The CALF ETF from Pacer seeks to capture US small cap stocks with higher free cash flow yield, which it calls “cash cows.” I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

CALF ETF Overview

Small cap stocks have greater expected returns than large cap stocks because they tend to be riskier and more volatile. Small stocks have beaten large stocks historically, compensating investors for taking on that greater risk.

But not all small caps are created equal. Small cap growth stocks with weak profitability don't tend to pay a risk premium, so it may be prudent to screen for strong earnings when investing within the small cap universe. Good small caps tend to be very good, and bad small caps tend to be very bad.

Enter the CALF ETF from Pacer, which focuses in on U.S. small cap stocks with higher-than-average cash flow relative to their price. Its full name is the Pacer U.S. Small Cap Cash Cows 100 ETF.

So why would we be interested in these particular stocks in the first place?

Well, like I just hinted at, we can introduce the potential for greater long-term returns to the portfolio while also weeding out what we think are stocks to probably avoid.

For factor investors like myself, CALF would also be a way to specifically target the Profitability factor, denoted RmW for “Robust minus Weak,” in a portfolio that may otherwise be lacking.

Now let's look at how exactly the CALF ETF achieves such exposure by analyzing its selection methodology.

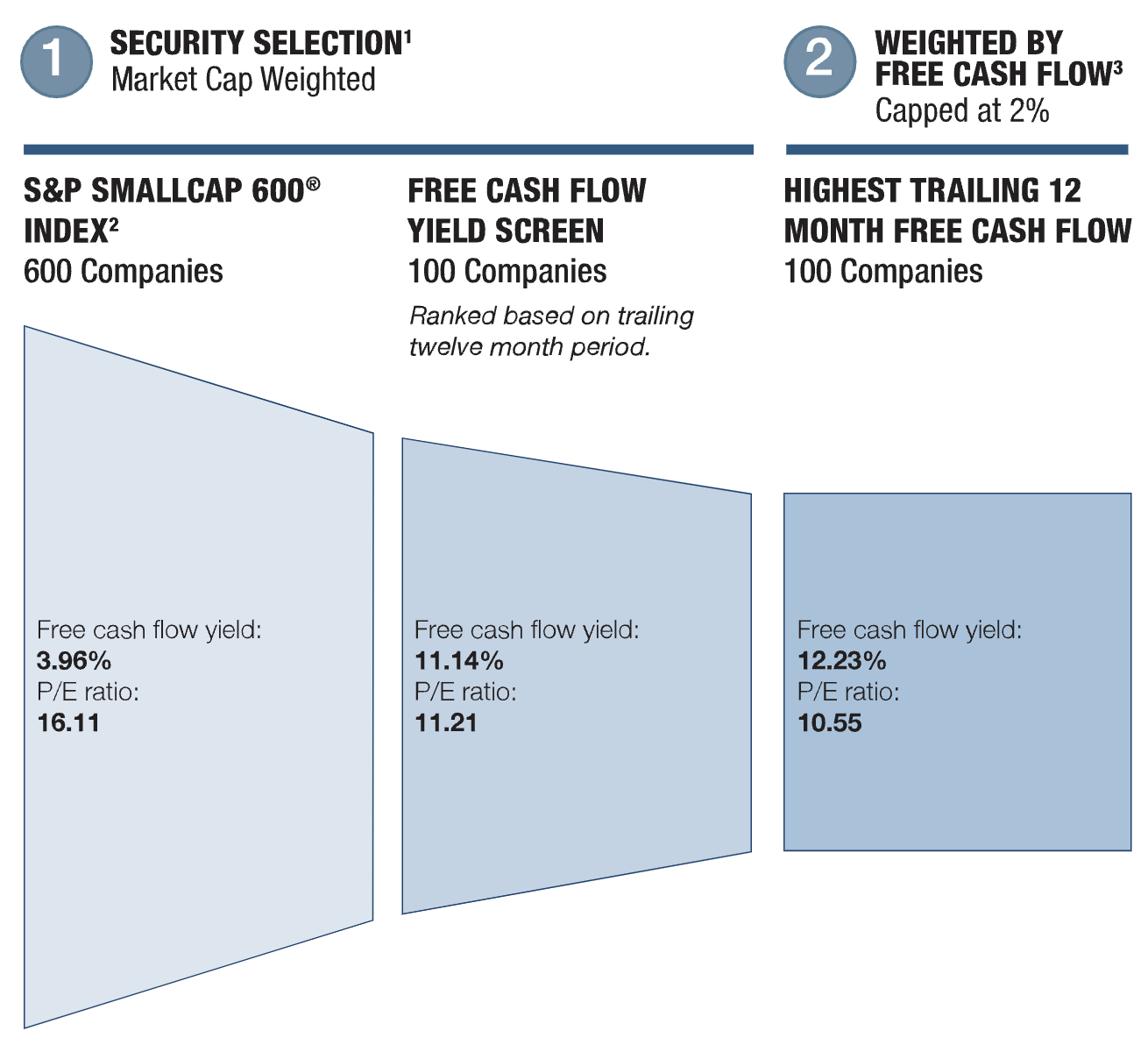

The fund starts with the S&P SmallCap 600 Index as its selection universe, which is a somewhat broad index of U.S. small cap stocks. This index already deploys a couple earnings screens. CALF then takes that basket of 600 profitable companies and screens for projected free cash flow and earnings for the next 2 years, while also excluding Financials. The fund then ranks that subset from greatest to least trailing 12-month free cash flow yield and picks the top 100 stocks on that list for inclusion in its proprietary index, called the Pacer US Small Cap Cash Cows Index. This fund's older brother COWZ takes the same approach in U.S. large caps.

