Covered calls are options sold on owned investments to generate current income. Here we'll review the best covered call ETFs for . Video - The Best Covered Call ETFs Prefer video? Watch it here: Introduction - What Are Covered Call ETFs and How Do They Work? Covered call ETFs own stocks, typically from some underlying index, and sell call options on … [Read more...] about 7 Best Covered Call ETFs for Income Investors in 2024

Dividends

SPHD ETF Review – Is SPHD a Good Investment? (Dividend Stocks)

SPHD is a popular dividend ETF from Invesco for high-yield U.S. large-cap stocks. But is it a good investment? I review it here. First, note that I don't chase dividends. But I recognize that many investors like to utilize dividend funds to supplement their current income with yield, particularly retirees. Others simply prefer dividend-paying stocks. I even designed a … [Read more...] about SPHD ETF Review – Is SPHD a Good Investment? (Dividend Stocks)

VIG ETF Review – Is VIG a Good Investment? (Dividend Growth Stocks)

VIG is a popular dividend ETF from Vanguard to capture U.S. dividend growth stocks. But is it a good investment? I review it here. First, note that I don't chase dividends. But of course many investors prefer to use dividends to supplement their current income, particularly in retirement. Others just prefer dividend-paying stocks because it feels good. I even designed a … [Read more...] about VIG ETF Review – Is VIG a Good Investment? (Dividend Growth Stocks)

VYM vs. HDV – Vanguard Dividend ETF vs. iShares Dividend ETF

Two popular dividend ETFs are VYM, the Vanguard High Dividend Yield ETF, and HDV, the iShares Core High Dividend ETF. They differ more than you may realize. Let's compare them. First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally prefer … [Read more...] about VYM vs. HDV – Vanguard Dividend ETF vs. iShares Dividend ETF

VYM ETF Review – Is VYM a Good Investment? (Dividend Stocks)

VYM is a popular dividend ETF from Vanguard to capture high-yield U.S. stocks. But is it a good investment? I review it here. First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally prefer dividend-paying stocks. I even designed a dividend-focused … [Read more...] about VYM ETF Review – Is VYM a Good Investment? (Dividend Stocks)

VIG vs. DGRO – Vanguard or iShares Dividend Growth ETF?

Two popular dividend growth ETFs are VIG, the Vanguard Dividend Appreciation ETF, and DGRO, the iShares Core Dividend Growth ETF. Let's compare them. To be clear, I don't obsess over dividends. But I know income investors often like to use dividends as current income, particularly in retirement, and thus seek out dividend-oriented funds. Others just irrationally prefer … [Read more...] about VIG vs. DGRO – Vanguard or iShares Dividend Growth ETF?

SCHD ETF Review – Is SCHD a Good Investment? (Dividend Stocks)

SCHD is a popular dividend ETF from Schwab to capture profitable U.S. stocks with a sustainable dividend. But is it a good investment? I review it here. First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally prefer dividend-paying stocks. I even … [Read more...] about SCHD ETF Review – Is SCHD a Good Investment? (Dividend Stocks)

SPYD vs. VYM – SPDR Dividend ETF vs. Vanguard Dividend ETF

Two popular dividend ETFs are SPYD, the SPDR Portfolio S&P 500 High Dividend ETF, and VYM, the Vanguard High Dividend Yield ETF. They're more different than you may realize. Let's compare them. First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just … [Read more...] about SPYD vs. VYM – SPDR Dividend ETF vs. Vanguard Dividend ETF

SPYD vs. SCHD – SPDR Dividend ETF vs. Schwab Dividend ETF

Two popular dividend-focused ETFs are SPYD, the SPDR Portfolio S&P 500 High Dividend ETF, and SCHD, the Schwab U.S. Dividend Equity ETF. Let's compare them. First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally prefer dividend-paying stocks. I … [Read more...] about SPYD vs. SCHD – SPDR Dividend ETF vs. Schwab Dividend ETF

SPHD vs. SCHD – Invesco Dividend ETF vs. Schwab Dividend ETF

Two popular dividend-focused ETFs are SPHD, the Invesco S&P 500 High Dividend Low Volatility ETF, and SCHD, the Schwab U.S. Dividend Equity ETF. Let's compare them. First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally prefer dividend-paying … [Read more...] about SPHD vs. SCHD – Invesco Dividend ETF vs. Schwab Dividend ETF

SCHD vs. VIG – Schwab Dividend ETF vs. Vanguard Div. Growth ETF

Two popular dividend-focused ETFs are the Schwab U.S. Dividend Equity ETF (SCHD) and the Vanguard Dividend Appreciation ETF (VIG), but they differ more than you may realize. Let's compare them. First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally … [Read more...] about SCHD vs. VIG – Schwab Dividend ETF vs. Vanguard Div. Growth ETF

