Financially reviewed by Patrick Flood, CFA.

The Couch Potato Portfolio was created by investing writer Scott Burns. Here we’ll take a look at its components, historical performance, and the best ETFs to use to build it in 2024.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Couch Potato Portfolio Review Video

Prefer video? Watch it here:

Who Is Scott Burns?

Scott Burns, creator of the Couch Potato Portfolio, is a finance columnist and co-founder of AssetBuilder.com. You can read more about him here.

What Is the Couch Potato Portfolio?

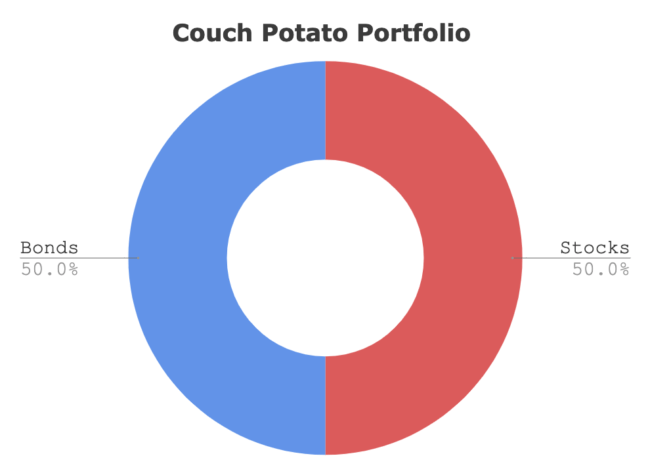

Scott Burns created the Couch Potato Portfolio in 1991. In terms of Lazy Portfolios, the Couch Potato Portfolio is about as simple as it gets: a 50/50 mix of stocks and bonds, using only 2 funds. Burns maintains that this makes it probably the most accessible and easy-to-understand portfolio out there, stating that anyone who “can divide by 2” can understand it.

The basic premise for the 50/50 allocation is, again, simplicity, and the idea that stocks can drive returns while bonds help protect against stock crashes and lower the portfolio's volatility. The portfolio is essentially a slightly more conservative version of a traditional 60/40 portfolio.

Interestingly, adherence to Burns's precise prescription of funds for the Couch Potato Portfolio doesn't seem to be required, and varies among investors. That is, you could use an S&P 500 index fund, total US stock market fund, or total world stock market fund on the equities side. On the bonds side, you could use intermediate treasuries, total bond funds, etc.

In fact, Burns tells of how immediately after initially he initially published the portfolio, readers called in to ask him exactly how to implement it. Burns himself has actually used several different recommendations of specific assets over the years, all while keeping it pretty general and still allowing you to DIY it. In describing the original iteration of Couch Potato Portfolio, Burns suggested an S&P 500 index fund and a short-term government bond fund. Fast forward to 2018, and he mentions total stock market funds and total bond market funds.

Burns submits that more important than the fund choices are the fundamental requirements of low-fee indexing, diversification, and simplicity, and states that “the single most important thing is the basic 50/50 mix of stocks and bonds.” This is consistent with Burns's writings on investing; he aims to be “an antidote to Wall Street.” The idea is that you can sit on the couch, check and rebalance this portfolio once a year, and let it do its thing.

Burns describes the implementation of the Couch Potato Portfolio in an article from 1991. I would highly suggest checking it out, if for no other reason than to get a laugh. Here are some direct quotes from the article:

Try this: once a year – like when you add new money – you take the total value of your investment and divide by “2”. That tells you how much you need in stocks. And in bonds. So you move some money, as necessary, from stocks to bonds. Or vice versa. With telephone exchange privileges at most mutual fund families, you can do this is less time than it takes to go to the refrigerator. Indeed, as a timing exercise, I suggest you put a medium sized potato in your microwave: your annual portfolio management will be done in less than the 10 minutes it takes to cook the potato.

Call Vanguard, the mother of all indexers, at 800 662 7447, and ask to make the minimum investment in the Vanguard Index 500 fund, which mimics the Standard and Poors' 500 index, and the Vanguard Fixed Income Short Term Government Bond Fund. Both have minimum investments of $3,000 and allow additional investments of only $100. That means you start with $6,000 and add as little as $100 at a time after that.

Since the broad index funds used are somewhat arbitrary, for the sake of this blog post and the analysis herein, I'm choosing to use Vanguard's Total US Stock Market ETF (VTI) and the iShares U.S. Treasury Bond ETF (GOVT).

- Why total US stock market (VTI) instead of the S&P 500 (VOO)? The S&P 500 is comprised of roughly 500 large-cap stocks. Using a total stock market fund, we increase diversification (VTI contains about 3,500 stocks) and get exposure to some small- and mid-caps, which have outperformed large-caps historically.

