Previously you could only get a target date fund in the form of a mutual fund. Now they're available as ETFs.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Prefer video? Watch it below. If not, keep scrolling to keep reading.

The enormous asset manager BlackRock has launched the industry's first lineup of target date ETFs.

I've noted elsewhere why ETFs are usually preferable to mutual funds for a number of reasons and are gradually replacing mutual funds. Millions of Americans also lack access to employer-sponsored retirement plans like a 401(k). So this new suite of iShares target date ETFs provide an easy, affordable solution.

Anne Ackerley, Head of Retirement at BlackRock, commented that “This product innovation will make saving for retirement even more accessible at a time when Americans are less confident about their retirement readiness than ever before.” According to a study from BlackRock themselves, 40% feel off-track to retire. The iShares® LifePath® Target Date ETF Suite can instill a renewed retirement confidence in those who don't know where to begin.

I've long maintained that target date funds are unfairly maligned. The knee-jerk criticism of many pundits and novices are that target date funds are too conservative because they put young investors in broadly diversified asset classes and namely total bond market funds. The flawed logic in “100% stocks while young” aside, we know empirically that most investors overestimate their tolerance for risk, only realizing so when they panic sell during a severe market crash.

Vanguard found that their TDF investors tend to outperform even their DIY index investors over the long term because TDF's remove the behavioral aspects like tinkering, biases, and performance chasing

Some even claim they're doing a public service by getting friends out of target date funds in their retirement plans, which I think is a pretty ridiculous stance, primarily because in doing so they introduce unnecessary complexity and the need for future management for the precise type of investor who very likely doesn't want and isn't prepared for either. To add insult to injury, these moves out of target date funds usually invariably result in less diversification for the portfolio.

iShares is already a powerhouse of an ETF provider, and their asset allocation ETFs like AOR, AOK, etc. provide single fund solutions for well-diversified, multi-asset portfolios. This new suite of LifePath® Target Date ETFs goes one step further in providing funds that automatically adjust asset allocation and rebalance as time passes, all inside an ETF wrapper.

This marks an important milestone in the innovation of financial products, as previously this sort of offering was only available in the mutual fund structure. Notably, these funds are also very affordable with an average expense ratio of about 0.10%, or 10 basis points.

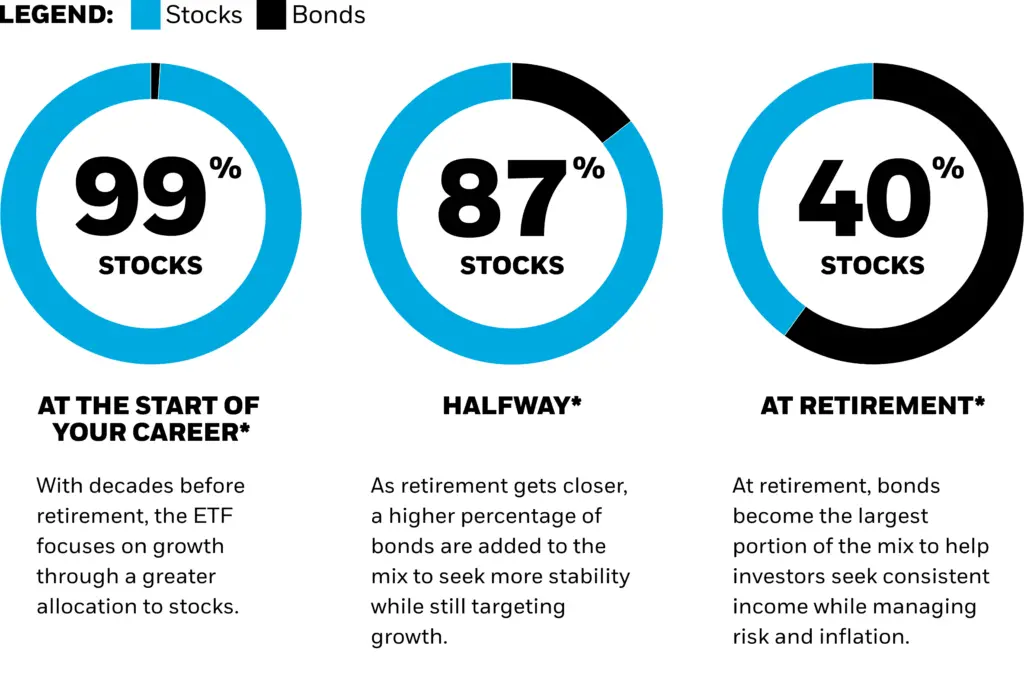

Target date funds take more risk early and adjust to a more conservative allocation over time. When the target retirement date is reached, the fund will transition into the iShares Target Retirement ETF for retirement income.

The LifePath suite will use underlying iShares ETFs inside. ITDE, the iShares® LifePath® Target Date 2045 ETF, for example, looks like this in 2023:

50% U.S. Large Cap Stocks

24% Int'l ex-US Developed Markets Stocks

9% Emerging Markets Stocks

5% Long-Term U.S. Corporate Bonds

4% U.S. REITs

3% Municipal Bonds

2% U.S. Small Cap Stocks

1% Long-Term U.S. Treasury Bonds

1% Intermediate U.S. Treasury Bonds

1% Short-Term U.S. Corporate Bonds

This comes out to about 89% stocks and 11% bonds, which is actually more aggressive than I would have expected. The bonds are even mostly long-term bonds, which is uncharacteristic of most target date funds. In the interest of full disclosure, these probably aren't the exact assets and allocations I would use, and you could definitely simplify the exposure and cut down on the number of underlying funds, but I can't deny the diversification, utility, accessibility, and affordability of these products.

These target date ETFs are also a perfect complement to an existing 401(k) for savers who are able to also contribute to an IRA but who don't want to manage their investments themselves. And because they're an ETF, they provide more tax efficiency for placement in taxable space as well. Since they're just fund-of-funds products, U.S. investors would also get pass-through foreign tax credits on the underlying international holdings.

There are currently a total of 10 ETFs in the lineup and they're staggered by 5 years, beginning with 2025.

What do you think of this new lineup? Let me know in the comments.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosure: None.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Say you have a Vanguard account. How do you like these ETFs vs the Vanguard target date mutual funds?