JEPI ETF Review – JPMorgan Equity Premium Income ETF

JEPI is a covered call ETF for the S&P 500 Index designed to mitigate volatility and generate income. But is it a good investment? I review it here. JEPI ETF Review Video Prefer video? Watch it here: Introduction - What Is JEPI and How Does It Work? JEPI is an income ETF from J.P. Morgan. It's called the JPMorgan Equity Premium Income ETF. In a … [Read more...] about JEPI ETF Review – JPMorgan Equity Premium Income ETF

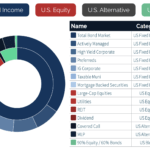

HNDL ETF Review – Is HNDL a Good Investment? (7HANDL™ ETF)

HNDL is a proprietary fund-of-funds income ETF from Strategy Shares with a target 7% yield. But is it a good investment? I review it here. Introduction - What Is HNDL and How Does It Work? HNDL is fund-of-funds ETF from Strategy Shares. The sub-advisor is Rational Capital LLC. "Fund-of-funds" just means it's a single fund that holds other funds inside it. HNDL is … [Read more...] about HNDL ETF Review – Is HNDL a Good Investment? (7HANDL™ ETF)

DIVO ETF Review – Amplify CWP Enhanced Dividend Income ETF

DIVO is an income ETF from Amplify. It uses active management to select blue chip stocks and then write covered calls on them. I review it below. Video Prefer video? Watch it here: Introduction - What Is DIVO and How Does It Work? DIVO is an ETF from Amplify, the folks who brought you SWAN. Its name is the Amplify CWP Enhanced Dividend Income ETF. As the … [Read more...] about DIVO ETF Review – Amplify CWP Enhanced Dividend Income ETF

NUSI ETF Review – Is NUSI a Good Investment?

NUSI is an option collar strategy ETF for the NASDAQ 100 Index designed to manage risk and generate income. But is it a good investment? I review it here. NUSI ETF Review Video Prefer video? Watch it here: Introduction - What Is NUSI and How Does It Work? Nationwide makes ETFs. This one is called the Nationwide Risk-Managed Income ETF. NUSI is an option … [Read more...] about NUSI ETF Review – Is NUSI a Good Investment?

SPHD vs. VYM – High Dividend ETFs from Invesco and Vanguard

The Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) and the Vanguard High Dividend Yield ETF (VYM) are two popular dividend-oriented ETFs. Let's compare them. First, I don't get excited about dividends. But I know that income investors often like to use dividends as current income, particularly in retirement, and thus seek out high-dividend-yield funds. Others … [Read more...] about SPHD vs. VYM – High Dividend ETFs from Invesco and Vanguard

SCHD vs. VYM – Dividend ETFs from Schwab and Vanguard

Two popular dividend-focused ETFs are the Schwab U.S. Dividend Equity ETF (SCHD) and the Vanguard High Dividend Yield ETF (VYM). Let's compare them. First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally prefer dividend-paying stocks. I even designed … [Read more...] about SCHD vs. VYM – Dividend ETFs from Schwab and Vanguard

QYLD – Avoid This ETF as a Long-Term Investment (A Review)

QYLD has been gaining popularity among income investors as a bullish-yet-defensive play on the NASDAQ 100. Here we'll review it and look at why it's probably not a great choice for a long-term buy-and-hold portfolio. Video Prefer video? Watch it here: Introduction - What Is QYLD and How Does It Work? QYLD is an ETF from Global X that holds the NASDAQ 100 … [Read more...] about QYLD – Avoid This ETF as a Long-Term Investment (A Review)

3 Best Preferred Stock ETFs & Why You Should Avoid Them (2024)

Preferred stock shares typically trade some capital appreciation for higher dividend yields. Here we'll look at the best preferred stock ETFs and why you might (not) want to use them. Video Prefer video? Watch it here: Introduction - Why Preferred Stock? Preferred stock shares - as opposed to common stock - have preferential claim to dividend … [Read more...] about 3 Best Preferred Stock ETFs & Why You Should Avoid Them (2024)

The 11 Best Dividend ETFs for Income Portfolios in (2024)

Dividend stocks are popular among income investors and those seeking more stability and lower volatility. Here we'll look at the best dividend ETFs for . Most of the dividend ETFs below are part of the dividend portfolio I designed. Introduction - Why Dividend Stocks? Dividends are simply a return of value to shareholders, in the form of periodic cash … [Read more...] about The 11 Best Dividend ETFs for Income Portfolios in (2024)