Free cash flow yield is the ratio of free cash flow to enterprise value, so we're still screening for Value here. Hopefully your spidey sense is tingling at this point, because you may recognize that CALF is honing in on highly coveted small cap value stocks with robust profitability, which have outperformed every other corner of the market historically. Individual holdings are capped at 2% and the index is rebalanced quarterly.

So why would anyone be interested in this specific methodology?

Pacer themselves maintain that Value strategies are flawed, or at least suboptimal, without also screening for free cash flow. They suggest that the traditional idea of simply looking at a valuation ratio like price-to-book alone is no longer a viable strategy due to the intangible assets of modern companies versus the tangible assets of companies a half century ago when the Value premium was alive and well in U.S. stocks. The evidence seems to indicate this idea of jointly considering earnings with Value is probably a prudent idea, particularly in smaller stocks.

This approach has proved attractive, and the CALF ETF has certainly been a “cash cow” for Pacer themselves, with the fund now boasting nearly $10 billion in assets after launching in 2017.

Let me reiterate once again that these are Value stocks. We could find small cap Growth stocks that exhibit higher-than-average earnings and cash flow, which is the first step in the selection process for this index, but then CALF is again comparing that cash flow to the price of the stock and eliminating ones that are relatively expensive, which is effectively a Value screen.

Unsurprisingly, this selection methodology of CALF results in positive loadings across all 5 factors in the Fama-French 5-Factor Model – Beta, Size, Value, Profitability, and Investment. This makes sense, as again these tend to be smaller stocks with strong earnings that don't reinvest aggressively into R&D.

All that being said, CALF's Value loading is considerably smaller than dedicated small cap value funds. Like I hinted at earlier, its primary focus is on Profitability. I'll touch on this comparison in more detail later.

It's also important to note that this selection process currently results in CALF massively overweighting Consumer Discretionary stocks at nearly 30% and massively underweighting Financials stocks (since it excludes them entirely).

