JEPI is a covered call ETF for the S&P 500 Index designed to mitigate volatility and generate income. But is it a good investment? I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

JEPI ETF Review Video

Prefer video? Watch it here:

Introduction – What Is JEPI and How Does It Work?

JEPI is an income ETF from J.P. Morgan. It's called the JPMorgan Equity Premium Income ETF. In a nutshell, JEPI is holding a basket of low-volatility stocks selected from the S&P 500 Index (the largest 500 U.S. companies), on which it sells covered call options via ELN's (Equity Linked Notes) to generate income. This fund launched in mid-2020 and has quickly amassed over $3.5 billion in assets. It has an expense ratio of 0.35%.

JEPI selects stocks based on ESG criteria, valuation metrics (think value stocks that pay dividends), and low volatility. The fund's stated objective is to match the performance of its benchmark index, the S&P 500, with lower volatility and greater yield. If the fund were able to achieve that objective (it hasn't), it would be pretty great for a retiree. Part of JEPI's high yield comes from the dividends of the stocks it holds. The other part comes from writing call options on those stocks.

As a brief refresher, covered call writers own the underlying and collect a premium on the option, and the buyer of the call option has the right to buy the underlying at the strike price at or before expiration. For example, if I own a fund like VOO for the S&P 500 and I think it's going to be relatively flat for the next 30 days or so, I might sell a call option on it, for which I receive cash immediately (called the premium). The buyer of that call option is hoping VOO goes up. As the seller, I'm hoping it stays flat. Call options are usually sold to generate income in a flat or mild bear market.

JEPI vs. DIVO

If JEPI reminds you of DIVO, you'd be right. The funds are extremely similar in that they're selecting large-cap dividend stocks from the S&P 500 and selling call options on them. They differ on a few specific dimensions, though:

- JEPI is more diversified with 95 holdings, compared to DIVO's 23.

- JEPI is also much more popular, with about 6x the AUM of DIVO.

- JEPI has a lower fee of 0.35% compared to 0.55% for DIVO.

- JEPI has greater loading on the Value and Investment factors, while DIVO has greater loading on Size and Profitability, so they are holding different stocks.

- JEPI considers ESG criteria for inclusion; DIVO does not.

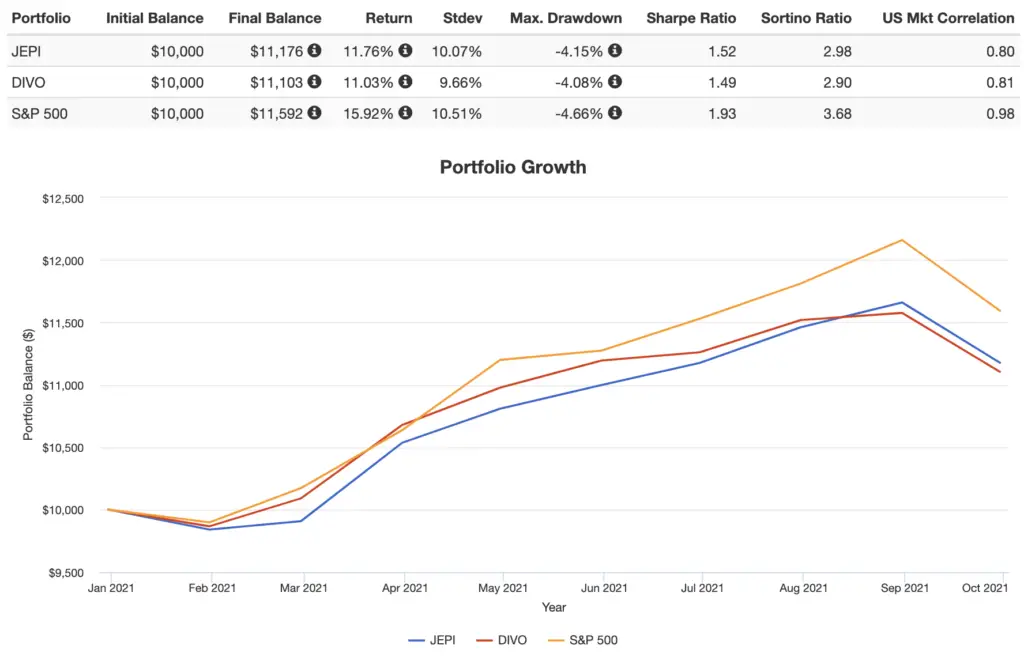

I noted previously that DIVO probably seemed the least offensive of all these popular covered call funds like QYLD, but I think I like JEPI even more given the facts above. In terms of sheer performance, JEPI and DIVO have been pretty close, but JEPI has also arguably delivered more reliably on its objective with higher returns at lower volatility. Consequently, in the very short lifespan of these two funds thus far, JEPI has generated slightly higher general and risk-adjusted returns than DIVO, though both have still lagged the broader market on both a general and risk-adjusted basis:

