With greater technological reliance comes a greater risk for cyber threats and thus a greater need for cybersecurity. Here we'll check out the 4 best cybersecurity ETFs for 2024.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – Why Cybersecurity ETFs?

Technological reliance by businesses and individuals is rapidly increasing globally, and with it the number and sophistication of cyber threats. Additionally, electronic storage of sensitive data and cloud computing open up more targets for cybercriminals. Thus, the need for robust cybersecurity solutions is important now more than ever.

Cybersecurity refers to protecting computers, servers, systems, networks, and data from digital attacks. These attacks can come in the form of malware, ransomware, phishing, and other forms of cybercrime. Cybersecurity maintains the confidentiality, integrity, and availability of data and systems by preventing unauthorized access by those who may want to use, modify, or destroy them.

Cybersecurity tools and techniques include things like firewalls, antivirus software, intrusion detection and prevention systems, and encryption. These tools help to identify potential vulnerabilities, implement measures to mitigate them, and respond to breaches.

As the use of technology and the internet continues to grow and more sensitive data is shared and stored electronically, cybersecurity is obviously becoming increasingly important.

Cybersecurity companies typically have great profit margins because the products and services they offer are in high demand and can thus command high prices. A further driver of that demand are government have laws and regulations that require businesses and organizations to protect against cyber threats.

In most cases, whether or not to employ cybersecurity measures is no longer a choice. Businesses and organizations are now considering cybersecurity an essential aspect of operations, as the cost of a cyber attack can be significantly greater than the tools and efforts that help prevent them.

ETFs allow investors to diversify among cybersecurity companies without having to try to pick the ones that will succeed. Below we'll check out the best cybersecurity ETFs.

The 4 Best Cybersecurity ETFs

The 4 cybersecurity ETFs below differ somewhat in size, scope, costs, and exposure.

CIBR – First Trust NASDAQ Cybersecurity ETF

CIBR from First Trust is by far the most popular ETF in this space with roughly $4.4 billion in assets. The fund launched in 2015.

CIBR focuses on cybersecurity companies as classified by the Consumer Technology Association (CTA), which means it holds mostly software and networking companies, but also branches out into industries like aerospace & defense. This broader selection basket is the main difference between CIBR and other similar cybersecurity funds, most of which have small, technology-centric portfolios.

CIBR weights holdings by liquidity. Top holdings are also capped at 6% each, while remaining holdings are capped at 3%. The index CIBR tracks – the NASDAQ CTA Cybersecurity Index – is rebalanced quarterly.

CIBR has 38 holdings and an expense ratio of 0.60%.

HACK – ETFMG Prime Cyber Security ETF

HACK from ETFMG launched in 2014, making it the oldest fund on this list, and has about $1.3 billion in assets.

HACK tracks the Prime Cyber Defense Index, which utilizes two different segments: developers of cybersecurity hardware or software and providers of cybersecurity services. Each of those 2 segments is weighted proportionally by its market cap weight relative to the other, and then holdings in each segment are equally weighted, after which those components are adjusted for liquidity.

This makes HACK tilt small cap, which a weighted average market cap of roughly $25 billion, about half that of CIBR.

HACK has 61 holdings and an expense ratio of 0.60%.

BUG – Global X Cybersecurity ETF

BUG from Global X launched in late 2019 and has since amassed about $675 million in assets.

BUG's selection methodology is arguably simpler than our previous two funds. It simply looks for companies around the world that derive at least 50% of their revenues from cybersecurity products and services, weights them by market cap, and then keeps the top 40. The fund's index is the Indxx Cybersecurity Index.

BUG's weighted average market cap is even smaller than HACK at roughly $13 billion.

BUG has a fee of 0.50%.

IHAK – iShares Cybersecurity and Tech ETF

IHAK from iShares launched in mid-2019 and has roughly $475 million in assets.

IHAK seeks to track the NYSE FactSet Global Cyber Security Index, which is composed of companies that get at least 50% of their revenue from cybersecurity hardware, software, products, and services. The index is market cap weighted, with individual holdings capped at 4%.

As such, IHAK and BUG are pretty similar and even have roughly the same weighted average market cap.

IHAK has 47 holdings and an expense ratio of 0.47%, making it the most affordable on this list.

Cybersecurity ETFs Performance Compared

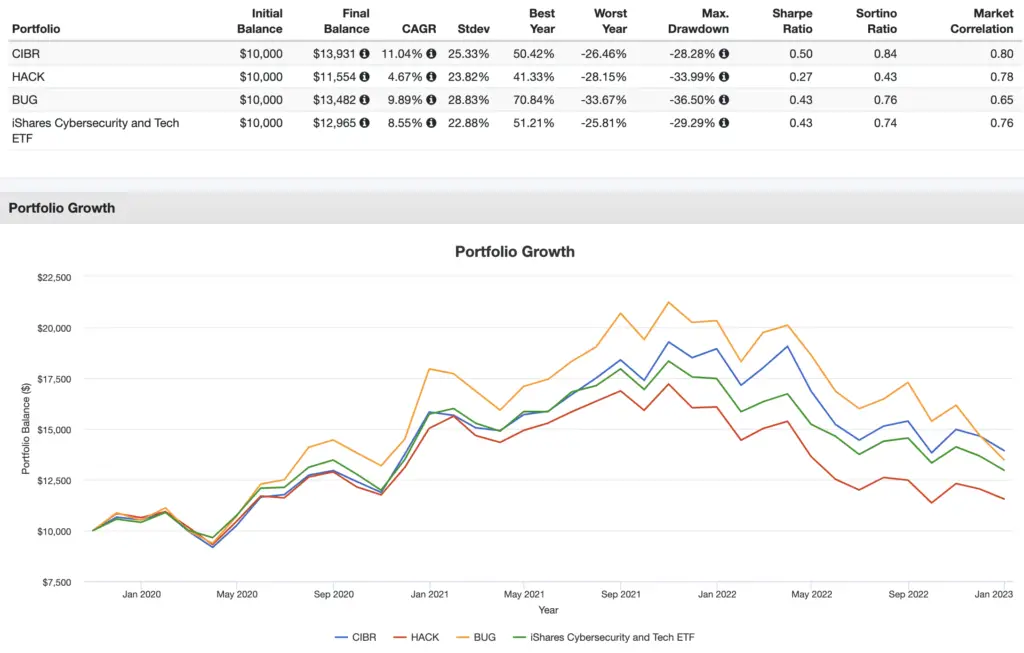

Here's a performance backtest of these 4 cybersecurity ETFs going back to BUG'S inception in late 2019 and looking through 2022:

CIBR has outperformed the others on both a general and risk-adjusted basis. Does that make it the best cybersecurity ETF for the future? It's impossible to know.

Remember that of these funds, CIBR is the broadest in scope and one of the most expensive. Also realize this is a very short backtest of only a few years and thus probably shouldn't mean much.

Where To Buy These Cybersecurity ETFs

All these cybersecurity ETFs should be available at any major broker. My choice is M1 Finance. The broker has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, and a modern, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply