REITs are typically used for diversification and/or income generation in long-term investment portfolios. Below we'll check out the best REIT ETFs to get exposure to the real estate market in 2024.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here's the list:

- VNQ – Vanguard Real Estate ETF

- VNQI – Vanguard Global ex-U.S. Real Estate ETF

- REET – iShares Global REIT ETF

- SCHH – Schwab U.S. REIT ETF

- USRT – iShares Core U.S. REIT ETF

- FREL – Fidelity MSCI Real Estate Index ETF

- REZ – iShares Residential Real Estate ETF

Contents

REIT ETFs Video

Prefer video? Watch it here:

Introduction – Why REITs?

Real Estate Investment Trusts, or REITs for short, are an efficient and effective way to get exposure to the real estate market to diversify one's investment portfolio without buying physical property. Better yet, REIT ETFs provide broad exposure to national and international commercial and residential real estate markets by pooling investor capital and diversifying their real estate buys, thereby allowing investors to avoid the idiosyncratic risks of local real estate markets inherent with owning property.

We would expect private property ownership to generate the highest returns because it cuts out all the middle men. Unfortunately, buying real estate directly has a lot of obvious downsides. It requires management, upkeep, and knowledge of the local market. It also exposes you to unsystematic, localized risks, as well as potential illiquidity when you want to sell. Owning real estate can be more like running a business than an investment. Do you want to be a landlord? Equity REITs solve all these issues.

Think of REITs like baskets of real estate properties that trade on exchanges. You're sacrificing some expected return by having to pay a bit for the management of that basket, but you don't have to lift a finger other than sitting at your computer and placing a buy order for the REIT fund. REITs also act as a decent inflation hedge because landlords can directly pass on inflation costs to tenants in the form of higher rents.

REIT portfolios can include apartment complexes, data centers, hospitals, hotels, cell towers, office buildings, retail spaces, warehouses, and more. REITs may offer a diversification benefit to long-term investment portfolios by being lowly correlated to both stocks and bonds. This means when stocks or bonds fall in value, REITs may rise in value. These correlations have shifted over time, but we wouldn't expect REITs to be perfectly correlated with common stocks anyway, as their fundamental risks are different.

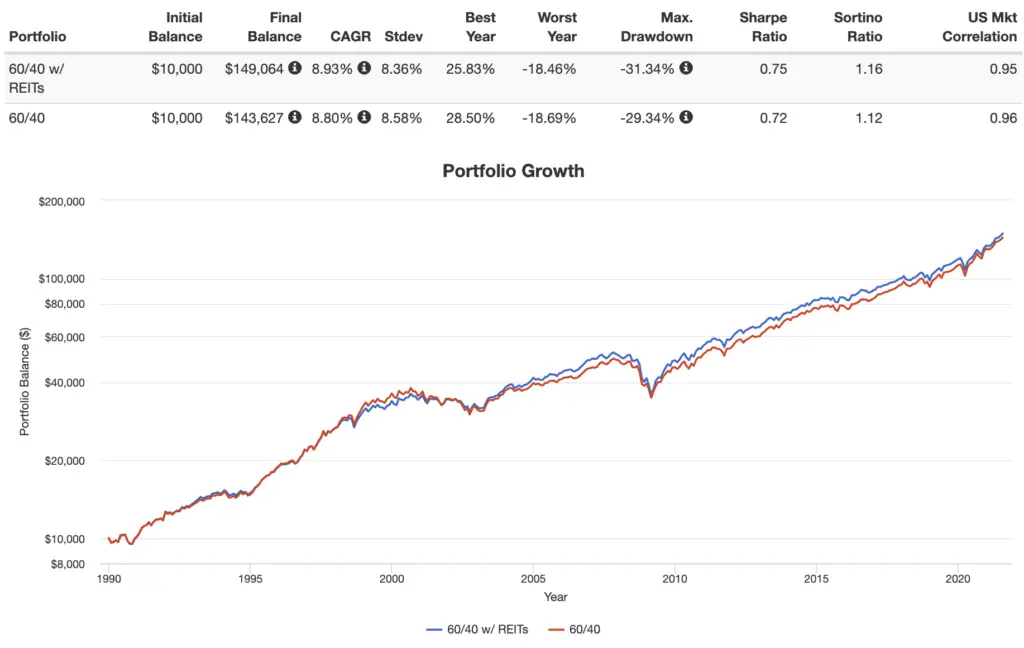

Remember, diversification is the only opportunity for a free lunch in investing. The inclusion of REITs in a portfolio has indeed basically been a free lunch historically, boosting returns while lowering volatility. This means a greater risk-adjusted return (Sharpe), or alpha, the holy grail of investing. Here's a backtest from 1990 through July, 2021 comparing a 60/40 portfolio with 10% REITs on the equities side versus a 60/40 portfolio without a dedicated allocation to REITs:

To be fair, one thing to note is that the portfolio with REITs still had a larger max drawdown, as REITs sometimes become highly correlated with the broader market during crashes.

Long-term leases mean rents are more stable than corporate earnings. That stable cash flow from rentals is precisely what drives REIT returns, as opposed to capital gains with equities. Lastly, landlords are also not trying to bring new products or services to market, meaning they have less business risk than a typical corporation.

REITs are also popular among income investors as they typically have a high dividend yield. REITs are required to generate 75% of their income from real estate investments, and are also required to distribute 90% of that income to shareholders, hence their high yields that income investors love. In doing so, REITs aren't subject to corporate income tax on those profits.

Note that REITs are relatively tax-inefficient due to their high yield and mostly unqualified dividends, so they are best held in a tax-advantaged account like a Roth IRA or 401k.