Recall that covered calls do not protect the downside, evidenced by the nearly identical drawdowns of all 3 portfolios above.

Is JEPI a Good Investment?

So is JEPI a good investment? Probably Not.

Just like with DIVO, I understand the desire to assemble a low-volatility basket of stocks that JEPI aims to hold, but we would still expect stock picking to underperform the market over the long term. We can also just buy a low-vol and/or value fund at a lower cost.

As I've noted elsewhere, covered call funds like this are inarguably only appropriate for the investor who actually needs and uses that regular income from the dividends and option premiums. That situation does not apply to me, and if you're reading this, it very likely does not apply to you. If you’re just planning on reinvesting the fund’s distributions, it doesn’t make much sense to buy JEPI, especially in a taxable account where you're taxed on those distributions.

If you want ESG, Value, or dividends, you can target those directly while paying lower fees. If you're bullish on the S&P 500, buy a low-cost index fund like VOO from Vanguard and call it a day. I showed above how that has still been more efficient than JEPI historically, at least so far in its short lifespan. Remember too that covered calls here are capping the upside potential if the index rallies.

You can also just create your own dividend that way instead of having the fund do it for you, which I've shown should be mathematically preferable anyway, as it allows more money to stay in the market longer. I think “income” is overrated anyway. I’d be more likely to go with something like SWAN and just set up an automatic monthly transfer from the brokerage account that sells shares for me; there’s my “income.” Again, I’m not a dividend investor anyway, so these types of yield-focused strategies don’t appeal to me regardless. I’d rather create my own dividend when I want to.

Aside from all that, I also designed a dividend portfolio for income investors here that may appeal to you.

Recall too that covered calls do not protect the downside. The option premium received does not help you much in a market crash (mental accounting, anyone?), and we'd expect these funds to crash just about as deeply as their benchmark index. The income investor for whom JEPI is suitable should almost certainly also still have bonds in the portfolio.

And don't forget about the ugly ELN's, which add another layer of credit risk for investors.

If you still want to buy JEPI after all this, it should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of JEPI? Let me know in the comments.

JEPI FAQ's

Lastly, here are some frequently asked questions about JEPI and their answers.

When does JEPI pay dividends?

JEPI pays dividends monthly.

When was JEPI started?

JEPI launched on May 20, 2020.

How does JEPI make money?

JEPI uses ELN's (Equity Linked Notes) with a covered call strategy baked in to effectively write call options on low volatility stocks from the S&P 500 Index.

How does JEPI work?

JEPI holds ELN's (Equity Linked Notes) with an underlying covered call strategy that effectively writes call options on low volatility stocks from the S&P 500 Index to generate income and subsequently pay a high monthly distribution yield.

Are JEPI dividends qualified?

No, dividends from JEPI are not qualified.

Can JEPI sustain dividends?

Unfortunately the future is unpredictable. We've already seen the distribution yield of JEPI can fluctuate in its short lifespan thus far.

Why is JEPI going down?

JEPI can go down with the underlying S&P 500 index. Writing covered call options does not make JEPI immune from market downturns.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosures: I am long VOO in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Even Redditors know that JEPI does not write coveted calls, but rather uses ELNs to generate outsized income. So article is very misleading and inaccurate.

From the prospectus: “The ELNs owned by the Fund are

structured to use a covered call strategy and have short call

positions embedded within them. When the Fund purchases the

ELN from the issuing counterparty, the Fund is entitled to the

premium generated by the short call position within the ELN.”

JEPI should be evaluated on a risk-adjusted return basis. The question is not whether its better than a typical stock index, but how it compares on a risk adjusted basis to the typical equity / bond portfolio. Holding JEPI may in fact reduce the amount of bonds required in your portfolio. Returns based on volatility and covered call trading provides valuable diversification, particularly for those closer to or in retirement. Much of the commentary that I read in regard to JEPI is entirely off the mark.,

As noted, JEPI doesn’t look too exciting even on a risk-adjusted basis.

Any time i hear “make my own dividend” et al the only thing i can think of is – “this guys a moron”. If i own an income yielding fund and you own a pure growth fund and we both recieve the same income – mine from distributions and yours from selling shares – it wont be long until you’ve sold enough to inhibit growth (or all of them). This isnt complicated.

Anytime I hear “you’ll run out of shares” the only thing I can think of is – “this guy’s a moron.”

“$JEPI’s process of adding protective puts to its covered call strategy doesn’t just help generate an 8% yield. It provides significant downside protection. It’s beating the S&P 500 by 7% year-to-date.Jul 22, 2022” – the google link just after yours.

Half baked reviews are at best stupid, and usually financially harmful. Yes, your disclaimer is thorough – but your poinently strategic omissions leave your ethical value at zero. Tsk.

Thanks for the comment, Drew!

As a long term investor, I’m not interested in short-term performance. I would assume that was clear but I guess not. Not sure where I “omitted” anything.

Half baked comments are at best stupid, and at worst are a waste of my time replying to them.

Its a small part of my portfolio and I receive about $2800 a month. Great return for a new retiree.

Thanks for your article. I had never heard of DIVO before. I just came across JEPI which is paying a lot more in dividends. However I like the growth potential of the stocks in DIVO. It seems like the JEPI portfolio manager could screw up one day. I’m young and should probably go with a S&P 500 fund or growth fund but I feel safer with these type of funds. It looks like the share price of most dividend paying funds have declined in value overtime. I don’t feel great about most value funds with high dividends because they have a lot of oil stocks and the price of oil could come down. I think I really like these types of funds.

Just remember, as I noted, that these covered call funds are not “safer” in really any way.

Hello! I’m entering college as a freshman later this fall and I have around 10,000 saved. I’m considering investing a majority of my savings into a high yield covered call ETF where I would need the extra income to pay off expenses in school, Would you support this? Or is there another ETF you might recommend?

Hey Zachary, thanks for dropping a comment. I can’t provide personalized advice but I’m a fan of having an emergency fund first and then diversifying broadly. It’s also impossible to know the future so I can’t say what the best income-generating strategy would be for the next few years. A covered call fund may indeed have a place in there but I’d also toss in other diversifiers like treasury bonds and TIPS for more safety, even though they aren’t paying much right now.

What about interest rate sensitivity?

I’m almost commenced my retirement and rearranging my portfolio. I’m trying to add some (within reason) high yield income funds, from which I’ll spend the income (rather than reinvest).

I see many of the high yield income ETFs are getting hammered as the 10 year yield rises. Does a fund like JEPI exhibit the same problem?

Yes. As noted, JEPI is just writing covered calls on stocks. It will fall with the stock market.

Income is overrated. Wow…if you’re retired and you don’t want to sell shares and need money to pay for stuff, what do you do?

You have to withdraw from your account either way. As I noted, whether that withdrawal comes from dividends, option premiums, or cap gains is largely irrelevant and is just mental accounting.

wONDER what your perspective is now? I am a retiree had been in cash since november, since I was going to have to cash out anyway to move my funds to a self managed brokerage account. just getting back in to the market and this fund looks attractive for the time being while the market is probably going to stagnate a bit. What do you think?

Not sure what you mean. My perspective has not changed.

maybe your perspective changed because JEPI outperformed the sp500 YTD 2022,

No. I’m not concerned with short-term, intra-year performance.

You should mention JEPI as a vehicle for income within a ROTH. As you reach the age, just before required distributions kick in, you will be earning 7-8% income tax free in a ROTH on JEPI holdings assuming dividend levels remain the same. Imagine holding a muni earning that rate and at the same time receiving some growth on your investment. I agree with your positing on growth and clipping a coupon as a way of providing income vs owning high dividend paying stocks assuming you are in a growth vehicle which is exceptionally tax efficient to begin with. A wise man told me many years ago that the only way to accumulate real wealth was to beat the tax man… legally of course.

Again, share price adjusts for that “income.” Account type is irrelevant to that fact. Obviously an IRA is preferable if you’re using a high-yield strategy.

RMDs from a ROTH?