CALF ETF Performance

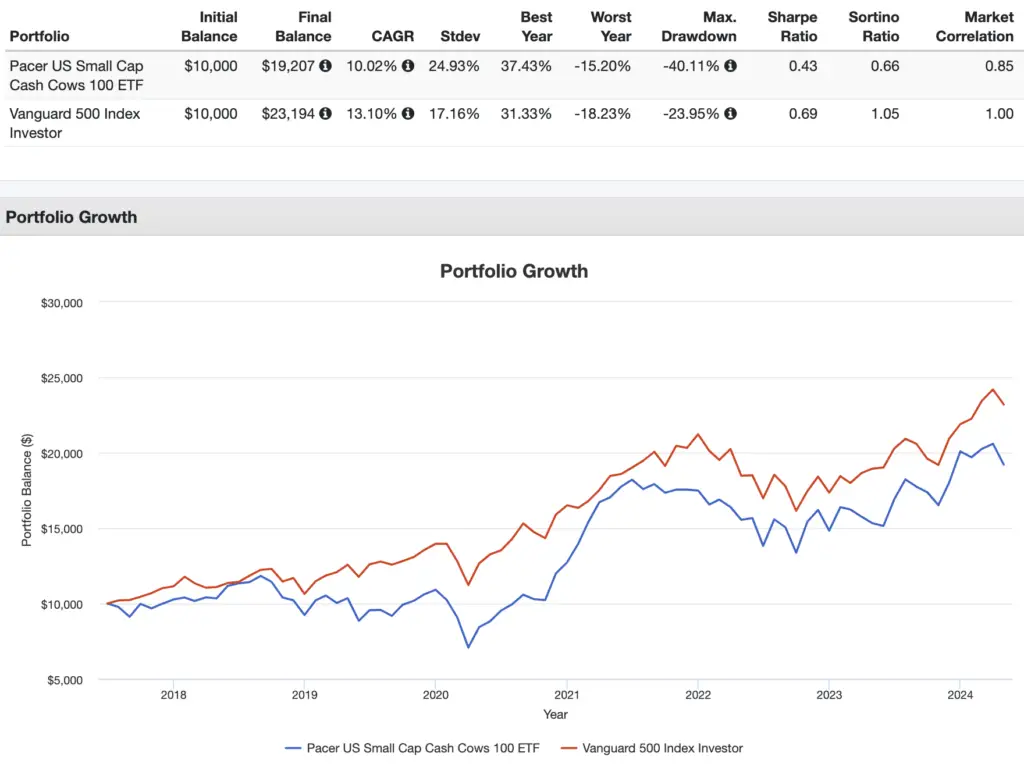

So how has CALF delivered on its promises so far in terms of performance? While it's not the appropriate benchmark, here's a backtest comparing it to the S&P 500 going back to CALF's inception in 2017:

CALF has lagged the market over this period, but small caps as a whole have lagged large caps over this period, so this shouldn't be too surprising. CALF has beaten the market in very recent years like 2021, 2022, and 2023.

I'll show some other, more appropriate performance comparisons a little later.

Is CALF a Good Investment?

So is CALF a good investment? Probably not.

Now seems like a good time to mention how much CALF costs. Its expense ratio is 0.59%, which I think is pretty pricey for what you're getting here in a handful of relatively simple earnings and cash flow screens. These days, in the same price range and sometimes cheaper, we've got multi-asset, option overlay, and levered funds – and sometimes combinations thereof – that are far more complex.

There's nothing really special or proprietary going on with CALF in my opinion, though admittedly I also can't really speak to how much other fund providers are specifically focusing on free cash flow yield as a primary indicator in their methodologies. My hunch is that it is not as much of a golden goose as Pacer make it out to be, but I could be wrong.

In other words, this fund just seems objectively expensive. It would be one thing if the fund provided global equities exposure wherein there's maybe an argument for the higher trading costs in Emerging Markets. But here we're just talking about U.S. small caps. I would have expected the fee to come in at no more than half of what it is.

