Return stacking refers to applying a modest amount of leverage to a diversified investment portfolio of different asset classes in an attempt to ratchet up expected returns while simultaneously potentially lowering or at least maintaining risk. Here we'll look at what return stacking is and when, why, and how to do it.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

What Is Return Stacking?

Return stacking is exactly what the name implies – borrowing to free up capital and “stacking” different sources of expected return atop one another, preferably using assets with low or negative correlations among them to maximize diversification and lower risk. This idea has historically also been called “portable alpha” and “overlays.”

I can't say with certainty who originally coined the term “return stacking.” I believe it was the guys from ReSolve Asset Management and Newfound Research, the creators of some of the products that exemplify the concept. They actually own trademarks on the terms Return Stacking® and Return Stacked®.

Basically, this means that we're, in the words of ReSolve themselves, “achieving more than $1.00 of exposure for each $1.00 invested.” In that sense, we're improving the efficiency of invested capital. And doing so with uncorrelated assets can actually reduce risk. Return stacking may be particularly useful in the face of low expected returns for multiple core assets like stock and bonds.

To set the stage for the return stacking discussion, let's first briefly talk about NTSX, one of the pioneer investable products for the concept.

NTSX from WisdomTree exemplifies this idea using 90% U.S. large cap stocks and 60% exposure to intermediate U.S. treasury bonds via futures contracts. It took a while for this fund to hit its stride in terms of popularity, but it now boasts nearly $1B in AUM 4 years later. Not too long after its debut, WisdomTree launched sister funds NTSI and NTSE for ex-US Developed Markets and Emerging Markets respectively. Compared to NTSX, those two have pretty low AUM.

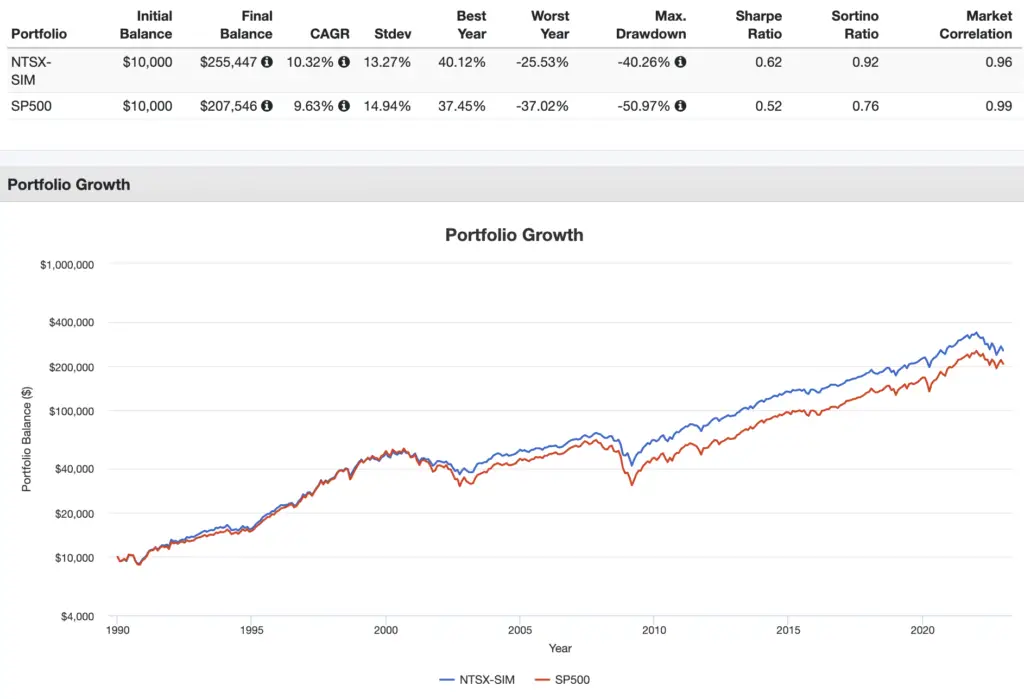

To read more about the specifics of NTSX, go read my post on it here first and then come back here. In a nutshell, we can show both theoretically and empirically that a portfolio of stocks and bonds using a modest amount of leverage would be expected to have a higher risk-adjusted return than that of a 100% stocks portfolio. To illustrate that concept, here's a rough approximation of NTSX (90% U.S. large cap stocks and 60% intermediate U.S. treasury bonds) versus the S&P 500 from 1990 through 2022:

While the term “return stacking” and its trademark are pretty new, having just entered the investing lexicon in recent years, the underlying concept has been around for a long time. Cliff Asness of AQR wrote a paper in 1996 titled Why Not 100% Equities in which he showed that bearing the same risk of 100% stocks with a leveraged mix of stocks and bonds delivered greater returns than 100% stocks due to the benefits of diversification.