- Why total US stock market (VTI) instead of total world stock market (VT)? If I were investing in the Couch Potato Portfolio, I would probably use the total world stock market (VT) to increase diversification and get exposure to ex-US equities at their market weights. However, I realize that the vast majority of investors seem to prefer to embrace home country bias and only allocate 20-30% max to ex-US stocks, using a combination of VTI and VXUS (total ex-US stock market). Since the Couch Potato Portfolio requires the use of only 2 assets to maintain the fundamental simplicity, that's not an option here. I've created a global pie version using VT that I include at the bottom of this post.

- Why treasury bonds instead of corporate bonds? Treasury bonds should be preferable to corporate bonds due to their superior volatility reduction and black swan protection in a long-term diversified portfolio, and have the added benefits of allowing you to avoid state and local taxes, credit risk, and liquidity risk that accompany corporate debt.

- Why treasury bonds instead of total bond market? Total bond market funds contain some allocation to corporate bonds, usually 25-30%. See above point.

So, without further ado, my interpretation of the Couch Potato is as follows:

- 50% Total US Stock Market (VTI)

- 50% Total US Treasury Bond Market (GOVT)

Interestingly, Jack Bogle, the founder of Vanguard and considered the pioneer of index investing, said this was basically what his own portfolio looked like.

Couch Potato Portfolio Performance Backtest

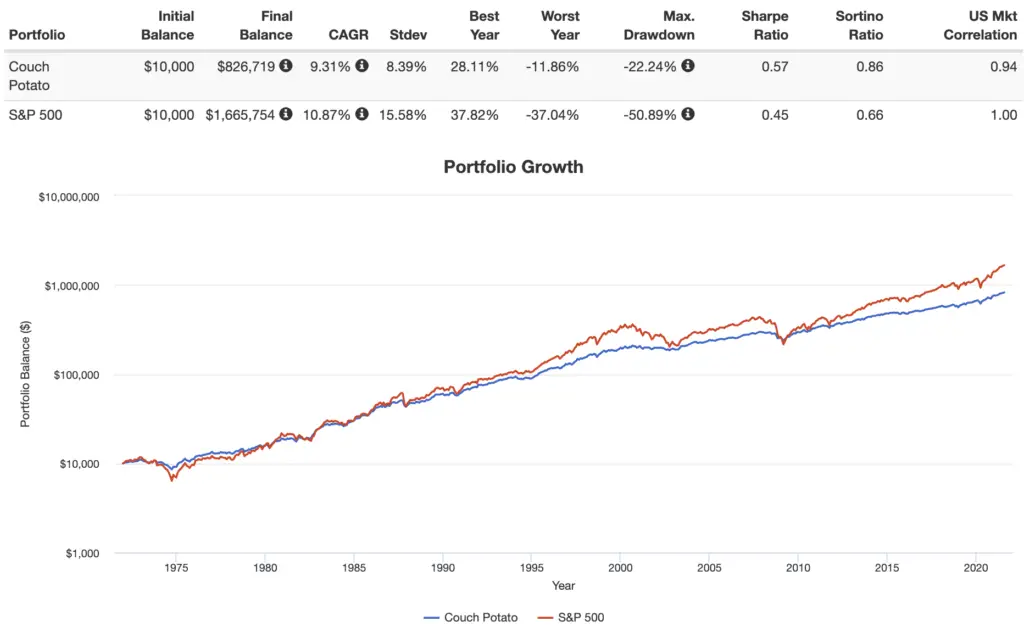

Going back to 1972, here's the Couch Potato Portfolio's performance vs. the S&P 500 through July, 2021:

I have to admit I expected the difference in return between these 2 portfolios to be much greater. Interestingly, the Couch Potato Portfolio achieved a lower CAGR than the S&P 500, with roughly half the volatility, much smaller drawdowns, and much higher risk-adjusted return (Sharpe). This is from the bonds doing their job of protecting from the downside risk of stocks. Granted, most of this time period – after 1982 – was great for bonds. The future may look different.

Couch Potato Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker for U.S. investors to implement the Couch Potato Portfolio because it makes annual rebalancing seamless and easy with one click (consistent with Scott Burns's recommendation of simplicity and low effort), has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here. Investors outside the U.S. can use eToro.

Utilizing 1 ETF from Vanguard and 1 from iShares, we can construct the Couch Potato Portfolio pie like this:

- VTI – 50%

- GOVT – 50%

You can add the Couch Potato Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Invest in this pie.” Investors outside the U.S. can find the ETFs above on eToro.

Taking the Couch Potato Portfolio International

To diversify globally and include international (ex-US) stocks in the Couch Potato Portfolio, we can simply replace Vanguard's Total US Stock Market (VTI) with Vanguard's Total World Stock Market (VT) like this:

- VT – 50%

- GOVT – 50%

You can add this global Couch Potato Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Invest in this pie.” Canadian investors can use Questrade, and those outside North America can use eToro.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosures: I am long VTI in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Love the Couch Potato. I’ve always been curious if Scott Burns himself has mentioned for whom he recommends this 50/50 split – i.e. accumulators, retirees, anyone at any stage who wants the simplicity?

Leveraging it would be interesting considering its relatively low volatility…

You can find that strategy here.