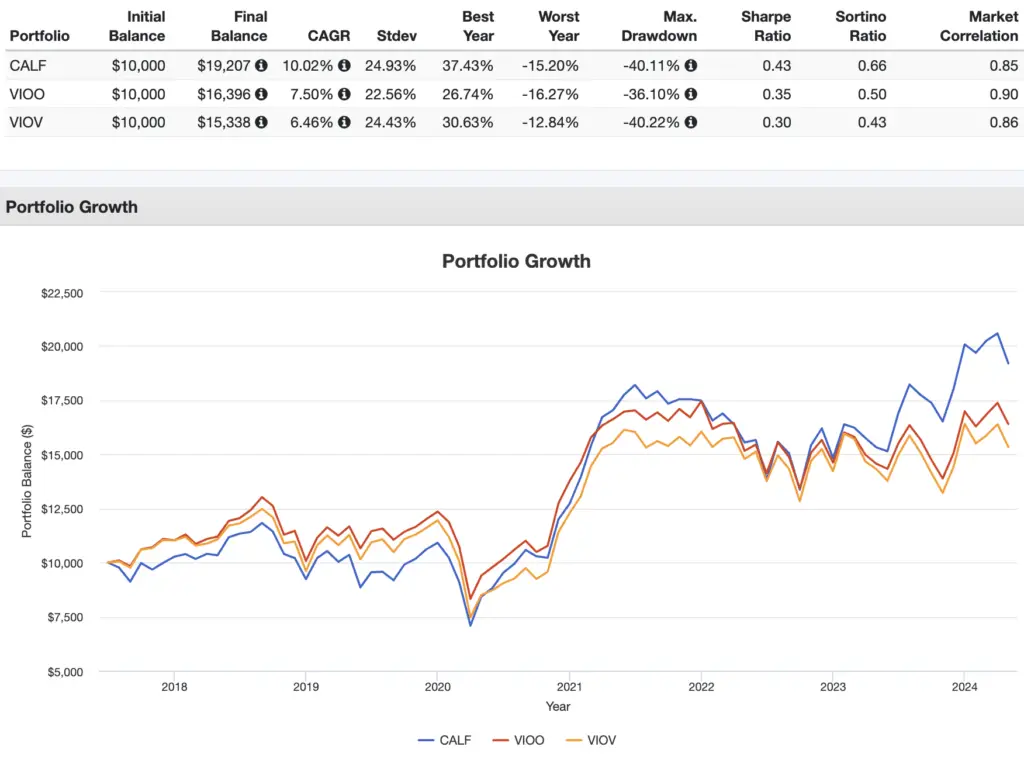

All that being said, there's no denying that CALF has significantly outperformed benchmarks like its S&P SmallCap 600 Index and even the S&P SmallCap 600 Value Index since its inception in 2017, more than compensating investors for its higher fee. Will it continue to do so in the future? No one knows.

A couple popular funds for those indexes I just mentioned are VIOO and VIOV respectively, both from Vanguard, visualized here:

Let's briefly circle back to factor loadings now for a second. As I hinted at earlier and as we would probably expect, compared to a dedicated small cap value ETF like VIOV, CALF has a much lower loading on Value but a much higher loading on Profitability, as it's narrowing in further on the most profitable stocks within small caps. As such, there's perhaps an argument for holding both, but then VIOV costs 1/4 of CALF at 0.15%.

At this point you're probably wondering how CALF compares to my darling U.S. small cap value fund AVUV from Avantis. Remember that Avantis use their own earnings screens to get positive loading on Profitability as well. As a result, CALF and AVUV have an almost identical loading on the Profitability factor, with AVUV having a much higher Value loading, again as we'd probably expect. Performance of these two has been very close since AVUV's inception in 2019, and AVUV costs less than half of CALF with a fee of 0.25%.

In total fairness to Pacer, their target audience is not retail investors like you and me, but rather financial advisors who are going to be buying investing for clients, so advisors may be less sensitive to these higher fees. This is a potentially win-win for Pacer and advisors, as Pacer gets revenue and advisors get to use unique and specific marketing materials with clients surrounding the potential merits of free cash flow yield. This arguably comes at a cost to the clients, though, who are paying more in fees and commissions. Only time will tell if CALF is able to deliver outsized returns that make up for its higher fee over the long term.

I'm the first to admit that fees are relative to the exposure you're paying for, and I'd prefer this fund's approach over an indiscriminate Value screen, but again I see no objective reason to pay this much for what CALF is providing. I'm perfectly happy with my comparable or arguably superior exposure to the U.S. small cap value segment via AVUV.

Just like I noted with its older brother COWZ, CALF seems like an inefficient factor fund that doesn't want to call itself a factor fund, though admittedly I suppose the semantics don't really matter.

Let's also not forget that CALF is only holding a relatively small basket of 100 small cap stocks from one single country at the end of the day, resulting in some pretty concentrated sector weights. I'd probably prefer if the selection methodology went one step further and capped sector weights to avoid such concentration. Expected performance aside, you may simply want a more diversified fund for the small cap value corner of the style box.

Further, recognize that CALF is constantly churning stocks. If you're a stock picker, you may have some picks that you plan to hold forever. CALF is basically doing the opposite. Every quarter, the fund is re-evaluating its holdings and doing quite a bit of buying and selling. Not only is this unfavorable from a tax perspective like I already mentioned, but this also means CALF very rarely holds on to any particular stock for more than about a year. At the same time, free cash flow itself can be extremely volatile, so one huge expense can send a company's free cash flow into the red but you might still have to hold onto it for 3 months.

I'll be curious to see how CALF performs over the long term going forward if the Value premium makes a strong comeback in the United States. Clearly many have flocked to this fund and its older brother COWZ based on their recent past performance. I'm a bit more hesitant knowing past performance doesn't indicate future results. Pacer have marketed free cash flow yield as their unique selling proposition. If it ends up somehow being the holy grail indicator of higher returns over the next 20+ years, I'll write about it. Until then, I don't see myself paying over half a percent for it.

Conveniently, CALF should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of the CALF ETF? Do you own it? Are you planning on buying it? Let me know in the comments.

Disclosure: I am long AVUV in my own portfolio.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply