If you've got a Fidelity investment account, you've probably encountered several options for your “core position” for cash: SPAXX, FDIC, FCASH, FDRXX, and/or FZFXX. Is there a best option? I review the options and compare them here.

Note that the yields and fees for these options change all the time, so the information and numbers you see on this page may be outdated by the time you see them. Be sure to do your due diligence and check for yourself.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Fidelity Core Position Video

Prefer video? Watch it here:

Introduction – What Is the Fidelity Core Position?

Your “core position” at Fidelity simply refers to where your uninvested cash goes inside your account. For example, if you have 75% in an S&P 500 index fund like VOO and 25% uninvested cash, that 25% cash will automatically go into whatever fund or vehicle you select as your “core position.”

The core position basically acts as a wallet. When you buy something in your Fidelity account like a stock, you pay for it with money from that wallet. When you sell something, proceeds go into that wallet. The core position also facilitates transactions like check processing, electronic funds transfers, direct deposits, wire transfers, authorized credit cards, and other payments. There is no minimum balance requirement for the core position.

You have several options for how exactly that cash is held, which is why you're on this page in the first place.

First, let's get the obligatory reminder out of the way that market timing is usually more harmful than helpful, and DCA is inferior to investing a lump sum on average, so you probably shouldn't be holding much actual cash in the first place. But note that I'm not referring to something like T-bills or short-term government bonds, which are considered a “cash equivalent,” and which may be a perfectly sensible investment depending on your personal goals, time horizon, and risk tolerance. While several of these funds do indeed have allocations to T-bills, none of these options we're discussing here for the core position would be considered a dedicated T-bills fund like SGOV, for example, which is an ETF, and none of them contain floating rate bonds which are held by a fund like USFR.

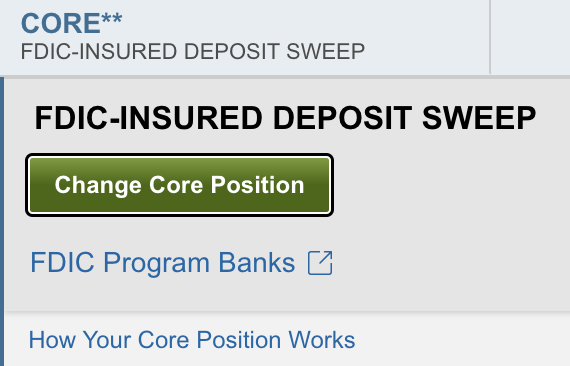

By the way, here's the section and button you're looking for in your Fidelity account:

Now that that's out of the way, let's compare SPAXX, FZFXX, FDIC, FCASH, and FDRXX.

SPAXX vs. FZFXX, FDIC, FCASH, & FDRXX

So which Fidelity core position should you go with? Let's talk about 'em.

SPAXX – Fidelity Government Money Market Fund

As the name suggests, SPAXX is what's called a money market fund. This is a fund that holds ultra-short-term instruments that are considered cash equivalents – such as CDs, commercial paper, and repo agreements – in order to pay what is usually a tiny interest rate.

This type of fund usually pays a marginally higher interest rate than that of a plain ol' savings account at a bank, including a high yield savings account. The tradeoff, of course, is that a money market fund is not FDIC-insured.

SPAXX is specifically collateralized by government securities, and would thus be considered safer than a broader money market fund that includes corporate debt. If we look at the holdings of SPAXX, it's mostly U.S. government repurchase agreements, followed by U.S. Treasury Bills and U.S. Treasury Coupons.

We would expect a fund like this to have volatility no greater than about 3% in either direction. At the time of writing, SPAXX has a 7-day SEC yield of 5.00%. (SEC yield is net of fees.)

You may see SPRXX instead of SPAXX. They're both very similar and should have the same fee, but SPRXX is slightly broader in its scope of debt instruments. As such, SPRXX may pay a higher yield than SPAXX.

SPAXX and all the money market funds on this list are insured by the SIPC, which stands for Securities Investor Protection Corporation, up to $500,000 in the event of financial troubles with the brokerage firm. You've probably heard of FDIC insurance for savings accounts. SIPC is basically the FDIC of investment securities.

SPAXX will likely be the primary option in your Fidelity Cash Management Account (CMA) and your Roth IRA.

Let me also explicitly remind you that SPAXX is not a “stock,” and none of these funds hold any stocks. SPAXX is a mutual fund, and specifically a money market fund.

FDIC – FDIC-Insured Deposit Sweep Program

As the name suggests, this is simply an FDIC-insured vehicle into which cash is “swept” inside the account. FDIC stands for Federal Deposit Insurance Corporation, which is quite literally the organization that insures your cash deposits up to $250,000. This is basically a true savings account like you'd have at your regular bank. In fact, Fidelity actually spreads your deposits here among several banks; that's why it's called a “program” and is not an actual investable fund.

As a result, your cash balances will be FDIC-insured even if they exceed $250,000. In the event of a lack of capacity or availability from program banks, any excess cash will be swept into the Fidelity Government Money Market Class S mutual fund, for which the ticker is FZSXX. Fidelity refers to this as the “Money Market Overflow.” At the time of this video, this mutual fund has a 7-day SEC yield of 5.00%.

Because this is basically a plain vanilla savings account, we'd expect it to pay less than the other options on this list, but it can be considered comparatively less risky and less volatile. With this program, your cash is not exposed to any kind of market risk like with others on this list. That said, “less risky” in this context just means we're basically going from extremely safe to riskless.

As of January 2024, this FDIC cash sweep program has an interest rate of 2.69% and also a fee of 0.01%.

It's worth noting that this option may pay less than a high yield savings account.

FCASH

FCASH is another option you'll see in your taxable brokerage account. Note that this is going to be the default option inside your account. This is a free credit balance from Fidelity that earns interest. At the time of writing, its interest rate is 2.69%.

FCASH will likely pay less than a high yield savings account.

FDRXX – Fidelity Government Cash Reserves

Like SPAXX, FDRXX is another U.S. government money market fund. For all intents and purposes, it is basically an older version of SPAXX. Their holdings are nearly identical and they have nearly the same yield and the same historical returns.

FDRXX launched in 1979 and has a 7-day SEC yield of 5.02%.

FZFXX – Fidelity Treasury Money Market Fund

You may encounter FZFXX as an option in your taxable account. It's basically the same as SPAXX and FDRXX except it does not have the 10% or so in agency securities. This one is entirely U.S. Treasury securities.

In that sense, it is slightly more tax-efficient and thus may appear as a choice for your taxable brokerage account with Fidelity. Its yield should be roughly the same as SPAXX. Right now it is exactly the same as SPAXX at 5.00%.

FDLXX is another option you may see that is basically the same thing as FZFXX. FDLXX is the Fidelity Treasury Only Money Market Fund.

Conclusion

Don't overthink your Fidelity Core Position.

If you are willing to sacrifice return/yield for zero volatility and virtual risklessness, go with the FDIC-insured cash sweep program. If, however, you want a very safe parking garage for cash that would be expected to have a positive nominal return, a government money market fund is a fine choice. Remember too that those money market funds are still SIPC-insured up to $500,000.

For all intents and purposes, the 3 money market funds on this list are nearly the same thing. Out of these, you may simply want to aim for the highest yield.

You can also switch between them at any point based on whichever one is paying the most, but this basically comes down to comparing the money market funds and the FDIC program (banks). You can obviously change your core position at any time online yourself, but if any of this seems overwhelming, you can also call a Fidelity representative to do it for you at 800-544-6666.

Conveniently, interest from the government securities will also be state-tax-exempt.

When looking at the performance of these funds, be sure you're looking at total return that includes dividends/interest, as most of them aim to maintain their principal value of $1.00 while simply paying out interest monthly, a price-return-only chart will obviously look flat.

Any of these would be a fine choice to park unused cash or to hold your emergency fund.

At the end of the day, this is definitely not a decision to lose sleep over.

What's your Fidelity Core Position? Let me know in the comments.

