Avantis has launched AVMA, a factor-tilted asset allocation ETF with global stocks and bonds. I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Prefer video? Watch it below. If not, keep scrolling to keep reading.

I've written plenty elsewhere about factor investing, diversification, and asset allocation. Avantis has now combined all three in a single fund that they call their Moderate Allocation ETF. The ticker is AVMA.

I previously covered AVGE, the first fund of funds from Avantis, which is global equities. But that's still only one asset class. I noted that such a fund may be extremely useful for the 100% stocks investor who wants factor tilts and ultimate simplicity.

But what about for the risk-averse investor or retiree? Enter AVMA, which adds global bonds to the mix for what should usually be around a moderate 60/40 allocation, meaning 60% stocks and 40% bonds. I say “usually” because the fund has the freedom to oscillate between 30 and 40 percent for the fixed income side. Technically it will probably usually fall somewhere in the middle around 65/35.

I've explained elsewhere that 60/40 is thought to be a very reasonable balance of risk and expected return. Now these investors have a single fund solution for their entire portfolio that can be well-diversified across multiple assets globally.

AVMA's target allocations are as follows:

- US stocks at 47% with an acceptable range of 40% to 60%.

- ex-US Developed Markets stocks at 12% with a range of 7% to 20%.

- Emerging Markets stocks at 6% with a range of 3% to 10%.

- REITs at 2% with a range of 0% to 5%.

- Fixed income at 33% with a range of 30% to 40%.

In order to achieve that exposure, AVMA holds 16 of Avantis's own funds. It does so to granularly access equities with greater expected returns across all cap sizes. You'll notice that just like with AVGE, AVMA aims for roughly global market cap weights with a slight US bias.

The current fund-of-funds lineup for AVMA looks like this:

- 29% AVUS – Avantis U.S. Equity ETF

- 21% AVIG – Avantis Core Fixed Income ETF

- 10% AVLV – Avantis U.S. Large Cap Value ETF

- 10% AVSF – Avantis Short-Term Fixed Income ETF

- 7% AVDE – Avantis International Equity ETF

- 4% AVEM – Avantis Emerging Markets Equity ETF

- 4% AVIV – Avantis International Large Cap Value ETF

- 3% AVUV – Avantis U.S. Small Cap Value ETF

- 3% AVSC – Avantis U.S. Small Cap Equity ETF

- 3% AVES – Avantis Emerging Markets Value ETF

- 2% AVRE – Avantis Real Estate ETF

- 1 AVDV – Avantis International Small Cap Value ETF

- 1% AVMV – Avantis U.S. Mid Cap Value ETF

- 1% AVMC – Avantis U.S. Mid Cap Equity ETF

- 0.5% AVEE – Avantis Emerging Markets Small Cap Equity ETF

- 0.5% AVDS – Avantis International Small Cap Equity ETF

I always remind people that most of Avantis's funds are what's called rules-based active, meaning strict parameters and screens to arrive at an objective basket, which is not the true “active” we usually think of like with stock picking, but note that here with AVMA, managers have a bit more freedom to allocate between assets, change allocation ranges, and rebalance at will. This will likely usually primarily be a tax consideration, but the prevailing market environment may play a role as well.

I think it's a little odd that they've sliced and diced this fund up into tiny individual allocations when they could have just used their existing global equities fund AVGE, but then I guess that would make it a fund-of-funds-of-funds; ETF inception.

Also remember the only reason we have a dedicated REITs allocation here is because Avantis's other funds exclude REITs.

You're probably curious about what that fixed income side looks like. Think of basically a global total bond market fund that tilts toward Term and Credit, the 2 risk factors for fixed income. This effectively means a roughly intermediate duration of about 6 years and a lot of corporate bonds. That's unlikely to make or break the portfolio, but recognize that does invariably mean slightly greater tax consequences, so AVMA may be more suitable for tax-advantaged space like an IRA. That said, because it's a fund of funds, US investors will get pass-through foreign tax credits on AVMA's foreign holdings.

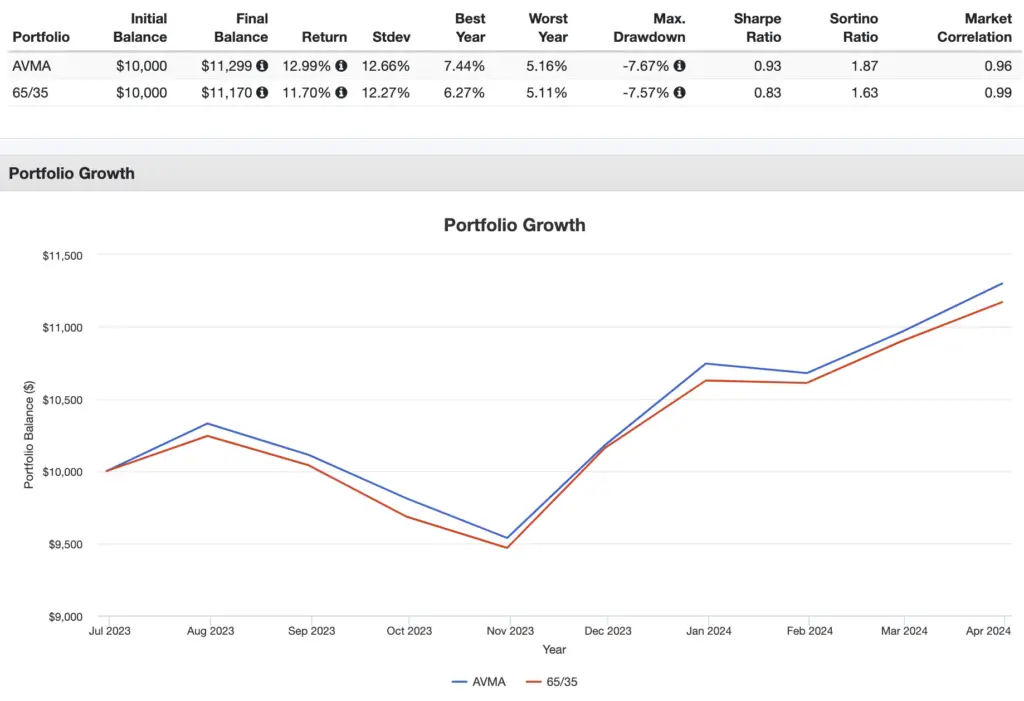

This performance backtest should mean basically nothing because it's less than a year, but here I've compared AVMA to a 65/35 portfolio of global stocks and bonds going back to AVMA's inception in June 2023 and looking through March 2024:

Over that time, AVMA has beaten that benchmark on both a general and risk-adjusted basis, but remember that does not mean it will continue to do so in the future.

AVMA launched in June 2023 but hasn't really caught on, as it only has about $10 million in assets. My guess for why this is the case is the same thing I noted with their other fund-of-funds products AVGE and AVGV – that sophisticated investors who are interested in global diversification and factor tilts probably want to granularly dial in their own allocations instead of having an allocation ETF do it for them. That said, I always say I think simplicity is vastly underrated and can be extremely valuable in portfolios, so it simply comes down to investor preference.

After a fee waiver of 0.02%, AVMA carries what I think is a fairly reasonable net expense ratio of 0.21%. Remember you're getting global stocks, global bonds, and factor tilts all in one fell swoop.

What do you think of AVMA? Do you own it or are you planning on buying it? Let me know in the comments.

Disclosure: I am long AVUV and AVDV in my own portfolio.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Noticing these fund of funds aren’t really catching on; Do you think they have a risk of closing? (I own sizable position in AVGV in a taxable account)