Inverse ETFs allow investors to bet against, or “short” the market. Here we'll look at the best inverse ETFs for the S&P 500 Index for 2024 to profit from stock market downturns.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Inverse ETFs Video

Prefer video? Watch it here:

What Is an Inverse ETF and How Do They Work?

So what is an inverse ETF?

Inverse ETFs can be a market timer's best friend. They allow bears to short, or bet against, the stock market. That is, when stocks drop, the value of these ETFs goes up. As such, these products are also referred to as “short ETFs” or “bear ETFs.”

Typically bonds are held for downside protection due to their uncorrelation to stocks. A more direct hedge to maximize gains while the market drops is to use inverse ETFs to short the market.

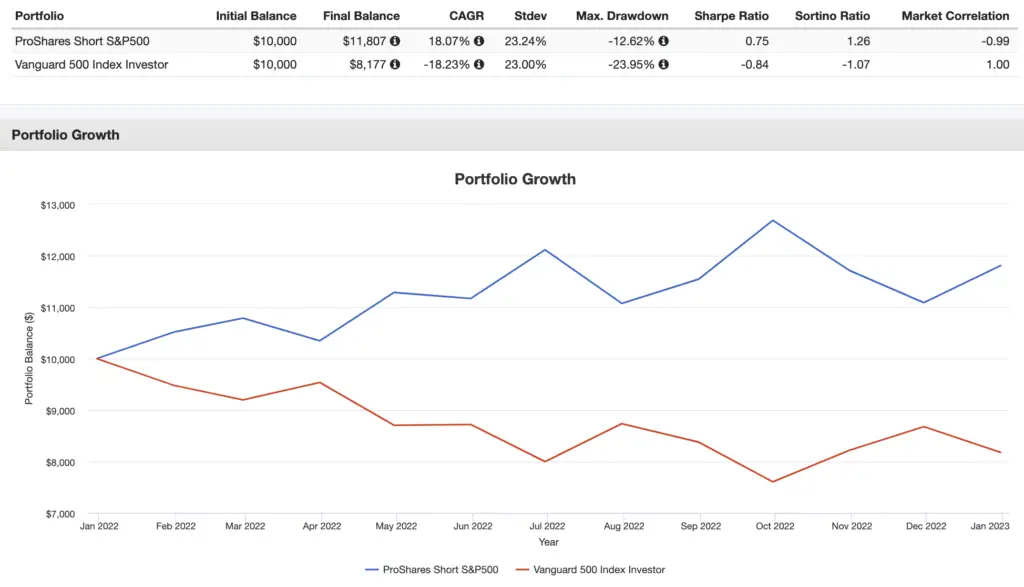

Inverse ETFs use derivatives such as futures, options, and swaps to produce positive returns from market declines. Specifically, as the name suggests, these funds aim to deliver the inverse return of their target index. I'll explain that math for each fund in a bit, but here's a visual illustration of this concept using the performance of one of the live funds mentioned below versus the S&P 500 index for the year 2022:

Notice how the lines are mirror images of each other.

In the next section we'll talk about why investors might want to use inverse ETFs.

Why Inverse ETFs?

Inverse ETFs allow investors to effectively short the market without using a margin account to short sell. Short selling involves borrowing a security and selling it to other traders with the hope of later buying it at a lower price to pocket the difference as profit.

When you short a stock or ETF in a margin account, theoretically the underlying security has infinite upside, so your portfolio can suffer catastrophic losses. The GameStop fiasco of 2021 is a great example of this. When using an inverse ETF, however, losses are limited only to the amount invested.

Using inverse ETFs also do not require you to have a margin account; you can buy them in your regular taxable brokerage account or even in your IRA.

Bears who use inverse ETFs usually target the S&P 500, as inverse ETFs for the index have the greatest liquidity, and the S&P 500 is considered a proxy for the broader stock market. These products have soared in popularity in 2022 and early 2023 with the U.S. stock market's disappointing recent performance and grim outlook for the near future.

Next we'll briefly cover the risks of inverse ETFs and things to keep in mind when using them.

Inverse ETF Risks

It's important to consider the risks of inverse ETFs and understand that they are not for everyone.

Inverse ETFs are best used over the short term since the underlying derivatives contracts are settled daily by the fund manager, meaning they experience decay over long time periods. The greater the leverage multiple of the inverse ETF, the greater that decay.

When using inverse ETFs, especially leveraged ones, go in with a game plan, stick to it, monitor your holdings, and have an exit strategy. Also pay attention to things like fees and trading volume, as inverse ETFs typically carry much greater fees than traditional funds, and liquidity is important when entering and exiting an inverse position.

Below we'll look at the 3 best inverse ETFs to bet against the S&P 500 Index with the greatest liquidity.

The 3 Best Inverse ETFs for the S&P 500 Index

So again, in this context we're using inverse ETFs to short the famous S&P 500 Index, which is considered a barometer for the U.S. stock market and is sometimes colloquially referred to as “the SPX” or “the S&P” or simply “SPY,” which is actually the ticker for the most popular S&P 500 ETF.

Below are the 3 best inverse ETFs to short the S&P 500. They all come from ProShares, one of the leading providers of inverse and leveraged ETFs.

SH – ProShares Short S&P 500 ETF

SH is the ProShares Short S&P 500 ETF. It is the most popular inverse ETF, with nearly $3 billion in assets.

The fund provides a -1x daily return – direct inverse behavior – of the S&P 500 Index. For example, if the S&P 500 Index drops by $1, this ETF will rise by roughly $1.

This ETF has an expense ratio of 0.89%.

SDS – ProShares UltraShort S&P 500 ETF

Those desiring a little more volatility may want to use leveraged funds. SDS is the ProShares UltraShort S&P 500 ETF. It is a leveraged inverse ETF providing -2x daily returns of the S&P 500. If the S&P 500 drops by $1, this ETF will rise by roughly $2.

This fund has about $1 billion in assets and an expense ratio of 0.90%.

SPXU – ProShares UltraPro Short S&P 500 ETF

There's also a -3x ETF. SPXU, the ProShares UltraPro Short S&P 500 ETF, delivers -3x daily returns of the S&P 500. If the index drops by $1, the value of this ETF will rise by roughly $3.

This ETF has nearly $1 billion in assets and an expense ratio of 0.91%.

Bears making a short-term bet on an impending crash may want to use this -3x ETF to get the most bang for your buck, since its expense ratio is only slightly higher than that of the other two funds above, but realize this could cause greater losses if your directional bet is wrong.

Where To Buy These Inverse ETFs for the S&P 500 (Not at Vanguard)

All the above inverse ETFs should be available at any major broker, though note that Vanguard does not allow the purchase of inverse or leveraged products.

My choice is M1 Finance. The online broker has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, intuitive pie visualization, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

I would like to use SH but I am concerned about the time period it can be safely held.

Is one month the answer to that?

Having to buy or sell it every day or so is not

Enticing.

Hi John,

Good information and very easy to follow. Great and interesting article. I was looking for information on how to short the stock market and this article is really useful. Would love to read more info on this topic, just if you ever need an idea for new content 🙂

A few questions:

1) Are inverse ETFs something you use yourself?

Either a) if you are trying to short the market for a shorter period of time (imagine you in Feb 2020 saw the crash coming and you then went in on one of these inverse ETFs for a period of time, e.g. 1 month or so), or

b) As part of your longer-term portofolio (I guess this is not the case since you in the article writes that inverse ETFs are best used over the short term but just wanted to ask)?

2) Or is there any other scenarios where you are using them?

Keep up the good work. Always looking forward to your articles.

Many thanks.

Thanks! No, I do not use inverse ETFs.

Many thanks for your reply.

So my follow-up question is:

Are you permanently bullish with all your investments? Always going long and never selling, for instance if you think the market(s) you are investing in is going lower?

Yes