Put another way, for any given level of risk, a “return stacked” portfolio tends to be more efficient, meaning a greater risk-adjusted return. Asness argues that a portfolio of 100% stocks “almost guarantees an inefficient portfolio.”

Remember Harry Markowitz, considered the father of Modern Portfolio Theory, put forth the uncontroversial opinion in the 1960's that for any given level of risk, investors should prefer the portfolio with the greatest expected return, or for any given expected return, investors should prefer the portfolio with the lowest risk.

The decision to take on more risk is a separate conversation. But in terms of the logistics and implementation, to assume more risk and subsequently increase expected return, one can either concentrate further within a single asset or diversify among multiple assets and use leverage to increase overall exposure. For most investors, the former is easier and more intuitive. More sophisticated investors, myself included, would probably rather do the latter, which is demonstrably more efficient. In point of fact, a portfolio of 100% stocks is almost always suboptimal and does not lie on the efficient frontier.

I laid out a lot of these same ideas a while back in a a post on how to beat the market, but I never specifically referenced “return stacking” because I don't even think I had heard of the term at that point.

But the goal doesn't have to be explicitly beating the market. ReSolve argue that in environments with high stock valuations and low bond yields and subsequently low future expected returns for both, return stacking can increase the portfolio's expected returns without taking on greater volatility and risk associated with concentration. They maintain that “grasping for returns” by “stretching for higher yields and increasing pro-cyclical asset exposure” is inherently an inefficient strategy.

The important distinction here is that while I mentioned the concept behind “return stacking” is nothing new, the term can describe singular products that have just recently become available to retail investors, e.g. one fund that combines multiple assets and levers exposure. I've listed some of those products later in this post. We would say this boosts the efficiency of capital because investors effectively hold traditional portfolios like the classic 60/40 and still have room for other assets to add additional return streams.

Moreover, ReSolve and Newfound submit that freeing up capital with prudent leverage is capital efficiency, but that “return stacking” is specifically going one step further and using that freed up capital to buy additional uncorrelated assets, effectively “stacking” a source (or multiple sources) of returns on top of a core portfolio.

If the investor doesn't want to increase the risk of the portfolio, it's important that those additional assets be structurally uncorrelated to the core assets. If you throw that requirement out the window, you can still buy correlated assets – like more stocks or more bonds – to increase expected returns, but the risk profile would necessarily increase as well. And of course, again, that latter example would just be levering up the core portfolio, not necessarily the true idea of “return stacking.” Also realize stacking a highly correlated asset introduces more potential for tracking error regret.

Put another way, the ideal return stacked portfolio uses an additional uncorrelated asset that addresses a short-term risk inherent of both stocks and bonds, such as inflation risk. In case you've been living under a rock, 2022 was an empirical proof of concept for that specific idea, when stocks and bonds both suffered and managed futures soared.

