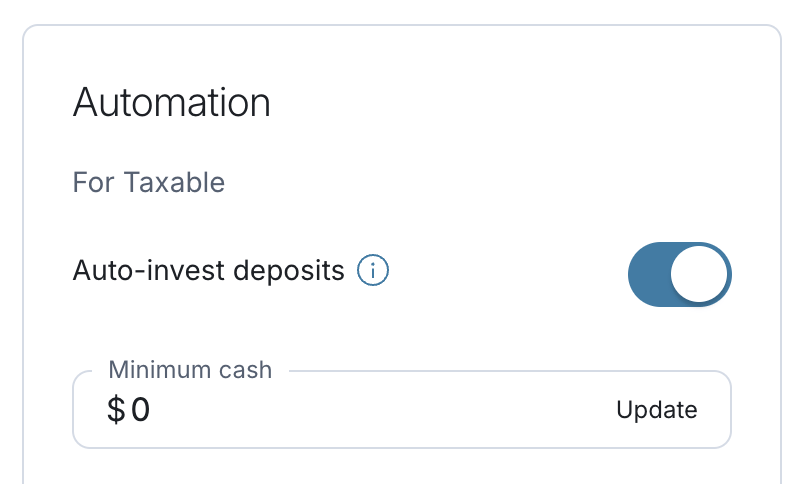

Auto-Invest

With M1's auto-invest feature, you can automatically invest new deposits if your cash balance meets a threshold that you specify. For example, you can set the auto-invest feature to invest your any excess cash balance over $500. This can be as low as $25. You can also turn auto-invest off to place buy orders yourself.

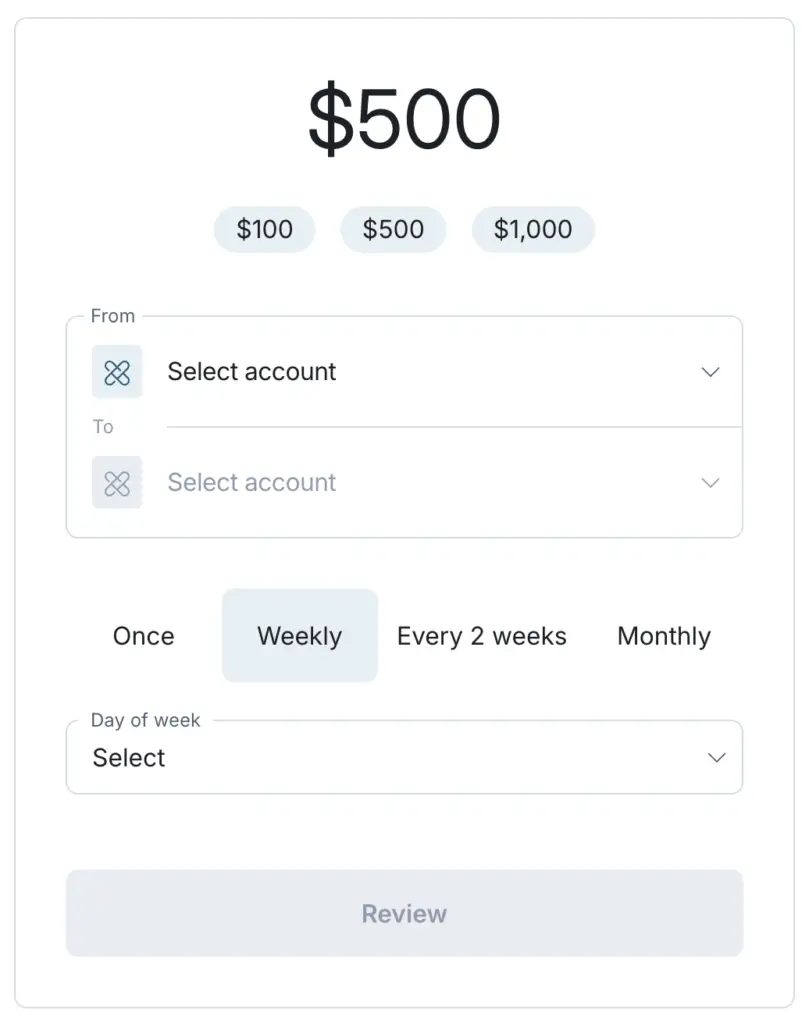

Recurring Deposits

Similarly, you can set up automatically recurring deposits from your bank account to your M1 Invest account to take advantage of automatic investing. This allows you to grow your portfolio behind the scenes without lifting a finger.

Mobile App

Consistent with modern investing platforms, M1 Finance has a sleek, intuitive mobile app that covers all their modules, available for both iPhone and Android.

Dark Mode

One of the newer features is “dark mode” – easier on the eyes in the mobile app:

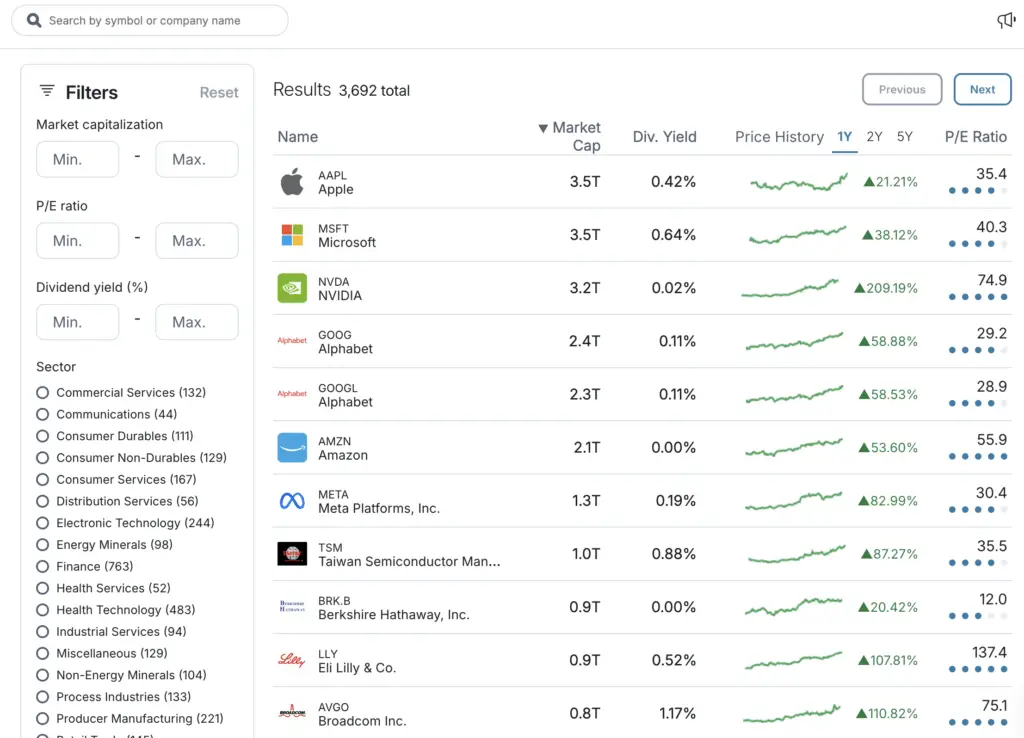

Research Tools

M1 Finance offers some basic research and filtering tools for stocks and funds.

There's also a section that aggregates recent market news:

Crypto

M1 Finance supports the buying and selling of Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

Investing in cryptocurrency comes with significant risk and may not be suitable for everyone. Based on your specific situation and financial condition, carefully consider whether investing in cryptocurrencies is suitable for you. For relevant disclosures and risks, visit m1.com/crypto-disclosures

As a customer of both M1 and Apex, you have a brokerage account held at Apex Clearing Corporation to hold your securities and cash and an account at Apex Crypto to hold your cryptocurrencies. M1 Digital LLC is a wholly separate affiliate of M1 Finance LLC, and neither are involved with the execution or custody of cryptocurrencies. Cryptocurrencies are not FDIC or SIPC insured.

M1 Finance Blog

M1 Finance has a blog where they regularly post useful tips and investing advice. You can find it here.

SIPC Insurance

Securities Investor Protection Corporation (SIPC) insurance covers your investments in cases of a firm's insolvency or misconduct. You can rest assured that your M1 Finance investment account is covered. You can read more about the details of SIPC insurance here.

Solid Clearing Firm

Apex Clearing Corporation clears IRAs and crypto, and M1 is self clearing for all other Invest accounts.

Security

All data transferred and stored in M1 Finance is protected with military-grade 4096-bit encryption. Two-factor authentication is available for account security.

Dividend Investing with M1 Finance

As I noted, M1 Finance is extremely popular with young investors, the FIRE (Financial Independence, Retire Early) community, and dividend investors. M1 allows for automatic deposits, dividend reinvestment at both the pie level and individual security level (like DRIP), and filtering to find stocks and ETF's within a specific dividend yield range. I created my own version of a dividend pie for M1 here.

You can read more about these dividend features in a separate post here.

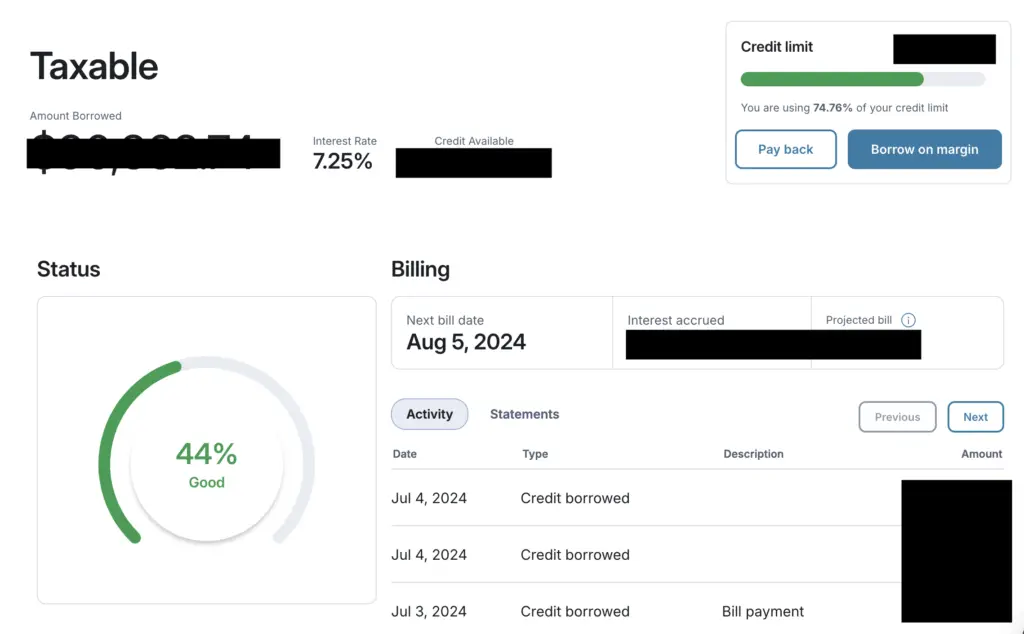

M1 Borrow

One of the most attractive features of M1 Finance is their margin loan, known as M1 Borrow. A margin loan is simply a loan where the investments in your taxable portfolio are the collateral.

With most brokerages, margin loans are just for the purpose of adding leverage to your portfolio by buying more securities, increasing your exposure. With M1, however, you can use the loan for whatever you want:

- Buy more securities (portfolio leverage).

- A home improvement project.

- Refinance higher-interest debt from student loans, credit cards, auto loans, etc.

- Finance a major purchase like a new appliance.

- Cover unforeseen expenses in lieu of an emergency fund.

- etc.

You can access a line of credit of up to 50% of your portfolio's value quickly and easily. For a $10,000 account, you can borrow up to $5,000. There are no denials, no loan officers, no paperwork, and no credit check; you automatically qualify if your taxable account has an invested balance of at least $2,000.

M1 Borrow offers one of the lowest interest rates on the market.

M1 also offers personal loans with a fixed interest rate and no fees with terms from 2 years to 7 years, allowing you to fund things like home renovations, debt consolidation, and major purchases.

As with any type of loan, there are risks like interest rate changes, margin calls, and magnified losses if you're using the loan for portfolio leverage. You can read more about these risks here.

Brokerage accounts on the M1 platform are either fully disclosed to APEX Clearing or cleared through M1 Finance LLC. Please look at your account statement to determine how your account is cleared. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future performance. Using margin can add to these risks. Users utilizing APEX cleared margin accounts should review the APEX margin account risk disclosure before borrowing. Users utilizing M1 cleared margin accounts should review the M1 margin account risk disclosure before borrowing. M1 Margin Loans are available on margin accounts with at least $2,000 invested per account. Not available for Retirement or Custodial accounts. Margin rates may vary. Brokerage products and services are offered by M1 Finance LLC, Member FINRA / SIPC, and a wholly owned subsidiary of M1 Holdings, Inc.

M1 is not a bank. M1 Personal Loans are furnished by B2 Bank NA, Member FDIC and Equal Opportunity Lender, and serviced by M1 Spend LLC, a wholly owned operating subsidiary of M1 Holdings, Inc.

M1 Earn

M1 Earn is an optional and free money management module within the M1 Finance umbrella. It gets you access to FDIC-insured high-yield Cash Accounts.

This makes M1 Finance as a whole considerably more attractive in my opinion, allowing you to house all your personal finance tools in one place if you want to, and extends it from just an investing platform to a financial management platform.

No minimum balance to open account. No minimum balance to obtain APY (annual percentage yield). APY valid from account opening. Fees may reduce earnings. Rates may vary.

M1 is not a bank. M1 Spend is a wholly-owned operating subsidiary of M1 Holdings Inc. M1 High –Yield Savings Accounts are furnished by B2 Bank, NA, Member FDIC.

M1 High-Yield Cash Account(s) is an investment product offered by M1 Finance, LLC, an SEC registered broker-dealer, Member FINRA / SIPC. M1 is not a bank and M1 High-Yield Cash Accounts are not a checking or savings account. The purpose of this account is to invest in securities, and an open M1 Investment account is required to participate in the M1 High-Yield Cash Account. All investing involves risk, including the risk of losing the money you invest.

The cash balance in your Cash Account is eligible for FDIC Insurance once it is swept to our partner banks and out of your brokerage account. Until the cash balance is swept to partner banks, the funds are held in a brokerage account and protected by SIPC insurance. Once funds are swept to a partner bank, they are no longer held in your brokerage account and are not protected by SIPC insurance. FDIC insurance is not provided until the funds participating in the sweep program leave your brokerage account and into the sweep program. FDIC insurance is applied at the customer profile level. Customers are responsible for monitoring their total assets at each of the sweep program banks. A complete list of participating program banks can be found here.

Smart Transfers

M1 also recently introduced “Smart Transfers.” Smart Transfers adds the ability to transfer from Earn to Invest (or reverse) based on a cash threshold set by the user. For example, if you want to keep $1,000 in cash in your high-yield cash account, you can choose to have any excess cash over $1,000 automatically be transferred and invested, without having to lift a finger.

You can also chain a few Smart Transfers together. For example, once your IRA hits its annual contribution limit, all transfers will begin going to your taxable account. Conversely, you could choose a set amount to go to your taxable brokerage account as an emergency fund, and then have any excess go to your retirement account.

Owner's Rewards Credit Card

M1 also has a credit card. It offers up to 10% cash back on certain brands in which you're invested. It may very well be worth it if you shop from certain brands often. I delved into the details in a separate post here.

M1 Finance Referrals

Upon signing up for M1 Finance, you can share your referral link with friends and family; you'll both receive $100 when they sign up and fund a new Invest account with $10,000.

M1 Finance Signup Bonus

M1 occasionally offers signup and transfer bonuses.

M1 Finance is for Long-Term Investing, Not Day Trading

M1 Finance themselves have made it explicitly clear from the start that the platform is not designed for – and would be a poor choice for – day trading. It is for long-term, buy-and-hold investing. I would argue that a beginner investor should forego the former in favor of the latter anyway. Trying to time the market tends to be more harmful than helpful.

I'll briefly explain the specific things that make M1 bad for day trading below.

M1 Finance Cons and Drawbacks

Cons and drawbacks of M1 Finance are few, but there are several worth mentioning.

No Money Market Account

M1 Finance doesn't offer a money market account option. I don't think this is a big deal, as you can use the interest bearing high-yield cash account called Earn.

Customer Support Might Be Slow

I personally have had no problems with M1's customer support. I also admit that I haven't really needed any customer support, because I'm not a beginner investor. But I've seen anecdotes of M1's customer support being slow to respond for some people. I'd like to think they're aware of this potential issue and will fix it going forward.

Update – January 2021: M1 has recently massively beefed up their Support by hiring new staff to cover inbound requests and questions. Users have reported that response times have notably decreased.

No Limit Orders

M1 uses market orders. There are no advanced order controls like limit orders that you'd see with traditional brokerages. Again, M1 is not designed for day trading; it is for long-term buy-and-hold investing. So I don't see the lack of order control as a major concern. Any price discrepancy on your initial buy order is negligible over 30 years.

No Options or FOREX

Again, M1 is not for trading. As such, they don't offer options contracts or FOREX (foreign exchange) trading that you might see with a traditional brokerage.

Two Trading Windows

M1 has two trading windows per day in the morning and afternoon during which orders are executed. This means that an order you input in the afternoon after the second window will not execute until the following morning.

Each account with $25,000 or more in equity can participate in both trade windows in a single day. For all other accounts, you can select which window you want to participate in.

This is precisely what keeps M1's management fees low and keeps transaction fees nonexistent. I again maintain that trade timing should be of no concern to a long-term, buy-and-hold investor.

Participate in both trade windows when you have $25,000 or more equity to comply with pattern-day trading regulations.

No Automatic Tax Loss Harvesting

Tax loss harvesting refers to selling securities at a loss before the end of the year in a taxable account to offset gains, thereby lowering tax liability. Some brokers offer an automatic feature for this. You have to do this manually if you want to in M1 Finance. This may be a feature they add in the future, but again, since it's built for long-term buy-and-hold investing, it's not as important anyway.

My Rebuttal to Common Complaints

Most complaints about M1 that I’ve seen fall in one of these categories: a fundamental lack of knowledge, characteristics that would apply to any broker, and/or things that M1 was very clearly never designed for, none of which are M1's fault.

I’ve also noticed a common theme where day traders join M1, realize it's not good for trading, and then blame the platform for their shortcomings of understanding. This is like buying a car, driving it into a lake, complaining that the car doesn't float, and then complaining to the world that the manufacturer didn't say the car doesn't float.

M1 makes it very clear that it's designed for long-term, buy-and-hold investing. Even if you didn't see or hear that fact anywhere, it should become obvious upon seeing the interface and learning how the trading window works, which can be done before ever putting a dime in.

I would even argue that M1 is easier for young, new investors to understand than traditional brokers. Thinking back to my early days on TradeKing (now Ally) and being presented with a bid-ask spread, different order types, some blank input fields, options like “immediate or cancel” and “good 'til canceled,” etc., I was pretty confused and definitely had to read up on what all that stuff meant before submitting my first real order.As with anything, at the end of the day, it's always up to the individual to do their own due diligence before joining any kind of website, app, etc., broker or otherwise, and especially before putting actual money into that thing they joined.

Many complained about the imposition of a new $3/month fee for accounts below the $10,000 threshold in 2024. Sure, no one likes fees. But features like dynamic rebalancing and especially one-click manual rebalancing are criminally underrated and were always worth paying a fee for in my opinion.

Let me set the stage for this brief op-ed with some personal history:

Over a decade ago I was using a broker called TradeKing. If you Google it, you won’t find much; it later got acquired by Ally. Picture the notoriously awful UI of TreasuryDirect.gov resembling Windows 95, but for trading stocks, funds, and options. But it had $5 trades, which was cheap at the time!

Rebalancing for 2 funds required logging in during market hours, making a little Excel sheet, calculating the relative % of each asset based on $ amount, figuring out how much I needed to buy and sell of each, going to the order screen, typing in the ticker, evaluating the bid-ask spread for my limit order, choosing a limit price, making sure it got filled, and then doing all that for the other ticker. Now imagine doing that for, let’s say, 6 funds. Now imagine also having to do most of those steps every time you deposited new money. Needless to say, I dreaded this process. (I would have gladly paid someone $3/mo. to do all this for me, by the way.)

Now fast forward to just a few years ago. I’m reading some thread on the the OG Bogleheads forum one night and someone mentions this new platform M1 and how it invests new money for you based on your set allocation, it buys the underweight asset(s) with deposits, and it has a Rebalance button that you can just click and it does it for you, and it’s a pretty slick, intuitive, modern interface, and they have cheap margin. Amazing! Us boomers were in awe. “How much does this service with these amazing features cost? It must be expensive! It’s free?! Wow!”

