Two of the most popular total U.S. bond market ETFs are the Vanguard Total Bond Market ETF (BND) and the iShares Core U.S. Aggregate Bond ETF (AGG). Let's compare them.

In a hurry? Here are the highlights:

- BND and AGG are the two most popular bond ETFs out there.

- Both ETFs track the same bond market index, providing broad exposure to U.S. investment-grade bonds.

- BND and AGG have had nearly identical historical performance.

- Both funds have the same low fee of 0.03%.

- BND holds slightly more treasury bonds than AGG, and AGG has slightly more exposure to mortgage bonds than BND.

- For all intents and purposes, these two ETFs should be considered reasonably identical.

- This is a great pair to use for tax loss harvesting.

Contents

Video

Prefer video? Watch it here:

BND vs. AGG – Methodology and Composition

If you've landed here, you already know that bonds provide downside protection and volatility and risk reduction for diversified portfolios, and you probably already know that total bond market funds provide broad exposure to market-weighted indexes of different bond classes, maturities, and credit levels.

The Vanguard Total Bond Market ETF (BND) is the most popular bond fund out there. It was established in 2007. The fund seeks to track the Bloomberg Barclays U.S. Aggregate Float Adjusted Index, holding over 9,700 U.S. investment-grade bonds with an average maturity of roughly 8.5 years and an average duration of roughly 6.5 years.

The iShares Core U.S. Aggregate Bond ETF (AGG) also provides similar broad exposure to the entire U.S. bond market. It was established in 2003. The fund seeks to track the Bloomberg Barclays US Aggregate Bond Index. This ETF holds over 8,600 U.S. investment-grade bonds with a weighted average maturity of 8 years and an average duration of 6 years.

BND holds slightly more treasury bonds than AGG, and AGG holds slightly more mortgage bonds. Consequently, one could argue that AGG is ever so slightly riskier. Both of these ETFs follow the same index, with Vanguard's BND using the float-adjusted version. Both funds use representative sampling to track the index. The index excludes municipal bonds, TIPS, and high-yield bonds.

BND vs. AGG – Historical Performance

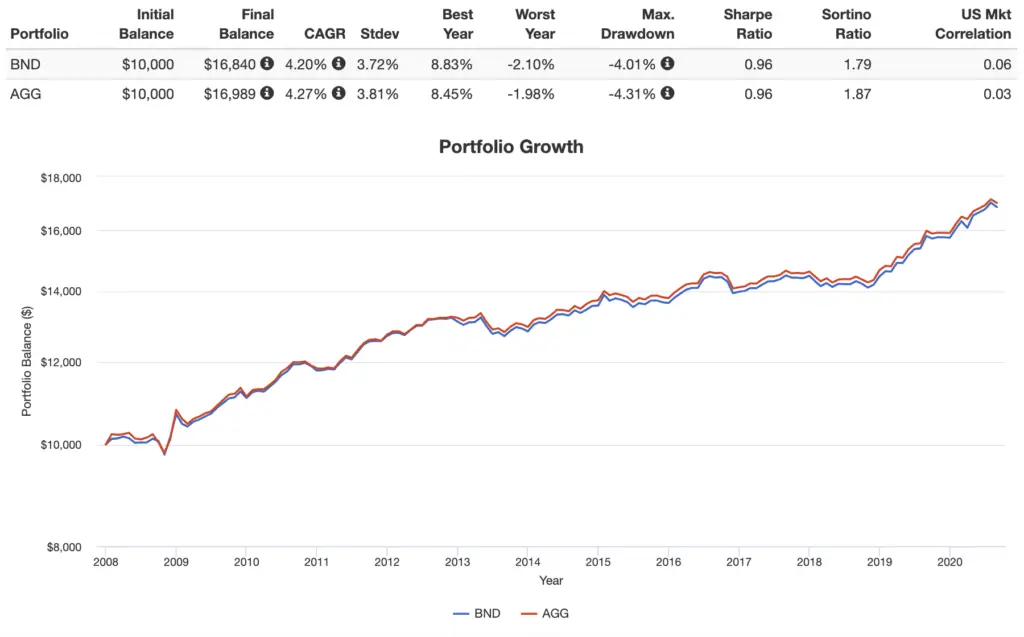

These two funds have delivered nearly identical performance since the inception of BND in 2007.

BND vs. AGG – AUM and Fees

Though both funds have extremely high liquidity, Vanguard's BND is considered more popular with over $285 billion in assets under management. AGG from iShares has roughly $80 billion in assets.

Both funds have the same low fee of 0.03%.

Conclusion

For all intents and purposes, these two ETFs are essentially identical, so you can't go wrong either way. I'd be inclined to go with the slightly cheaper BND. This is obviously a good pair to tax loss harvest with.

Conveniently, both of these funds should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

Do you own BND or AGG? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

John;

Well done and explained. As a retired high school teacher that only had 40 minutes max to get the point across – you did it! I was told by an FA that I was too. Stock market heavy and that diversifying my portfolio with BONDS would be the way to go.

Again the teacher in me said “OK let’s compare what else is out there.

FA Chose AGG

So I (learned from my students) google “How does AGG compare to other BOND ETF’s?

Your site came up and NOW as all great Economics Teachers will tell you…

“It begins with CHOICE!”

Thank you Jim I now have some homework to do.

Peace

Glenn