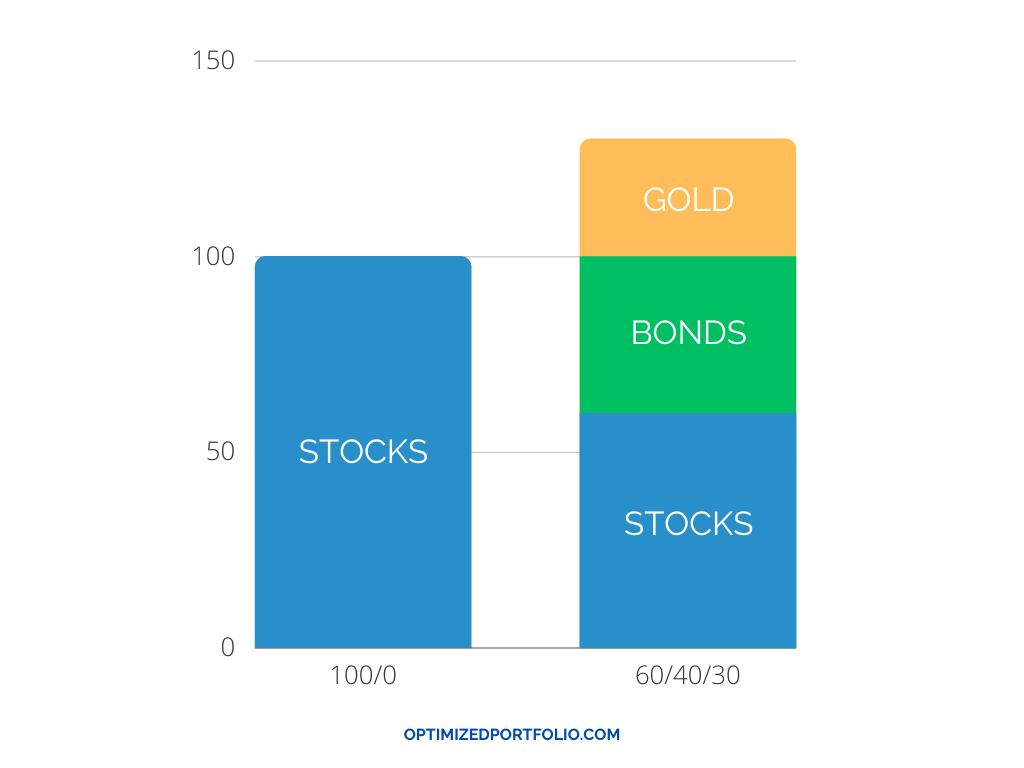

While some of this may sound fairly complicated, we're basically just borrowing against the portfolio, e.g. a 60/40, to then buy other uncorrelated assets. For a hypothetical example, a 60/40 portfolio that borrows 30% to go buy gold would thus have effective exposure of 60% stocks, 40% bonds, and 30% gold, i.e. 130% notional exposure. Here's that visualized:

Warren Buffett himself does this to the tune of about 60% borrowed, i.e. 160% notional exposure, though he doesn't care so much about uncorrelated assets and simply prefers to lever up his stocks exposure.

“Ok, all this jargon is confusing. Just show me the backtest!”

Return Stacking Visualized With Backtesting

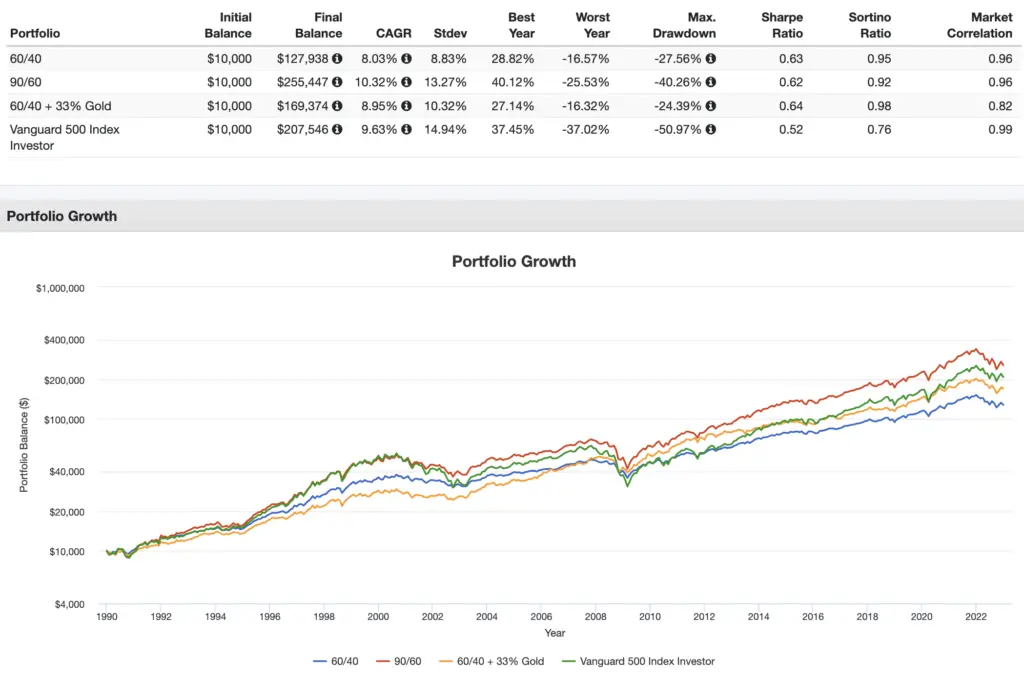

Here's a backtest of an approximation of WisdomTree's NTSX (90/60) compared against some other portfolios to illustrate these concepts for the period 1990-2022. I'll walk you through what we've got.