REIT ETFs provide cheap and easy access to that diversification and dividend yield. Let's explore the best REIT ETFs.

The 7 Best REIT ETFs

Below are the 7 best REIT ETFs, which vary in size, scope, and cost.

VNQ – Vanguard Real Estate ETF

The Vanguard Real Estate Index Fund (VNQ) is far and away the most popular REIT ETF out there, with over $50 billion in assets. The fund seeks to track the MSCI US Investable Market Real Estate 25/50 Index, providing broad exposure to the U.S. real estate market. This ETF has over 180 holdings and an expense ratio of 0.12%.

VNQI – Vanguard Global ex-U.S. Real Estate ETF

Diversifying internationally with REITs may be prudent, as U.S. and international REITs are actually lowly correlated to each other. The Vanguard Global ex-U.S. Real Estate ETF (VNQI) provides exposure to international REITs outside the U.S.

The fund tracks the S&P Global ex-U.S. Property Index, providing exposure to REITs in over 30 countries around the world. This ETF has over 640 holdings and an expense ratio of 0.12%.

REET – iShares Global REIT ETF

Want a single fund for both U.S. and international REITs? REET is basically the sum of VNQ and VNQI above. It has about $3.3 billion in assets and seeks to track the FTSE EPRA Nareit Global REITs Index.

The downside is you'll pay a tiny bit more for that simplicity and convenience. REET has an expense ratio of 0.14%.

SCHH – Schwab U.S. REIT ETF

Another low-fee option for U.S. REITs is from Schwab – the Schwab U.S. REIT ETF. It launched in 2011 and has over $6 billion in assets.

SCHH can be considered comparable to VNQ above and is conveniently cheaper by 5 bps. It's actually the cheapest ETF on the list with an expense ratio of 0.07%. This ETF seeks to track the Dow Jones Equity All REIT Capped Index, excluding mortgage REITs.

USRT – iShares Core U.S. REIT ETF

The iShares Core U.S. REIT ETF (USRT) seeks to track the FTSE NAREIT Equity REITs Index. The fund was established in 2007.

For all intents and purposes, USRT should also be considered comparable to VNQ, except USRT isn't quite as concentrated in its top holdings as VNQ and SCHH.

USRT has over $2 billion in assets and an expense ratio of 0.08%.

FREL – Fidelity MSCI Real Estate Index ETF

FREL from Fidelity seeks to track the MSCI USA IMI Real Estate 25/25 Index. It is comparable to SCHH and USRT and has a fee of 0.08%.

FREL launched in 2015 and has a little over $1B of assets.

REZ – iShares Residential Real Estate ETF

All the preceding REIT ETFs hold mostly commercial real estate. To specifically target residential, healthcare, and public storage REITs, the iShares Residential Real Estate ETF (REZ) is a great choice. This ETF seeks to track the FTSE NAREIT All Residential Capped Index and has an expense ratio of 0.48%.

Where To Buy These REIT ETFs

All these REIT ETFs should be available at any major broker. My choice is M1 Finance. M1 has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

I actually created this REIT pie for M1 Finance that provides roughly 50/50 exposure to U.S. commercial and residential REITs, since again most of the REIT ETFs above are dominated by commercial REITs, which have underperformed residential REITs historically.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosures: I am long VNQ in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

What are your thoughts about Real Estate Select Sector SPDR Fund (XLRE)? I’m thinking you shy away from it since it’s only been around since 2015?

John:

Pres Trump passed tax law in 2017 that made up to 20% of REIT dividends tax-free. Do those benefits not pass through a ETF REIT to the shareholders, hence making them more tax-efficient? Therefore I would want to hold these in a brokerage account – not a tax deferred IRA.

What am I missing here?

RonB

Ron, “more tax-efficient” =/= ideal for a taxable account. All else equal, REITs should still go in tax-advantaged space.

Hey John,

Perhaps AVRE from Avantis was not available when you wrote the original post (or was a red flag due to only 17m AUM) but it looks to my eye like a potentially better REET with some international exposure and sector price based weighting. (underweight office for example right now). Fee structure also similar to REET.

Be curious to get your second opinion if you’ve considered it. Thanks as always!

Hey John,

Love your website and analysis. I hope it turns into a great passive income stream for you! I was curious why you excluded Fidelity’s FREL from your list. It seems comparable to Vanguard’s VNQ, but with a slightly lower expense ratio. Thanks!

Thanks, Jim! I think I left it off because SCHH is cheaper and more liquid than FREL.

I wonder why SCHH’s performance over the past 3 and 5 years is quite poor compared to the other similar broad-based Real-Estate ETFs like VNQ, FREL, USRT?

Different indexes. 3-5 years is just noise. 10 years is likely just noise. SCHH outperformed in 2014, 2015, 2018, and 2021.

Hi John,

You don’t mention REITS in your Ginger Ale portfolio, but I see here that you invest in them. That actually makes the Ginger Ale portfolio even more attractive to me (I’m modeling my portfolio after that, and am invested in REITS). What is your REIT allocation? Also, do you have an opinion on the iShares Global REIT ETF (REET)?

Thanks for your great website!

Jason

Hey Jason, glad you’re enjoying the site! I do still have some old REIT holdings in my HSA. Check out my mention of replicating them here and you might consider just using that instead of actual REITs. REET looks like a solid fund for REIT exposure. Might add it to the list.

Hi John,

Do you hold VNQ in a tax- advantage acc ? I am always learning something new from all the articles that you put out. I wish I can be able to pay you back . Pat.

Yea, REITs are pretty tax-inefficient.