Fidelity Core Position FAQ's

Lastly, here are some frequently asked questions regarding the Fidelity Core Position and its fund options.

Does SPAXX pay interest?

Yes. SPAXX aims to maintain a net asset value of $1.00 while paying out monthly interest close to that of 3-month Treasury Bills.

When does SPAXX pay dividends?

SPAXX pays dividends monthly, typically at the beginning of the month.

When does SPAXX pay interest?

SPAXX pays interest monthly, typically at the beginning of each month.

Is SPAXX a good investment?

SPAXX may indeed be a good investment for those investors who need a money market fund for short-term liabilities or to simply park cash.

Is SPAXX safe?

SPAXX holds ultra short term, high quality debt instruments, and is thus very safe.

Is SPAXX FDIC insured?

No. The FDIC insures bank deposits, not investment securities. SPAXX, being the latter, is insured by the SIPC – Securities Investor Protection Corporation – up to $500,000.

Is SPAXX insured?

Yes. SPAXX is insured by the SIPC – Securities Investor Protection Corporation – up to $500,000.

Is SPAXX tax exempt?

No. Interest from SPAXX is federally taxable as income, though its government debt issues are exempt from state taxes.

Can you lose money in SPAXX?

While it is technically possible to lose money in SPAXX, it is highly unlikely.

Can SPAXX lose value?

While it is technically possible for SPAXX to lose money (because we can't guarantee positive returns), it is highly unlikely.

Is SPAXX a good fund?

SPAXX is a good fund if you need a safe vehicle in which to park cash.

How does SPAXX work?

SPAXX aims to maintain principal while paying monthly dividends (its yield) close to the risk-free rate of T bills.

Can you sell SPAXX?

In this context, SPAXX would simply be the vehicle that temporarily holds cash inside your Fidelity account, so you wouldn't need to sell it. If you specifically buy SPAXX as an investment, yes you can sell it.

Which Fidelity Core Position is best?

It's hard to objectively conclude that one Fidelity Core Position option is “best,” as some of them are extremely similar. Ideally, one would usually aim for the highest yield net of fees. Assess your own goals and risk tolerance to choose the most suitable vehicle.

Is Fidelity Core Position FDIC insured?

Your Fidelity Core Position is only FDIC insured if you choose the FDIC-Insured Deposit Sweep Program inside your account.

What Fidelity Core Position should I choose?

Only you can decide which Fidelity Core Position to choose. Some are money market funds and one is basically an FDIC-insured savings account. Assess your own goals and risk tolerance to choose the most suitable vehicle.

Does Fidelity Core Position earn interest?

Yes, all the options for the Fidelity Core Position earn interest.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Anyone have any opinions regarding what will happen to all these core position options if the US gov. does not agree to raise the debt ceiling by 6/1/23 ?

After reading this article, I’ve switched to SPAXX from FCash. Thanks for the article.

Would Schwab SNVXX be similar to Fidelity SPAXX?

Thank you for all you do. I learn so much from your YouTube channel and blog.

“SPAXX launched in 1990 and has a net expense ratio of 0.06%” — actually SPAXX has a net expense ratio of 0.42%

Not true. Effective net ER is lower due to “voluntary reimbursements and waivers.” Read the prospectus.

Not sure why you’d assert this. Fidelity agrees that SPAXX has [negligibly] higher mgmt fees than FDRXX. The language you reference of potential voluntary fee refunds is in the prospectus for both SPAXX and FDRXX.

Bill, I asserted that because at the time it was a true assertion when SPAXX did indeed, as I said, have a net ER of 0.06%. However, you’ll notice that comment is 7 months old and the net ER has changed since then; it is now 0.42% at the time of writing in March, 2023.

One thought is making a practice of alerting readers to what “net expense ratio” actually means and suggesting that it’s prudent to check the current effective rate as well as to periodically monitor the fund for changes that can and do occur. It’s the same as listing a TTM yield to suggest how a fund has performed when the fund’s portfolio effective portfolio may be quite different as it’s always changing and better reflected by the 7-day SEC yield.