I have a big list of lazy portfolios on this page and people constantly ask me which one is the best portfolio or which is my favorite. In this brief blog post, I’m going to go over one of my favorite lazy portfolios, and I’m willing to bet it’s not one you would guess.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Prefer video? Watch it below. If not, keep scrolling to keep reading.

So first let’s briefly talk about why there’s no single objective answer for the “best lazy portfolio.” Is “best” the highest historical return, or the highest risk-adjusted return, or the lowest volatility, or the simplest, or the one that contains every possible investable asset? Each of those criteria would suggest a very different portfolio. While it’s a boring non-answer, I maintain that the best portfolio is the one YOU can stick with for the long term through good times and bad. For some, that may be 100% stocks, and for others it may be 100% short term government bonds.

Some of my important fundamental boxes to check would be:

- low costs for the exposure we’re getting

- diversification in the broadest possible sense across multiple assets

- a decent expected return per unit of risk which we call risk adjusted return, and

- simplicity in the form of a relatively small number of components.

Considering those things, you’re probably thinking of popular names like the Bogleheads 3 Fund Portfolio, Dalio’s All Weather Portfolio, or even my Ginger Ale Portfolio. And while those would certainly fit the bill, none of them is the one I want to talk about here.

Ok dude, enough already, just give me the answer…

One of my favorite lazy portfolios is the Desert Portfolio from the Gyroscopic Investing forum. Chances are you’ve probably never even heard of it. It’s one of my lowest trafficked blog posts and one of my least popular videos. It looks like this:

30% stocks

60% intermediate treasury bonds

10% gold

Hopefully you didn’t exit out of this page when you read 60% bonds. Let me explain why those weights are what they are.

Seasoned investors may recognize these as roughly the risk parity weights for these 3 assets. Risk parity is a weighting scheme in which each asset contributes the same volatility to the portfolio. For example, suppose Asset A has volatility of 15% and Asset B has volatility at 10%. Risk parity is achieved at 40% of Asset A and 60% of Asset B, where each asset is contributing the same 6% volatility.

This is arguably the most agnostic way to weight assets in a portfolio. Risk parity weights are also usually very close to what produced the highest risk-adjusted return historically.

What I love so much about this portfolio is the elegant simplicity in taking 3 uncorrelated, approachable assets and not really inserting opinions about their future expected returns in weighting them.

You may recognize this portfolio as essentially being a simpler form of Ray Dalio’s All Weather Portfolio. Dalio, one of the smartest minds in investing and founder of Bridgewater, the largest hedge fund in the world, famously said he chose this type of “all weather” approach precisely because he acknowledges he CAN’T predict the future.

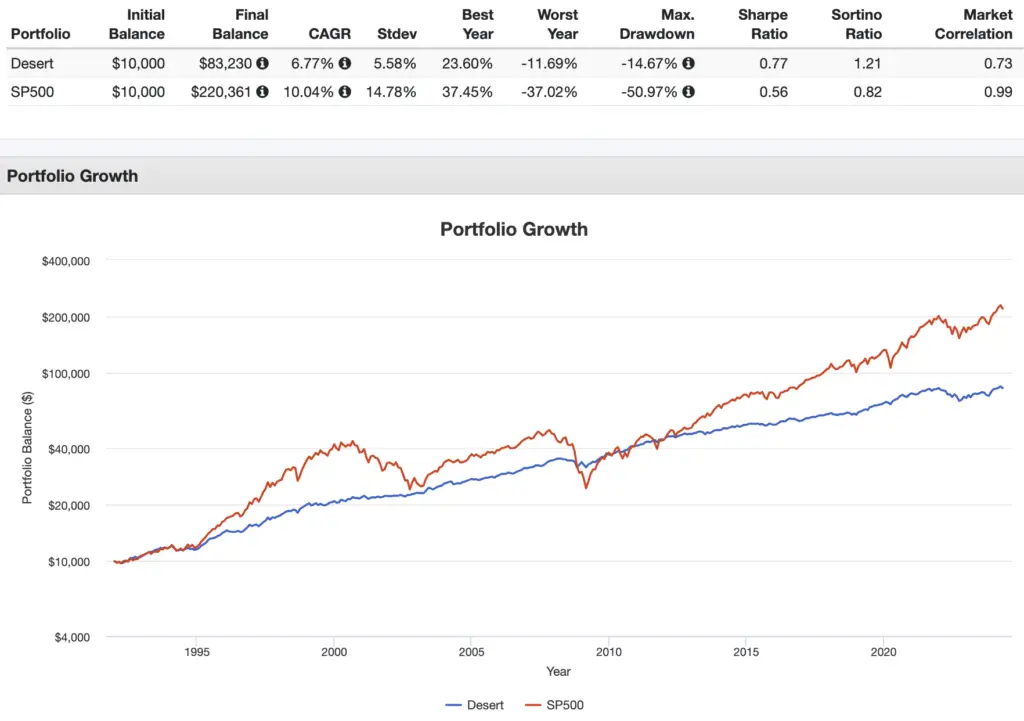

This strategy has worked out well historically, delivering appreciable returns while significantly lowering volatility and risk. While it’s not the appropriate benchmark, here I’ve compared the Desert Portfolio to 100% stocks purely to show just how much lower the volatility and risk of the Desert Portfolio was in comparison:

Volatility less than half, max drawdown less than 1/3 the magnitude, and the worst year down only 12%. In short, a much smoother ride that would certainly be easier to stick with during tough times.

We know that most vastly overestimate their tolerance for risk and then panic sell during crashes. Bonds and gold can also outperform stocks for extended periods. While it’s probably an unpopular opinion, I would submit that MOST investors would be much better suited with something more diversified like the Desert Portfolio than with 100% stocks. That may sound crazy to you right now, but I sincerely hope you remember this during our next major market crash.

Again, you may immediately shy away from 60% bonds, but recognize that intermediate treasuries are a one-size-fits-most bond duration between short and long, so that higher allocation is required in this case for risk parity because those bonds are roughly twice as volatile as stocks.

Also appreciate that other than rebalancing, the allocations of the Desert Portfolio would never need adjusting from early years all the way through retirement. That simplicity alone is extremely attractive in my opinion. You can invest in this portfolio at M1 Finance by clicking this link.

What do you think of the Desert Portfolio? Do you have a favorite lazy portfolio? Let me know in the comments.

Disclosure: None.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Could you extend the back test to cover years after 2020? I’d be curious to see how hard this was hit in 2022, and how it’s been recovering since.