People think the pies are the attraction. Nah. For me, it's that Rebalance button. It saves me so much time and effort. I never see this mentioned. You have to understand this basically did not exist previously.

All that to say, I think some of these features are vastly under-appreciated by those young investors who have perhaps never known anything else, and have always been worth paying a fee for.

If you’re actually into the features, just view it as paying a small fee for some cool stuff, and then when you hit $10k – which will likely be sooner than you think thanks to compound returns – it goes away. Or go further and flip it, and think to yourself you’ve been so lucky to get this stuff for free for so long, and now you have to pay a small fee. Are those features somehow now worth less just because you have to pay for them? Were they previously more valuable when they were free?

I also saw a lot of people expressing the $3 fee as a percentage of assets, saying it’s 0.3% of $1k, as if it’s an expense ratio for a fund. While certainly true mathematically, to me, this is sort of a useless comparison. My bank charges a $10/mo. fee for a balance below $1k. Does that make my ability to access cash from an ATM, for example, suddenly not worth paying for if I have less than $1k in my account?

You are paying a flat fee for a service and features. Its percentage relative to the account balance is irrelevant to that fact. Yes, that may mean it takes you longer for your investment returns to get you to $10k, but does that mean the features aren’t valuable during that journey and then suddenly become “worth it” once you hit $10k? Of course not.

If you want to go to Schwab or Fidelity or Vanguard and spend time doing what I described above, more power to ya. Go for it. But I personally would have gladly paid someone to do all that for me, and much more than $3/mo.

Of course Fidelity has their “Baskets” product. I’ve personally found it terribly unintuitive, clunky, and frustrating. And it costs $5/mo.

Acorns is truly for beginners and it starts at $3/mo. and goes up from there.

I’ve mentioned elsewhere that I’d never give Robinhood a dime out of principle, considering their myriad of outages, lawsuits, SEC violations, blocking users’ trades, and psychological manipulation tactics on young brains via the gamification of investing. People seem to either disregard or forget about all that. I’m surprised Robinhood still exists.

I don’t have much of a dog in the fight on the new fee. I don’t really have a hard stance on it either way. My account value is above the threshold so the fee doesn’t apply to me. If it did, I would still pay for those features, and a $3 fee does not change my endorsement of the platform, regardless of one’s assets. I would even say I believe $3/mo. is still cheap for the features you get. Though of course admittedly I can’t truly empathize with the people now getting hit with a new fee after it being free for so long, so I can’t fully step into their shoes and understand how the news feels.

On the $3 per se, people drop $20/mo. on Netflix or Starbucks like it's nothing, but when it comes to their financial future, which should be more important, they suddenly pinch pennies. Banks have low balance fees. Fidelity used to have one.

M1 Finance FAQ

Is M1 Finance safe?

Yes. All data transferred and stored in M1 Finance is protected with military-grade 4096-bit encryption. Two-factor authentication is available for account security.

Is M1 Finance legit?

M1 Finance recently passed $2 billion ($2,000,000,000) in platform assets. That's 9 zeros. The company is registered with the SEC (Securities and Exchange Commission) as a broker dealer and is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). They are indeed “legit.”

Is M1 Finance free?

No. M1 has a monthly platform fee of $3.00 which is waived for clients who have $10,000 or more in M1 assets at least one day during each billing cycle or an active Personal Loan. They do have miscellaneous fees related to paper statements, account liquidations, etc. that are outlined here.

Is M1 Finance SIPC insured?

Yes, investment accounts with M1 Finance are SIPC-insured.

Is M1 Finance FDIC insured?

The FDIC doesn't insure investment accounts. Investment accounts with M1 Finance are SIPC-insured. M1 Finance's high-yield cash account product is indeed FDIC-insured.

Is M1 Finance available in Australia/Europe/Canda/UK?

The M1 Finance platform is usable from anywhere in the world, but currently they only accept U.S. customers.

How does M1 Finance make money?

M1 Finance makes money through common revenue streams – interest on cash, interest on lending securities, interest on margin loans (M1 Borrow), and annual fees for M1 Plus memberships. They also have miscellaneous fees related to paper statements, account liquidations, outgoing account transfers, etc. that are outlined here.

How does M1 Finance rebalance?

Dynamic Rebalancing is of the most important features of M1 Finance.

Rebalancing your portfolio is necessary from time to time as your allocations among assets stray over time. Let's say you have a 60/40 asset allocation of stocks to bonds and after 6 months, your stocks have increased in value more than your bonds to where your allocation has become 65/35. With a traditional brokerage, rebalancing would require some time and effort – manually calculating the number of shares you need to buy and sell on each side relative to the value of your portfolio to get back to your target allocation of 60/40, and incurring transaction fees in doing so, as well as capital gains taxes if it's a taxable account.

Dynamic rebalancing with M1 simply refers to how new deposits are allocated to buy orders based on your specified target allocations. That is, underweight assets are automatically bought with new deposits to bring them back to your target allocation. This means your new deposits will be doing the rebalancing for you. This is especially significant in a taxable account, because it means you can rebalance without doing any actual selling of your securities, thereby avoiding capital gains taxes.

When does M1 Finance trade?

Trades are executed once per day during the 10AM trade window. You can optionally add an additional afternoon trade window with M1 Plus.

Where is M1 Finance located?

The M1 Finance headquarters is located in Chicago, IL.

Who founded M1 Finance?

Brian Barnes is the Founder and CEO of M1 Finance.

When was M1 Finance founded?

M1 Finance launched in 2016.

Where can I find pies to invest in?

M1 Finance offers Expert Pies created by the staff that you can invest in and be completely hands-off. I've also created a number of “lazy portfolio” pies here that are perfect for long-term buy-and-hold investing.

Is there an M1 Finance forum?

There's a community on Reddit for M1 Finance members at https://www.reddit.com/r/M1Finance/. There's also a weekly “portfolio discussion” thread on the subreddit where users can post pies and get or provide feedback.

Does M1 Finance have an account minimum?

Taxable accounts require an initial minimum balance of $100. Future deposits can be made in any amount above $10. Retirement accounts require an initial investment of $500.

The minimum buy amount per security is $1.00. The minimum cash balance threshold for auto-invest to trigger is $25.

Can I buy index funds and ETF's with M1 Finance?

Definitely! I exclusively invest in index funds and ETF's. M1's Expert Pies are comprised entirely of index funds and ETF's.

Does M1 Finance offer an HSA?

Currently M1 Finance does not offer an HSA (Health Savings Account). Hopefully they will in the future.

Does M1 Finance have crypto?

Yes, M1 Finance supports the buying and selling of Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

Investing in cryptocurrency comes with significant risk and may not be suitable for everyone. Based on your specific situation and financial condition, carefully consider whether investing in cryptocurrencies is suitable for you. For relevant disclosures and risks, visit m1.com/crypto-disclosures

As a customer of both M1 and Apex, you have a brokerage account held at Apex Clearing Corporation to hold your securities and cash and an account at Apex Crypto to hold your cryptocurrencies. M1 Digital LLC is a wholly separate affiliate of M1 Finance LLC, and neither are involved with the execution or custody of cryptocurrencies. Cryptocurrencies are not FDIC or SIPC insured.

Does M1 Finance have fractional shares?

Yes! M1 Finance is one of only a handful of brokers to offer fractional shares, which is a great feature allowing every penny to go to work for you in your portfolio.

Does M1 Finance have mutual funds?

No, M1 Finance does not have mutual funds, but most mutual funds nowadays have an ETF equivalent, which M1 does have.

Can you trade options on M1 Finance?

No, M1 Finance does not offer options trading.

Can you day trade on M1 Finance?

You could try, but M1 Finance is built for long-term, buy-and-hold investing, not day trading. M1 would not be optimal for day trading since it only uses a single trading window per day (or 2 with M1 Plus). Because of SEC regulations, you need at least $25k in your account to day trade at any broker.

Does M1 Finance offer covered calls?

No, M1 Finance does not offer covered calls (you probably shouldn't use them anyway) or any options trading.

M1 Finance Awards

- Investopedia 2020 Best Roth IRA Accounts

- Investopedia 2020 Best Robo-Advisors Awards: Best for Sophisticated Investors

- Investopedia 2023: Best for Sophisticated Investors and Low Costs

- Insider 2023: Best Investment App for Portfolio Customization

- Bankrate 2023: One of the best robo-advisors of 2023

- Fortune 2023: One of the best Roth IRAs

M1 Finance Comparisons

See how M1 stacks up against the competition:

- M1 Finance vs. Vanguard

- M1 Finance vs. Betterment

- M1 Finance vs. Interactive Brokers

- M1 Finance vs. Webull

- M1 Finance vs. Robinhood

- M1 Finance vs. Fidelity

- M1 Finance vs. Stash

- M1 Finance vs. Acorns

- M1 Finance vs. TD Ameritrade

- M1 Finance vs. Schwab

- M1 Finance vs. Ally Invest

- M1 Finance vs. ETRADE

- M1 Finance vs. Folio Investing

- M1 Finance vs. Merrill Edge

M1 Finance Promotions and Discounts

M1 occasionally offers promotions and discounts.

I'll try to keep this section updated with any current/future promotions.

Getting Started with M1 Finance

Getting started with M1 Finance is quick and easy.

- Sign up.

- Create an investing account.

- Connect your bank.

- Fund your account.

- Start investing!

Conclusion

I like that M1 has tried to remove every barrier to investing for young beginners and seasoned investors alike. Fees and complexity alone can be prohibitive for new investors with traditional brokerage platforms. M1 has inarguably made investing much more accessible than ever before. This has been CEO and Founder Brian Barnes's goal from the start. He believes that “everyone’s money should be working harder for them.” He maintains that investing should be simple, easy, and low cost. I can get behind that.

M1 Finance is great for medium- to long-term investors. It is not great for day traders. M1 makes investing quick, simple, and easy at little to no cost. M1 allows for as much or as little customization as you want, making it perfect for both seasoned and beginner investors. M1 has one of the cheapest margin rates around, and has powerful features that allow for automated, hands-off, set-and-forget passive investing, especially when it comes to low-cost, broad index funds.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hello John!

The recent changes to M1 Plus seem to be in my favor.

I would take advantage of the pie investing, plan to invest $10,000 to avoid the $3/month fee and would use the 5% High Yield Cash Account.

Looks to be a great deal.

Am I missing anything?

Do you still recommend?

Thanks,

Jon

Same here, Jon. Sounds like a good plan to me. Still recommend for sure. I just did a post and video on their new dividend features and I’ll be doing some more soon on new margin features coming out.

Do the recurring deposits happen before the trading window on the specified day?

In case anyone comes across this and doesn’t see the answer, yes, the deposits happen before the first trade window of the day.

Hi John,

Enjoyed reading your review of M1 Finance. A personal question: do you use M1 Borrow, and if so, how do you use it?

Thanks.

Thanks! I do use Borrow for leverage.

Question on dynamic rebalancing – does the reverse hold for sales?

Let’s say I have $500k in a portfolio, 80/20 that drifts to 75/25 over the course of a year, and at the end of the year I want make a draw of $25k.

Would M1 execute the sales in such a way that it would rebalance the portfolio back to my original pie? Or does it only work unilaterally for investing?

Great question, Kate. In short, yes it should. But M1 primarily sells to minimize tax impact, so tax lots with a loss are sold first to offset any gains, then longer tax lots that would incur long term capital gains taxes, followed by shorter tax lots that would incur short term capital gains. Secondarily, it would focus on the rebalancing. If this is an IRA, the former is irrelevant.

Thanks for the reply! I’m very close to FI, and I’ve built everything in Vanguard for years. The manual rebalancing I’ve done each time I’ve periodically made an investment, and using the clunky shares calculator to place buy orders has always been a bit of an annoyance.

I transferred my account over to M1 because it eliminates that step entirely.

I also began a custodial brokerage account for my teen, because the interface is simple, intuitive, and the auto-invest feature is terrific. It’s 100% indexed equities, and each time there’s a dividend payment my teen is going to top off their cash to hit $25 to auto invest. Fantastic incentive and easy for them to “see” it.

Sounds great! I agree, the auto-rebalancing and one-click manual rebalancing are super valuable features of M1 that save me a lot of time.

Just got a notification through the app — M1 Plus currently has $45 promotion pricing through 10/19. That lower the break-even on the margin discount from $8333 invested to $3000!

Indeed! I think it’s for existing customers only, but it definitely makes M1 Plus a lot more attractive for those using M1 Borrow.