- Portfolio 1 is just the classic 60/40 portfolio – 60% stocks and 40% bonds using intermediate treasuries.

- Portfolio 2 is an approximation of NTSX, which is 90/60, or effectively 1.5x 60/40. So 90% stocks and 60% intermediate treasuries.

- For Portfolio 3, we're using that return stacking idea of taking freed up capital and buying an uncorrelated asset, in this case gold. So we're holding NTSX at 67% of the portfolio which provides that classic 60/40 core exposure and then using the other 33% to buy gold, which tends to be uncorrelated to both stocks and bonds.

- Lastly we've got 100% stocks via the plain ol' S&P 500 to compare against.

Here are the salient takeaways from this:

- As we'd expect, the 60/40 portfolio delivered a lower absolute return than the S&P 500 but with a much lower risk profile, so it delivered a higher risk-adjusted return, as shown by Sharpe and Sortino. That is, it generated a higher return per unit of risk. Remember, this means we say the 60/40 was more efficient.

- 90/60 exposure delivered the highest absolute return of the bunch, with general and risk-adjusted returns considerably higher than those of the S&P 500. Because we simply levered up the 60/40, those two have nearly identical risk-adjusted returns.

- Portfolio 3 with gold didn't get us the highest absolute return but it did get us the smallest drawdown (2008 crash), the best worst year, and the highest risk-adjusted return. Again, we had a much lower risk profile than 100% stocks across multiple dimensions of risk.

Note that I'm not suggesting Portfolio 3 with 33% gold is the optimal portfolio. I'm simply using it as a hypothetical example to illustrate the concept of return stacking. The optimal portfolio can also only be known in hindsight. Gold is also just one example of a potential asset to hold alongside stocks and bonds. The asset(s) could be whatever you want: TIPS, factor tilts, Emerging Markets stocks, gold, commodities, corporate bonds, managed futures, global macro, downside convexity, etc.

For example, Corey Hoffstein from Newfound specifically suggested a while back in a Twitter thread that 67% NTSX (90/60) and 33% DBMF (managed futures) may be prudent. Others may prefer something like short-term corporate bonds. Another option is downside convexity with put options or long vol for tail risk hedging. Bridgewater, the largest hedge fund in the world founded by Ray Dalio, have been doing this for decades.

Demand for liquid alts increased following 2008, but in most cases investors invariably had to sacrifice some of their stocks or bonds to buy them. Return stacking solves that issue by freeing up capital while maintaining that core exposure. ReSolve and Newfound submit that return stacking with leverage reduces the FOMO (fear of missing out) that accompanies traditionally diversified strategies like 60/40 during equity bull markets and unlocks the benefits of diversification.

While “leverage” may cause knee-jerk aversion and may sound scary to some, it's all about the amount used and its context. Recognize that Portfolio 3 above with the 33% gold, for example, is effectively “only” 1.33x leverage spread across 3 uncorrelated assets. Is that really more risky than, say, 100% stocks? Probably not. On the other end of the spectrum would be something like a daily-reset 3x leveraged stocks ETF. While both are “leverage,” they are very different things. In this context, we are simply using leverage as a tool to enhance the benefits of diversification, not as a timing gamble.

But it's important to remember that while it may seem like one, return stacking is not a free lunch. Make no mistake that we are indeed taking on more compensated risk; it just happens to be spread across different uncorrelated assets that tend to move at different times relative each another. That's the definition of diversification and is what decreases the volatility and risk of the total portfolio.

The worst case scenario, of course, is those correlations converging to 1 and all assets dropping at the same time. However, I would submit that with a “prudent” amount of leverage under about 1.5, an admittedly subjective amount, we're not introducing so much additional risk to where the portfolio would blow up even if correlations converge.

“Ok, you've convinced me that this ‘return stacking' thing has some merit, but how do I actually do it in my portfolio?”

Return Stacking ETFs and Mutual Funds

The idea of borrowing against your portfolio may sound daunting, but don't fear. Products have emerged in just the past few years for retail investors to access this concept of return stacking by just buying the fund(s) in the form of ETFs or mutual funds, and fund managers are handling the logistics of that borrowing via derivatives. PIMCO admittedly had some products for these ideas over a decade ago – one of which is listed below – but they were supposed to be for institutions only.

Previously individuals would have had to manage options and futures positions themselves, and who wants to do that? So just like you might buy an S&P 500 ETF, now you can just buy an ETF or multiple ETFs to stack sources of expected return.

What are those ETFs and mutual funds, you ask? Below are some examples. The list is not exhaustive and is simply meant to highlight real-world examples of the concept of return stacking. New funds seem to be launching almost annually now.

| Ticker | Brand | Strategy and Notional Allocation |

|---|---|---|

| NTSX | WisdomTree | 90/60 U.S. large cap stocks and interm. U.S. treasuries |

| NTSI | WisdomTree | 90/60 U.S. large cap ex-US Developed Markets stocks and interm. U.S. treasuries |

| NTSE | WisdomTree | 90/60 U.S. large cap Emerging Markets stocks and interm. U.S. treasuries |

| RSBT | Return Stacked® | 100/100 managed futures (trend) and total U.S. bond market |

| RSSB | Return Stacked® | 100/100 global stocks and interm. U.S. Treasury bonds |

| PSLDX | PIMCO | 100/100 U.S. large cap stocks and actively managed total U.S. bond market |

| RPAR | Evoke | Risk parity stocks, bonds, gold, commodities |

| UPAR | Evoke | RPAR with more leverage |

| SPD | Simplify | 98% U.S. stocks, 2% OTM put options (downside convexity) |

| SPUC | Simplify | 98% U.S. stocks, 2% OTM call options (upside convexity) |

I'd guess we'll see more of these popping up going forward. ReSolve and Newfound maintain that “return stacked” solutions are likely the next frontier in ETFs.

Conclusion

In conclusion, return stacking may improve absolute and risk-adjusted returns while maintaining or even decreasing the risk profile of the portfolio. In borrowing to add additional streams of return, return stacking effectively “unlocks” the benefits of diversifying among uncorrelated assets.

While the implementation of the idea was previously only available to institutions and savvy investors who were able to manage options and futures themselves, packaged solutions have emerged in recent years for retail investors in the form of ETFs and mutual funds.

Just remember that return stacking is not necessarily a free lunch and we are indeed taking on more systematic, compensated risk by levering up. The key is we're avoiding the idiosyncratic risk inherent of concentration and we're spreading our additional risk among different, structurally uncorrelated sources of returns with a relatively small, prudent amount of leverage.

What do you think of return stacking? Do you employ it in your portfolio? Let me know in the comments.

Disclosure: I am long NTSX, NTSI, NTSE, and PSLDX.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Awesome article for explaining this for a nerd investor like myself. Thank you John. I’m wondering for those close to or in retirement if this strategy is appropriate. It appears that a fund like NTSX would be more appropriate for a young investor. Is there other funds I should look at? Thanks

Thanks, Brian. Arguably more appropriate for younger investors but still useful for those close to or in retirement because it allows you to diversify into additional assets without sacrificing space.

Love this blog. For portfolios like the your “90/60”, where is the “-50” in there for the leverage? Surely your accounting for the cost of borrowing.

Thanks, Emile! For funds like NTSX 90/60, it’s 10% bond futures.

Curious what you think of GDE from Wisdom Tree?

Hi John, love your content. I am curious what the main differences (advantages/costs) are between PSLDX and RSBT? Thanks!

Thanks, Lawrence! Those 2 funds are very different. PSLDX is levered stocks/bonds. RSBT is levered bonds/trend.

Great article, John! What percentage of your own portfolio is invested in

Return Stacking?

Thanks! Not sure on exact % but most of my taxable account is NTSX, NTSI, and NTSE.

John, I’m curious about the allocation between the three? Equal weighting or something else?

Roughly market cap

Hi John, this is great work! Wondering how you feel about applying return stacking to just your equities portion of your portfolio? That is, if you already have a 50/50 stock to bonds set up and want to keep the 50 in bonds (all short term treasuries) , is there a value to rearranging your 50 in equities with a return stacking strategy (ie switching Voo to nstx, Vea to nsti, etc) or does that not make sense because there is already a 50% portion in bonds on the other side? Is the risk there that now there is more bond exposure than what we originally wanted? I’m trying to understand how to think about it as one big pie. Thanks so much!

I’d view the portfolio holistically and what total asset allocation you’re aiming for, not as separate buckets. If anything, it would make more logical sense to keep the same 50/50 for the other bucket, i.e. 25% stocks, 25% bonds, and 50% Return Stacking in your hypothetical example. But as I noted, usually this strategy is meant to free up space to use other assets.